Islamic banking is a unique financial system that operates on the principles of Islamic law (Shariah). Unlike conventional banking, which relies heavily on interest-based transactions, Islamic banking provides interest-free solutions that comply with ethical and religious principles.

One of the key principles of Islamic banking is the prohibition of usury, which refers to excessive or exploitative interest charged on loans. Instead of earning interest, Islamic banks engage in profit-sharing arrangements, where they share both the risks and rewards of investments with their customers.

In addition to profit-sharing, Islamic banking also utilizes other financial contracts such as leasing (ijarah), partnership (mudarabah), and cost plus (murabahah). These contracts facilitate the financing of various activities, including trade, real estate, and business ventures, while ensuring ethical and equitable outcomes for both parties involved.

Another important concept in Islamic banking is the avoidance of uncertainty (gharar). This means that financial contracts must be clear and transparent, with all terms and conditions fully disclosed. This principle promotes fairness and mitigates the risk of deceptive or fraudulent practices in the financial industry.

By understanding the mechanics of Islamic banking and its interest-free solutions, individuals and businesses can explore alternative financial options that align with their values and principles. Islamic banking offers a compelling alternative to conventional banking, providing a more inclusive and equitable financial system for all.

Understanding the Principles

Islamic banking operates on the principles of Shariah, which is based on Islamic law and forbids the payment or receipt of interest (riba). Instead, Islamic banking follows the concept of profit-sharing, where the risks and rewards are shared between the bank and the customers.

1. Prohibition of interest (Riba): Riba refers to usury or interest, which is strictly prohibited in Islamic banking. This prohibition is based on the belief that lending money should be an act of charity and should not result in exploitation or economic inequality.

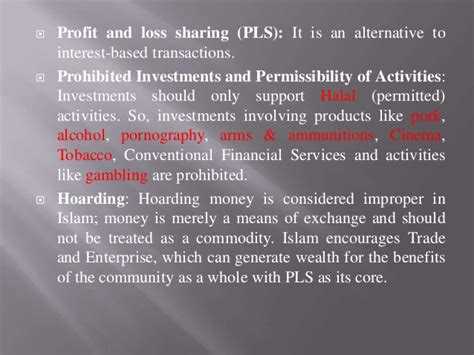

2. Profit and loss sharing (Mudarabah): Islamic banking encourages profit and loss sharing between the bank and the customers. In a Mudarabah contract, the bank provides the capital, and the customer provides the labor or expertise. The profits are shared between the bank and the customer based on a pre-determined ratio, while the losses are solely borne by the bank.

3. Ethical investments (Halal): Islamic banking prohibits investments in industries or activities that are considered unethical or against Islamic principles. This includes investments in industries such as alcohol, gambling, or pork-related businesses. Instead, Islamic banks focus on investing in halal industries, such as education, healthcare, and renewable energy.

4. Prohibition of speculation (Gharar): Islamic banking discourages speculative activities or transactions that involve excessive uncertainty or ambiguity. Contracts must be clear, transparent, and based on known information to avoid any form of exploitation or deception.

5. Real asset-based financing: Islamic banking emphasizes real asset-based financing, where loans are provided against tangible assets such as property, vehicles, or equipment. This ensures that the financing is backed by real value and reduces the chances of financial instability or unethical practices.

6. Social and economic justice: Islamic banking aims to promote social and economic justice by encouraging financial inclusion and fair distribution of wealth. It emphasizes the importance of helping the less fortunate through mechanisms such as Zakat (charitable giving) and Qard al-Hasan (benevolent loans).

7. No interest on loans (Qard al-Hasan): Islamic banking allows for interest-free loans known as Qard al-Hasan. These loans are provided as an act of charity and are given without any expectation of profit. The borrower is only required to repay the principal amount borrowed.

By adhering to these principles, Islamic banking provides an alternative financial system that aligns with the values and beliefs of the Islamic faith. It promotes ethical, inclusive, and sustainable financial practices while ensuring compliance with Shariah law.

Islamic Banking

Islamic banking is a financial system that operates according to the principles of Islamic law, also known as Shariah. This system is based on the belief that all financial transactions should be conducted in a manner that is ethical and compatible with religious principles.

One of the key differences between Islamic banking and conventional banking is the prohibition of interest in Islamic finance. In Islamic banking, interest is considered usury and is strictly forbidden. Instead, Islamic banks offer profit-sharing arrangements and other alternative financing methods to ensure that transactions are free from interest.

Islamic banking also emphasizes ethical investments and promotes economic development in a socially responsible manner. This means that Islamic banks are prohibited from investing in industries that are considered haram, or forbidden, such as alcohol, gambling, and pork. Instead, Islamic banks focus on sectors that align with Islamic principles, such as healthcare, education, and renewable energy.

In addition to interest-free financing, Islamic banking also incorporates risk-sharing and asset-backed financing. This means that Islamic banks share both profits and losses with their customers, creating a more equitable and balanced financial system. Islamic banks also prefer to provide financing based on real assets, such as property or commodities, rather than speculative investments.

Islamic banking has grown significantly in recent years and is now practiced in many countries around the world. It offers an alternative and ethical approach to finance that appeals to individuals and businesses who wish to align their financial activities with their religious beliefs.

Overall, Islamic banking promotes economic stability, social justice, and responsible investing. It provides an interest-free solution for individuals and businesses seeking financial services that are in line with their religious and ethical values.

