When it comes to finding the right insurance for your needs, getting quotes for different policies is a common practice. However, with the plethora of websites and companies offering insurance quotes online, it’s important to question the legitimacy of these quotes and understand how they work.

Insurance quotes are estimates of the premium you would pay for a specific insurance policy based on the information you provide. They can be obtained online through insurance comparison websites or directly from insurance companies. While these quotes can give you a rough idea of the cost of insurance, it’s crucial to note that they are not binding contracts nor a guarantee of the final premium you will have to pay.

It’s essential to exercise caution when relying solely on insurance quotes to make your insurance decisions. The accuracy of these quotes depends on the accuracy of the information you provide. Any incorrect or incomplete details may result in significant discrepancies between the quote and the actual premium you’re offered. Additionally, many insurance quotes don’t take into account certain factors that could affect the cost, such as your driving history, credit score, or other personal circumstances.

Therefore, it’s recommended to treat insurance quotes as a starting point of your research rather than a final decision-making tool. To obtain a more accurate estimate of your insurance premium and coverage, it’s advisable to contact insurance companies directly and provide them with all the necessary information. This will allow them to evaluate your specific circumstances and provide you with a more precise quote tailored to your needs.

What Are Insurance Quotes?

Insurance quotes are estimates of the cost of an insurance policy, provided by insurance companies to potential customers. They are based on the information provided by the customer, including personal details, coverage requirements, and other relevant factors. Insurance quotes serve as a way for individuals and businesses to compare different insurance options and choose the one that best fits their needs and budget.

Insurance quotes are typically free and can be obtained online, over the phone, or through an insurance agent. They provide an overview of the coverage options offered by the insurance company, as well as the associated costs. Quotes can vary widely from one insurance company to another, which is why it is important to obtain multiple quotes and compare them before making a decision.

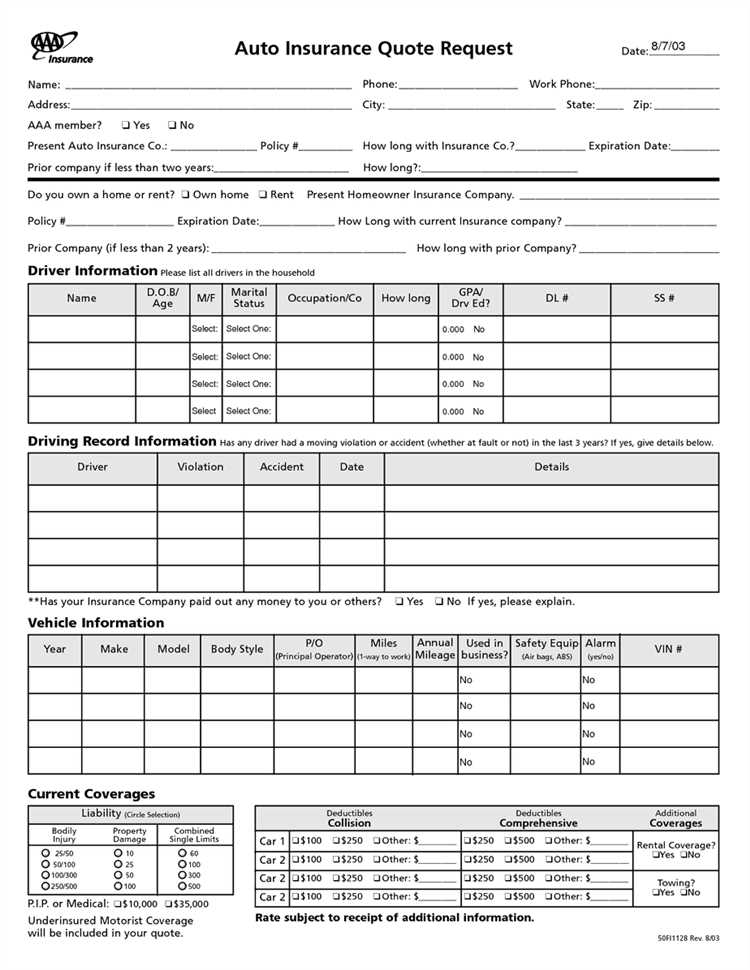

The process of getting an insurance quote usually involves providing information about the individual or business seeking coverage, such as age, location, type of property or vehicle, and desired coverage limits. This information allows the insurance company to assess the level of risk involved and calculate a premium (the amount of money the customer will need to pay for the insurance policy).

