Islamic finance, also known as Sharia-compliant banking, is a system of banking and financial transactions that adheres to the principles of Islamic law, or Sharia. This unique approach to finance emphasizes ethical and socially responsible investment and prohibits the charging of interest.

One of the key reasons why Islamic finance has gained popularity in recent years is its focus on fairness and justice. Islamic finance emphasizes the concept of risk-sharing, where both the lender and the borrower share the risks and rewards of a financial transaction. This promotes a more equitable distribution of wealth and helps to avoid the exploitation and predatory lending practices that can be prevalent in conventional banking.

Another advantage of Islamic finance is its emphasis on real economic activities. Islamic financial institutions invest in tangible assets such as real estate, infrastructure projects, and productive businesses, rather than engaging in speculative financial activities. This helps to promote economic growth and stability by fostering productive use of capital and discouraging speculative bubbles.

“The principles of Islamic finance encourage a more sustainable and responsible approach to banking and investment.”

Furthermore, Islamic finance encourages financial inclusion and supports the development of microfinance and small businesses. Islamic banks offer a range of products and services that cater to the needs of individuals and businesses, including interest-free loans, profit-sharing investment accounts, and equity-based financing options. This helps to promote economic development and reduce poverty, particularly in emerging economies with large populations of unbanked or underbanked individuals.

In conclusion, Islamic finance offers a unique and socially responsible alternative to conventional banking. Its focus on fairness, real economic activities, financial inclusion, and sustainability make it an attractive option for individuals and businesses seeking a more ethical and responsible approach to banking and investment.

The Concept of Islamic Finance

Islamic finance is a system of banking and financial transactions that is based on the principles of Islamic law, or Shariah. It is a growing financial sector that adheres to ethical and moral standards, and prohibits certain activities such as charging interest or investing in industries that are considered unethical in Islam.

At the heart of Islamic finance is the concept of risk sharing and promoting socio-economic justice. Instead of charging interest, Islamic financial institutions offer profit-sharing arrangements where both parties share in the profits and losses of a business venture. This ensures a fair distribution of risk and encourages responsibility and accountability.

The prohibition of interest in Islamic finance is based on the belief that money should not be treated as a commodity to be traded and profited from. Instead, money is seen as a means of facilitating economic activities and promoting the welfare of society as a whole.

In addition to the prohibition of interest, Islamic finance also prohibits investments in sectors that are considered haram (forbidden) in Islam, such as alcohol, gambling, and pork. This ensures that funds are invested in socially responsible and ethical ventures that contribute to the well-being of society.

Islamic finance encompasses a wide range of financial products and services, including banking, insurance, asset management, and capital markets. It offers a viable alternative to conventional banking and finance for Muslims who wish to adhere to the principles of Shariah in their financial transactions.

The principles of Islamic finance are not only beneficial for Muslims, but also have the potential to contribute to global economic stability and sustainability. By promoting risk-sharing and ethical investments, Islamic finance can help mitigate financial risks and prevent economic crises. It also encourages a more inclusive financial system that caters to the needs of society as a whole.

In conclusion, the concept of Islamic finance is rooted in the principles of justice, fairness, and ethical conduct. It offers an alternative financial system that promotes responsible and sustainable economic development. By adhering to the principles of Shariah, Islamic finance provides individuals and businesses with the opportunity to engage in financial transactions that are both ethical and profitable.

Islamic Banking Principles

Islamic banking, also known as Sharia-compliant banking, follows the principles of Islamic law (Sharia), which prohibits the charging or receiving of interest and prohibits investments in industries that are considered unethical or haram (forbidden), such as alcohol, gambling, or pork.

Here are some key principles of Islamic banking:

- Prohibition of Interest: Islamic banking operates on the principle of profit and loss sharing. Instead of charging interest on loans, Islamic banks enter into partnerships with their clients, sharing the profits or losses resulting from the investments.

- Asset-Backed Financing: Islamic banks emphasize asset-backed financing, meaning that all transactions must be supported by tangible assets. This helps to ensure transparency and reduce risk.

- Ethical Investment: Islamic banking promotes ethical investment and prohibits investing in industries that are considered unethical or harm society. This encourages investments in sectors such as healthcare, education, renewable energy, and socially responsible businesses.