Interest-Free Solutions

Islamic banking offers a range of interest-free solutions that adhere to the principles of Shariah law. These solutions aim to provide financial services without involving any form of interest or riba, which is considered unethical in Islamic finance.

One of the key interest-free solutions provided by Islamic banking is the concept of profit-sharing. This involves the bank and the customer sharing profits and losses from a specific business or investment. Instead of charging interest on a loan, the bank becomes a partner in the venture and shares the risks and rewards.

Another interest-free solution is the concept of leasing or ijara. In this arrangement, the bank purchases an asset and leases it to the customer for a specified period. The customer pays regular rental payments, which include a portion for the use of the asset and the financial services provided by the bank. At the end of the lease period, the customer has the option to purchase the asset at an agreed-upon price.

Murabaha is another commonly used interest-free solution in Islamic banking. It involves the bank purchasing goods on behalf of the customer and reselling them at a higher price. The customer then pays the bank for the goods in installments, effectively avoiding any interest charges.

In addition to these solutions, Islamic banking also offers alternatives to traditional interest-based loans. For example, instead of providing loans with interest, banks may offer financing through partnerships or joint ventures. The bank and the customer become partners in a business or investment, and the bank provides the necessary funds while sharing the risks and rewards.

Islamic banking also promotes ethical investment and activities that benefit society. It prohibits investment in industries or activities that are considered haram, such as those related to alcohol, gambling, or pork products. Instead, Islamic banks focus on investments that promote social welfare and economic development.

In conclusion, Islamic banking provides interest-free solutions that align with the principles of Shariah law. These solutions include profit-sharing, leasing, murabaha, and alternatives to traditional loans. By adhering to ethical guidelines and promoting social welfare, Islamic banking offers a unique approach to finance that appeals to individuals seeking interest-free financial solutions.

Exploring the Riba

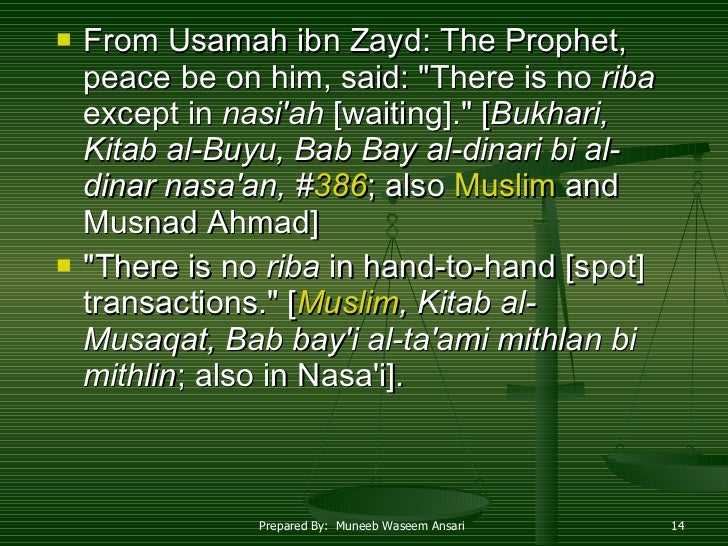

Riba is a concept in Islamic finance that refers to the prohibition of interest or usury. It is a crucial element in understanding the mechanics of Islamic banking, as it sets it apart from conventional banking systems.

Riba is explicitly prohibited in the Quran, the religious text of Islam, and is considered a major sin in Islamic teachings. The term Riba refers not only to lending and borrowing with interest but also encompasses any unjust increase in a financial transaction.

Islamic scholars have defined two types of Riba: Riba al-Fadl and Riba al-Nasi’ah.

Riba al-Fadl

Riba al-Fadl refers to the prohibition of unequal exchange in monetary transactions. It arises when one party receives an excess amount of a specific commodity in a trade, such as gold or silver, in exchange for another commodity of the same kind. This type of Riba is prohibited as it leads to unfairness and exploitation in transactions.

For example, if a person borrows 100 grams of gold and returns 110 grams of gold after a specified period, this would be considered Riba al-Fadl as the borrower is returning more than the initial amount borrowed.

Riba al-Nasi’ah

Riba al-Nasi’ah refers to the prohibition of interest in lending and borrowing transactions. It arises when a lender charges an additional amount of money, known as interest, on a loan, resulting in an increase in the overall repayment amount for the borrower.

Islamic banking follows the principles of Riba al-Nasi’ah and aims to provide interest-free solutions to financial needs. Instead of charging interest, Islamic banks use profit-sharing arrangements, rent-based contracts, and other alternative methods to facilitate lending and investment while complying with the principles of Riba.

The prohibition of Riba in Islamic finance is rooted in the principles of fairness, justice, and economic stability. By avoiding Riba, Islamic banking seeks to promote ethical financial practices that benefit individuals and society as a whole.

Prohibition in Islam

In Islam, there are certain prohibitions that believers are expected to adhere to. These prohibitions are based on the teachings of the Quran, which Muslims consider to be the word of God, as well as the examples set by the Prophet Muhammad.

Riba: One of the main prohibitions in Islam is the charging or paying of interest, known as riba. The Quran explicitly prohibits riba and considers it to be exploitative and unjust. Islamic banking, therefore, operates on the principle of interest-free transactions, providing alternative solutions for individuals and businesses

Alcohol and drugs: Consumption or involvement in the production and sale of alcohol and drugs is also prohibited in Islam. Muslims are expected to abstain from alcohol and avoid any activities that promote or facilitate its use. This prohibition extends to all intoxicating substances and narcotics that alter the state of consciousness.

