In the world of international trade, tariffs and quotas are two common tools used by governments to control imports and protect domestic industries. While both aim to limit the amount of foreign goods entering a country, they have distinct differences in how they achieve this goal.

A tariff is a tax imposed on imported goods, making them more expensive for consumers. It is typically a percentage of the value of the goods and is collected by the customs authorities of the importing country. Tariffs can be used to raise revenue for the government, but their primary purpose is to make foreign goods less competitive and protect domestic industries. By increasing the price of imported goods, tariffs discourage their consumption and promote the purchase of domestic alternatives.

On the other hand, quotas are a physical restriction on the quantity of imported goods. They limit the amount of a particular product that can be brought into a country within a specified time frame. Quotas are often implemented to protect domestic industries from foreign competition, especially when those industries are unable or unwilling to compete on price or quality. Unlike tariffs, which raise the price of imports, quotas directly restrict the supply and availability of foreign goods in the domestic market.

The choice between tariffs and quotas depends on the specific goals of a country’s trade policy. Tariffs can be more beneficial for governments seeking to generate revenue, while quotas may be more effective in protecting certain domestic industries. Both measures have advantages and disadvantages, and their impact on international trade can vary depending on the circumstances.

The Key Distinction Between Tariffs and Quotas Described

Tariffs and quotas are both types of trade barriers that can be implemented by governments to protect domestic industries, regulate imports, and affect international trade. While these measures are similar in their goal of controlling trade, they differ in their mechanisms and impacts. Understanding the key distinctions between tariffs and quotas is crucial for comprehending their effects on the global economy.

Tariffs, also known as import duties or customs duties, are taxes imposed on imported goods. They are levied on a specific percentage of the value of the imported product. The purpose of tariffs is twofold: to generate revenue for the government and to provide protection to domestic industries by making imported goods more expensive compared to domestically produced goods. Tariffs are usually imposed by the government as a means of protecting domestic industries from foreign competition.

Quotas, on the other hand, are quantitative restrictions on the quantity of imported goods. Instead of imposing taxes on imports, quotas directly limit the volume of goods that can be imported within a given time period. The primary objective of quotas is to restrict the inflow of foreign goods into the domestic market, ensuring a certain level of market share for domestic industries. Quotas are often implemented to protect domestic industries or to address concerns related to national security.

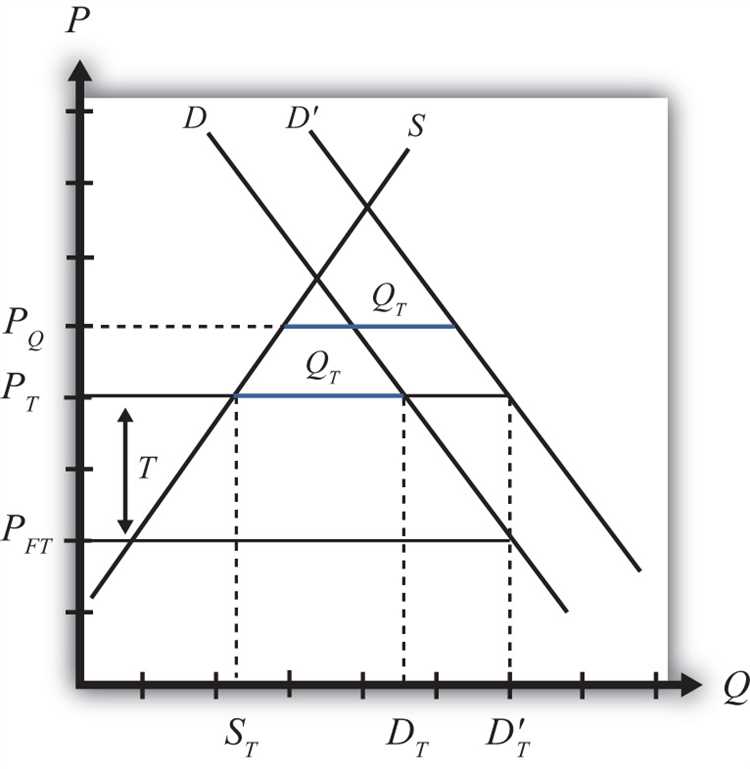

While both tariffs and quotas are intended to regulate trade, their distinct mechanisms have different impacts on the economy. Tariffs, by imposing taxes on imports, increase the price of foreign goods. This makes imported goods less competitive and encourages consumers to purchase domestically produced alternatives. Tariffs can also generate revenue for the government through the collection of import duties. However, these additional costs for consumers can lead to higher prices and reduced choices.

