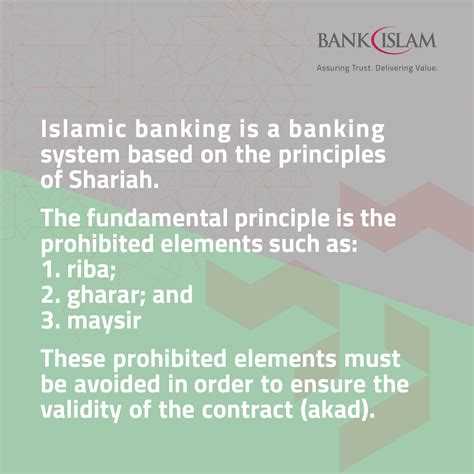

In the modern world, where financial systems play a crucial role, the concept of Islamic banking has gained significant attention. With a focus on ethical and religious principles, Islamic banking operates in accordance with Islamic law, known as Shariah. However, there is often confusion around whether Islamic banking practices are halal (permissible) or haram (forbidden). This article aims to explore the ethics and rulings surrounding Islamic banking to shed light on this topic.

Islamic banking operates based on a fundamental principle of avoiding injustices and unethical practices. One of the key aspects of Islamic banking is the prohibition of interest, known as riba in Arabic. In Islamic finance, making money from money is seen as unfair and exploitative. Therefore, instead of charging interest, Islamic banks engage in profit-sharing arrangements or provide financing through a system called murabaha, where the bank purchases the desired item and sells it to the client at a mutually agreed-upon markup.

Another important concept in Islamic banking is the avoidance of uncertainty and speculation, known as gharar. This means that Islamic banks are prohibited from engaging in activities that involve excessive risk or ambiguity. This ethical principle aims to promote stability and fairness in financial transactions. Islamic banks also avoid investing in sectors that are considered haram, such as alcohol, gambling, and pork-related products, as these go against Islamic teachings.

Islamic banking operates within a framework governed by Shariah scholars who provide guidance on the permissibility of financial products and transactions. These scholars review the contracts and practices of Islamic banks to ensure they comply with Shariah principles. This oversight ensures that the banking system adheres to ethical standards and gives Muslim consumers confidence that their financial affairs are in line with their religious beliefs.

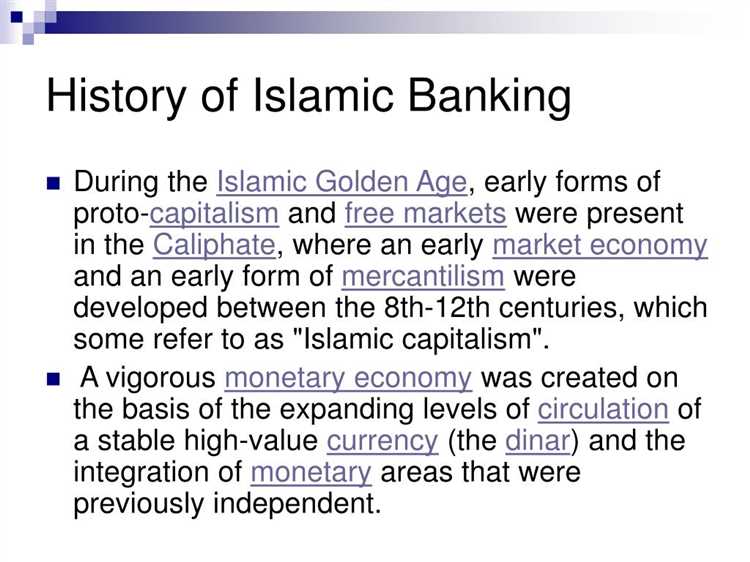

Understanding Islamic Finance Principles

Islamic finance is a financial system that is guided by principles derived from Islamic law, or Shariah. It is based on the concept of fairness, equity, and social justice, and aims to provide financial products and services that are in line with Islamic teachings.

There are several key principles that govern Islamic finance:

- Prohibition of Riba: Riba, or interest, is strictly prohibited in Islamic finance. It is considered exploitative and unfair, as it allows the lender to receive more than the principal amount lent. Instead, Islamic finance promotes profit-sharing and risk-sharing arrangements.

- Prohibition of Gharar: Gharar refers to uncertainty or ambiguity in contracts. Islamic finance discourages speculative transactions and contracts that involve excessive uncertainty or ambiguity. Contracts should be transparent and based on real economic activities.

- Prohibition of Haram Activities: Islamic finance also prohibits investments in activities that are considered haram, or sinful, according to Islamic teachings. This includes activities related to alcohol, gambling, pork, and other prohibited goods or services.

- Emphasis on Ethical Investments: Islamic finance encourages ethical investments that have a positive social impact. Investments should be made in sectors that contribute to the well-being of society, such as healthcare, education, renewable energy, and infrastructure development.

- Prohibition of Excessive Speculation: Islamic finance discourages excessive speculation and encourages real economic activities. Investments should be based on real assets and productive economic activities, rather than purely financial speculation.

In order to comply with these principles, Islamic financial institutions offer a range of products and services that are designed to be halal, or permissible, under Shariah law. Some common Islamic financial products include:

- Murabaha: This is a cost-plus financing arrangement, where the financial institution purchases an asset on behalf of the customer and sells it to them at a higher price, allowing them to pay in installments.

- Mudarabah: This is a profit-sharing arrangement, where the financial institution provides the capital and the customer provides the expertise. Profits are shared between both parties based on pre-agreed ratios.

- Sukuk: These are Islamic bonds that represent ownership in a tangible asset or project. Investors earn returns based on the performance of the underlying asset or project.

- Ijarah: This is a lease agreement, where the financial institution purchases an asset and leases it to the customer for a specified period of time. At the end of the lease term, the customer may have the option to purchase the asset.

- Takaful: This is an Islamic form of insurance, where participants contribute premiums into a pool that is used to provide coverage for any losses or damages. It operates on the principles of mutual cooperation and shared responsibility.