Pork: The consumption of pork and pork products is strictly prohibited in Islam. This prohibition is based on the Quranic verse that declares pork to be impure. Muslims are expected to avoid eating pork or using any products derived from it.

Adultery and fornication: Engaging in sexual relations outside of a lawful marriage is considered to be a major sin in Islam. Muslims are expected to maintain chastity and adhere to the teachings of Islam regarding sexual conduct.

Gambling: Participating in any form of gambling or games of chance is forbidden in Islam. Muslims are expected to abstain from gambling activities and avoid any behaviors associated with them.

Gambling: Participating in any form of gambling or games of chance is forbidden in Islam. Muslims are expected to abstain from gambling activities and avoid any behaviors associated with them.

Immoral business practices: Engaging in dishonest and unfair business practices, such as fraud, bribery, and deception, is strictly prohibited in Islam. Muslims are expected to conduct their business affairs with integrity and adhere to ethical principles

Usury: Similar to the prohibition on riba, usury refers to the charging or paying of exorbitant interest rates. Muslims are expected to avoid engaging in usurious practices and seek financial transactions that are fair and equitable

Falsehood and dishonesty: Telling lies and practicing deceit is strongly discouraged in Islam. Muslims are instructed to be truthful and honest in their dealings with others.

Violence and aggression: Islam emphasizes peaceful coexistence and condemns violence and aggression except in the context of self-defense or a just war. Muslims are expected to resolve conflicts peacefully and avoid any form of harm to others unless it is necessary for protection.

It is important to note that these prohibitions are not meant to restrict the freedom of individuals, but rather to promote a society built on justice, fairness, and moral values. Muslims are encouraged to follow these prohibitions as a means of seeking spiritual and ethical growth.

Economic Consequences

Islamic banking operates on the principles of justice and fairness, aiming to promote economic stability and social welfare. This distinct approach has several economic consequences:

- Reduced Financial Risks: Islamic banking prohibits the charging and paying of interest, which eliminates the potential for excessive debt accumulation. This reduces financial risks and promotes more responsible lending practices.

- Encouragement of Real Economic Activities: Islamic banking encourages investment in real economic activities such as trade, production, and services. This focus on real assets contributes to the growth and stability of the economy.

- Promotion of Ethical Investing: Islamic banking adheres to ethical guidelines that prohibit investments in sectors such as alcohol, gambling, and tobacco. This promotes socially responsible investing and encourages the development of sustainable industries.

- Greater Financial Inclusion: Islamic banking strives to provide financial services to a wider segment of the population, including those who may not have access to conventional banking services. This promotes financial inclusion and helps reduce income inequality.

- Stability during Economic Crises: Islamic banks have demonstrated greater resilience during economic crises compared to conventional banks. Their asset-based financing model and risk-sharing principles help mitigate the impact of economic downturns.

Overall, the economic consequences of Islamic banking contribute to a more sustainable and equitable financial system, fostering economic growth and social development.

Sharia Law and Banking

Islamic banking operates within the guidelines of Sharia law, which is derived from the teachings of the Quran and the Hadiths (the sayings and actions of the Prophet Muhammad). Sharia law encompasses all aspects of a Muslim’s life, including financial transactions.

One of the key principles of Sharia law is the prohibition of interest, also known as Riba. Interest is seen as unjust and exploitative, as it allows lenders to profit without taking on any risk. Instead, Islamic banking promotes profit-sharing and risk-sharing arrangements.

Islamic banks offer a range of products and services that comply with Sharia law. The most common among them are:

- Mudarabah: In this arrangement, the bank acts as the investor while the customer acts as an entrepreneur. Any profits generated are shared between the bank and the customer according to pre-agreed ratios.

- Musharakah: This is a partnership arrangement where both the bank and the customer contribute capital and share both profits and losses based on their respective contributions.

- Ijara: This is an Islamic alternative to conventional leasing. The bank purchases the asset and leases it to the customer for a predetermined period. The customer pays rent instead of interest.

- Sukuk: These are Islamic bonds that serve as an alternative to interest-based bonds. Sukuk holders earn a share of profits generated by the underlying assets.

Furthermore, Islamic banking also considers certain prohibited activities according to Sharia law. These activities include:

- Riba: Charging or paying interest.

- Gharar: Excessive uncertainty or ambiguity in a contract.

- Maysir: Gambling or games of chance.

- Haram activities: Activities that are considered sinful or prohibited in Islam, such as alcohol, pork, and gambling.

It is important to note that Sharia law can vary across different regions and interpretations. Islamic banking institutions have Sharia boards or committees composed of Islamic scholars who ensure that their products and services comply with the principles of Sharia law.

In conclusion, Sharia law plays a fundamental role in the operations of Islamic banking. It provides guidance on ethical and fair financial transactions, prohibiting interest and promoting profit-sharing and risk-sharing arrangements. Islamic banking institutions offer a range of products and services that adhere to Sharia principles, providing Muslims with interest-free solutions for their banking needs.

Compliance Requirements

Islamic banking operates under a set of principles and guidelines that are derived from the Shariah, or Islamic law. These principles ensure that banking transactions and practices align with the ethical and moral values of Islam. Compliance with these requirements is essential for Islamic banks to maintain their credibility and integrity.