Quotas, on the other hand, limit the physical quantity of imported goods. By restricting supply, quotas can drive up the prices of imported goods and reduce availability in the domestic market. This can help domestic industries by ensuring a larger share of the market, but it can also lead to higher prices for consumers and reduced choices. Additionally, quotas can create inefficiencies by creating artificial scarcity and disrupting the supply chain.

In summary, the key distinction between tariffs and quotas lies in their mechanisms. Tariffs are taxes imposed on imported goods, increasing prices and protecting domestic industries. Quotas are quantitative restrictions on imports, limiting the quantity of goods and ensuring a certain market share for domestic industries. Understanding these differences is important for evaluating the effects of trade barriers on economies and global trade.

Understanding Tariffs

A tariff is a tax imposed on imported goods and services. It is one of the most common tools used by governments to protect domestic industries and regulate international trade. Tariffs can be imposed for various reasons, such as to protect domestic production, reduce competition from foreign companies, or generate revenue for the government.

Tariffs are typically divided into two types: ad valorem and specific tariffs.

Ad Valorem Tariffs

An ad valorem tariff is a tax that is applied as a percentage of the value of the imported goods. For example, if a 10% ad valorem tariff is imposed on a $100 product, the importer will have to pay an additional $10 as a tariff.

The main advantage of ad valorem tariffs is that they are relatively easy to calculate and administer. However, they can also lead to disputes and disagreements over the valuation of goods, as different parties may have different interpretations of the value.

Specific Tariffs

A specific tariff is a fixed amount per unit of the imported goods. For example, if a specific tariff of $10 per unit is imposed on a certain product, the importer will have to pay $10 for each unit imported, regardless of the value of the goods.

The advantage of specific tariffs is that they provide certainty in terms of the cost of importing goods. However, they can also have unintended consequences, such as disproportionately affecting low-value goods or providing excessive protection to certain industries.

Effects of Tariffs

Tariffs have several effects on the economy. They can protect domestic industries by making imported goods more expensive and therefore less competitive. This can help create jobs and promote the growth of domestic industries.

However, tariffs can also lead to higher prices for consumers, as imported goods become more expensive. They can also lead to trade wars and retaliation from other countries, as each country tries to protect its own industries.

Overall, tariffs can be an effective tool for protecting domestic industries and regulating international trade. However, they should be carefully considered and implemented to balance the needs of domestic industries with the interests of consumers and international trade relationships.

Examining Quotas

A quota is a restriction on the quantity of a certain product that can be imported or exported within a given time period. Unlike tariffs, which are a tax on imported goods, quotas directly limit the quantity of goods that can enter or leave a country.

Quotas can be implemented for various reasons, such as protecting domestic industries, promoting local production, or addressing trade imbalances. They are often used as a tool for controlling the quantity of goods in the market and maintaining a balance between domestic production and foreign competition.

There are two types of quotas: absolute quotas and tariff quotas.

Absolute Quotas

An absolute quota imposes a strict limit on the quantity of a specific product that can be imported or exported. Once the quota is reached, no more of the product can be imported or exported, regardless of the demand or availability. This can lead to supply shortages and higher prices for consumers.

Absolute quotas are typically used for highly regulated or sensitive products, such as agricultural goods or textiles. They aim to protect domestic industries from foreign competition and ensure a certain level of local production.

Tariff Quotas

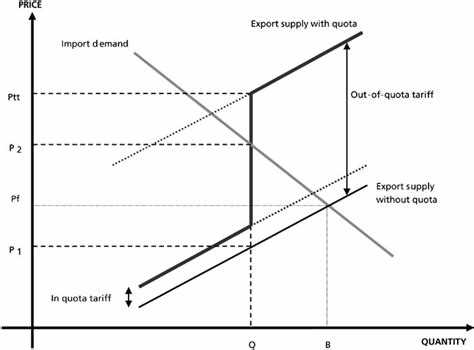

A tariff quota, also known as a “tariff-rate quota,” combines a quota with a tariff. It allows a certain quantity of a product to be imported or exported at a lower tariff rate, but any quantity beyond the quota is subject to a higher tariff rate.