Overall, Islamic finance principles aim to promote fairness, transparency, and social responsibility in the financial sector. They provide an alternative model of finance that is aligned with Islamic teachings and values.

The Concept of Halal and Haram

In Islamic ethics, the concept of halal and haram plays a significant role. Halal refers to anything that is permissible or allowed according to Islamic principles, while haram refers to anything that is prohibited or forbidden.

The sources for determining what is halal and haram come from the Quran, the holy book of Islam, and the Hadith, the sayings and actions of Prophet Muhammad (peace be upon him). These sources provide guidelines and principles for Muslims to follow in their daily lives, including in matters of finance and banking.

Islamic banking, also known as Shariah-compliant banking, operates based on the principles of halal and haram. It follows a set of rules and guidelines that ensure transactions are conducted in accordance with Islamic principles.

One of the main principles of Islamic banking is the prohibition of interest, or riba. Charging or receiving interest is considered haram in Islamic finance as it is seen as exploitative and unfair. Instead, Islamic banks use alternatives such as profit-sharing arrangements or fee-based transactions that align with the principles of halal.

Another principle in Islamic banking is the avoidance of investments that involve haram activities. This includes industries such as gambling, alcohol, pork, and any other activities that are explicitly prohibited in Islam.

Transparency and ethical behavior are also emphasized in Islamic banking. Banks are required to disclose all relevant information regarding their transactions and investments to ensure that customers can make fully informed decisions. This promotes fairness and ensures that transactions are conducted in a halal manner.

Overall, Islamic banking operates on the principles of halal and haram, ensuring that financial activities and transactions are conducted in an ethical and Shariah-compliant manner. By adhering to these principles, it provides an alternative banking system that aligns with the values and beliefs of practicing Muslims.

Islamic Banking: Halal or Haram?

In the debate surrounding Islamic banking, one of the key issues discussed is whether it is considered halal (permissible) or haram (prohibited) according to Islamic principles. Islamic banking operates based on the principles of Islamic law (Shariah), which prohibits the payment or receipt of interest (riba) and promotes fairness, ethical conduct, and sharing of risk and reward.

Proponents of Islamic banking argue that it is halal because it avoids involvement in interest-based transactions, which are considered exploitative and unfair. Islamic banks operate under a profit-sharing model, where they invest funds in halal activities and share the profits and losses with their clients. This system ensures that both parties share the risks and rewards of their investments.

Furthermore, Islamic banking emphasizes ethical and socially responsible behavior. Islamic banks are prohibited from investing in activities that are considered haram, such as gambling, alcohol, pork, or any business that contradicts Islamic values. This prohibition aims to promote a more ethical financial system that aligns with Islamic principles.

However, critics argue that Islamic banking is not entirely halal due to various reasons. One criticism is that some Islamic banks still engage in transactions that may resemble interest-based loans, such as murabaha (cost-plus financing). Critics claim that these transactions are merely a form of disguised interest and do not comply with the true spirit of Islamic principles.

Another criticism pertains to the issue of financial innovation and global competitiveness. Some argue that the strict adherence to Islamic principles in banking may limit the capacity of Islamic banks to compete effectively in the global financial market. They argue that in order to remain competitive, Islamic banks may need to adopt certain conventional banking practices that may not fully align with Islamic principles.

In conclusion, the question of whether Islamic banking is halal or haram is a complex and debated topic. While Islamic banking strives to operate within the boundaries of Islamic principles and promotes fairness and ethical behavior, there are differing opinions on the extent to which it complies with the true spirit of Shariah. Ultimately, it is up to individuals to assess the ethical aspects of Islamic banking and make informed decisions based on their own religious beliefs and principles.

The Debate around Interest

The issue of interest (or Riba in Arabic) is at the heart of the debate surrounding Islamic banking. Riba refers to the charging or paying of interest on loans, and it is considered to be haram (forbidden) in Islam.

Islamic scholars argue that Riba is ethically problematic because it creates an unjust economic system. They believe that charging interest encourages the rich to exploit the poor and leads to societal inequality. Additionally, they argue that Riba goes against the principles of fairness, justice, and mutual cooperation that are central to Islamic teachings.

In response to the prohibition of Riba, Islamic banking operates on the principle of profit-sharing (Mudarabah) and risk-sharing (Musharakah). In Islamic banking, instead of receiving interest on loans, the bank and the customer share the profits and risks of a business venture. This system is seen as more equitable and in line with Islamic values.

However, some critics argue that the prohibition of interest limits the financial options available to Muslims and hinders economic growth. They argue that interest-based financing allows for greater access to capital and can stimulate economic activity. They also claim that Islamic banking products, which often involve profit-sharing and risk-sharing agreements, can be complex and less flexible than conventional banking products.

Despite the ongoing debate, Islamic banking has continued to grow worldwide, with many Muslim-majority countries implementing Islamic banking regulations and institutions. While the issue of interest remains contentious, Islamic banking aims to provide financial services that are compliant with Islamic principles and cater to the needs of Muslim consumers.

In conclusion

The debate around interest in Islamic banking centers on the ethical implications of charging or paying interest on loans. Islamic scholars consider interest to be a form of exploitation and economic inequality, while critics argue that interest-based financing allows for greater access to capital and economic growth. Islamic banking adheres to profit-sharing and risk-sharing principles as an alternative to interest-based financing. Despite the ongoing debate, Islamic banking has gained prominence worldwide and aims to provide financial services that align with Islamic ethics.

Rulings on Interest in Islamic Jurisprudence

Interest, or riba, holds a significant position in Islamic jurisprudence. Islamic scholars have debated and provided various rulings on the permissibility of interest in financial transactions.

- Ruling 1: Prohibition of Riba: The majority of Islamic scholars agree that riba is strictly prohibited in Islam. Riba refers to any increase or excess that is added to the principal amount borrowed or lent in a financial transaction. It is considered exploitative and unfair, as it allows the lender to gain profit without taking any risk.