Insurance quotes can be for various types of insurance, including auto insurance, home insurance, life insurance, health insurance, and business insurance. They can also include optional coverage add-ons, such as roadside assistance or rental car reimbursement for auto insurance policies.

| 1. | Insurance quotes are estimates of the cost of an insurance policy. |

| 2. | They are based on the information provided by the customer. |

| 3. | Quotes allow individuals and businesses to compare different insurance options. |

| 4. | They can be obtained for various types of insurance. |

| 5. | Insurance quotes can vary widely from one company to another. |

In conclusion, insurance quotes are an essential tool for individuals and businesses looking to find the right insurance coverage at the best price. By gathering and comparing quotes from different insurance companies, it is possible to make an informed decision and choose the policy that provides the desired protection at an affordable cost.

How Do Insurance Quotes Work?

Insurance quotes are estimates of the cost of an insurance policy based on information provided by the applicant. They are provided by insurance companies to help potential customers understand the costs and coverage options available to them.

When a person is interested in purchasing insurance, they can request a quote from an insurance company. This typically involves filling out an application form that asks for information about the person’s age, gender, occupation, health history, and other relevant details.

Once the application is submitted, the insurance company uses this information to assess the level of risk the applicant presents. They consider factors such as the likelihood of a claim being made and the potential cost of that claim. Based on this assessment, the insurance company calculates the premium, or the cost of the insurance policy.

The insurance quote will typically include details about the coverage being offered, such as the type of policy, the coverage limits, and any deductibles or exclusions. It may also include additional information, such as optional coverage options or discounts that the applicant may be eligible for.

Insurance quotes can be obtained from multiple insurance companies, allowing the applicant to compare prices and coverage options. This can help the individual make an informed decision about which insurance policy is best suited to their needs and budget.

It’s worth noting that an insurance quote is not a guarantee of coverage or price. The final premium and terms of the policy may be subject to further review and underwriting by the insurance company.

In conclusion, insurance quotes provide potential customers with an estimate of the cost and coverage options for an insurance policy. They are based on information provided by the applicant and help individuals make informed decisions about their insurance needs.

Are Insurance Quotes Accurate?

When it comes to shopping for insurance, one of the first steps is to obtain insurance quotes. Insurance quotes provide an estimate of the premium you can expect to pay for a specific insurance policy. However, many people wonder if insurance quotes are accurate and reliable. Here are some factors to consider:

- Information provided: The accuracy of an insurance quote depends on the information you provide. Insurance companies rely on the information you provide to calculate the premium. It is important to provide accurate and detailed information about yourself, your vehicle, or your property to receive an accurate quote.

- Insurance company: Different insurance companies may provide different quotes for the same coverage. Each insurance company has its own underwriting guidelines and pricing models. It is recommended to obtain quotes from multiple insurance companies to compare the prices and coverage options.

- Market conditions: Insurance quotes can be affected by market conditions. Insurance companies consider factors such as the overall market trends, claims history, and competition when determining the premiums. Therefore, the quotes you receive may vary over time.

- Additional factors: Insurance quotes may not include all possible factors that can affect the premium. Factors like your credit history, driving record, or specific coverage endorsements may be considered after the initial quote is provided. These additional factors can result in a change in the premium.

While insurance quotes can provide a good starting point for comparing prices and coverage options, it is important to keep in mind that the final premium may vary from the quote. To get the most accurate quote, it is recommended to provide accurate and detailed information to the insurance company. Additionally, it is a good idea to review the policy terms and conditions carefully before making a final decision.

Can You Trust Insurance Quotes?

When it comes to insurance quotes, trust is a major concern for consumers. With so many insurance providers out there offering different rates and coverage options, it can be difficult to determine which quotes can be trusted and which ones are misleading. Here are some factors to consider when evaluating the trustworthiness of insurance quotes:

- Source of the Quotes: It is important to consider the source of the insurance quotes. Quotes provided by reputable insurance companies or licensed insurance agents are more likely to be trustworthy compared to quotes from unknown or unlicensed sources.