Shariah Compliance Board: Each Islamic bank is required to have a Shariah Compliance Board consisting of Islamic scholars and experts who are well-versed in the principles of Shariah. This board reviews and approves all products, services, and transactions offered by the bank to ensure their compliance with Islamic law.

Prohibited Transactions: Islamic banking prohibits the involvement of interest (riba) and speculation (gharar) in financial transactions. Interest is considered exploitative and unjust, as it generates income without any real economic activity. Speculation, on the other hand, carries excessive risk and uncertainty, which is not in line with the principles of stability and fairness in Islamic finance.

Asset-Backed Financing: Islamic banking promotes asset-backed financing instead of traditional debt-based financing. This means that banks must engage in tangible economic activities and share the risk with their customers. Assets such as real estate, equipment, or commodities are used as collateral for financing, ensuring that the bank has a tangible stake in the transaction.

Transparency and Disclosure: Islamic banks are required to maintain transparency and provide full disclosure to their customers regarding the terms, conditions, and risks associated with their products and services. Clear communication and documentation are essential to ensure that customers fully understand the nature of the transactions they are entering into.

Profit and Loss Sharing: Islamic banks operate on the principle of profit and loss sharing (PLS). This means that both the bank and the customer share the profits and losses of a venture based on a pre-agreed ratio. This encourages a partnership-based approach where both parties have a vested interest in the success of the venture.

Charitable Contributions: Islamic banking encourages the concept of social responsibility and charitable giving. A portion of the bank’s profits is typically allocated to charitable causes, such as poverty alleviation, education, healthcare, and other initiatives that benefit the community.

Audit and Governance: Islamic banks are subject to regular audits by independent Shariah auditors to ensure compliance with Islamic principles. Additionally, strong governance structures are put in place to maintain the integrity, accountability, and transparency of the bank’s operations.

Ethics and Morality: Islamic banking places a strong emphasis on ethics and mora

Role of Islamic Scholars

The role of Islamic scholars is crucial in the functioning and development of Islamic banking. These scholars play a significant role in ensuring that Islamic financial institutions adhere to the principles of Shariah law.

Islamic scholars, also known as Shariah scholars or Islamic jurists, are experts in Islamic law and are responsible for providing guidance and issuing fatwas (religious rulings) on various financial products and transactions. Their role is to ensure that the products and services offered by Islamic banks comply with the principles of Shariah.

Islamic scholars are typically appointed by Islamic banks to serve on their Shariah boards. These boards are responsible for reviewing and approving financial products and transactions to ensure their compliance with Shariah law. They also provide ongoing supervision and monitoring to ensure that the operations of the bank remain Shariah-compliant.

The primary role of Islamic scholars is to assess whether a financial product or transaction is in line with the principles of Islamic finance. They evaluate the underlying contracts and structures, as well as the terms and conditions, to determine whether they comply with Shariah law. If they find any non-compliance, they provide recommendations for changes or modifications to ensure compliance.

Islamic scholars also play a role in resolving disputes and providing arbitration services in Islamic finance. If a dispute arises between parties involved in an Islamic financial transaction, the matter can be referred to a Shariah scholar for resolution. The scholar will use their expertise in Islamic law to mediate and find a solution that is in line with Shariah principles.

In addition to their role in Islamic banking, Islamic scholars also contribute to the development of Islamic finance through research, teaching, and writing. Many scholars are involved in academia and contribute to the scholarly discourse on Islamic finance. Their research and publications help to advance the understanding and implementation of Islamic finance principles.

In conclusion, Islamic scholars play a crucial role in ensuring the compliance of Islamic banks with the principles of Shariah law. They provide guidance, issue fatwas, and serve on Shariah boards to ensure that financial products and transactions are in line with Islamic finance principles. They also contribute to the resolution of disputes and the development of Islamic finance through research and teaching.

Key Features and Concepts

Islamic banking operates on a set of fundamental principles that distinguish it from conventional banking. Some of the key features and concepts of Islamic banking include:

-

Prohibition of Interest: Islamic banking strictly prohibits the charging or payment of interest (riba) on financial transactions. Riba is seen as exploitative and unfair, as it involves earning money without participating in any productive activity.

-

Profit-Sharing: Instead of earning interest, Islamic banks engage in profit-sharing transactions with their customers. This means that the bank and the customer share the profits or losses generated by an investment or project.

-

Asset-Backed Financing: Islamic banking focuses on providing financing based on tangible assets, such as real estate, commodities, or equipment. The bank and the customer enter into a partnership or joint venture, where the bank provides the capital and the customer contributes the expertise and labor.

-

Prohibition of Speculation: Islamic banking discourages speculative activities that involve excessive risk or uncertainty. Instead, investments are encouraged to be socially responsible and contribute to the overall welfare of society.

-

Ethical Investments: Islamic banking adheres to strict ethical standards, prohibiting investments in industries or activities that are considered haram (forbidden) according to Islamic law. These include industries such as alcohol, gambling, weapons, and pork.

-

Moral Hazard: Islamic banking promotes a sense of responsibility and accountability between the bank and its customers. Financial risks are shared, and the bank evaluates the viability and ethical nature of each investment opportunity.

These key features and concepts form the foundation of Islamic banking, providing an alternative approach to finance that aligns with the principles and teachings of Islam.