- Ruling 2: Quranic Prohibition: The prohibition of riba is mentioned in the Quran multiple times. The verses clearly state that engaging in riba is a sin and earns the displeasure of Allah. These verses serve as the primary source for the ruling on interest in Islamic jurisprudence.

- Ruling 3: Differentiating between Riba al-Fadl and Riba al-Nasi’ah: Islamic scholars further differentiate between two types of riba, namely riba al-fadl and riba al-nasi’ah. Riba al-fadl refers to the excess in a barter transaction, where the goods exchanged are of the same type but differ in quality or quantity. This type of riba is also prohibited. Riba al-nasi’ah, on the other hand, refers to the increase in a loan transaction. This is the main type of riba that is debated in the context of interest-bearing financial transactions.

- Ruling 4: Permissibility of Profit-Sharing: Islamic scholars agree that profit-sharing arrangements, such as partnerships and joint ventures, are permissible in Islamic banking. In these arrangements, the parties share the profits and losses of a business venture, without involving interest. Profit-sharing promotes risk-sharing and encourages productive economic activities.

- Ruling 5: Permissibility of Interest-Free Loans: Islamic jurisprudence allows for interest-free loans, known as Qard al-Hasan, where the borrower is only required to repay the principal amount borrowed. This is based on the principle of kindness and helping those in need without expecting anything in return.

In conclusion, the majority ruling in Islamic jurisprudence is that interest, or riba, is strictly prohibited. Islamic scholars emphasize the importance of avoiding riba and encourage alternative financial arrangements that promote fairness and equity, such as profit-sharing partnerships and interest-free loans.

Comparing Islamic Banking and Conventional Banking

Islamic banking and conventional banking are two different systems of banking that operate based on different principles and values. While conventional banking follows a secular and interest-based system, Islamic banking adheres to the principles of Shariah law. Here are some key differences between the two:

- Interest: One of the fundamental differences between Islamic banking and conventional banking is the handling of interest. In conventional banking, interest is charged and paid on loans and deposits. However, in Islamic banking, interest is strictly prohibited as it is considered to be exploitative and unfair. Instead, Islamic banks use profit-sharing agreements, leasing arrangements, and other non-interest-based financial instruments.

- Risk-sharing: Islamic banking promotes the concept of risk-sharing between the bank and its clients. In conventional banking, the bank bears the risk of default on loans, while customers bear no risk. However, in Islamic banking, both parties share the risk of investment, and profit or loss is distributed accordingly.

- Asset-backing: Islamic banking focuses on real economic activities and encourages asset-backing. This means that all transactions must be backed by tangible assets or real economic activities. Investments in speculative or unethical activities, such as gambling, alcohol, or pork-related businesses, are strictly prohibited.

- Ethical standards: Islamic banking operates based on ethical principles, such as fairness, transparency, and social responsibility. Lending practices must adhere to these principles, and investments should benefit society as a whole. Conventional banking, on the other hand, may prioritize profit-making over societal welfare.

Despite these differences, there are also some similarities between Islamic banking and conventional banking. Both systems provide financial services, such as savings accounts, investment opportunities, and loans. They also aim to serve the needs of individuals and businesses by providing them with banking solutions.

Overall, the main difference between Islamic banking and conventional banking lies in the underlying principles and values that guide their operations. Islamic banking aims to promote fairness, social justice, and adherence to Shariah law, while conventional banking operates based on profit-making and interest-based transactions.

The Role of Sharia Boards in Islamic Banking

In the world of Islamic banking, a crucial component is the presence of a Sharia Board. A Sharia Board is a group of Islamic scholars who provide guidance and oversight to ensure that all activities and transactions undertaken by an Islamic bank are in accordance with the principles of Sharia law.

The Sharia Board plays a vital role in Islamic banking for several reasons:

- Ensuring compliance with Sharia principles: The primary responsibility of the Sharia Board is to ensure that all banking activities are conducted in a manner that is compliant with the principles of Sharia law. This involves reviewing and approving the bank’s products, services, and transactions to ensure they align with Islamic principles.

- Providing expert advice: Sharia scholars on the board possess deep knowledge of Islamic jurisprudence and finance. They provide expert advice to the bank on complex financial matters, ensuring that the bank’s operations are in line with Sharia principles.

- Reviewing and approving contracts: The Sharia Board reviews and approves all contracts entered into by the Islamic bank. This includes contracts with customers, suppliers, and other parties. The board ensures that these contracts are free from any elements deemed haram (prohibited) under Islamic law.

- Conducting regular audits: Sharia Boards conduct regular audits of the bank’s operations to ensure ongoing compliance with Sharia principles. They review financial statements, transaction records, and other relevant documents to identify any potential violations of Islamic law.

- Resolving disputes: In the event of a dispute or disagreement regarding a particular transaction or decision, the Sharia Board acts as an independent arbitrator. They examine the issue from a Sharia perspective and provide a resolution in line with Islamic principles.

The presence of a Sharia Board in Islamic banking serves as a key differentiating factor from conventional banking. It provides confidence to customers that their financial transactions are being conducted in accordance with their religious beliefs. Additionally, it helps the bank establish its reputation as an institution that adheres to the highest standards of ethical finance.

| Benefits of a Sharia Board in Islamic Banking |

|---|

| Enhanced consumer trust and confidence |

| Preservation of Islamic ethics and values |

| Protection against potential non-compliance risks |

| Expert guidance on complex financial matters |

In conclusion, the Sharia Board plays a crucial role in Islamic banking by ensuring compliance with Sharia principles, providing expert guidance, reviewing contracts, conducting audits, and resolving disputes. Its presence reinforces the ethical and moral foundations on which Islamic banking is built, instilling trust in customers and stakeholders.

Ethical Considerations in Islamic Banking

Islamic banking operates within the framework of Shariah, which prohibits certain financial practices based on ethical and moral considerations. Here are some key ethical considerations in Islamic banking:

- Prohibition of Interest (Riba): Islamic banking strictly prohibits the charging or earning of interest. Riba is considered exploitative and unfair, as it creates an unequal distribution of wealth. Instead, Islamic banks engage in profit-sharing and risk-sharing arrangements as a more ethical alternative.