- Accuracy of Information: Reliable insurance quotes are based on accurate and up-to-date information provided by the consumer. It is essential to provide complete and accurate details about your insurance needs in order to receive accurate quotes.

- Comparison of Multiple Quotes: To get a better understanding of the trustworthiness of insurance quotes, it is advisable to request quotes from multiple insurance providers. This allows you to compare rates, coverage options, and customer reviews, helping you make an informed decision.

- Clarity and Transparency: Trustworthy insurance quotes are clear and transparent about the coverage details, deductibles, exclusions, and any additional fees or charges. Be cautious of quotes that seem too good to be true or have hidden costs.

- Customer Reviews and Ratings: Checking customer reviews and ratings can provide insights into the trustworthiness of insurance quotes. Look for feedback from customers who have purchased insurance from the same provider and consider their experiences.

While insurance quotes can be a helpful tool in comparing rates and coverage options, it is important to approach them with caution. Some quotes may be misleading or incomplete, leading to unexpected costs or inadequate coverage. By considering the factors mentioned above and being aware of potential red flags, you can make a more informed decision when it comes to trusting insurance quotes.

How to Compare Insurance Quotes?

When it comes to finding the right insurance policy for your needs, comparing insurance quotes is an essential step. By comparing quotes from different insurance providers, you can ensure that you are getting the best coverage at the most competitive rates. Here are some steps to help you effectively compare insurance quotes:

- Identify your insurance needs: Before you start comparing quotes, it’s important to determine what type of insurance coverage you need. Whether it’s auto insurance, home insurance, or health insurance, understanding your specific needs will help you narrow down your options and find the most relevant quotes.

- Gather quotes from multiple providers: Once you have identified your insurance needs, start gathering quotes from different insurance providers. You can either contact insurance companies directly or use online comparison websites to obtain multiple quotes quickly and conveniently.

- Review coverage details: When comparing insurance quotes, it’s crucial to review the coverage details offered by each provider. Pay attention to the policy limits, deductibles, exclusions, and any additional benefits or discounts. This will help you understand the level of protection you will receive and make an informed decision.

- Compare premium rates: In addition to coverage details, comparing premium rates is essential to finding the most cost-effective insurance policy. Consider the annual premium amount, payment frequency, and any discounts or incentives that can help reduce the overall cost.

- Check customer reviews and ratings: Before finalizing your decision, take the time to check customer reviews and ratings for each insurance provider you are considering. This will give you insights into their customer service, claims handling process, and overall satisfaction level.

- Speak with insurance agents: If you have any questions or concerns about the quotes or policies, don’t hesitate to speak with insurance agents directly. They can provide additional information, clarify any doubts, and help you make an informed decision based on your unique situation.

- Make your final decision: After comparing all the aspects mentioned above, it’s time to make your final decision. Choose the insurance policy that provides adequate coverage, fits your budget, and is offered by a reputable insurance provider.

Remember, comparing insurance quotes not only helps you find the right coverage but also ensures that you are not overpaying for your insurance. By following these steps, you can compare insurance quotes effectively and make an informed decision to protect yourself and your assets.

What Factors Affect Insurance Quotes?

When it comes to insurance quotes, there are several factors that can affect the price you are quoted. Insurance companies take into account a variety of factors to determine the risk associated with insuring you, and these factors can ultimately impact the cost of your insurance premiums. Here are some key factors that can affect insurance quotes:

- Age: Your age can play a significant role in determining your insurance quote. Generally, younger drivers are considered to be higher-risk and may be quoted higher premiums compared to older, more experienced drivers.

- Driving Record: Your driving record is another important factor that insurers consider. If you have a history of accidents or traffic violations, you may be deemed higher-risk and therefore receive higher insurance quotes.

- Type of Vehicle: The type of vehicle you drive can also impact your insurance quote. Insurers take into account factors such as the make, model, year, and safety features of your vehicle when determining your premium. Generally, more expensive or high-performance vehicles may result in higher insurance quotes.

- Location: Your location can affect your insurance quotes as well. If you live in an area with a higher crime rate or a higher incidence of accidents, you may be quoted higher premiums.

- Credit Score: In some cases, your credit score may also be taken into consideration when obtaining insurance quotes. Insurers believe that individuals with lower credit scores are more likely to file claims, and therefore may offer higher quotes to those with lower scores.