- Prohibition of Speculation: Islamic banking discourages speculative activities, such as gambling or excessive risk-taking. Instead, investments should be based on real economic activities and have a positive impact on society.

- Shared Risk and Profit: In Islamic banking, the bank shares both the risks and the profits with the customers. This encourages a more balanced and fair approach to banking, with both parties having a stake in the success of the investment.

- Charitable Giving: Islamic banking encourages charitable giving through the practice of Zakat, which is the obligation for Muslims to give a percentage of their wealth to those in need. Islamic banks often allocate a portion of their profits for charitable purposes.

These principles guide the operations of Islamic banks, ensuring that they follow ethical practices and contribute to the welfare of society. Islamic banking offers an alternative banking model that aligns with the values and principles of Muslims.

Financial Stability in Islamic Finance

One of the key benefits of Islamic finance is its focus on financial stability. Islamic banks operate in accordance with Sharia principles, which emphasize ethical and responsible financial practices. This approach helps to protect both the individual and the financial system as a whole.

In Islamic finance, there are several mechanisms in place to ensure financial stability:

- Prohibition of Interest (Riba): Islamic finance strictly prohibits the charging or earning of interest. This eliminates the potential for speculative activities and excessive risk-taking that can lead to financial instability. Instead, Islamic banks provide financing through profit-sharing arrangements, where both the bank and the customer share in the business risks and rewards.

- Asset-Backed Financing: Islamic finance encourages asset-backed financing, which means that every transaction must be backed by a tangible asset. This requirement reduces the likelihood of inflated valuations and promotes more transparency and stability in financial transactions.

- Risk Sharing: Islamic finance promotes the concept of risk sharing between the provider of funds (the bank) and the user of funds (the customer). This encourages a more balanced distribution of risk and prevents one party from bearing the full burden of financial losses. By sharing the risk, Islamic finance helps to maintain stability in the financial system.

- Socially Responsible Investments: Islamic finance encourages investments in socially responsible ventures that benefit society as a whole. This helps to ensure that financial resources are allocated to projects that have a positive impact and contribute to long-term financial stability.

Overall, the focus on financial stability in Islamic finance provides a strong foundation for a robust and sustainable financial system. By adhering to ethical principles and promoting responsible financial practices, Islamic finance helps to mitigate the risks associated with excessive speculation and unsustainable debt levels.

Transparency and Ethical Standards

In Islamic finance, transparency and ethical standards play a crucial role in ensuring the trust and confidence of customers. Unlike conventional banking systems, Islamic finance operates under strict guidelines derived from Sharia (Islamic law).

These guidelines promote transparency and ethical practices in various ways:

- No hidden charges or interest: Islamic finance follows the principle of profit and loss sharing, where interest-based transactions are prohibited. This means that there are no hidden charges or interest rates in Islamic banking products. Everything is disclosed upfront, and customers have a clear understanding of the terms and conditions of the financial transactions.

- Halal investments: Islamic finance focuses on investing in halal (permissible) assets and avoiding haram (prohibited) activities. This ensures that the funds are invested ethically and in sectors that comply with Islamic principles. For example, investments in industries such as alcohol, gambling, or pork are strictly prohibited.

- Community development: Islamic finance emphasizes community development and social responsibility. Financial institutions offering Islamic products and services are encouraged to invest in projects that benefit the community, such as infrastructure development, education, healthcare, and affordable housing.

Moreover, Islamic financial institutions are required to provide detailed reports on their operations, ensuring transparency and accountability. These reports include information on the distribution of profits, shareholder equity, and the performance of the investments.

By adhering to these transparency and ethical standards, Islamic finance aims to create a fair and just financial system that benefits individuals, businesses, and the society as a whole.

Risk Sharing and Responsible Lending

One of the key principles of Islamic finance is risk sharing, which sets it apart from conventional banking. In conventional banking, the lender bears all the risk while the borrower is responsible for repaying the loan with interest. However, in Islamic finance, both the lender and the borrower share the risk and reward of an investment or financing transaction.

