Islamic banking is a banking system that operates based on the principles of Islamic law, also known as Sharia. One of the key differences between Islamic banking and conventional banking is the approach to profits. In Islamic banking, the concept of profit and its permissibility, or halal, is a subject of much debate.

The debate centers around the Islamic prohibition on charging or paying interest, known as riba. Riba is considered exploitative and oppressive, as it allows the lender to benefit from the borrower’s financial difficulties. Islamic scholars argue that this violates the principle of fairness and justice.

Instead of interest, Islamic banking offers profit-sharing arrangements, where the bank and the customer share the profits and risks of an investment or business venture. This concept, known as mudarabah or musharakah, is considered more equitable and in line with Islamic values.

However, critics of Islamic banking argue that the profit-sharing arrangement is merely a semantic difference and that the result is similar to interest. They suggest that the fixed return on investment and the bank’s involvement in decision-making make Islamic banking no different from conventional banking.

Understanding Islamic Banking

Islamic banking, also known as Islamic finance, is a financial system that operates according to the principles of Sharia law. Sharia law is derived from the teachings of the Quran and the Hadith, which are the sayings and actions of the Prophet Muhammad.

Unlike conventional banking, Islamic banking prohibits earning or paying interest (riba). Instead, Islamic banks operate on the concept of profit sharing (mudarabah) and risk sharing (musharakah). This means that the bank and the customer share the profits or losses generated from the funds invested.

Islamic banking also prohibits investing in businesses that are considered haram (forbidden) according to Sharia law. This includes industries such as alcohol, gambling, pork, and usury.

One of the key principles of Islamic banking is the avoidance of excessive uncertainty (gharar) and exploitation (riba). This means that transactions must be based on transparency, fairness, and social responsibility.

To ensure compliance with these principles, Islamic banks use a variety of financial products and contracts. Some of the most common ones include:

- Mudarabah: In this contract, one party provides the funds (the investor) and the other party manages the investment (the entrepreneur). The profits and losses are shared according to a pre-agreed ratio.

- Musharakah: This is a partnership contract where all parties contribute capital and share profits and losses in proportion to their investment.

- Ijarah: This is a leasing contract where the bank purchases an asset and leases it to the customer for a specific period of time and for a pre-agreed rental fee.

- Sukuk: These are Islamic bonds that represent ownership in an underlying asset. Investors receive a share of the profits generated by the asset.

Islamic banking has gained popularity in Muslim-majority countries and has also attracted interest from non-Muslims seeking ethical and socially responsible financial alternatives.

While there is ongoing debate about the profitability and compliance of Islamic banking with Sharia law, it has grown significantly in recent years and has become an important player in the global financial industry.

Examining the Concept of Halal

The concept of halal is central to Islamic banking and finance and is important to understand when evaluating the profitability of Islamic banking practices.

Definition

Halal is an Arabic word that means “permissible” or “lawful” according to Islamic law, or Shariah. It refers to anything that is allowed or permitted according to the teachings of Islam.

Application in Islamic Banking

Islamic banking aims to provide financial services that are compliant with Shariah principles. In this context, the concept of halal is used to determine whether a financial transaction or investment is permissible or not.

Prohibited Activities

Islamic banking prohibits any involvement in activities that are considered haram, meaning “forbidden” or “prohibited” in Islam. Some examples of haram activities include:

- Charging or paying interest (riba)

- Engaging in speculative or uncertain transactions (gharar)

- Investing in businesses that are considered unethical or harmful (such as alcohol, gambling, or pork)

Halal Financial Transactions

For a financial transaction or investment to be considered halal, it must meet certain criteria:

- Absence of Riba: There should be no interest charges or the payment/receipt of interest.

- Absence of Gharar: The transaction should be free from ambiguity and uncertainty.

- Absence of Haram Activities: The transaction should not involve any haram activities or investments.

- Risk Sharing: Islamic banking encourages risk-sharing between the bank and the customer, rather than placing all the risk on one party.

Halal Profits

In the context of Islamic banking, profits are considered halal when they are derived from halal sources and comply with Shariah principles. This means that the profitability of Islamic banking must be assessed in terms of the compliance of the underlying transactions and investments with Shariah guidelines.

The Role of Shariah Scholars

Shariah scholars play a critical role in evaluating the compliance of financial products and services offered by Islamic banks. Their expertise is necessary to ensure that the activities of Islamic banks align with the principles of halal and haram.

| Halal | Haram |

|---|---|

| Permissible | Forbidden |

| Compliant with Islamic principles | Not compliant with Islamic principles |

| In accordance with Shariah law | Contrary to Shariah law |

Controversies Surrounding Islamic Banking

While Islamic banking has gained popularity for providing an alternative financial system for Muslims, it has also faced several controversies and debates. These controversies arise from the interpretation and implementation of Islamic principles in banking practices.

1. Criticism of Profit-Sharing Model:

One of the primary controversies surrounding Islamic banking is related to the profit-sharing model used in Islamic financial transactions. Critics argue that this model is not truly profit-sharing, as it only guarantees a fixed return for depositors and leaves the majority of the profits for the bank. They argue that this contradicts the principle of risk-sharing and fairness in Islamic finance.

2. Lack of Consistency in Implementation:

Another controversy stems from the lack of consistent implementation of Islamic banking principles across different institutions and countries. There is no universal standard or regulatory framework for Islamic banking, leading to variations in interpretation and practices. This lack of consistency raises concerns about the authenticity and credibility of Islamic financial products.

3. Controversy over Murabaha Contracts:

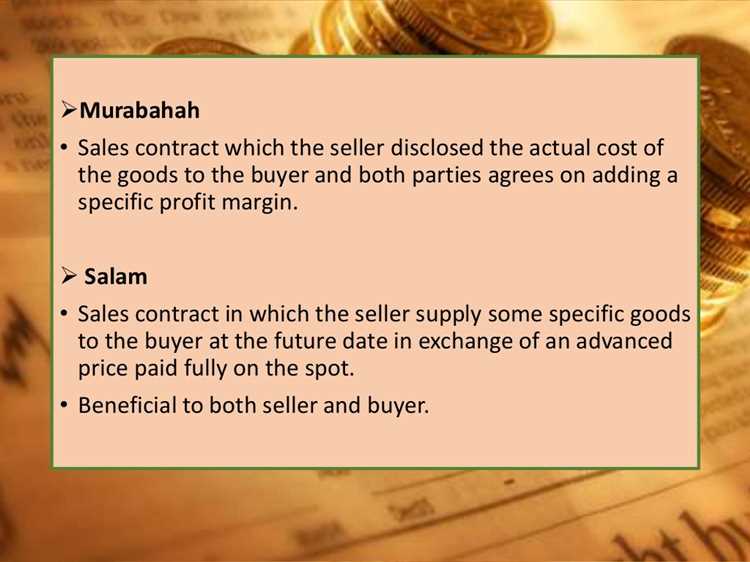

The use of murabaha contracts, a type of cost-plus sale, has also sparked controversy. Critics argue that these contracts are often used as a workaround to charge interest, which is prohibited in Islamic finance. They claim that these contracts undermine the principles of fairness and justice and can lead to exploitation of customers.