- Avoidance of Speculation (Gharar): Islamic banking discourages speculative transactions that involve excessive uncertainty or ambiguity. This helps to prevent unfair practices and promote stability in financial transactions.

- Prohibition of Gambling (Maysir): Islamic banking avoids investments or transactions that involve uncertainty and gambling-like activities. This includes activities such as betting on uncertain outcomes or engaging in games of chance.

- Adherence to Ethical Standards (Adab): Islamic banking emphasizes ethical behavior, honesty, and transparency in all financial transactions. Banks are expected to uphold high moral standards and act in the best interest of their customers.

In addition to these core principles, Islamic banking also promotes social and economic justice. It encourages financing projects that have a positive impact on society, such as those focused on sustainable development, poverty alleviation, and community welfare. Islamic banks are also encouraged to avoid investments in industries that are considered harmful or unethical, such as gambling, alcohol, pork, and other prohibited activities.

Overall, ethics play a crucial role in Islamic banking. By adhering to Shariah principles, Islamic banks aim to create an ethical and socially responsible financial system that benefits both individuals and the wider society.

Transparency and Accountability

Transparency and accountability are essential principles in Islamic banking that aim to ensure the integrity of the financial system and maintain trust between the institution and its stakeholders. These principles are emphasized in order to align the practices of Islamic banking with Islamic teachings and ethical standards.

Islamic banks are required to be transparent in their operations, ensuring that all relevant information is disclosed to their customers and stakeholders. This includes providing clear and accurate information about their products, services, fees, and charges. Transparency allows customers to make informed decisions and understand the risks and benefits associated with Islamic banking transactions.

Furthermore, Islamic banks are also required to be accountable for their actions and adhere to ethical standards. This means that they must operate in a manner that is consistent with Shariah principles and avoid any practices that are considered unethical or prohibited in Islam. Islamic banks must establish strong mechanisms for monitoring and oversight to ensure compliance with these principles.

To enhance transparency and accountability, Islamic banks often establish Shariah boards or committees composed of scholars well-versed in Islamic law. These boards are responsible for reviewing and approving the bank’s products and practices to ensure they are in line with Shariah principles. They also provide guidance and supervision to ensure the bank’s operations are conducted ethically and in accordance with Islamic teachings.

In addition, Islamic banks are required to undergo regular audits by independent auditors to ensure compliance with Shariah principles and ethical standards. These audits help to identify any irregularities or violations and provide recommendations for improvement. The results of these audits should be made available to customers and stakeholders to maintain transparency and accountability.

Overall, transparency and accountability are fundamental principles in Islamic banking that ensure the integrity and ethical conduct of the financial system. By adhering to these principles, Islamic banks can maintain trust and confidence among their customers and stakeholders, and uphold the values of Islamic finance.

Socially Responsible Investments

Socially Responsible Investments (SRIs) are a type of investment that not only aims to generate financial returns but also considers the social and environmental impacts of the invested funds. SRIs are based on the principle that investment should align with the investor’s values and strive for positive change in society.

In the context of Islamic banking, socially responsible investments play a vital role as they adhere to the principles of Islamic finance while also considering ethical and sustainable criteria. Islamic finance emphasizes the importance of ethical behavior and discourages investments in industries such as alcohol, gambling, tobacco, and weapons.

SRIs in Islamic banking follow certain guidelines to ensure compliance with Islamic principles. These guidelines include avoiding investments in companies involved in prohibited activities, such as gambling or the production of alcohol, and prioritizing investments in sectors that promote social well-being, such as healthcare, education, and renewable energy.

Furthermore, Islamic banks often employ screens or filters to identify investments that align with Islamic values. These filters help identify companies that comply with Islamic principles, such as those with low debt levels, ethical business practices, and fair treatment of employees.

One of the key advantages of socially responsible investments in Islamic banking is that they align with Islamic ethical values and provide investors an opportunity to contribute to positive social and environmental changes. By investing in sectors that promote social well-being and sustainable development, investors can support initiatives that benefit society as a whole.

Additionally, SRIs have the potential to attract a wider range of investors, including those who are conscious of the social and environmental impact of their investments. This can lead to increased financing options and overall growth in Islamic banking.

In conclusion, socially responsible investments in Islamic banking offer a unique approach to investing that integrates ethical values with financial returns. By adhering to Islamic principles and prioritizing investments in sectors that promote social well-being, these investments provide a platform for positive change and contribute to a more sustainable and equitable society.

Prohibition of Speculation and Gambling

In Islamic banking, one of the main ethical principles is the prohibition of speculation and gambling. This prohibition is based on the belief that wealth should be generated through legitimate and productive means, and not through chance or gambling.

Speculation is considered Haram (prohibited) in Islamic banking because it involves uncertain or speculative transactions that are based on future price movements. This can lead to exploitation and injustice, as it allows individuals to profit at the expense of others without participating in real economic activities. Islamic banking promotes fairness and justice in economic transactions, and speculation goes against these principles.

Gambling is also strictly prohibited in Islamic banking. Gambling involves risking money or other valuables on an uncertain outcome, purely relying on chance and luck. This contradicts the Islamic belief in personal responsibility and earning wealth through legitimate means. Gambling is seen as a form of exploitation and a source of societal problems, such as addiction and financial ruin.

In Islamic banking, transactions must have an element of certainty, transparency, and benefit to society. Investments are based on real assets and productive activities, such as trade, manufacturing, and services. This ensures that wealth is generated in a sustainable and ethical manner, benefiting both individuals and society as a whole.

Islamic banking offers alternative financial instruments that comply with the prohibition of speculation and gambling, such as Islamic bonds (sukuk), profit-sharing agreements (mudarabah), and joint venture partnerships (musharakah). These instruments promote fairness, risk-sharing, and the sharing of profits and losses between the parties involved.