This concept of risk sharing promotes responsible lending practices because it encourages banks to thoroughly assess the creditworthiness of the borrower and the viability of the investment project. By sharing the risk, Islamic banks have a vested interest in ensuring that the borrower’s business or investment venture is successful, as they will also share in the profits.

In addition, Islamic finance discourages excessive debt and promotes responsible borrowing. Since interest-bearing loans are prohibited in Islam, borrowers are encouraged to only take on debt for productive purposes, such as starting a business or acquiring essential assets. This helps to prevent individuals and businesses from becoming overburdened with debt and promotes responsible financial behavior.

Furthermore, Islamic finance promotes ethical and responsible investments. Sharia-compliant banks are not allowed to invest in industries or activities that are deemed unethical, such as alcohol, gambling, or any form of exploitative practices. This ensures that the funds deposited in Islamic banks are used in a socially responsible manner, benefitting the community and the environment.

Overall, risk sharing and responsible lending are integral principles of Islamic finance that contribute to its stability and sustainability. By aligning the interests of the lender and the borrower, Islamic finance encourages responsible borrowing and lending practices, promotes ethical investments, and helps to prevent financial crises caused by excessive debt.

Interest-Free Banking

In Islamic finance, the concept of interest-free banking is one of the core principles. The prohibition of interest, known as riba, is based on the belief that making money from money, without any productive efforts or risks, is morally wrong.

This principle is derived from the Islamic teachings found in the Quran and the Hadith (sayings and actions of the Prophet Muhammad). In these teachings, interest is described as a sin and a form of exploitation, as it can lead to wealth concentration and inequality.

In an interest-free banking system, financial transactions are structured in a way that avoids the payment or receipt of interest. Instead, Islamic banks provide various alternative mechanisms to facilitate financial activities while adhering to the principles of Sharia-compliance.

One key concept in an interest-free banking system is profit sharing. Islamic banks operate on a profit-and-loss sharing (PLS) model, where both the bank and the customer share the risks and rewards of investments and business ventures. This encourages a more equitable distribution of wealth and fosters a sense of partnership between the bank and its customers.

Another alternative mechanism used in Islamic finance is the concept of purchasing and selling on a deferred payment basis. This allows customers to acquire assets or goods without having to pay interest. Instead, the bank may purchase the desired item and sell it to the customer at a mutually agreed-upon price, which can be paid in installments over time.

Furthermore, Islamic finance promotes ethical investments that align with Islamic values. Investments in sectors such as alcohol, gambling, tobacco, and weapons are prohibited. Instead, Islamic finance encourages investment in socially responsible sectors, such as healthcare, education, renewable energy, and ethical businesses.

Interest-free banking provides numerous benefits for individuals and businesses. It promotes financial inclusivity by offering access to banking services for those who may have religious or ethical objections to conventional interest-based banking. It also encourages responsible financial behavior by discouraging excessive borrowing and promoting investment in productive ventures.

Moreover, interest-free banking helps to foster financial stability by avoiding excessive debt, as interest payments can often lead to financial distress. By sharing risks and rewards through profit-and-loss sharing, Islamic banks prioritize long-term sustainability and economic stability.

In conclusion, interest-free banking is a distinguishing feature of Islamic finance. It provides an alternative financial system that is rooted in ethical and moral principles. By avoiding interest, Islamic banks promote responsible financial behavior, encourage investment in socially responsible sectors, and contribute to financial stability and inclusivity.

Supporting Real Economic Activities

Islamic finance is built on the principles of fairness and ethical conduct, emphasizing the importance of supporting real economic activities. Unlike conventional banking, which often focuses on speculative investments and excessive risk-taking, Islamic finance promotes investment in real assets and productive activities. This approach helps in the development of a sustainable economy and reduces the risk of financial instability.

One of the key principles of Islamic finance is the prohibition of interest (riba), which prevents the exploitation of borrowers and promotes fair lending practices. Instead, Islamic banks engage in profit-sharing arrangements, where the bank and the customer share the risks and rewards of the investment. This encourages the banks to invest in projects that have a positive impact on the economy, as they have a vested interest in the success of these projects. It also ensures that the financing provided by Islamic banks is aligned with the real needs of the economy.