4. Debate over Engagement with Conventional Banking Practices:

There is a ongoing debate within the Islamic banking community about whether it should engage with conventional banking practices, such as derivatives and speculation. Some argue that engaging with these practices is necessary to remain competitive and meet the financial needs of customers. However, others believe that these practices are incompatible with Islamic principles and should be avoided.

5. Lack of Transparency:

The lack of transparency in some Islamic financial institutions has also been a subject of controversy. Critics argue that there have been instances of non-disclosure and misrepresentation of financial activities, which raises concerns about the integrity of these institutions and the trust placed in them by customers.

Overall, while Islamic banking offers an alternative financial system for Muslims, it is not without its controversies. These controversies highlight the need for greater standardization, transparency, and adherence to Islamic principles in order to build trust and ensure the authenticity of Islamic financial products.

Interpreting Islamic Law

Interpreting Islamic law, or Sharia, is a complex and nuanced task that requires expertise in Islamic jurisprudence. Scholars and jurists study the Quran, Hadith (sayings and actions of the Prophet Muhammad), and consensus among Islamic scholars to derive legal rulings.

Islamic law is based on the principles of justice, fairness, and ethical conduct. It provides guidelines for individuals and communities on matters ranging from personal ethics to economic transactions.

When it comes to financial matters, Islamic law prohibits usury (charging or paying interest) and promotes risk-sharing and fairness. This has led to the development of Islamic banking, which aims to provide banking services in compliance with Islamic principles.

However, there are differing interpretations of Islamic law regarding the permissibility of certain financial practices in Islamic banking. Some scholars argue that any kind of interest, including profit on loans, is prohibited and violates the principles of Islamic law.

Other scholars argue that profit-sharing arrangements, where the bank and the client share both profits and losses, are allowed under Islamic law. They argue that Islamic banking operates on the principle of equity and participatory finance, and it adheres to the prohibition of interest while promoting economic development and social justice.

There is also debate about the permissibility of some financial products offered by Islamic banks, such as murabaha (cost-plus financing) and ijara (leasing arrangements). Some scholars argue that these products are nothing more than disguised forms of conventional interest-based loans, while others believe that they can be structured in a way that complies with Islamic principles.

To address these debates and ensure compliance with Islamic law, many Islamic banks have established Sharia boards or committees composed of Islamic scholars. These boards are responsible for reviewing and approving financial products and transactions to ensure their compatibility with Islamic principles.

Different Perspectives on Halal Banking

Halal banking, also known as Islamic banking, is a system of banking that operates in accordance with Islamic principles. It prohibits the paying or receiving of interest, as it is considered usury or riba in Islam. Instead, Islamic banks operate on the basis of profit sharing and risk-sharing, where the risks and rewards of investment are shared between the bank and its clients.

- Supporters of Halal Banking: Those in favor of halal banking argue that it provides an ethical and fair alternative to traditional banking. They believe that the prohibition on interest aligns with Islamic values and encourages responsible financial practices. Supporters argue that halal banking promotes economic stability and social justice by ensuring that financial transactions are based on real assets and productive activities.

- Critics of Halal Banking: Critics of halal banking argue that it is merely a form of financial engineering that replicates the interest-based system under a different name. They argue that the profit sharing model is not truly representative of the risks involved in investment and that Islamic banks often guarantee a fixed return to depositors. Critics also argue that the lack of interest-based tools, such as bonds, limits the ability of Islamic banks to operate effectively in the global financial system.

- Regulatory Perspective: Regulatory bodies play an important role in determining the legitimacy and compliance of halal banking practices. They set standards and guidelines to ensure that Islamic banks operate according to Islamic principles. However, there is often debate and disagreement among regulatory bodies about the interpretation and application of these principles.

- Diversity of Practices: It is important to note that there is diversity within the halal banking industry, with different banks and financial institutions adopting varying approaches to Islamic banking. Some Islamic banks adhere strictly to Islamic principles, while others adopt more flexible interpretations. This diversity of practices reflects the ongoing debate and evolution of the halal banking industry.

- Conclusion: The debate surrounding the halal banking industry is complex and multifaceted. While supporters argue that it provides an ethical and fair alternative to traditional banking, critics raise concerns about its effectiveness and adherence to Islamic principles. Ultimately, the perspectives on halal banking vary, and it is up to individuals to assess and decide whether they consider it halal or not.

Financial Inclusion and Ethical Banking

Financial inclusion refers to the accessibility and availability of financial services to all members of society, particularly those who are typically underserved or excluded from the traditional banking system. Ethical banking, also known as socially responsible banking or sustainable banking, focuses on the inclusion of ethical considerations in financial decision-making.

Financial inclusion has become a significant issue worldwide, as many individuals and communities lack access to basic banking services, such as savings accounts, loans, and insurance. This lack of access can lead to exclusion from economic opportunities and hinder social and economic development.

Ethical banking aims to address this issue by providing financial services that are aligned with ethical and social principles. Islamic banking, for example, is one form of ethical banking that follows the principles of Sharia law.

In Islamic banking, profit halal is a central consideration. The use of interest, or riba, is prohibited, and instead, financial transactions are based on partnerships and risk-sharing. This approach ensures that the benefits and risks of financial transactions are shared between the bank and its customers, fostering a more inclusive and equitable financial system.

Through profit-and-loss-sharing arrangements, Islamic banks can provide financing to individuals and businesses in a way that encourages entrepreneurship and economic development. This approach can also prevent exploitative lending practices that can lead to debt cycles and financial distress.

Furthermore, Islamic banking promotes the concept of ethical investments. Islamic financial institutions are prohibited from investing in industries that are considered unethical, such as those related to gambling, alcohol, or pork production. Instead, investments are made in sectors that are deemed socially responsible, such as renewable energy, healthcare, and education.

By combining financial inclusion with ethical considerations, ethical banking can contribute to sustainable and equitable economic growth. It provides individuals and communities with the tools and resources they need to participate fully in the economy while ensuring that financial transactions adhere to ethical principles.

However, ethical banking is not without its challenges. One of the main concerns is the limited availability and accessibility of ethical financial products and services. Many individuals and communities, particularly those in rural or underserved areas, still do not have access to ethical banking options.

Addressing these challenges requires collaboration between financial institutions, policymakers, and regulators. Efforts should be made to expand the reach of ethical banking services, improve financial education, and promote the adoption of ethical banking principles within the wider financial industry.

In conclusion, financial inclusion and ethical banking are closely intertwined. By expanding access to financial services and incorporating ethical considerations into decision-making, ethical banking can promote inclusive and sustainable economic development.

Comparing Islamic and Conventional Banking Systems

Islamic banking and conventional banking are two different systems that operate on different principles. Here are some key differences between the two:

- Interest: The most fundamental difference between Islamic and conventional banking lies in the concept of interest. Conventional banks practice lending and borrowing with interest, which is strictly prohibited in Islamic finance. Islamic banks operate on the principles of profit-sharing, where returns are generated through profit-sharing agreements rather than charging interest.