Tariff quotas provide a mechanism for balancing trade interests. They offer some flexibility by allowing a limited amount of trade at a lower tariff rate, while still providing protection for domestic industries when the quota is exceeded.

This type of quota is often used to promote fair competition and prevent excessive imports or exports of specific goods. It can help manage the impact of sudden surges in trade and ensure a more gradual adjustment to changing market conditions.

Impact of Quotas

Quotas can have various effects on the economy. They can protect domestic industries from foreign competition, but they can also restrict consumer choice and lead to higher prices due to limited supply.

Quotas can also trigger retaliation from other countries, as they are seen as barriers to free trade. This can lead to trade disputes and potentially impact international relations.

Overall, quotas can be a useful tool for managing trade, but they should be carefully considered and implemented to avoid negative consequences. It is important to find a balance between protecting domestic industries and promoting fair competition in the global marketplace.

Main Differences Between Tariffs and Quotas

Tariffs and quotas are both trade barrier measures that countries use to protect their domestic industries from foreign competition. While they aim to achieve the same goal, there are significant differences between the two. Understanding these differences is vital for policymakers, economists, and anyone interested in international trade.

1. Policy Objective

Tariffs are primarily used to raise revenue for the government or to protect domestic industries. They are imposed on imported goods and services, increasing their cost, and making them less competitive in the domestic market. Quotas, on the other hand, aim to restrict the quantity of specific goods that can be imported into a country. The goal is to limit foreign competition and protect domestic industries.

2. Implementation

Tariffs are implemented by imposing a tax on imported goods and services. The tax is usually a percentage of the value of the goods or services. Quotas, on the other hand, are a physical limitation on the quantity of goods that can be imported. They are usually set in terms of quantity, such as a maximum number of units or weight.

3. Impact

Tariffs directly affect the price of imported goods and services, making them more expensive for the consumers. They can also lead to retaliatory measures from other countries, resulting in a trade war. Quotas, on the other hand, limit the availability of imported goods, leading to higher prices as well. However, they do not have the same potential for retaliation as tariffs.

4. Flexibility

Tariffs can be adjusted more easily than quotas. Governments can increase or decrease the tariff rate depending on the changing economic conditions or political considerations. Quotas, on the other hand, are generally set for a specific period and cannot be easily modified.

5. Trade Effects

Tariffs can result in a decrease in both imports and exports. By making imported goods more expensive, tariffs reduce the demand for imported goods, leading to a decline in imports. Additionally, other countries may retaliate by imposing tariffs on the exporting country, reducing its exports. Quotas primarily affect imports by limiting the quantity of goods that can be imported. They do not have the same direct impact on exports.

Conclusion

Tariffs and quotas are two distinct trade barrier measures, each with its own objectives, implementation methods, impacts, flexibility, and trade effects. Understanding the differences between the two is crucial for policymakers and those involved in international trade to make informed decisions about trade policy.

Impact on Domestic Industries

Tariffs and quotas both have a direct impact on domestic industries. They aim to protect and support local producers by limiting competition from foreign imports. However, they achieve this goal in different ways.

Tariffs:

- Tariffs impose additional costs on imported goods, making them more expensive compared to domestic products.

- This increase in price can give domestic industries a competitive advantage, as they can offer their goods at a lower price.

- Tariffs also generate revenue for the government, as importers must pay the imposed fees.

- Domestic industries benefit from the protection provided by tariffs, as they face less competition and have increased market share.

- Tariffs can stimulate domestic production and encourage the growth of industries that may have struggled without protection.

Quotas:

- Quotas restrict the quantity of imported goods that can enter a country, regardless of their price.

- This artificial limit can create scarcity and drive up prices, potentially benefiting domestic industries.

- Since the quantity of imports is controlled, local producers have the opportunity to fulfill the demand for goods that cannot be met by foreign suppliers.

- Quotas can lead to the development of domestic industries and the creation of new job opportunities.

- However, quotas can also create market inefficiencies, as they limit consumer choices and competition.