Islamic finance also encourages ethical investment practices by prohibiting investment in industries that are considered harmful or unethical according to Islamic principles. These industries include but are not limited to alcohol, gambling, pork-related products, and tobacco. By avoiding investments in such industries, Islamic finance promotes sustainable and responsible business practices.

Moreover, Islamic finance promotes financial inclusion by providing access to financial services for the underserved and marginalized segments of society. Islamic banks offer a range of products and services tailored to the needs of individuals and businesses, including microfinance and SME financing. This helps in reducing income inequality and promoting economic growth.

In summary, Islamic finance supports real economic activities by promoting fair lending practices, investing in productive assets, avoiding unethical industries, and providing financial inclusion. These principles contribute to the stability and sustainability of the economy, making Islamic finance an attractive alternative to conventional banking.

Removing Exploitative Practices

In Islamic finance, the principles of fairness, justice, and equality are emphasized, which leads to the removal of exploitative practices that are often found in conventional banking.

One of the key exploitative practices that is prohibited in Islamic finance is usury or charging excessive interest rates. Usury is considered unethical as it leads to a cycle of debt and can cause financial hardship for borrowers. Instead, Islamic finance promotes profit-sharing arrangements where risks and rewards are shared between the bank and the customer.

Another exploitative practice that is eliminated in Islamic finance is speculation or gambling. Conventional finance often engages in speculative activities that can create instability in the market. Islamic finance promotes real economic activities and investments in tangible assets, ensuring that transactions are based on the real economy rather than speculation.

Furthermore, Islamic finance prohibits investments in activities that are considered unethical or harmful to society. This includes industries such as gambling, alcohol, tobacco, and weapons. By avoiding these sectors, Islamic finance promotes ethical and socially responsible investments.

In addition to eliminating exploitative practices, Islamic finance also emphasizes transparency and accountability. Islamic banks are required to disclose all relevant information about their financial transactions, ensuring that customers are fully aware of the terms and conditions of their investments.

Overall, by removing exploitative practices and promoting fairness, justice, and ethical investments, Islamic finance offers a more inclusive and sustainable banking system that aligns with the values of many individuals seeking financial services that are in line with their religious beliefs.

Creating Social and Economic Equality

In addition to its adherence to Islamic principles, Islamic finance also promotes social and economic equality. This is achieved through various mechanisms that prioritize fair distribution of wealth and resources.

One of the main principles of Islamic finance is the prohibition of usury, or riba. Riba refers to the charging or receiving of interest on loans. By eliminating interest-based transactions, Islamic finance aims to prevent exploitation and reduce income inequality. Instead, Islamic finance encourages profit-sharing and risk-sharing arrangements, which ensure that both parties involved in a financial transaction bear the risks and rewards proportionately.

Another aspect of Islamic finance that contributes to social and economic equality is the concept of zakat. Zakat is a mandatory charitable contribution that Muslims are required to make annually. It is calculated as a percentage of an individual’s wealth and is distributed to those in need. By requiring individuals to give a portion of their wealth to those less fortunate, zakat helps to alleviate poverty and reduce wealth disparities.

Islamic finance also promotes ethical investment practices. The principles of Islamic finance prohibit investing in activities that are considered unethical or harmful to society, such as gambling, alcohol, and tobacco. This encourages investments in sectors that have a positive social impact, such as healthcare, education, and renewable energy.

Furthermore, Islamic finance encourages financial inclusion and access to banking services for all individuals, including those from lower-income backgrounds. Islamic banks often offer a range of products and services tailored to the needs of marginalized communities, such as microfinance, small business loans, and affordable housing finance. By providing these services, Islamic finance helps to empower individuals and promote economic opportunities.

| Key Points: |

|

Resilience to Financial Crises

One of the key benefits of Islamic finance is its resilience to financial crises. This resilience can be attributed to several factors:

- Prohibition of Interest: Islamic finance operates on the principle of avoiding interest or “riba.” This means that Islamic financial institutions do not lend money at an interest rate, which helps to reduce the risk of financial bubbles and speculative activities that can lead to crises.