- Asset-Backed Financing: Islamic banking promotes asset-backed financing, meaning that every transaction must be backed by a tangible asset. This ensures that all transactions are linked to real economic activities and avoids speculative practices.

- Risk-Sharing: Under Islamic banking, risk sharing is a key principle. This means that both profits and losses are shared between the bank and the customer in any given transaction. In conventional banking, the bank bears the risk while customers receive a fixed predetermined return.

- Prohibited Activities: Islamic banking prohibits certain activities that are considered unethical or haram (forbidden) in Islam. This includes investments in alcohol, gambling, pork, and other forbidden products and services.

Despite these differences, both Islamic and conventional banking systems offer similar services such as savings accounts, checking accounts, and loans. However, the underlying principles and mechanisms of operation differ significantly.

| Islamic Banking | Conventional Banking |

|---|---|

| Based on Shariah principles | Not based on religious principles |

| No interest charged or paid | Interest charged and paid |

| Asset-backed financing | Collateral-based financing |

| Risk-sharing | Bank bears the risk |

| Prohibits unethical activities | No specific restrictions on investments |

The Role of Religious Scholars in Islamic Banking

Religious scholars play a crucial role in the functioning of Islamic banking. They are responsible for interpreting and applying the principles and guidelines of Islamic law, known as Shariah, to the practices and operations of Islamic financial institutions. Their involvement ensures that the banking activities abide by the principles of Islam and are in compliance with Shariah law.

Islamic banking operates based on the principles of mutual risk sharing, prohibition of usury (riba), and ethical investment. Religious scholars, who are well-versed in Islamic jurisprudence, provide fatwas (religious rulings) on various financial products, services, and transactions to ensure that they are Shariah-compliant. This involves thoroughly examining the terms and conditions, the underlying assets, and the overall structure of the financial products offered by the Islamic bank.

Religious scholars also serve on Shariah boards, which are independent committees established by Islamic financial institutions to supervise their operations. These boards consist of Islamic scholars with expertise in Shariah law and finance. They review and approve the products and operations of Islamic banks to ensure their compliance with Islamic principles. This includes evaluating the contracts, transaction structures, and investment portfolios of the banks.

The involvement of religious scholars in Islamic banking not only ensures the integrity of the financial system but also instills confidence among Muslim customers. The opinions and rulings of religious scholars provide a stamp of approval and reassurance to the customers that the financial products and services offered by the bank are in accordance with their religious beliefs and values.

However, the role of religious scholars in Islamic banking has been a subject of debate. Some argue that their involvement may lead to differences in interpretations and inconsistency in the application of Shariah principles. Others believe that the involvement of scholars ensures a continuous dialogue and critical examination of financial practices, leading to the development of a robust and evolving Islamic financial system.

In conclusion, the role of religious scholars in Islamic banking is vital in ensuring the adherence of Islamic financial institutions to Shariah principles. They provide guidance and oversight, ensuring that the products and services offered by these institutions are in compliance with Islamic law. Their involvement helps to maintain the integrity of Islamic banking and instills confidence among Muslim customers.

Does Interest Align with Islamic Principles?

One of the main reasons why Islamic banking operates on a profit-sharing model rather than an interest-based model is because charging or paying interest goes against Islamic principles. In Islam, charging interest is considered to be usury (riba), which is prohibited by the Quran.

The Quran explicitly forbids the charging of interest in several verses, such as in Surah Al-Baqarah (2:275-279), which states that those who charge interest will face severe punishment in the afterlife. Islamic scholars interpret these verses to mean that engaging in interest-based transactions is not permissible for Muslims.

According to Islamic principles, money should not generate money on its own. Instead, it should be used to facilitate real economic transactions and create value for society. Islamic banking aims to align with this principle by promoting profit-sharing instead of charging interest.

In Islamic banking, instead of lending money and charging interest on it, the bank and the customer enter into a partnership for a specific project or investment. The profit and loss are shared between the bank and the customer based on agreed-upon terms. This encourages a more equitable distribution of wealth and promotes economic justice.

It is important to note that Islamic banking does involve the concept of returns on investments. However, the returns are generated through sharing the actual profits or losses of the venture, rather than through fixed interest rates.

Islamic scholars and experts argue that this profit-sharing model is more ethical and sustainable than the conventional interest-based system. They believe that interest-based transactions can lead to exploitation and inequality, as the rich get richer while the poor struggle to repay their debts.

While Islamic banking may not be without its challenges and criticisms, it is seen by many as a way to align financial practices with Islamic principles and promote a more inclusive and just economic system.

The Concept of Profit-Sharing

The concept of profit-sharing is fundamental to Islamic banking and finance. It is based on the principle that both parties to a transaction should share in the profits and risks, rather than one party bearing all the risks and the other only receiving a fixed return.

Under the profit-sharing concept, Islamic banks operate as partners or stakeholders in their clients’ businesses instead of being mere lenders. They share in the profits and losses of the ventures they finance, depending on the agreed-upon terms and conditions.

This concept aligns with the belief that all wealth is a blessing from Allah and should be shared among society. It promotes cooperation, risk-sharing, and fairness in economic activities.

There are various modes of profit-sharing used in Islamic banking, such as:

- Mudarabah: This is a partnership between the bank (as the financial provider) and the entrepreneur (as the manager of the project). The bank provides the capital, and the entrepreneur contributes skills and effort. Profit-sharing is based on a pre-agreed ratio.

- Musharakah: In this mode, the bank and the client contribute capital to a joint venture or business. Both parties share the profits and losses based on their respective investment ratios.

- Wakalah: Under this arrangement, the bank acts as an agent for the client’s investment. The bank earns a management fee for its services, and the client receives a share of the profits.

Profit-sharing is considered halal (permissible) in Islamic banking as it is in line with Islamic principles of fairness and mutuality. It encourages economic growth and also reduces the risk of financial exploitation.

However, the concept of profit-sharing does not mean that Islamic banks are exempt from generating profits. They are still businesses that need to cover their costs and provide returns to their shareholders. The difference lies in the ethical and transparent manner in which profits are generated and shared.

Sharia Compliance in Islamic Banking

Islamic banking operates under the principles of Sharia, which is the Islamic law derived from the Quran and the Hadith (sayings and actions of the Prophet Muhammad). Sharia compliance is of utmost importance in Islamic banking, as it ensures that the financial transactions and practices align with Islamic principles.

There are several key principles that distinguish Islamic banking from conventional banking:

- Prohibition of Interest (Riba): Islamic banking prohibits the charging or receiving of interest, as it is considered exploitative and leads to inequality. Instead, Islamic banks employ alternative models such as profit sharing, leasing (Ijarah), and cost-plus financing (Murabaha) to generate returns.

- Shared Risk and Profit: Islamic banking promotes the concept of shared risk and profit between the bank and its clients. In profit sharing contracts, such as Mudarabah and Musharakah, the bank and the client enter into a partnership where both parties contribute capital and share profits or losses.

- Prohibition of Uncertainty (Gharar) and Gambling (Maysir): Islamic banking discourages contracts that involve uncertainty or excessive risk, as well as those that resemble gambling. This principle ensures that transactions are based on real assets and economic activities.