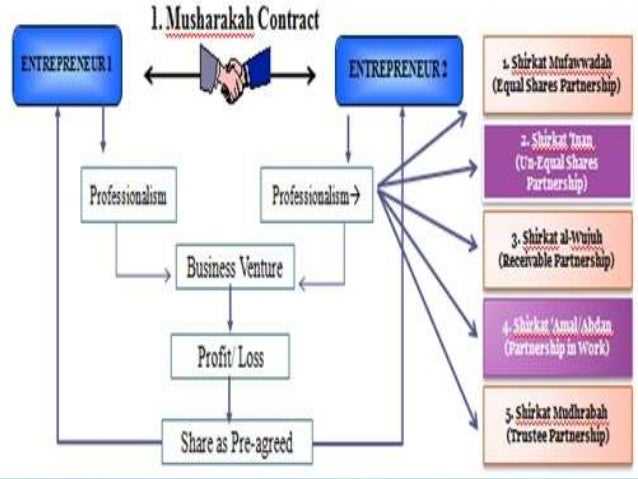

Musharakah

Musharakah is a type of partnership that is commonly used in Islamic finance. It is based on the principle of profit sharing, where two or more parties contribute capital to a joint venture or project.

In a musharakah arrangement, each partner contributes capital to the venture based on an agreed-upon ratio. The partners also share in the profits of the venture based on their agreed-upon ratio. However, losses are shared in proportion to each partner’s capital contribution.

This type of partnership is often used in large-scale projects, such as real estate development or infrastructure projects, where the capital requirements are high. By pooling their resources, the partners can leverage their combined capital to finance the project.

Musharakah is often considered a more equitable form of partnership compared to traditional financing models. It aligns the interests of the partners and encourages cooperation and shared responsibility.

There are different types of musharakah arrangements, including diminishing musharakah, where one partner gradually buys out the other partner’s share over time. This is often used in home financing, where the bank and the individual share ownership of the property until the individual’s share is fully bought out.

Musharakah can also be used in trade financing, where the partners pool their capital to finance the purchase of goods for resale. The profits from the sale of the goods are then shared among the partners based on their agreed-upon ratio.

Overall, musharakah provides an interest-free alternative to traditional financing models in Islamic banking. It promotes shared risk and reward and encourages collaboration among partners.

Murabaha

Murabaha is a commonly used Islamic banking transaction model based on the concept of cost-plus financing. It is often implemented for the purchase of goods and assets.

In a Murabaha transaction, the bank agrees to purchase a specific asset or good requested by the customer. The cost incurred by the bank is the purchase price of the asset, plus any related expenses. The bank then sells this asset to the customer at a higher price, which includes an agreed-upon profit margin. The customer pays the bank for the asset in deferred installments or as a lump sum depending on the terms of the agreement.

Unlike conventional interest-based loans, Murabaha transactions involve a transparent and upfront disclosure of costs and profit margins. The bank’s profit is determined beforehand, ensuring that all parties are aware of the terms and conditions of the transaction. This makes Murabaha compliant with Islamic principles that emphasize fairness and transparency in financial dealings.

Murabaha is commonly used for financing short-term consumer goods, such as cars, household appliances, or even real estate. It allows customers to make purchases without incurring interest charges, making it an attractive financing option for those who prefer Sharia-compliant banking.

Steps Involved in a Murabaha Transaction:

- The customer approaches the bank with a request to purchase a specific asset or good.

- The bank agrees to purchase the asset on behalf of the customer and discloses the cost, profit margin, and payment terms.

- The bank and customer enter into an agreement, outlining the terms and conditions of the Murabaha transaction.

- The bank purchases the asset and becomes the legal owner.

- The bank sells the asset to the customer at an agreed-upon higher price, which includes the cost and profit margin.

- The customer makes payment to the bank according to the agreed-upon payment terms.

- Once the customer completes the payment, ownership of the asset is transferred from the bank to the customer.

Overall, Murabaha provides an interest-free financing solution that aligns with the principles of Islamic finance. It enables individuals and businesses to access necessary goods and assets while adhering to the ethical and religious guidelines of Sharia law.

Ijarah

Ijarah is a concept in Islamic banking that relates to leasing. It is a financial agreement where one party, the lessor, grants the use or ownership of an asset to another party, the lessee, in exchange for a periodic rental payment. The rental payment is determined by mutual agreement between the lessee and the lessor.

Under an Ijarah agreement, the lessor retains the ownership of the asset while allowing the lessee to use it for a specified period. The lessee pays rental payments during the period of the lease, which could be short-term or long-term, depending on the parties’ agreement.

In an Ijarah agreement, the lessor is responsible for the maintenance and insurance of the leased asset. The lessee, on the other hand, is responsible for using the asset in compliance with the agreed terms and conditions.

Types of Ijarah

There are two main types of Ijarah:

- Ijarah Thumma Al-Bai (ITB): This is a two-step process where the lessor initially leases the asset to the lessee for a specific period. At the end of the lease period, the lessee has the option to purchase the asset at an agreed price. This type of Ijarah is commonly used for long-term financing of assets.

- Ijarah Muntahia Bittamleek (IMB): This is a lease-purchase agreement, where the leased asset is gradually transferred to the lessee’s ownership over time. The lessee pays regular rental payments and an additional portion towards the purchase price of the asset. At the end of the lease period, the lessee becomes the owner of the asset. This type of Ijarah is often used for commercial property financing.