- Asset-Backed Financing: Islamic finance emphasizes asset-backed financing, where transactions must be supported by tangible assets. This mitigates the risk of overleveraging and reduces the exposure to toxic assets that can trigger financial crises.

- Profit and Loss Sharing: Islamic finance promotes the sharing of profits and losses between the financial institution and the customer. This encourages more responsible lending practices and discourages excessive risk-taking, as both parties bear the consequences of investment outcomes. This helps in preventing the accumulation of unsustainable debts and reducing the likelihood of financial crises.

- Ethical and Responsible Investments: Islamic finance principles encourage investments in sectors that are socially responsible and ethically sound. This means that investments in industries such as gambling, alcohol, and tobacco are prohibited. By avoiding these high-risk and controversial sectors, Islamic finance minimizes the exposure to activities that can contribute to financial instability.

In addition to these factors, Islamic finance also incorporates risk-sharing mechanisms, such as mudaraba and musharaka, which promote equitable distribution of risks and rewards. These features contribute to the overall stability and resilience of the Islamic financial system, making it less susceptible to financial crises.

Overall, the resilience of Islamic finance to financial crises stems from its emphasis on principles of fairness, ethicality, and risk-sharing. By promoting responsible and sustainable banking practices, Islamic finance offers an alternative model that can help prevent and mitigate the impact of future financial crises.

Diversifying Investment Opportunities

One of the significant benefits of Islamic finance is the ability to diversify investment opportunities. Islamic financial institutions follow certain principles and guidelines that ensure investments are made in ethical and socially responsible sectors.

Unlike conventional banking, which may invest in sectors that are prohibited in Islam, such as gambling, alcohol, and pork, Islamic finance focuses on industries that are in line with Sharia principles. This includes sectors like real estate, infrastructure, renewable energy, and technology.

By adhering to these principles, Islamic finance opens up a range of investment opportunities that align with the values and beliefs of Muslims. Moreover, by investing in sectors that have a strong ethical and sustainable focus, Islamic finance helps promote positive social and environmental impact.

Furthermore, Islamic finance encourages diversification by providing a variety of investment vehicles. These include equity investments, real estate investment, trade finance, and Islamic bonds (sukuk). This wide range of options allows individuals and institutions to allocate their capital across multiple sectors and reduce risks associated with a single investment.

Another aspect of diversification in Islamic finance is geographic diversification. With the growing global reach of Islamic finance, investors have the opportunity to invest in various countries and regions, allowing them to tap into different growth markets and benefit from economic diversification.

Overall, diversifying investment opportunities is a key advantage of Islamic finance. It enables individuals and institutions to invest in sectors that align with their values, promote ethical practices, and contribute to sustainable development. By providing a range of investment vehicles and opportunities for geographic diversification, Islamic finance allows investors to reduce risks and maximize returns.

Promoting Sustainable Development

One of the key benefits of Islamic finance is its focus on promoting sustainable development.

Islamic finance principles emphasize ethical and responsible investment practices, which align with the goals of sustainable development. This means that Islamic financial institutions prioritize investments in industries and projects that have a positive impact on the environment and society.

By adhering to Sharia-compliant principles, Islamic finance promotes social justice, economic stability, and environmental sustainability. Here are some ways in which Islamic finance contributes to sustainable development:

- Prohibition of exploitative practices: Islamic finance prohibits investments in industries that involve activities such as gambling, alcohol, tobacco, and weapons production. Instead, it encourages investments in sectors like healthcare, education, renewable energy, and affordable housing.

- Ethical financing: Islamic finance follows strict ethical guidelines, ensuring that investments are made in a responsible manner. This means that financial institutions avoid engaging in excessive risk-taking or speculative behavior, which can contribute to financial crises. Instead, they promote stable and sustainable economic growth.

- Zakat and charity: Zakat, an obligatory form of charity in Islam, plays a significant role in Islamic finance. Financial institutions often allocate a portion of their profits to charitable causes, such as poverty alleviation, education, and healthcare initiatives. This helps address social inequality and promotes sustainable development.

- Economic inclusivity: Islamic finance aims to provide financial services to all segments of society, including the underprivileged and marginalized. By promoting financial inclusivity, Islamic finance helps uplift communities and enables them to participate in economic activities, leading to sustainable development.