- Prohibition of Financing Prohibited Activities: Islamic banking prohibits financing activities that are considered haram (forbidden) in Islam, such as gambling, alcohol, pork, and any business involving usury or unethical practices.

To ensure Sharia compliance, Islamic banks have dedicated Sharia boards or committees comprised of Islamic scholars and experts. These boards oversee the bank’s operations, products, and services to ensure compliance with Islamic principles. They provide guidance and issue fatwas (religious opinions) on financial matters, ensuring that the bank’s activities align with Sharia standards.

Moreover, Islamic banks disclose their sources of income and investments, providing transparency to clients and ensuring ethical behavior. They also engage in socially responsible financing, investing in projects that have positive social impact while complying with Sharia principles.

In conclusion, Sharia compliance is fundamental to Islamic banking. By adhering to Islamic principles, Islamic banks provide an alternative banking system that caters to Muslims and those seeking ethical and socially responsible financial services.

Ethical Investments in Islamic Banking

One of the key principles of Islamic banking is the prohibition of engaging in activities that are considered unethical or haram (forbidden) in Islam. This means that Islamic banks are restricted in the types of investments they can make, as they must adhere to strict ethical guidelines.

Islamic banking prioritizes ethical investments, focusing on industries and sectors that promote social and environmental sustainability, as well as avoiding investments that involve interest, speculation, and gambling. Here are some key aspects of ethical investments in Islamic banking:

- Socially responsible investment: Islamic banks are encouraged to invest in companies and ventures that have a positive impact on society. They consider factors such as corporate social responsibility, human rights, labor practices, and environmental sustainability when making investment decisions.

- Ethical financing: In Islamic banking, financing activities should be based on ethical principles. This means avoiding interest-based transactions and instead utilizing profit-sharing arrangements, such as mudarabah and musharakah, where the bank shares profits and losses with its customers.

- Avoidance of speculative investments: Islamic banking prohibits investments in speculative activities, such as gambling, derivatives, and speculative trading. Instead, investments must be based on tangible assets and real economic activities.

- Ethical screening: Islamic banks conduct thorough screening processes to ensure investments comply with Shariah guidelines. This involves analyzing the business activities, financial ratios, and overall ethical practices of potential investee companies.

- Environmental sustainability: Islamic banking encourages investments in sectors that promote environmental sustainability, such as renewable energy, clean technology, and waste management. This aligns with the Islamic principle of stewardship, where Muslims are encouraged to protect and preserve the environment.

By prioritizing ethical investments, Islamic banking aims to create a financial system that is not only compliant with Shariah principles but also contributes positively to society and the environment. This emphasis on ethical values sets it apart from conventional banking and has gained popularity among individuals who want to align their financial activities with their religious and ethical beliefs.

| Characteristics | Description |

|---|---|

| Socially Responsible Investment | Investing in companies with positive social impact |

| Ethical Financing | Avoiding interest-based transactions and using profit-sharing arrangements |

| Avoidance of Speculative Investments | Avoiding gambling, derivatives, and speculative trading |

| Ethical Screening | Thorough analysis of investee companies’ ethical practices |

| Environmental Sustainability | Investing in sectors that promote sustainability |

International Recognition of Islamic Banking

Islamic banking, which follows the principles of Shariah law, has gained international recognition and acceptance in recent years. Many countries around the world are adopting Islamic banking practices to cater to the needs of their Muslim populations and to tap into the growing global Islamic finance market.

One of the primary reasons for the international recognition of Islamic banking is its ethical and socially responsible approach towards finance. Islamic banking prohibits the charging or receiving of interest (riba) and promotes the sharing of risk and profit between the bank and the customers. This approach is seen as more equitable and fair compared to the conventional banking system.

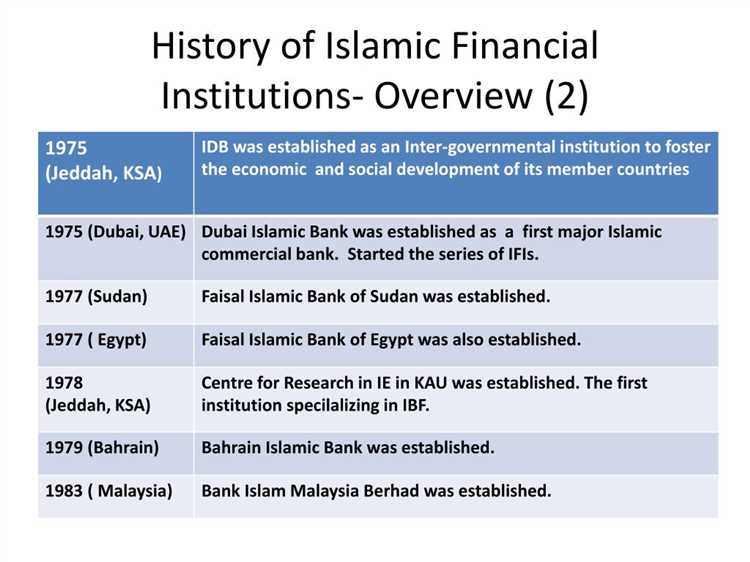

Several countries have taken steps to promote Islamic banking within their jurisdictions. For example, Malaysia has created a dedicated regulatory framework for Islamic banking and finance since the 1980s. Today, Malaysia is recognized as one of the leading centers for Islamic finance, attracting international investors and financial institutions.

Saudi Arabia, the birthplace of Islam, has also played a significant role in the development of Islamic banking. The country’s banking system is fully Islamic, and it is home to some of the largest Islamic banks in the world, such as Al Rajhi Bank and Saudi British Bank.

In addition to these countries, many other nations have started to offer Islamic banking services or have established Islamic banking windows within their existing banks. This includes countries like Pakistan, Qatar, Bahrain, the United Arab Emirates, and the United Kingdom.

Furthermore, international financial institutions and regulatory bodies have also recognized the importance of Islamic banking. The International Monetary Fund (IMF) and the World Bank have been actively involved in promoting Islamic finance and providing guidance on Islamic financial standards.

In conclusion, Islamic banking has gained international recognition due to its ethical and socially responsible approach towards finance. Many countries have embraced Islamic banking, creating dedicated regulatory frameworks and attracting international investors. This recognition and growing acceptance indicate the potential for further expansion of Islamic banking globally.

Is Islamic Banking Sustainable?

Islamic banking, as a financial system that operates in accordance with Islamic principles, aims to create a sustainable and ethical banking environment. It focuses on principles such as fairness, justice, and avoiding any form of exploitation. However, the question remains: Is Islamic banking truly sustainable?

One of the key aspects that makes Islamic banking sustainable is its emphasis on ethical investments. Islamic banking prohibits investments in activities that are considered haram (forbidden) in Islam, such as gambling, alcohol, and pork. This exclusion of unethical investments ensures that Islamic banks operate in a socially responsible manner and contribute to sustainable economic growth.

Islamic banking also promotes risk-sharing and discourages excessive risk-taking. In conventional banking, the borrowers bear all the risk, while the lenders are guaranteed a fixed return. In contrast, Islamic banking operates on the principle of profit-and-loss sharing, where both parties share the risk and reward. This encourages responsible lending and discourages speculative practices, which can contribute to financial stability and sustainability.