In conclusion, both tariffs and quotas can have a positive impact on domestic industries by protecting them from foreign competition. Tariffs achieve this by increasing the price of imported goods, while quotas limit the quantity of imports. The specific effects of tariffs and quotas will depend on the industry and the economic conditions of each country.

Effect on International Trade

Tariffs and quotas both have an effect on international trade, but in different ways.

- Tariffs: Tariffs are taxes or duties imposed on imported goods. They increase the cost of the imported goods, making them more expensive for consumers. This can lead to a decrease in demand for the imported goods, as consumers may choose to buy cheaper domestic alternatives. Tariffs can also lead to retaliation from other countries, as they may impose their own tariffs on the exporting country’s goods. This can result in a trade war, where both countries try to protect their domestic industries by increasing tariffs on each other’s goods.

- Quotas: Quotas, on the other hand, restrict the quantity of imported goods that can enter a country. This limits the supply of the imported goods, making them scarcer and potentially driving up prices. Quotas can protect domestic industries by limiting competition from foreign producers. However, a quota can also lead to a shortage of the imported goods, as the limited supply may not be able to meet the demand. This can result in higher prices for consumers and potentially create incentives for smuggling or illegal trade.

Both tariffs and quotas can disrupt international trade patterns and reduce the overall volume of trade. They can also lead to trade imbalances as countries try to protect their domestic industries. However, tariffs and quotas can also be used strategically to gain leverage in trade negotiations or to protect sensitive industries.

Overall, the impact of tariffs and quotas on international trade depends on how they are implemented, their duration, and the specific industries or products affected. Governments must carefully consider the potential benefits and drawbacks before implementing these trade restrictions.

Economic Consequences of Tariffs and Quotas

Tariffs and quotas are trade barriers imposed by governments to protect domestic industries from foreign competition. While their primary goal is similar, there are distinct economic consequences associated with each.

Tariffs:

- Increased prices: Tariffs lead to higher prices for imported goods due to the additional taxes imposed on them. This can have a direct impact on consumer purchasing power and increase the cost of living.

- Reduced consumption: Higher prices resulting from tariffs can decrease the demand for imported goods, as consumers may opt for cheaper domestic alternatives or shift their preferences altogether.

- Distorted resource allocation: Tariffs can distort resource allocation within an economy. By making imported goods more expensive, tariffs can incentivize domestic production, even if it is less efficient or of lower quality.

- Trade wars: Tariffs can trigger retaliatory actions from other countries. This can lead to a trade war, with escalating tariffs on both sides, resulting in reduced global trade, higher prices, and economic uncertainty.

- Revenue generation: Tariffs can generate revenue for the government. This additional revenue can be used to fund public spending or reduce budget deficits.

Quotas:

- Reduced supply: Quotas limit the quantity of imported goods that can enter a country. This can result in reduced supply, leading to higher prices and potential shortages of certain goods.

- Increased domestic production: Quotas can incentivize domestic production to meet the demand that cannot be satisfied by imports. This can lead to the growth of domestic industries and create employment opportunities.

- Higher prices: Limited supply due to quotas can drive up prices, as consumers compete for the available goods. This can have adverse effects on consumer purchasing power and inflation rates.

- Market inefficiencies: Quotas can create market inefficiencies by preventing the most efficient producers from supplying goods. This can lead to a misallocation of resources and hinder overall economic growth.

- Smuggling and black market: Quotas can create incentives for smuggling and the emergence of a black market. When the legal supply is limited, individuals may resort to illegal means to acquire the restricted goods.

In conclusion, tariffs and quotas have various economic consequences. Tariffs can lead to higher prices, reduced consumption, and trade wars, while quotas can result in reduced supply, increased domestic production, and market inefficiencies. Understanding these consequences is crucial for policymakers, businesses, and consumers in assessing the impact of trade barriers on the economy.

Examples of Tariffs and Quotas in Practice

In order to understand the practical implications of tariffs and quotas, let’s consider a few examples:

Tariffs Examples:

Example 1: Country A imposes a 10% tariff on imported automobiles.

- As a result of this tariff, the price of imported automobiles in Country A increases by 10%.