Overall, Islamic finance’s adherence to ethical and sustainable principles makes it a powerful tool for promoting sustainable development. It addresses social, environmental, and economic challenges by channeling investments towards responsible and impactful projects.

Empowering Small and Medium-Sized Enterprises (SMEs)

Islamic finance plays a crucial role in empowering small and medium-sized enterprises (SMEs) by providing them with access to much-needed capital and financial support. SMEs are the backbone of any economy, contributing significantly to job creation, innovation, and economic growth. However, these enterprises often face challenges in obtaining funding from traditional banks due to their limited operating history, lack of collateral, and higher risk profiles.

Islamic finance principles prioritize ethical and sustainable business practices, making it an ideal financing option for SMEs. Here are a few ways in which Islamic finance empowers SMEs:

- Murabaha Financing: Under Islamic finance, murabaha financing allows SMEs to purchase assets or inventory through an installment sale arrangement. This structure enables SMEs to acquire the necessary resources while ensuring compliance with Sharia principles.

- Musharakah Financing: Musharakah financing is a form of partnership where the financier and SME share the profits and losses of the business venture. This arrangement allows SMEs to access funds without solely relying on debt and promotes a sense of shared responsibility and risk-sharing.

- Ijarah Financing: SMEs can also benefit from ijarah financing, which is similar to a lease agreement. This financing structure allows SMEs to access necessary assets such as machinery or equipment without the burden of ownership. It provides flexibility and cost-effectiveness for SMEs, allowing them to conserve capital.

In addition to these financing options, Islamic finance institutions often offer tailored financial solutions to meet the unique needs of SMEs. These solutions may include trade financing, working capital financing, and project financing tailored specifically for SMEs.

Furthermore, Islamic finance promotes ethical business practices and discourages speculative behavior. This emphasis on ethical conduct aligns with the objectives of many SMEs that aim to contribute to their communities and operate in a socially responsible manner.

Additionally, Islamic finance encourages financial transparency and accountability, which can be particularly beneficial for SMEs. The emphasis on disclosure and risk-sharing promotes a healthier and more sustainable financial ecosystem for SMEs.

In conclusion, Islamic finance serves as a powerful tool for empowering SMEs by providing access to capital, promoting ethical business practices, and offering tailored financial solutions. By leveraging the principles of Islamic finance, SMEs can overcome the financing challenges they often face and contribute to sustainable economic growth.

Enhancing Financial Inclusion

One of the key benefits of Islamic finance is its focus on financial inclusion, which aims to provide access to financial services for all individuals and businesses, regardless of their income level or social status.

In conventional banking, interest-based transactions often exclude those who cannot afford to pay high interest rates or meet the stringent requirements for obtaining loans. However, Islamic finance operates on the principles of justice, fairness, and ethical conduct, ensuring that financial services are accessible to everyone.

In Islamic banking, financial products and services are designed to cater to the needs of a diverse range of customers. This includes individuals, microenterprises, women entrepreneurs, and financially underserved communities. Islamic banks offer various types of financing facilities, such as Murabaha (cost-plus financing), Ijarah (leasing), and Musharakah (partnership), which accommodate different business models and investment needs.

The transparent and ethical nature of Islamic finance also promotes financial inclusion. Sharia-compliant banks ensure that their operations are aligned with Islamic principles, which prohibits engaging in activities deemed harmful to society. This means that investments in sectors such as gambling, alcohol, and tobacco are avoided. Instead, Islamic banks focus on sectors that contribute positively to society, such as healthcare, education, and environmentally friendly industries.

Furthermore, Islamic finance encourages shared prosperity and social welfare through the concept of Zakat (charitable giving). Islamic banks often allocate a certain percentage of their profits towards Zakat funds, which are then distributed to those in need. This redistribution of wealth helps to alleviate poverty and create a more equitable society.

In conclusion, Islamic finance significantly contributes to enhancing financial inclusion by offering accessible and ethical financial services to a wider range of individuals and businesses. Its focus on justice, fairness, and social responsibility ensures that no one is left behind in the pursuit of financial stability and economic growth.