Furthermore, Islamic banking promotes financial inclusion by offering inclusive banking services to underserved populations. This can help reduce income inequality and promote economic development in communities that have limited access to financial services. By providing affordable and accessible banking products, Islamic banks can contribute to financial stability and sustainable development.

However, there are also challenges to the sustainability of Islamic banking. One challenge is the lack of uniformity and standardization in Islamic financial products and contracts. The interpretation of Islamic principles may vary among scholars and practitioners, leading to different practices and products in different countries. This lack of standardization can create confusion and undermine the credibility and consistency of Islamic banking.

Another challenge is the potential for financial engineering and the development of complex products that may resemble conventional interest-based products. While Islamic banking aims to avoid interest and promote equitable transactions, there is a risk that some products may deviate from the core principles and resemble conventional banking practices. This can undermine the trust and confidence of customers, as well as the sustainability of the Islamic banking industry.

In conclusion, Islamic banking has the potential to be sustainable due to its emphasis on ethical investments, risk-sharing, and financial inclusion. However, challenges such as lack of standardization and potential for product deviation need to be addressed in order to ensure the long-term sustainability and credibility of Islamic banking.

Pros and Cons of Islamic Banking

Pros:

- Alignment with Islamic principles: Islamic banking operates based on principles derived from the Quran and the teachings of Prophet Muhammad. This means that all financial transactions are conducted in a manner that is compliant with Islamic law, providing a sense of ethical and moral satisfaction for individuals who want to adhere to their religious beliefs.

- Risk-sharing: Islamic banking promotes the concept of risk-sharing between the bank and the customer. This means that the bank shares both the risk and the profit with the customer. This can lead to a more balanced and fair financial system, as both parties are incentivized to make prudent and ethical financial decisions.

- Asset-backed financing: Islamic banking focuses on providing financing based on real assets instead of interest-based lending. This creates a more tangible connection between the bank and the customer, as the bank invests directly in a customer’s venture or asset, rather than simply providing a loan with interest. This can reduce the risk of excessive debt and encourage more responsible financial behavior.

- Community development: Islamic banking aims to contribute to the overall development of the community by supporting projects that have a positive impact. This can include financing for infrastructure, healthcare, education, and other sectors that benefit society as a whole.

Cons:

- Limited product offering: Islamic banking products are subject to the restrictions imposed by Shariah law, which can limit the range of financial products available for customers. This may result in fewer options for individuals who want to access certain types of financial services or products.

- Complexity: Islamic banking operates based on a complex framework of Shariah principles. This complexity can make it challenging for individuals to understand the details of the products and services that they are engaging in, potentially leading to misunderstandings or confusion.

- Higher transaction costs: Islamic banking often involves additional administrative processes and overhead costs compared to conventional banking. This can result in higher transaction costs for customers, potentially making it less financially attractive for some individuals.

- Market risk: Islamic banking relies heavily on the real economy and real assets, which can be subject to market fluctuations and risks. This means that investments made by Islamic banks may be exposed to the same market risks as conventional banks, which could affect the profitability of these institutions.

Overall, Islamic banking offers a unique alternative to conventional banking, providing a financial system that is based on ethical principles and risk-sharing. However, it also presents certain challenges and limitations that individuals need to consider when making financial decisions.

Challenges Faced by Islamic Banking Institutions

Islamic banking institutions face several challenges in their operations, which can hinder their ability to provide halal profits to their customers. These challenges include:

- Sharia Compliance: The primary challenge faced by Islamic banking institutions is ensuring strict adherence to Islamic principles and sharia law. They must develop innovative financial products that comply with the principles of profit and risk sharing, while avoiding prohibited activities such as usury or interest.

- Lack of Standardization: There is a lack of standardization in Islamic banking practices and regulations across different countries and jurisdictions. This can create confusion and inconsistency in the interpretation and implementation of sharia-compliant financial transactions.

- Financial Innovation: Islamic banking institutions need to continually innovate and develop new products that satisfy the evolving needs of their customers. However, this can be challenging due to the constraints imposed by sharia law, which limits the types of financial instruments and transactions that can be used.

- Limited Knowledge and Awareness: Many individuals, both customers and professionals in the financial industry, have limited knowledge and awareness of Islamic banking principles. This can create a barrier to the adoption and growth of Islamic banking, as customers may be hesitant to switch from conventional banking systems.

- Liquidity Management: Managing liquidity is a significant challenge for Islamic banking institutions due to the absence of interest-based financial instruments such as bonds and loans. Islamic banks must find alternative ways to manage their liquidity needs, such as through profit-sharing investment accounts and the use of commodity-based financing.

- Regulatory Framework: Islamic banking institutions operate within a regulatory framework designed for conventional banking systems. This can create regulatory challenges and inefficiencies for Islamic banks, as they must navigate through regulations that may not fully address their unique business models and operations.

- Social Perception: Islamic banking still faces skepticism and misconceptions in some societies, which can create challenges in gaining trust and acceptance from potential customers. There is a need to improve the social perception of Islamic banking and educate the public about its benefits and principles.

In conclusion, Islamic banking institutions face various challenges in their operations. Overcoming these challenges requires not only compliance with sharia principles but also innovation, education, and addressing regulatory and social perceptions. Despite these challenges, the growth of Islamic banking continues to demonstrate its viability as a halal alternative to conventional banking systems.

Regulatory Framework for Islamic Banking

In order to ensure compliance with Islamic principles and maintain the integrity of the industry, Islamic banking operates within a strong regulatory framework. This framework is designed to provide guidelines and rules for the establishment and operation of Islamic banks, as well as to ensure the transparency and accountability of the industry.

One of the key components of the regulatory framework for Islamic banking is the establishment of Shariah boards. These boards are composed of Islamic scholars who are responsible for ensuring that the operations and products of Islamic banks comply with Shariah principles. They review and approve all financial products and services offered by the banks, as well as provide guidance on the application of Islamic principles to various banking activities.

In addition to Shariah boards, Islamic banking is also subject to supervision and regulation by the central bank or financial regulatory authorities of the country in which it operates. These regulatory bodies are responsible for overseeing the operations of Islamic banks, monitoring their financial stability, and enforcing compliance with applicable laws and regulations.

The regulatory framework for Islamic banking also includes specific requirements for capital adequacy and risk management. Islamic banks are required to maintain adequate levels of capital to absorb potential losses and ensure their financial stability. They are also required to implement robust risk management systems and processes to identify, assess, and mitigate risks associated with their operations.

Furthermore, the regulatory framework for Islamic banking emphasizes transparency and disclosure. Islamic banks are required to provide clear and comprehensive information to their customers about the nature and risks of the financial products and services they offer. They are also required to regularly report their financial performance and comply with accounting and financial reporting standards that are consistent with international best practices.

Overall, the regulatory framework for Islamic banking plays a crucial role in ensuring the integrity and stability of the industry. It provides guidelines for the establishment and operation of Islamic banks, sets standards for compliance with Shariah principles, and promotes transparency and accountability. By adhering to this framework, Islamic banks can maintain the trust and confidence of their customers and contribute to the growth and development of the Islamic finance industry as a whole.