Advantages of Ijarah

- Interest-free: Ijarah is considered a Sharia-compliant solution as it does not involve charging or paying interest.

- Asset availability: Ijarah allows individuals and businesses to access assets without having to purchase them outright. This is particularly beneficial for individuals or businesses that may not have the means to buy an asset outright or prefer not to tie up their capital.

- Flexibility: Ijarah agreements can be structured to meet the specific needs of the parties involved. The terms of the lease, including rental payments, lease period, and purchase options, can be negotiated to suit the lessee’s requirements.

- Asset management: The lessor is responsible for managing and maintaining the leased asset, relieving the lessee of any additional maintenance and insurance costs. This can be particularly advantageous for businesses that prefer to focus on their core operations.

Conclusion

Ijarah is a leasing arrangement commonly used in Islamic banking as an interest-free alternative to conventional financing. It offers individuals and businesses access to assets without the need for substantial upfront capital and provides flexibility in terms of lease agreements. Ijarah is considered a Sharia-compliant solution, making it a popular choice for those seeking interest-free financial options.

Mudarabah

Mudarabah is a partnership-based contract in Islamic finance, where one party provides the capital and the other party provides the expertise to utilize that capital in a business venture. The party providing the capital is called the ‘rab al-mal’ (capital provider) and the party providing the expertise is called the ‘mudarib’ (entrepreneur).

The mudarib is responsible for managing the business operations and making investment decisions, while the rab al-mal provides the necessary capital. The profits generated from the business venture are shared between the two parties according to a pre-determined ratio, while any losses are borne solely by the rab al-mal.

Unlike conventional banking, where the capital provider is guaranteed a fixed rate of return (interest), mudarabah allows for a profit-sharing arrangement based on the actual performance of the business venture. This aligns with the principles of Islamic finance, which prohibit the payment or receipt of interest.

Mudarabah contracts can be used in various forms, such as financing projects, trade activities, and investment ventures. They are commonly utilized for financing small and medium-sized enterprises (SMEs), as they allow entrepreneurs to access capital without resorting to interest-based loans.

It is important to note that mudarabah contracts carry a certain degree of risk for the capital provider, as they are not guaranteed a specific rate of return. However, this risk can be mitigated through careful evaluation of the entrepreneur’s expertise and track record, as well as thorough market analysis for the proposed business venture.

Key Features of Mudarabah

- Partnership-based contract

- Capital provider (rab al-mal) and entrepreneur (mudarib)

- Profit-sharing based on pre-determined ratio

- Losses borne solely by the capital provider

- Used for financing projects, trade activities, and investments

- Risk-sharing between parties

Mudarabah is one of the key principles of Islamic finance, promoting equitable and fair financial transactions. It provides an alternative to interest-based systems, encouraging entrepreneurship and risk-sharing while ensuring socially responsible investments. By understanding the mechanics of mudarabah, individuals can make informed decisions when it comes to Islamic banking and financing solutions.

Wakala

In Islamic banking, wakala is a contract that involves a principal (muwakkil) and an agent (wakil). The principal authorizes the agent to act on their behalf in managing their investment or assets.

The role of the agent in a wakala contract is to invest or use the principal’s funds in a halal (permissible) manner in order to generate returns. The agent is expected to act honestly, diligently, and in the best interest of the principal.

Wakala contracts are commonly used in Islamic banking to facilitate various financial transactions. They are often structured in a way that allows the agent to earn a fee or a percentage of the profits from the investment activities.

There are different types of wakala contracts that can be used in Islamic banking:

- General Wakala: In this type of wakala, the agent has a broad authority to manage the principal’s assets or investments. The agent has the flexibility to make investment decisions on behalf of the principal within the agreed guidelines.

- Specific Wakala: In a specific wakala contract, the agent is authorized to carry out specific investment activities on behalf of the principal. The scope of authority is limited to the specified activities.

Wakala contracts are used in a variety of Islamic financial products, such as mutual funds, investment accounts, and wealth management services. They provide a Sharia-compliant mechanism for investors to participate in the financial markets while adhering to Islamic principles.

In conclusion, wakala contracts play a significant role in Islamic banking by enabling investors to entrust their funds to a qualified agent to generate returns in a halal manner. These contracts provide a transparent and ethical alternative to conventional interest-based financial transactions.

Takaful

Takaful is a system of Islamic insurance that provides coverage against certain risks related to life, health, property, and liabilities. Unlike conventional insurance, which involves the concept of interest and uncertainty, takaful is based on the principles of cooperation, shared responsibility, and mutual protection.

In a takaful arrangement, participants contribute money into a common pool, known as the takaful fund, to provide financial assistance to those who suffer from a covered loss or damage. This fund is managed by a takaful operator, which is responsible for overseeing the operations and ensuring that the principles of takaful are upheld.

The takaful fund is used to pay claims to the participants who experience a loss or damage covered by the takaful policy. Any excess amount in the fund after paying the claims and expenses is distributed among the participants as a surplus, in accordance with the principle of equity.

There are different types of takaful policies available, including family takaful, general takaful, and medical takaful. Family takaful provides coverage for events such as death, disability, or critical illness, while general takaful covers risks related to property, fire, and accidents. Medical takaful provides coverage for medical expenses and hospitalization.

One of the main advantages of takaful is its compliance with Shariah principles, as it avoids activities that are prohibited in Islam, such as interest (riba) and gambling (maysir). Takaful also promotes the values of cooperation and mutual support within the community.