Overall, the prohibition of speculation and gambling in Islamic banking reflects the ethical and moral principles of Islam. It encourages responsible and sustainable economic activities while protecting individuals and society from the potential harm and exploitation associated with speculation and gambling.

Support for Small and Medium Enterprises

Islamic banking has a strong focus on supporting small and medium enterprises (SMEs) due to their vital role in the economy and their potential for creating jobs and driving economic growth. The principles of Islamic banking promote equity, fairness, and social justice, making it an ideal choice for SMEs seeking financial assistance.

One way in which Islamic banking supports SMEs is through the provision of interest-free loans, known as Qard al-Hasan. These loans are provided to SMEs without charging any interest, making them more accessible and affordable for small businesses. This allows SMEs to obtain the necessary capital for their operations and expansion without the burden of interest payments.

In addition to interest-free loans, Islamic banks also offer other financial products and services tailored to the needs of SMEs. These include profit-sharing agreements, partnerships, and trade financing solutions. Profit-sharing agreements, such as Mudarabah and Musharakah, enable SMEs to partner with Islamic banks, sharing both the profits and losses of their business ventures.

Furthermore, Islamic banks often provide advisory and mentoring services to SMEs, helping them with business planning, financial management, and market analysis. These services aim to support SMEs in making informed decisions and implementing sound strategies for growth and success. Islamic banks understand the challenges faced by SMEs and strive to provide them with the necessary support and guidance.

Islamic banks also actively participate in government initiatives and programs aimed at promoting SME development. They collaborate with government agencies and other stakeholders to provide financial assistance, training, and networking opportunities to SMEs. By doing so, they contribute to the overall growth and stability of the SME sector.

Overall, Islamic banking offers significant support for SMEs, aligning with the principles of fairness, equality, and social welfare. Through interest-free loans, profit-sharing agreements, advisory services, and active participation in government programs, Islamic banks empower SMEs and contribute to their success and economic impact.

Benefits of Islamic Banking

Islamic banking, also known as Sharia-compliant banking, offers several benefits to individuals and society as a whole. These benefits include:

- Ethical and moral: Islamic banking operates on principles that align with ethical and moral values. It prohibits interest-based transactions, speculation, and investments in businesses that are considered unethical (such as alcohol, gambling, and pork-related industries). This makes Islamic banking an attractive option for individuals who want to engage in financial activities that align with their beliefs.

- Risk-sharing: Islamic banking promotes risk-sharing between the bank and the customer. In conventional banking, the burden of financial risks is mostly borne by the customer. However, in Islamic banking, profit and loss sharing is an integral part of transactions. This encourages a more equitable distribution of risks and rewards.

- Stability and resilience: Islamic banks tend to focus on long-term investments rather than short-term gains. This approach promotes stability and resilience in the banking sector, as it discourages speculative activities that can lead to financial crises. By prioritizing sustainable growth, Islamic banking contributes to the overall stability of the economy.

- Financial inclusion: Islamic banking aims to be accessible to all individuals, regardless of their socio-economic status or religious beliefs. This promotes financial inclusion and provides opportunities for individuals who may have previously been excluded from the traditional banking system. Islamic banking also offers products and services that cater to the needs of specific communities, such as interest-free loans and Sharia-compliant investment options.

- Asset-backed financing: In Islamic banking, transactions are typically backed by tangible assets, such as real estate or commodities. This reduces the reliance on debt and encourages responsible financial behavior. By requiring assets as collateral, Islamic banking mitigates the risks associated with lending and enhances the overall stability of the banking system.

In conclusion, Islamic banking offers various benefits, including ethical and moral principles, risk-sharing, stability, financial inclusion, and asset-backed financing. These features make Islamic banking an appealing option for individuals and contribute to a more equitable and sustainable financial system.

Financial Stability

Financial stability is an essential component of Islamic banking. The principles and guidelines established in Islamic finance aim to ensure a more stable and resilient financial system.

One of the key features that contribute to financial stability in Islamic banking is the prohibition of interest, known as riba. This prohibition helps to avoid the financial instability and inequality that can arise from interest-based transactions in conventional finance.

In addition to the prohibition of interest, Islamic banking promotes risk-sharing and fairness in transactions. This encourages a more stable financial environment by ensuring that risks are distributed equitably among all involved parties. It also discourages excessive risk-taking and speculation, which can lead to financial instability.

Furthermore, Islamic banking emphasizes the importance of real economic activities and asset-backed financing. This means that banks must have a direct link to the real economy, supporting productive sectors and investments. By focusing on tangible assets and real economic activities, Islamic banks contribute to greater financial stability by avoiding speculative bubbles and unsustainable lending practices.

The regulatory frameworks for Islamic banking also play a crucial role in maintaining financial stability. These frameworks ensure compliance with Islamic principles and provide guidelines for risk management, transparency, and accountability. They also help prevent fraudulent activities and unethical practices, contributing to a more stable and trustworthy financial system.

In conclusion, Islamic banking promotes financial stability through its principles of interest-free transactions, risk-sharing, fairness, focus on real economic activities, and robust regulatory frameworks. By adhering to these principles, Islamic banks aim to create a more stable and resilient financial system that benefits both individuals and society as a whole.

Risk Sharing and Fair Distribution of Wealth

Risk sharing and fair distribution of wealth are core principles in Islamic finance and banking. Islamic banking operates on the principle of sharing risks and profits between the bank and its customers, as opposed to conventional banking where the bank takes on all risks and the customer is guaranteed a fixed return.

In Islamic finance, the concept of risk sharing is based on the idea that both parties involved in a transaction should share the risks and rewards in a fair and equitable manner. This means that in Islamic banking, the bank and the customer share both the profits and losses arising from their investment activities.

This principle of risk sharing encourages transparency and accountability in the financial system. It also promotes a more equitable distribution of wealth, as it allows for the sharing of both profits and losses between the bank and its customers.