Islamic Banking’s Impact on Economic Development

Islamic banking, with its unique principles and guidelines, has a significant impact on economic development. It promotes economic stability, social justice, and ethical conduct, fostering a balanced and sustainable economic environment. Here are some key ways in which Islamic banking influences economic development:

1. Financial Inclusion: Islamic banking aims to provide financial services to all individuals, regardless of their socioeconomic status. By offering interest-free loans and innovative financial products, it helps to include marginalized sections of society in the formal financial system, opening up avenues for economic growth and reducing poverty.

2. Ethical Investment: Islamic banking operates based on principles that prohibit investments in sectors such as alcohol, gambling, and pork. This ethical approach ensures that funds are channeled into productive sectors of the economy, promoting sustainable development and discouraging harmful activities.

3. Risk Sharing: In Islamic banking, risk sharing is a fundamental principle. Unlike conventional banking, where the burden of risk lies solely with the borrower, Islamic banks share the profit and loss with their clients. This encourages the creation of partnerships and promotes a more equitable distribution of risk, fostering entrepreneurship and innovation.

4. Stability and Resilience: Islamic banks avoid excessive risk-taking and speculative practices, which can contribute to financial crises. The emphasis on tangible assets and ethical financial practices provides a more stable and resilient financial system, minimizing the likelihood of economic disruptions and promoting long-term economic growth.

5. Infrastructure Financing: Islamic banking plays a vital role in infrastructure development and financing. Through Islamic bonds (sukuk), it provides long-term funding for infrastructure projects, such as roads, airports, and power plants. This helps improve the country’s infrastructure, which is crucial for economic development and attracting foreign investment.

6. Social Development: Islamic banking encourages social welfare and development by promoting the concept of “zakat,” a form of compulsory wealth redistribution. Islamic banks collect and distribute zakat funds to support education, healthcare, and other social development initiatives, contributing to poverty alleviation and social progress.

7. Financial Stability: Islamic banking adheres to sound Shariah-compliant risk management practices, ensuring a more stable and resilient financial system. This stability helps to prevent excessive speculation and financial bubbles, reducing the likelihood of financial crises and promoting a healthy economic environment.

In conclusion, Islamic banking’s impact on economic development is wide-ranging and significant. By promoting financial inclusion, ethical investment, risk sharing, stability, infrastructure financing, social development, and financial stability, it contributes to creating a more balanced, sustainable, and inclusive economy.

Global Adoption of Islamic Banking Practices

Islamic banking, also known as Sharia-compliant banking, has witnessed significant global adoption in recent years. This banking model, which follows the principles of Islamic law (Sharia), has gained popularity among Muslims and non-Muslims alike.

The growth of Islamic banking can be attributed to several factors:

- Religious and Cultural Factors: Islamic banking appeals to Muslims who seek financial services that align with their religious beliefs. The prohibition of interest (usury) in Islam, for example, attracts individuals who want to avoid the conventional interest-based banking system.

- Inclusive Approach: Islamic banking promotes financial inclusion by offering services that cater to the needs of a wide range of individuals, regardless of their religious background. This inclusiveness has contributed to its popularity among non-Muslims, especially in regions with a significant Muslim population.

- Social Responsibility: Islamic banking emphasizes ethical and socially responsible practices. Investments made by Islamic banks are subject to strict criteria that prohibit investing in industries such as gambling, alcohol, and tobacco. This approach resonates with individuals who prioritize ethical considerations in their financial decisions.

- Financial Stability: Islamic banking principles emphasize risk-sharing and asset-backed transactions, which are believed to promote financial stability. This has attracted individuals and institutions seeking alternative banking models that prioritize stability over speculative activities.

As a result of these factors, Islamic banking has experienced significant growth in different parts of the world. Countries with a majority Muslim population, such as Saudi Arabia, Iran, and Malaysia, have established Islamic banking systems as an alternative to conventional banking.

Furthermore, several non-Muslim majority countries, including the United Kingdom, Singapore, and Luxembourg, have also embraced Islamic banking practices to cater to the needs of their Muslim populations and attract investments from the Middle East and other Islamic regions.

The global adoption of Islamic banking practices is expected to continue growing as more individuals and institutions recognize its merits. However, challenges such as regulatory frameworks and standardized practices across different jurisdictions need to be addressed to ensure its sustainable growth and integration into the global financial system.

Islamic Banking and Social Responsibility

Islamic banking is not only focused on profit, but also on promoting social responsibility and sustainable development. The principles of Islamic banking are rooted in Islamic teachings, which emphasize fairness, justice, and ethical behavior.

One of the key concepts in Islamic banking is the prohibition of riba (interest). This principle ensures that financial transactions are conducted in a fair and equitable manner, without exploiting individuals or causing harm to society. Instead of charging interest, Islamic banks provide financing through profit-sharing mechanisms such as mudarabah (partnership) and musharakah (joint venture).

In addition to avoiding interest, Islamic banking also promotes the concept of sharing risk and reward. This means that both the bank and the customer share in the profits and losses of a particular venture. This not only increases transparency, but also encourages responsible lending and investment practices.

Furthermore, Islamic banking encourages investment in socially responsible projects that benefit society as a whole. Islamic banks are required to ensure that the funds they invest adhere to ethical guidelines, such as avoiding investments in industries that are considered harmful or unethical according to Islamic principles, such as gambling, alcohol, or pork.

Islamic banks also play a role in promoting financial inclusion and reducing poverty. They offer financial products and services that are accessible to individuals who may not have access to traditional banking systems. This helps to empower marginalized communities and promote economic growth.

In conclusion, Islamic banking is not simply about making profits, but also about promoting social responsibility and sustainable development. By adhering to the principles of fairness, justice, and ethical behavior, Islamic banks aim to create a banking system that benefits both individuals and society as a whole.

Islamic Banking Products and Services

Islamic banking offers a range of products and services that are compliant with Islamic principles. These offerings are designed to provide financial solutions to individuals and businesses while adhering to Islamic law.

- Murabaha: This is a financing arrangement where the bank purchases an asset on behalf of the customer and sells it to them at a higher price, allowing the customer to pay in installments. The bank earns a profit on the sale, which is considered halal.

- Ijarah: Ijarah is a leasing agreement where the bank purchases an asset and leases it to the customer for a specified period. The customer pays rental payments to use the asset, and at the end of the lease term, the asset may be sold to the customer at a predetermined price.

- Mudarabah: Mudarabah is a profit-sharing partnership between the bank (as the financier) and the customer (as the entrepreneur). The bank provides the capital, and the customer manages the business. Profits are shared according to a pre-agreed ratio, while any loss is borne by the bank.

- Wakalah: Wakalah is a contract where the bank acts as an agent on behalf of the customer. The bank invests the customer’s money in Shariah-compliant activities and charges a fee for its services.

In addition to these core products, Islamic banks also offer a variety of other services, including:

- Takaful: Takaful is a Shariah-compliant insurance alternative. It operates on the principle of mutual assistance, where policyholders contribute premiums to a common pool to provide coverage against risks.