It’s important to note that these factors can vary depending on the insurance company and the type of insurance policy you are seeking. Additionally, insurance companies may use different weighting systems for these factors, so it’s always a good idea to shop around and compare quotes from multiple insurers to ensure you’re getting the best possible rate.

Are Online Insurance Quotes Reliable?

When it comes to finding the best insurance coverage for your needs, online insurance quotes can be a useful tool. However, many people wonder if these quotes are actually reliable. In order to determine their reliability, it’s important to understand how online insurance quotes work and what factors can affect their accuracy.

Online insurance quotes are generated based on the information provided by the user. This information includes details about the individual’s age, gender, location, driving history, and other relevant factors. The insurance company then uses this information to calculate a premium estimate.

While online insurance quotes can provide a quick and convenient way to compare prices and coverage options, it’s important to keep in mind that they are just estimates. The final premium rate may vary based on additional information and underwriting criteria that the insurance company considers.

There are several factors that can affect the accuracy of online insurance quotes. These include:

- Accuracy of information: Providing accurate and up-to-date information is crucial for obtaining reliable insurance quotes. Any discrepancies or omissions in the provided information can lead to inaccurate quotes.

- Changes in the market: Insurance rates can vary based on market conditions and other external factors. Online insurance quotes may not reflect these changes in real-time, leading to discrepancies between the quoted price and the actual premium.

- Underwriting criteria: Insurance companies have their own underwriting criteria, which they use to assess risk and determine premium rates. These criteria can vary between companies, and online quotes may not take them all into account.

- Discounts and additional fees: Online insurance quotes may not include all potential discounts or additional fees that may be applicable. It’s important to review the details of the policy carefully to understand the final cost.

In general, while online insurance quotes can be a helpful starting point for comparing prices and coverage options, they should not be considered as the final word. To obtain the most accurate and reliable quotes, it’s recommended to contact insurance companies directly and provide detailed information about your specific needs and circumstances.

Why Should You Get Insurance Quotes?

Getting insurance quotes has many benefits for individuals and businesses alike. Here are some compelling reasons why you should consider obtaining insurance quotes:

- Cost Comparison: Insurance quotes allow you to compare the costs and coverage details from different insurers. By obtaining multiple quotes, you can find the best deal that suits your needs and budget.

- Affordability: Insurance quotes help you assess the affordability of various insurance policies. You can select the option that provides adequate coverage without breaking the bank.

- Coverage Options: Insurance quotes provide you with a detailed breakdown of coverage options offered by different insurers. This enables you to choose policies that align with your specific needs and requirements.

- Customization: Some insurance companies allow you to customize your policy based on your unique circumstances. By obtaining quotes, you can explore these customization options and tailor your coverage to meet your individual needs.

- Customer Service: Insurance quotes provide insight into the customer service reputation of various insurers. You can research and evaluate customer reviews and ratings, helping you make an informed decision about the insurer’s reliability and responsiveness.

Moreover, getting insurance quotes allows you to be proactive in managing potential risks or losses. By understanding the costs associated with different insurance policies, you can take steps to protect your assets, mitigate risks, and achieve peace of mind.

Question and answer:

What are insurance quotes?

Insurance quotes are estimates provided by insurance companies that give you an idea of how much a particular insurance policy will cost you.

How accurate are insurance quotes?

Insurance quotes are usually accurate, but the final premium may vary depending on additional details and factors such as your driving record, age, and location.

Are insurance quotes free?

Yes, insurance quotes are usually free. You can request quotes from multiple insurance companies to compare prices and find the best deal.

What information do I need to get an insurance quote?

To get an insurance quote, you will need to provide details such as your name, address, date of birth, information about your vehicle or property, and any additional coverage options you may want.

Can I trust insurance quotes online?

Yes, you can trust insurance quotes online, but it is important to verify the legitimacy of the website or company providing the quotes. Stick to reputable insurance comparison sites or contact insurance companies directly.

How do insurance companies calculate insurance quotes?

Insurance companies calculate insurance quotes based on a variety of factors, including your age, location, driving record, type of coverage, claims history, and more. They use complex algorithms to determine the risk and pricing associated with insuring you.