In addition to risk sharing, Islamic banking also emphasizes the fair distribution of wealth. Islamic finance aims to establish a just financial system that promotes economic growth and social welfare. This is achieved through various mechanisms such as zakat, which is a mandatory charitable contribution required of Muslims, and the prohibition of usury (riba) and exploitation.

Zakat is an important aspect of Islamic finance and plays a crucial role in redistributing wealth and addressing social inequalities. It requires Muslims to give a certain portion of their wealth to the poor and needy. This act of charity helps to ensure a fairer distribution of wealth and alleviate poverty.

The prohibition of usury in Islamic banking also contributes to a more equitable distribution of wealth. Usury is seen as exploitative and unjust, as it allows lenders to make excessive profits at the expense of borrowers. In Islamic finance, interest is replaced with profit-sharing mechanisms and other alternative financial instruments that promote fairness and social justice.

Overall, risk sharing and fair distribution of wealth are fundamental principles in Islamic finance and banking. These principles aim to create a more just and equitable financial system that promotes economic growth and social welfare.

Economic Growth and Sustainable Development

Economic growth and sustainable development are two interconnected concepts that play a crucial role in shaping the future of societies and economies. While economic growth refers to an increase in the production and consumption of goods and services, sustainable development emphasizes the need to meet the present needs without compromising the ability of future generations to meet their own needs.

In the context of Islamic banking, economic growth is seen as a means to achieve sustainable development. Islamic banking principles promote ethical and equitable economic activities that contribute to the overall development of society. The focus is on establishing a financial system that is based on justice, fairness, and social welfare.

Islamic banking aims to achieve economic growth in a sustainable manner by considering both the short-term and long-term impacts of financial decisions. The concept of sustainable development in Islamic banking entails balancing economic, social, and environmental considerations to ensure the well-being of society as a whole.

One key aspect of sustainable development is the emphasis on ethical investments and avoiding activities that harm the environment or exploit individuals. Islamic banks follow strict guidelines that prohibit investments in industries such as alcohol, gambling, and interest-based transactions. Instead, they promote investments in sectors that have a positive social impact, such as healthcare, education, renewable energy, and affordable housing.

In addition to ethical investment practices, Islamic banking also promotes financial inclusion and the concept of risk-sharing. This means that financial products and services are designed to be accessible to all segments of society, including those who are financially marginalized or disadvantaged. By providing access to financial services, Islamic banks contribute to economic growth and social development.

Furthermore, Islamic banking encourages responsible lending practices, ensuring that loans are given to individuals and businesses that have the capacity to repay without falling into financial distress. This helps to maintain stability in the financial system and promotes sustainable economic growth.

In conclusion, economic growth and sustainable development are closely intertwined in the context of Islamic banking. By adhering to ethical principles and promoting inclusive and responsible financial practices, Islamic banks aim to achieve economic growth that benefits society as a whole. By considering the long-term impacts of financial decisions and prioritizing the well-being of future generations, Islamic banking contributes to sustainable development and a more equitable and just society.

Challenges and Criticisms of Islamic Banking

While Islamic banking has gained popularity and spread globally, it also faces several challenges and criticisms. Some of the main challenges and criticisms include:

- Lack of standardization: One of the significant challenges in Islamic banking is the lack of standardization in terms of legal frameworks and practices. Different countries and financial institutions follow different interpretations and approaches, which can lead to inconsistencies and confusion.

- Complexity: Islamic banking products and contracts can often be complex and require a high level of expertise for implementation. This complexity can make it difficult for customers to understand the terms and conditions, leading to potential misunderstandings or disputes.

- Access to liquidity: Islamic banks face challenges in accessing liquidity compared to conventional banks. Conventional banks have access to global financial markets, including interest-based instruments, which can provide them with more liquidity options. Islamic banks, on the other hand, need to rely on Islamic financial markets, which are still developing and may have limited liquidity options.

- Limited product range: Another criticism of Islamic banking is the limited range of products available compared to conventional banking. Islamic banks primarily offer profit-sharing and asset-based financing products, which may not cater to the diverse needs of customers. This limitation can impact the competitiveness and growth of the Islamic banking industry.

- Regulatory challenges: Islamic banking operates within the framework of both Islamic principles and regulatory requirements. Balancing these two aspects can be challenging, especially in countries where Islamic banking is a relatively new concept. Regulators need to ensure that Islamic banks comply with Shariah principles while also meeting the necessary regulatory standards.

- Lack of awareness and understanding: Many customers and investors may have limited awareness and understanding of Islamic banking principles and products. This lack of awareness can hinder the growth of Islamic banking and limit its potential market penetration.

Despite these challenges and criticisms, Islamic banking continues to grow, and efforts are being made to address these issues. Standardization initiatives, educational programs, and regulatory reforms are being introduced to enhance the transparency and efficiency of Islamic banking operations.

Lack of Standardization

One of the major challenges in Islamic banking is the lack of standardization. Unlike conventional banking, where there are globally accepted rules and regulations, Islamic banking relies on interpretations of Shariah law that can vary from one jurisdiction to another.

This lack of standardization can lead to confusion and inconsistency in the implementation of Islamic banking principles. Different scholars may have different interpretations of what is halal (permissible) and what is haram (prohibited) in banking practices, resulting in a lack of uniformity in the industry.

For example, some Islamic banks may consider certain financial products or practices to be compliant with Shariah law, while others may consider them to be non-compliant. This can create a sense of uncertainty for customers and investors, who may find it difficult to determine which Islamic banks or products are truly in line with their ethical and religious beliefs.

Furthermore, the lack of standardization can also hinder cross-border transactions and cooperation between Islamic banks operating in different countries. If there are significant differences in interpretations of Shariah law, it can be challenging for Islamic banks to come to a consensus on common practices and standards.

Efforts have been made to address this issue, such as the establishment of international organizations like the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) and the Islamic Financial Services Board (IFSB). These organizations aim to promote standardization and harmonization in Islamic finance by issuing guidelines and standards for the industry.