Contributing to Global Economic Growth

Islamic finance has emerged as a significant contributor to global economic growth in recent years. With its emphasis on ethical values and principles, it offers a unique and sustainable approach to financing that aligns with the needs of the modern world. Islamic finance is not only beneficial for Muslims but also for non-Muslims seeking an alternative banking system that promotes fairness, transparency, and social responsibility.

One of the key reasons why Islamic finance is contributing to global economic growth is its focus on risk-sharing. Unlike conventional banking, which relies heavily on debt and interest-based transactions, Islamic finance promotes profit-sharing and risk-sharing arrangements. This encourages entrepreneurship, promotes innovation, and stimulates economic activity, ultimately leading to sustainable growth.

The prohibition of interest (riba) in Islamic finance also plays a crucial role in fostering economic growth. Interest-based transactions often lead to excessive debts and financial crises, as seen in the global financial crisis of 2008. By eliminating interest and promoting fair and equitable transactions, Islamic finance helps prevent such economic instabilities, making it a more stable and resilient system.

Islamic finance also encourages real economic activities and investments in productive assets. Islamic financial institutions engage in trade, invest in real estate, and provide financing for productive ventures. This focus on tangible assets and real economic activities helps stimulate economic growth, create employment opportunities, and contribute to the overall development of communities.

Furthermore, Islamic finance offers innovative solutions to meet the financing needs of various sectors, including infrastructure development, housing, and small and medium-sized enterprises (SMEs). Islamic financial instruments such as Sukuk (Islamic bonds), Istisna’a (project financing), and Murabaha (cost-plus financing) provide flexible and efficient funding options that can support economic development and infrastructure projects.

Additionally, Islamic finance promotes ethical investments and discourages investments in industries that are considered harmful to society, such as gambling, alcohol, and tobacco. This focus on responsible investments aligns with the growing demand for socially responsible investments (SRI) and sustainable finance worldwide. It attracts ethical investors and contributes to the overall stability and sustainability of the global financial system.

In conclusion, Islamic finance offers a unique and sustainable approach to financing that contributes to global economic growth. It promotes risk-sharing, eliminates interest, encourages real economic activities, and provides innovative solutions for financing various sectors. With its emphasis on ethical values and responsible investments, Islamic finance is well-positioned to address the evolving needs of the global economy and contribute to a more inclusive and sustainable financial system.

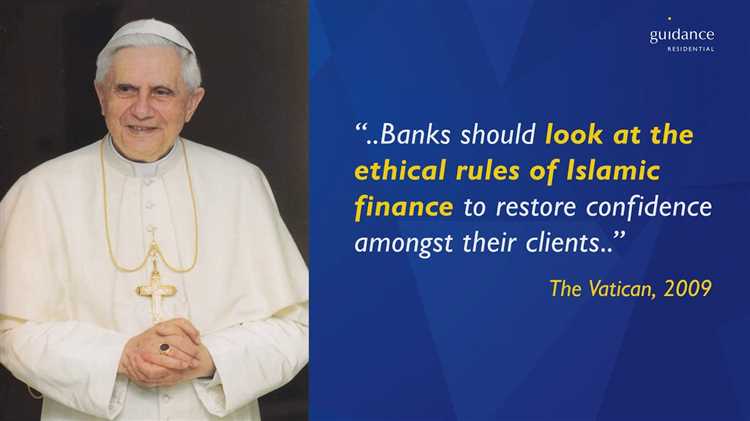

Building Trust and Confidence

One of the main advantages of Islamic finance is its focus on building trust and confidence among its stakeholders. This is achieved through a number of key principles and practices that are embedded in Islamic finance.

- Transparency: Islamic finance emphasizes transparency in all transactions. This means that all parties involved in a transaction must have access to all the relevant information and terms of the agreement. This helps build trust as it ensures that there are no hidden fees or clauses that could potentially lead to disputes or conflicts.

- Accountability: Islamic finance promotes accountability by ensuring that all parties involved in a transaction take responsibility for their actions. This includes lenders, borrowers, and investors. By holding all parties accountable, Islamic finance helps create a system that is fair and just, enhancing confidence among stakeholders.