- Domestic automobile producers in Country A may benefit from the increased prices, as they can compete more effectively with the higher-priced imports.

- However, consumers in Country A will face higher prices and have fewer choices in the automobile market.

Example 2: Country B imposes a $5 tariff per unit on imported steel.

- As a result of this tariff, the price of imported steel in Country B increases by $5 per unit.

- Domestic steel producers in Country B may benefit from the increased prices, as they can compete more effectively with the higher-priced imports.

- Manufacturers in Country B that rely on imported steel may face higher production costs, potentially leading to higher prices for their products.

Quotas Examples:

Example 1: Country C imposes a quota of 10,000 units on imported televisions.

- Once the quota is reached, no additional televisions can be legally imported into Country C.

- Domestic television producers in Country C may benefit from reduced competition and increased market share.

- Consumers in Country C may face higher prices due to limited supply and reduced competition.

Example 2: Country D imposes a quota of 500,000 tons on imported sugar.

- Once the quota is reached, no additional sugar can be legally imported into Country D.

- Domestic sugar producers in Country D may benefit from reduced competition and increased market share.

- Food manufacturers in Country D that rely on imported sugar may face higher production costs and potentially higher prices for their products.

These examples demonstrate how tariffs and quotas can impact the prices of imported goods, domestic industries, and consumers. The specific effects will vary depending on the nature of the industry, the size of the tariff or quota, and other factors.

Policy Implications and Considerations

Implementing tariffs or quotas can have significant policy implications and considerations for a country. Here are some key points to consider:

- Economic impact: Both tariffs and quotas can affect the domestic economy and foreign trade. Tariffs may protect domestic industries and workers but can lead to higher prices for consumers and potentially reduce overall economic efficiency. Quotas can limit competition and protect domestic industries, but they may also lead to higher prices and reduce consumer choices.

- Trade relationships: The use of tariffs or quotas can impact trade relationships with other countries. Imposing tariffs or quotas may lead to retaliatory actions from trading partners, potentially resulting in a trade war. Countries may also use tariffs or quotas strategically to negotiate better trade deals or address trade imbalances.

- Domestic industries: Tariffs and quotas can have varying effects on different domestic industries. While they may protect certain industries from foreign competition, they may also discourage innovation and hinder growth in industries that rely on imported inputs or access to foreign markets.

- Consumer prices: Tariffs and quotas can influence consumer prices. Tariffs can lead to higher prices for imported goods, while quotas may limit supply and result in higher prices as well. This can affect the purchasing power of consumers and their access to a wide range of products.

- Government revenue: Tariffs can generate revenue for the government through import duties. This revenue can be used to fund public programs or infrastructure projects. Quotas, on the other hand, do not generate revenue directly, but their implementation may limit imports and reduce the need for government subsidies to domestic industries.

- Political considerations: The implementation of tariffs or quotas can have political implications. They may be used to address public concerns about job losses, protect specific industries, or appeal to nationalist sentiments. However, they can also face opposition from industries, consumers, and international organizations advocating for free trade.

Overall, the policy implications and considerations of tariffs and quotas are complex and multifaceted. Governments need to carefully evaluate the potential benefits and drawbacks of implementing these trade policy measures, taking into account the specific context and objectives of their country.

Question and answer:

What are tariffs and quotas?

Tariffs are taxes imposed on imported goods, while quotas are limits set on the quantity of goods that can be imported.

How do tariffs and quotas affect trade?

Tariffs increase the cost of imported goods, making them less competitive compared to domestically produced goods. Quotas, on the other hand, restrict the amount of imported goods available in the market, which can lead to increased prices and limited consumer choices.

What are the reasons for implementing tariffs or quotas?

One reason for implementing tariffs is to protect domestic industries and workers from cheap foreign competition. Quotas can be used to protect domestic industries as well, but they can also be implemented for other reasons such as national security concerns or to prevent dumping of goods at unfairly low prices.

Are tariffs or quotas more effective in achieving their goals?

There is no one-size-fits-all answer to this question, as the effectiveness of tariffs or quotas depends on the specific goals and circumstances. Tariffs can generate revenue for the government and may be easier to implement and adjust, but quotas can provide more certainty in limiting imports. Ultimately, policymakers need to consider the trade-offs and potential consequences of each measure.