However, achieving full standardization and consensus among Islamic banks worldwide remains a complex task. It requires ongoing dialogue and cooperation between scholars, regulatory bodies, and industry practitioners to develop a common understanding and interpretation of Shariah law in the context of banking and finance.

| Pros | Cons |

|---|---|

|

|

In conclusion, the lack of standardization in Islamic banking poses both challenges and opportunities for the industry. While it allows for adaptability and innovation, it also gives rise to uncertainty and inconsistency. Achieving greater standardization and harmonization in the interpretation and implementation of Shariah law is crucial for the long-term growth and stability of Islamic banking.

Limited Access and Awareness

One of the main challenges facing Islamic banking is limited access and awareness among individuals and businesses. While conventional banking has been around for centuries and is well-established, Islamic banking is still relatively new and less widely known. This lack of awareness means that many people are not familiar with the principles and benefits of Islamic banking, and therefore do not consider it as an option.

In addition to limited access, the availability of Islamic banking services is also a concern. Islamic banks and financial institutions are not as widespread as conventional banks, making it difficult for individuals and businesses in certain areas to access Islamic banking products and services. This scarcity of Islamic banking options limits the choice and opportunities available to those who prefer to adhere to Islamic principles in their financial dealings.

Furthermore, the lack of awareness and limited access to Islamic banking can be attributed to various factors. One reason is the relatively small number of Islamic banking professionals and experts compared to those in conventional banking. As a result, there are fewer resources and expertise available to promote and educate people about Islamic banking.

Another factor contributing to limited access and awareness is the lack of comprehensive information and educational materials about Islamic banking. Many individuals and businesses may not be aware of the principles, concepts, and products that Islamic banks offer. This lack of information makes it difficult for them to make informed decisions and consider Islamic banking as a viable alternative to conventional banking.

To address these issues, efforts are being made to increase awareness and improve access to Islamic banking. Islamic banks are expanding their networks and opening branches in more locations to reach a wider customer base. They are also collaborating with conventional banks and financial institutions to offer Islamic financial products through their existing platforms.

Furthermore, educational initiatives and programs are being introduced to educate individuals and businesses about Islamic banking. These initiatives include workshops, seminars, and online courses that aim to raise awareness and provide a better understanding of Islamic banking principles and products.

By increasing access and awareness of Islamic banking, more individuals and businesses will have the opportunity to choose banking products and services that align with their ethical and religious beliefs. This will not only contribute to the growth of Islamic banking but also provide individuals and businesses with a viable alternative to conventional banking.

Financial Innovation and Product Adaptation

Islamic banking has undergone significant financial innovation and product adaptation over the years to meet the needs of its customers while maintaining compliance with Shariah principles. This has allowed Islamic banks to compete with conventional banks in the global financial market and attract a wider customer base.

One of the key areas of financial innovation in Islamic banking is the development of Shariah-compliant financial products and services. Islamic banks have created a wide range of products that provide alternative financial solutions to meet the needs of individuals and businesses. These products are designed to comply with the principles of fairness, transparency, and mutual benefit.

One example of financial innovation is the development of Islamic home financing, which is referred to as Musharakah Mutanaqisah or Diminishing Musharakah. This product allows individuals to purchase properties without interest. Instead, the bank and individual jointly own the property, and the individual gradually buys out the bank’s share over time. This arrangement ensures that the banks share in the risks and rewards of the property.

Another example is the development of Islamic insurance, known as Takaful. Takaful operates on the principles of mutual cooperation and shared responsibility, where participants contribute to a fund that is used to compensate for any loss or damage suffered by any individual within the group. This system is based on the principles of solidarity and fairness.

Islamic banks have also adapted conventional banking products to make them compliant with Shariah principles. For example, Islamic banks offer Shariah-compliant credit cards that do not charge interest on purchases but may charge an annual fee for services. Similarly, Islamic banks offer Shariah-compliant car financing that is based on the concept of Murabaha, where the bank buys the car and sells it to the customer at a higher price, allowing the customer to pay in installments over time.

In addition to product innovation, Islamic banks have also embraced technological advancements in the financial industry. They have developed online banking platforms, mobile applications, and other digital solutions to provide convenient and accessible banking services to their customers. This allows Islamic banks to keep up with the changing landscape of the financial industry and cater to the needs of tech-savvy customers.

In conclusion, Islamic banking has evolved through financial innovation and product adaptation to offer a wide range of Shariah-compliant financial products and services. These innovations have allowed Islamic banks to compete in the global financial market, attract a broader customer base, and provide alternative financial solutions that adhere to the principles of fairness and mutual benefit.

Global Expansion of Islamic Banking

Islamic banking, also known as Sharia banking, has experienced significant growth and expansion in recent years. What started as a niche market primarily in Muslim-majority countries has now become a global phenomenon, with Islamic financial products and services being offered in many non-Muslim majority countries as well.

The expansion of Islamic banking can be attributed to several factors:

- Increasing Muslim population: The steady growth of the Muslim population worldwide has created a demand for Islamic financial products and services. Muslims who adhere to Islamic principles seek banking solutions that align with their religious beliefs.

- Globalization and international trade: The increasing interconnectedness of global economies and international trade has facilitated the spread of Islamic banking. Non-Muslim majority countries recognize the potential economic benefits of attracting Muslim investors and promoting Islamic finance as an alternative banking system.

- Ethical appeal: Islamic banking’s emphasis on ethical and socially responsible practices attracts customers from various religious backgrounds. The prohibition of interest (riba) and the focus on profit-sharing and asset-based financing resonate with individuals who prioritize ethical financial transactions.

- Government support: Many governments, both in Muslim-majority countries and non-Muslim majority countries, have taken initiatives to promote Islamic banking. This support includes the establishment of regulatory frameworks, tax incentives, and the issuing of sukuk (Islamic bonds) to attract Islamic investors.

The global expansion of Islamic banking has resulted in the establishment of Islamic banks, Islamic windows in conventional banks, and the offering of Islamic financial products and services by multinational banks. Some countries have even introduced Islamic banking regulations to accommodate the needs of Muslim customers and facilitate the growth of Islamic finance.