- Shared Risk and Reward: Unlike conventional banking, Islamic finance promotes a system where risks and rewards are shared between the parties involved. This helps build trust as it aligns the interests of all stakeholders. It also encourages responsible lending and investing, as all parties have a vested interest in the success of the transaction.

- Ethical Standards: Islamic finance operates within a framework of ethical standards derived from Islamic principles. These principles promote fairness, justice, and responsibility. By adhering to these ethical standards, Islamic finance builds trust and confidence among its stakeholders.

In addition to these principles and practices, Islamic finance also offers mechanisms for resolving disputes and conflicts. This helps ensure that if any issues arise during a transaction, they can be resolved in a fair and transparent manner.

Overall, by placing an emphasis on transparency, accountability, shared risk and reward, and ethical standards, Islamic finance builds trust and confidence among its stakeholders. This makes it an attractive option for those seeking a banking system that operates within an ethical and responsible framework.

The Future of Islamic Finance

Islamic finance has experienced significant growth over the past few decades and is expected to continue expanding in the future. Here are some key factors that contribute to the bright future of Islamic finance:

- Increasing Muslim population: The global Muslim population is growing at a faster rate than the overall population. With more Muslims becoming economically active, the demand for Islamic financial products and services is expected to rise.

- Ethical and sustainable finance: Islamic finance is based on principles that promote ethical and socially responsible behavior. As the awareness of sustainable finance increases, more individuals and institutions are likely to be attracted to Islamic finance due to its alignment with ethical values.

- Institutional support: Islamic finance has gained support from governments, regulatory authorities, and international organizations. Many countries have established dedicated regulatory frameworks to support the growth of Islamic finance, which has created a conducive environment for the industry to thrive.

- Product innovation: Islamic finance has seen significant product innovation in recent years. Financial institutions are constantly developing new products and services to cater to the diverse needs of customers. This innovation is expected to continue, further expanding the range and appeal of Islamic financial products.

- Global recognition: Islamic finance has gained recognition and acceptance on a global scale. International financial institutions and investors are increasingly incorporating Islamic finance into their portfolios, giving the industry greater exposure and credibility.

- Technology advancements: The use of technology has transformed the financial industry and is expected to have a similar impact on Islamic finance. Fintech solutions, such as mobile banking and digital wallets, are making Islamic financial products more accessible and convenient, attracting a larger customer base.

Overall, the future of Islamic finance looks promising, with continued growth and innovation expected. As the industry evolves and adapts to changing market dynamics, it will play an increasingly significant role in the global financial landscape.

FAQ

What is Islamic finance?

Islamic finance refers to the financial system and products that are compliant with Sharia law, the Islamic legal framework. It prohibits the earning and payment of interest, and promotes economic activities that are ethical and socially responsible.

Why is Islamic finance becoming popular?

Islamic finance is gaining popularity due to its ethical and socially responsible nature. It provides an alternative banking system that aligns with the values and beliefs of Muslims, and also appeals to non-Muslims who are looking for a more ethical way of banking.

What are the benefits of Sharia-compliant banking?

Sharia-compliant banking offers several benefits. First, it promotes equality and fairness by avoiding interest-based transactions that can lead to financial exploitation. Second, it encourages shared risk and profit, as Islamic banks operate on a partnership basis with their clients. Third, it encourages ethical and socially responsible investments, avoiding industries that are prohibited in Islam such as alcohol, gambling, and pork.

How does Islamic finance contribute to economic growth?

Islamic finance contributes to economic growth in several ways. First, it encourages savings and investments by providing innovative financial products that meet the needs of both individuals and businesses. Second, it promotes stability in the financial system by avoiding excessive leverage and speculative activities. Third, it encourages the development of Islamic financial institutions, creating competition and diversity in the banking sector.

Can non-Muslims benefit from Islamic finance?

Absolutely! Islamic finance is not limited to Muslims only. Non-Muslims can benefit from Islamic finance by enjoying the ethical and socially responsible nature of the system. They can also explore alternative financial products and services that may align better with their values and beliefs. Islamic finance offers a more inclusive and ethical approach to banking.