- Sukuk: Sukuk are Islamic bonds that represent ownership in underlying assets. They provide a way for investors to earn returns while complying with Islamic principles.

- Trade Finance: Islamic banks offer trade finance services that comply with Islamic principles, such as letters of credit, trade guarantees, and export finance.

- Asset Management: Asset management services are provided to help individuals and institutions manage their investments in a Shariah-compliant manner.

Overall, Islamic banking products and services aim to provide ethical and socially responsible financial solutions that align with Islamic principles. By offering a range of options, Islamic banks cater to the diverse needs of customers while ensuring compliance with Shariah law.

Corporate Governance in Islamic Banking

Corporate governance refers to the system of rules, practices, and processes by which a company is controlled and directed. In the context of Islamic banking, corporate governance plays a crucial role in ensuring that the principles and values of Islamic finance are adhered to.

Shariah Supervisory Board: One of the key elements of corporate governance in Islamic banking is the presence of a Shariah Supervisory Board (SSB). The SSB is responsible for ensuring that the bank’s operations and activities comply with the principles of Shariah law. This board consists of scholars knowledgeable in Islamic finance and they provide guidance and supervision on all matters related to the bank’s compliance with Islamic principles.

Transparency and Disclosure: Islamic banks are expected to have a high level of transparency and disclosure in their operations. This includes providing accurate and comprehensive information to all stakeholders, such as shareholders, depositors, and regulators. Islamic banks are also required to disclose their financial statements and the mechanisms they use to ensure compliance with Islamic principles, such as profit-sharing ratios and distribution formulas.

Audit and Internal Control: Proper audit and internal control mechanisms are essential in ensuring the integrity and accountability of Islamic banks. These mechanisms help identify and prevent any potential breaches of Shariah principles and ensure that internal processes and controls are effective in detecting and addressing any non-compliance issues.

Board of Directors: The board of directors of an Islamic bank is responsible for overseeing the bank’s operations and ensuring that the bank operates in compliance with its stated objectives and Shariah principles. The board is also responsible for setting the bank’s strategy, approving major decisions, and ensuring proper risk management practices are in place.

Social Responsibility: Islamic banks are expected to have a strong commitment to social responsibility and ethical practices. This includes conducting business in a manner that benefits society as a whole and considering the social and environmental impacts of their operations.

Training and Development: Islamic banks should provide ongoing training and development opportunities to their employees, including Shariah scholars, to ensure they have the necessary knowledge and skills to carry out their roles effectively. This also helps in promoting a culture of compliance with Islamic principles throughout the organization.

Regulatory Oversight: Regulatory authorities play a crucial role in ensuring proper corporate governance in Islamic banking. They set the standards and guidelines that Islamic banks must comply with and conduct regular inspections and audits to ensure banks’ compliance and protect the interests of stakeholders.

Conclusion: Corporate governance is a fundamental aspect of Islamic banking, ensuring compliance with Islamic principles and enhancing transparency, accountability, and ethical practices. The presence of a Shariah Supervisory Board, transparency in operations, effective audit and internal control mechanisms, responsible board of directors, social responsibility, employee training, and regulatory oversight are all essential components of a robust corporate governance framework in Islamic banking.

Financial Stability of Islamic Banks

Islamic banking operates on the principles of Sharia law, which prohibits the payment or receipt of interest (riba) and promotes ethical and social responsibility in financial transactions. While these principles provide a unique framework for Islamic banking, they also raise questions about the financial stability of Islamic banks compared to conventional banks.

Islamic banks are required to adhere to strict guidelines that govern their operations. These guidelines emphasize risk-sharing and asset-backing, with a focus on real economic activities. This approach aims to ensure that Islamic banks are more resilient to financial shocks and crises, as they are less dependent on speculative activities.

One key feature of Islamic banking that enhances its financial stability is the prohibition of interest-based lending. Instead of charging interest, Islamic banks engage in profit-sharing agreements and provide financing through modes such as murabaha (cost plus), musharakah (partnership), and ijara (leasing). This profit-sharing mechanism aligns the interests of the bank and the customer, as the bank only earns a profit if the financed project or investment is successful. This encourages responsible lending and reduces the likelihood of borrowers defaulting on their obligations.

Furthermore, Islamic banks are required to maintain higher capital adequacy ratios to mitigate risks. These capital requirements ensure that Islamic banks have enough capital to absorb potential losses and maintain their financial stability. Additionally, Islamic banks are encouraged to diversify their portfolios and avoid excessive risk concentration, which further enhances their resilience.

The governance structure of Islamic banks also contributes to their financial stability. Islamic banks are required to establish Sharia boards composed of Islamic scholars who oversee the bank’s compliance with Sharia principles. These boards provide guidance and ensure that Islamic banks operate in accordance with ethical and religious principles. This oversight helps mitigate moral hazards and unethical practices that can undermine financial stability.

However, it is important to note that no financial institution is immune to risks and challenges. Islamic banks, like conventional banks, are exposed to market fluctuations, credit risks, and liquidity challenges. The global financial crisis of 2008 highlighted some of these vulnerabilities in the Islamic banking sector.

Overall, while Islamic banking offers a unique model grounded in ethical and religious principles, its financial stability is influenced by various factors such as risk management practices, regulatory frameworks, and macroeconomic conditions. Continued research and collaboration between scholars and practitioners are crucial for assessing and enhancing the financial stability of Islamic banks.

Islamic Banking and Wealth Management

Islamic banking is not limited to providing financial services alone, but also extends to wealth management for its customers. Wealth management in Islamic banking adheres to the principles of Shari’ah, which prohibit the charging or paying of interest (riba) and promote risk-sharing and ethical investment practices.

Unlike conventional banking, Islamic wealth management focuses on Islamic investments that are deemed permissible (halal) according to Islamic principles. Some of these investment options include:

- Sukuk: Islamic bonds that represent ownership in a specific asset or project. The return on sukuk is derived from the income generated by the underlying asset, making it an alternative to interest-based bonds.

- Islamic mutual funds: Investment funds that comply with Islamic principles by investing in halal businesses and industries. These funds avoid investments in companies involved in activities such as gambling, alcohol, or pork.

- Real estate investment: Islamic banking offers real estate investment options such as musharaka and ijara. Musharaka involves a partnership between the bank and the customer, where both parties provide capital and share profits and losses. Ijara is a leasing contract where the bank purchases the property and leases it to the customer.

In addition to these investment options, Islamic wealth management also emphasizes philanthropic activities, such as waqf (endowments) and zakat (charitable giving). These activities help in the redistribution of wealth and social welfare, aligning with the principles of fairness and justice in Islamic finance.

Overall, Islamic banking and wealth management promote ethical and responsible financial practices that are compliant with Islamic principles. By focusing on halal investments and incorporating philanthropic activities, Islamic banking seeks to create a more inclusive and sustainable financial system.

Islamic Banks and Financial Inclusion

Islamic banks have the potential to promote financial inclusion and provide access to financial services for individuals and businesses who may otherwise be excluded from the formal banking sector.