Another key feature of takaful is the concept of tabarru, which means donation or contribution. Participants willingly contribute a portion of their premiums to the takaful fund, with the intention of helping other participants in times of need. This spirit of sharing and solidarity sets takaful apart from conventional insurance.

In conclusion, takaful offers an interest-free and Shariah-compliant alternative to conventional insurance. It fosters the principles of cooperation, equity, and mutual protection among its participants. With the growing awareness and demand for Islamic financial products, takaful has gained popularity as an ethical and sustainable solution.

Qard Hasan

Qard Hasan is a concept in Islamic banking that refers to loans given on a goodwill basis, meaning that they are provided without any interest or profit. The term “Qard” comes from the Arabic word for loan, and “Hasan” means “good” or “beneficial” in Arabic.

In Islamic finance, Qard Hasan is considered a form of charity or social lending, as it involves lending money to individuals or businesses in need without expecting any return on the loan. This concept is based on the principle of helping others and promoting social welfare.

Qard Hasan can be used in various ways within Islamic banking. For example, individuals or businesses can borrow money through Qard Hasan to meet their short-term financial needs or for emergency situations. This can include situations such as medical expenses, education expenses, or starting a small business.

The borrower is only required to repay the principal amount borrowed and is not obligated to pay any additional interest or profit. However, the borrower may choose to give a gift or donation to the lender out of gratitude or as an act of goodwill, but this is not a requirement.

The practice of Qard Hasan is encouraged in Islamic finance as it promotes social solidarity, compassion, and the sharing of financial resources within the community. It allows individuals and organizations with surplus funds to support those in need without expecting any financial gain in return.

It is important to note that Qard Hasan is different from other forms of financing in Islamic banking, such as Murabaha or Musharakah, which involve profit-sharing or trading activities. Qard Hasan is purely a loan given without any expectation of return.

In conclusion, Qard Hasan is a key concept in Islamic banking that promotes interest-free lending for the benefit of those in need. It is based on the principles of social welfare, compassion, and solidarity within the Islamic finance system.

Benefits and Challenges

Islamic banking offers several benefits and faces certain challenges:

Benefits:

- Interest-free transactions: One of the main benefits of Islamic banking is that it offers interest-free transactions. This is in line with Islamic principles that prohibit the charging or payment of interest.

- Focus on real economic activities: Islamic banks focus on financing real economic activities and investments. This promotes economic growth and helps avoid speculative practices.

- Risk-sharing: Islamic banking promotes a greater sense of risk-sharing between the bank and the client. Both parties share the profit or loss of the investment, fostering a more equitable relationship.

- Financial inclusion: Islamic banking aims to provide financial services to a broader range of people, including those who may not have access to traditional banking. This promotes financial inclusion and helps reduce poverty.

- Ethical approach: Islamic banking operates based on ethical principles and avoids investments in sectors considered unethical in Islam, such as alcohol, gambling, and tobacco.

Challenges:

- Limited expertise: Islamic banking requires specialized knowledge and expertise, which may be limited in certain regions. This can pose a challenge in developing and implementing Islamic banking services.

- Legal and regulatory framework: Islamic banking faces challenges in adapting to existing legal and regulatory frameworks that are based on conventional banking practices. Developing appropriate regulations to govern Islamic banking can be complex.

- Perception and awareness: Many people may not be aware of the principles and benefits of Islamic banking. Building awareness and changing perceptions about Islamic banking can be a challenge.

- Limited product variety: Islamic banking may have a limited range of financial products compared to conventional banking. This can restrict the options available to customers.

- Financial risk management: Islamic banking relies on innovative financial products and risk management techniques to mitigate financial risks. Developing effective risk management strategies can be a challenge.

In conclusion, Islamic banking offers various benefits, including interest-free transactions, a focus on real economic activities, risk-sharing, financial inclusion, and an ethical approach. However, it also faces challenges related to limited expertise, legal and regulatory frameworks, perception and awareness, limited product variety, and financial risk management.

Financial Stability

In the context of Islamic banking, financial stability refers to the ability of the banking system to maintain its operations and meet its obligations in the long term. This stability is achieved through various mechanisms and principles inherent in Islamic finance.

One of the primary factors contributing to financial stability in Islamic banking is the prohibition of interest (riba). Unlike conventional banks, which rely heavily on interest-based transactions, Islamic banks operate on the principle of profit sharing (mudarabah) and risk sharing (musharakah). This ensures that the risks and rewards of financial transactions are shared between the bank and the customer, creating a more stable and equitable system.

Additionally, Islamic banks are required to adhere to Shariah-compliant practices, which promote transparency and ethical conduct. This includes the avoidance of speculative activities and investments in prohibited sectors such as gambling, alcohol, and pork. By adhering to these principles, Islamic banks reduce the likelihood of engaging in risky and unsustainable practices, thereby enhancing their financial stability.

Moreover, Islamic banks are required to maintain adequate capital reserves to withstand financial shocks. These reserves act as a buffer against unforeseen losses and ensure that the bank can continue its operations without defaulting on its obligations. The capital adequacy requirements for Islamic banks are often higher than those for conventional banks, further strengthening their financial stability.

Islamic banking also emphasizes prudent risk management practices. Banks are required to conduct thorough due diligence before entering into any financial transactions and to maintain a diversified portfolio of assets. This helps mitigate risks and reduces the potential impact of any single loss on the bank’s overall stability.