The growth of Islamic banking has also seen the emergence of Islamic financial centers, such as Dubai, Malaysia, and Bahrain, which serve as hubs for Islamic finance activities and attract international investors. These financial centers provide a conducive environment for Islamic banking institutions and contribute to the development of Islamic finance on a global scale.

In conclusion, the global expansion of Islamic banking can be attributed to factors such as the increasing Muslim population, globalization, ethical appeal, and government support. As the demand for Islamic financial products and services continues to grow, Islamic banking is expected to further expand globally, offering a viable alternative to conventional banking systems.

Islamic Banking in Muslim-Majority Countries

In Muslim-majority countries, Islamic banking plays a significant role in the financial sector. These countries have established Islamic banking systems to cater to the needs of their Muslim populations and provide them with financial services that adhere to Islamic principles. This allows Muslims to engage in economic activities while remaining compliant with their religious beliefs.

Islamic banking institutions in these countries offer various products and services, such as Islamic mortgages (Murabaha), Islamic savings accounts (Wadiah), Islamic car financing (Ijarah), and Islamic credit cards (Takaful). These products are structured in a way that avoids interest-based transactions (riba) and promotes profit-sharing, risk-sharing, and ethical investment practices.

Shariah boards, comprising of Islamic scholars and financial experts, oversee and ensure the compliance of Islamic banking practices with Islamic law (Shariah). This ensures that financial transactions and investments do not involve forbidden activities, such as gambling, speculation, and investment in prohibited industries (e.g., alcohol, pork, weapons).

Muslim-majority countries have also established regulatory bodies, such as Central Banks and Islamic Banking Supervisory Authorities, to oversee and regulate the Islamic banking sector. These regulatory bodies develop rules and guidelines for the operation of Islamic banks, monitor their compliance with Shariah principles, and conduct periodic inspections.

Islamic banking has gained popularity in these countries due to its alignment with Islamic values and principles. Many Muslims prefer to utilize Islamic banking services as it allows them to manage their finances in accordance with their faith. Additionally, Islamic banks have contributed to the growth and stability of the financial sectors in these countries, attracting both Muslim and non-Muslim customers who seek ethical financial solutions.

Overall, Islamic banking in Muslim-majority countries serves as a viable alternative to conventional banking systems, providing Muslims with a way to conduct their financial affairs in a manner consistent with their religious beliefs. The growth and success of Islamic banking in these countries highlight the importance and demand for ethical and Shariah-compliant financial services within Muslim communities.

Islamic Banking in Non-Muslim-Majority Countries

In recent years, Islamic banking has gained popularity not only in Muslim-majority countries, but also in non-Muslim-majority countries. This rise in popularity can be attributed to various factors.

1. Ethical Investing: Many individuals, regardless of their religious beliefs, are drawn to Islamic banking due to its ethical principles. Islamic banking prohibits the charging of interest (riba) and promotes fairness in financial transactions. This resonates with individuals who are concerned about the ethical implications of traditional banking practices.

2. Diversification of Financial Services: Non-Muslim-majority countries have started embracing Islamic banking as a means to diversify their financial services sector. By offering Islamic financial products and services, these countries can attract a wider range of customers and tap into new markets.

3. Foreign Investment Opportunities: Islamic banking provides an avenue for non-Muslim-majority countries to attract foreign investments from Muslim-majority countries. By establishing Islamic banks and offering Sharia-compliant financial products, countries can create a favorable environment for Muslim investors and entrepreneurs, fostering economic growth and strengthening international relationships.

4. Financial Inclusion: Islamic banking can also contribute to financial inclusion in non-Muslim-majority countries. By offering Sharia-compliant financial products, Islamic banks can cater to the needs of Muslim individuals who may have previously faced challenges accessing conventional banking services due to religious restrictions.

5. Market Competition: The growth of Islamic banking in non-Muslim-majority countries can lead to increased market competition, ultimately benefiting consumers. As conventional banks may feel the pressure to adopt Islamic banking practices to remain competitive, customers can expect a wider range of financial products, improved customer service, and better deals.

It is important to note that the implementation and regulation of Islamic banking in non-Muslim-majority countries may vary. While some countries have established specific laws and regulatory bodies to oversee Islamic banking operations, others may allow Islamic banking to be offered within the existing regulatory framework.

In conclusion, Islamic banking has found a place in non-Muslim-majority countries due to its ethical principles, diversification opportunities, foreign investment potential, financial inclusion benefits, and market competition advantages. As the demand for Islamic financial services continues to grow, it is likely that more non-Muslim-majority countries will explore and adopt Islamic banking practices.

FAQ

Is Islamic banking halal or haram?

Islamic banking is considered halal (permissible) according to Islamic law.

What makes Islamic banking different from conventional banking?

Islamic banking operates on the principles of Shariah law, which prohibits the payment or receipt of interest (riba) and certain types of speculation (gharar). It also requires investments to be made in socially responsible activities.

Are there any specific rules regarding deposits and savings in Islamic banking?

Yes, in Islamic banking, deposits are viewed as a trust, and the bank must guarantee the return of the deposited amount to the customer. The bank can use the customer’s deposits for investment purposes but must share the profits and losses with the customer.

Can I take out a loan in Islamic banking?

Islamic banking offers alternatives to loans with interest. One common option is a Murabaha contract, where the bank purchases an asset and sells it to the customer at a higher price, allowing the customer to pay in installments. This way, the bank can still make a profit without charging interest.

Is Islamic banking widely available worldwide?

Islamic banking is most prevalent in Muslim-majority countries, such as Saudi Arabia, Malaysia, and the United Arab Emirates. However, it is also growing in popularity in other parts of the world, including the United States and Europe.

Are there any potential risks or challenges associated with Islamic banking?

One potential challenge is ensuring the compliance of Islamic banking institutions with Shariah principles. There may be differences in interpretation among scholars, leading to inconsistencies in practices. In addition, Islamic banking products sometimes face higher costs due to the need for alternative mechanisms to replace interest.