1. Interest-free banking: Islamic banking operates on the principle of avoiding interest (riba), which can be a barrier to financial inclusion for individuals who prefer or are prohibited from engaging in interest-based transactions. By offering alternative products such as profit-sharing agreements (mudarabah), leasing (ijara), and trade-based financing (murabaha), Islamic banks can cater to diverse financial needs and religious beliefs.

2. Inclusive financing: Islamic banks can play a crucial role in providing financing options for small and medium-sized enterprises (SMEs) and individuals who may not meet the rigorous collateral requirements of conventional banks. Through participatory modes of financing, Islamic banks can share risk and reward, making it more accessible for those with limited assets or credit histories.

3. Community development: Islamic banks are often deeply rooted in local communities and emphasize social and economic justice. They may allocate a portion of their profits to charitable activities or develop programs aimed at uplifting marginalized groups. This focus on community development can contribute to greater financial inclusion by addressing specific needs and fostering economic empowerment.

4. Transparency and ethical standards: Islamic banks are guided by ethical principles that promote transparency, fairness, and accountability in their operations. By adhering to these standards, they can build trust among their customers, especially those who are skeptical of conventional banking practices. This trust is an essential component of financial inclusion, as individuals and businesses are more likely to engage in financial transactions when they feel confident that their interests are protected.

5. Education and awareness: Islamic banks can also contribute to financial inclusion by providing education and raising awareness about Islamic financing principles. This can help individuals make informed decisions about their financial needs and better understand the options available to them. By empowering individuals with knowledge, Islamic banks can improve financial literacy and promote the responsible and ethical use of financial services.

In conclusion, Islamic banks have the potential to promote financial inclusion by offering interest-free banking, inclusive financing options, community development initiatives, transparency and ethical standards, and by providing education and awareness. These factors contribute to a more inclusive financial system that caters to diverse needs and respects religious beliefs, ultimately fostering economic empowerment and sustainable development.

Islamic Banking’s Contribution to the Global Economy

Islamic banking, also known as Sharia-compliant banking, is a unique and growing sector of the global economy. With its principles firmly rooted in Islamic law, it offers an alternative banking model that adheres to ethical and moral standards.

One of the primary contributions of Islamic banking to the global economy is its promotion of financial inclusivity. Islamic banks provide access to financial services to individuals and businesses who may not have access to conventional banking due to religious restrictions or personal beliefs. By offering products and services that align with Islamic principles, such as profit-sharing partnerships and asset-based financing, Islamic banks cater to a diverse range of customers.

Moreover, Islamic banking plays a significant role in promoting economic stability. The system discourages excessive risk-taking and speculative practices, which were major contributors to the global financial crisis of 2008. Islamic banks are required to engage in real economic transactions and avoid investments in industries that are deemed unethical or prohibited in Islam, such as gambling, alcohol, or pork-related businesses. This emphasis on real economic activities promotes a more sustainable and stable financial system.

Furthermore, Islamic banking fosters responsible lending practices. Unlike conventional banks, Islamic banks cannot charge or receive interest (riba) as it is considered usury and prohibited in Islam. Instead, they participate in profit-sharing arrangements that provide a more equitable distribution of risks and rewards between the bank and the client. This encourages responsible borrowing and discourages excessive debt accumulation, which is crucial for maintaining financial stability.

In addition to these contributions, Islamic banking has also played a significant role in channeling funds towards socially responsible investments. Islamic finance principles prioritize investments in sectors that have a positive impact on society, such as healthcare, education, renewable energy, and affordable housing. By allocating resources to these sectors, Islamic banks contribute to economic development, poverty reduction, and sustainable growth.

In conclusion, Islamic banking’s contribution to the global economy is multi-faceted. It promotes financial inclusivity, fosters economic stability, encourages responsible lending practices, and channels funds towards socially responsible investments. As the demand for ethical and sustainable banking continues to grow, Islamic banking is poised to play an even more significant role in shaping the future of the global economy.

Future Outlook for Islamic Banking

The future of Islamic banking looks promising as the demand for ethical financial products continues to grow worldwide. With a strong emphasis on financial inclusion and social responsibility, Islamic banking offers a unique alternative to conventional banking systems.

One of the key drivers for the growth of Islamic banking is the increasing Muslim population and their preference for Sharia-compliant finance. As Muslims become more aware of the principles of Islamic banking and its connection to their religious beliefs, they are seeking out financial institutions that align with their values.

Additionally, non-Muslims are also showing interest in Islamic banking due to its ethical nature. The principles of Islamic banking, such as avoiding interest (riba) and investing in socially responsible projects, resonate with people who are looking for a more ethical and sustainable way of managing their finances.

The adoption of Islamic banking is not limited to Muslim-majority countries. Many Western countries, such as the United Kingdom, France, and Germany, have recognized the potential of Islamic finance and have taken steps to facilitate its growth. This includes enabling legislation, tax incentives, and the establishment of Islamic banking institutions.

The growth of technology and digital banking also presents an opportunity for the expansion of Islamic banking. Mobile banking, online transactions, and fintech solutions can make Islamic financial products more accessible and convenient for customers. This can attract a wider customer base and increase the overall market share of Islamic banking.

However, there are challenges that Islamic banking will need to overcome to sustain its growth. One of the main challenges is the lack of standardized regulations and practices across different countries. Harmonizing regulations and establishing a global framework for Islamic banking will enhance transparency, facilitate cross-border transactions, and promote trust in the industry.

Furthermore, Islamic banking will need to continue innovating and developing new products that meet the evolving needs of customers. This includes offering digital banking solutions, expanding into new areas such as Islamic insurance (Takaful), and addressing emerging issues such as climate change and sustainability.

In conclusion, the future of Islamic banking looks bright as it continues to gain recognition and attract interest from both Muslim and non-Muslim customers. With the right regulatory framework, technological advancements, and innovative solutions, Islamic banking has the potential to become a significant player in the global financial industry while upholding its ethical principles.+

FAQ

What is the concept of halal profit in Islamic banking?

The concept of halal profit in Islamic banking is based on the principles of Shariah law, which prohibits Riba (interest). According to Islamic finance, profit must be earned from legitimate and ethical business activities that comply with Islamic principles.

Why is there a debate about whether Islamic banking profit is halal?

The debate arises due to differing interpretations of Shariah law and the application of Islamic finance principles. Some scholars argue that certain practices in Islamic banking, such as profit-sharing and risk-sharing, are not truly halal, while others believe that these practices align with the principles of Shariah and are therefore halal.

What are some arguments against the halal status of Islamic banking profit?

Some arguments against the halal status of Islamic banking profit include the perception that profit-sharing schemes may still contain elements of interest and that the financial industry as a whole is inherently haram due to its speculative nature. Additionally, some critics question whether certain financial products offered by Islamic banks truly adhere to Shariah principles.

What are some arguments in favor of the halal status of Islamic banking profit?

Proponents of the halal status of Islamic banking profit argue that profit-sharing and risk-sharing align with the principles of justice, fairness, and ethical business practices outlined in Shariah law. They argue that Islamic finance offers alternative financial models that prioritize shared risk and return, thus promoting economic stability and social welfare.