Overall, the principles and mechanisms inherent in Islamic banking contribute to its financial stability. By avoiding interest-based transactions, adhering to ethical practices, maintaining adequate capital reserves, and implementing prudent risk management strategies, Islamic banks are able to create a more stable and resilient financial system.

Greater Social Equality

One of the key principles of Islamic banking is the promotion of social equality. Islamic banks strive for a more inclusive financial system that benefits all members of society, rather than just a select few. This is achieved through various mechanisms and practices:

- Prohibition of Interest: Islamic banking operates based on the principle of interest-free financing. Instead of charging interest on loans, Islamic banks engage in profit-sharing arrangements or provide financing through leasing arrangements. This ensures that the financial burden is shared equitably between the bank and the customer.

- Focus on Real Assets: Islamic banks predominantly invest in real assets and tangible projects that contribute to the real economy. This approach prevents excessive speculation and helps direct capital towards productive sectors, fostering economic growth and job creation.

- Zakat: Islamic banking encourages the payment of Zakat, which is a form of obligatory charity for wealthy individuals. The funds collected through Zakat are redistributed to those in need, fostering social solidarity and reducing wealth disparities.

- Microfinance: Islamic banks actively participate in microfinance initiatives, providing financial services to individuals and small businesses who may have limited access to conventional banking. By extending financial support to marginalized segments of society, Islamic banks help promote economic empowerment and social inclusion.

- Ethical Investment: Islamic banking adheres to strict ethical standards, avoiding investments in sectors such as gambling, alcohol, and tobacco. This emphasis on ethical investments ensures that funds are channeled into socially responsible projects and avoids harm to society.

Through these mechanisms, Islamic banking seeks to reduce income inequality, promote economic justice, and create a more equitable society. By prioritizing social welfare and focusing on the real economy, Islamic banking contributes to the achievement of greater social equality.

Adapting to Global Markets

Islamic banking has been able to adapt to global markets while still adhering to its principles of interest-free banking. By understanding the dynamics of the global financial system, Islamic banks have been able to develop innovative solutions that meet the needs of their customers while remaining compliant with Shariah law.

One way Islamic banks have adapted to global markets is by offering a wide range of Shariah-compliant financial products. These products include Islamic mortgages, car loans, and credit cards, among others. By offering these products, Islamic banks are able to compete with conventional banks and attract a broader customer base.

In addition to offering Shariah-compliant financial products, Islamic banks have also developed innovative structures to facilitate international trade and investment. For example, Islamic banks offer trade finance facilities such as letters of credit and documentary collections, which comply with Shariah principles. These structures enable Islamic banks to participate in global trade and investment while ensuring that all transactions are interest-free.

Furthermore, Islamic banks have also embraced technology to adapt to global markets. Many Islamic banks now offer online banking services, mobile banking applications, and other digital solutions. These technological advancements have made it easier for customers to access Islamic banking services and have helped Islamic banks expand their reach beyond their traditional markets.

Another way Islamic banks have adapted to global markets is by developing partnerships and collaborations with conventional banks and financial institutions. These partnerships allow Islamic banks to tap into the expertise and networks of conventional banks, enabling them to offer more diverse and sophisticated financial products and services. This strategy has helped Islamic banks gain access to new markets and attract a wider range of customers.

Overall, Islamic banking has successfully adapted to global markets by offering a diverse range of Shariah-compliant financial products, developing innovative structures for international trade and investment, embracing technology, and forming partnerships with conventional banks. Through these strategies, Islamic banks are able to provide interest-free solutions to customers around the world while remaining competitive in the global financial system.

FAQ

What is Islamic banking?

Islamic banking is a system of banking that is based on the principles of Islamic law, also known as Shariah law. It operates without the use of interest and follows ethical guidelines that promote fairness, transparency, and social justice.

How is Islamic banking different from conventional banking?

Islamic banking differs from conventional banking in that it prohibits the charging or paying of interest. Instead, it promotes profit-sharing and risk-sharing as the main mechanisms for generating income and conducting transactions.

What is the main objective of Islamic banking?

The main objective of Islamic banking is to provide financial services in a way that is consistent with the principles of Islamic law. It aims to promote economic development, social justice, and ethical conduct while avoiding exploitative practices.

How does Islamic banking handle financing?

In Islamic banking, financing is done through various Islamic financial contracts such as mudarabah (profit sharing), musharakah (partnership), murabaha (cost-plus sale), ijara (leasing), and sukuk (Islamic bonds). These contracts ensure that the lender and the borrower share both the risks and the profits of a given transaction.

What are the benefits of Islamic banking?

Islamic banking provides a number of benefits such as promoting ethical conduct, financial inclusion, risk sharing, and economic stability. It also encourages socially responsible investment and ensures that financial transactions are conducted in a transparent and fair manner.

Are there any challenges faced by Islamic banking?

Yes, Islamic banking faces challenges such as the lack of standardized regulations and legal frameworks in some countries, the limited availability of qualified Islamic finance professionals, and the need for greater awareness and understanding of Islamic banking principles among the general public.

Is Islamic banking limited to Muslim countries?

No, Islamic banking is not limited to Muslim countries. It has gained popularity and recognition worldwide, with Islamic financial institutions operating in various countries, including non-Muslim majority countries such as the United Kingdom, the United States, and Australia.