In recent years, Islamic finance has gained traction and popularity as an alternative to conventional banking systems. One aspect of Islamic finance that has gained attention is the concept of Islamic credit cards. These cards follow the principles of Shariah law, which prohibits charging or paying interest. In this article, we will explore the basics of how Islamic credit cards work and how they differ from conventional credit cards.

Unlike conventional credit cards that charge interest on outstanding balances, Islamic credit cards operate on the basis of profit sharing. The cardholder pays a fee for the services provided by the credit card company, and this fee is used to generate profits. The profits made by the credit card company are then shared with the cardholder in accordance with the terms and conditions of the card. This profit sharing arrangement ensures compliance with Shariah law.

Another key difference between Islamic credit cards and conventional credit cards is that Islamic credit cards do not offer a revolving credit facility. This means that cardholders are required to pay their outstanding balance in full each month, unlike conventional credit cards that allow for revolving credit. This requirement helps cardholders avoid accumulating debt and promotes responsible spending.

Islamic credit cards also offer a range of benefits and features similar to conventional credit cards. Cardholders can enjoy cashback rewards, travel privileges, and purchase protection, among other perks. Additionally, Islamic credit cards are accepted worldwide, making them a convenient payment option for cardholders.

In conclusion, Islamic credit cards offer a Shariah-compliant alternative to conventional credit cards. By operating on the principle of profit sharing and requiring full payment each month, they provide cardholders with a responsible and interest-free means of making payments. Moreover, they offer a range of benefits and features that make them a competitive choice in the global market. As Islamic finance continues to grow, understanding how Islamic credit cards work is crucial for those seeking to align their financial practices with their religious beliefs.

What are Islamic Credit Cards?

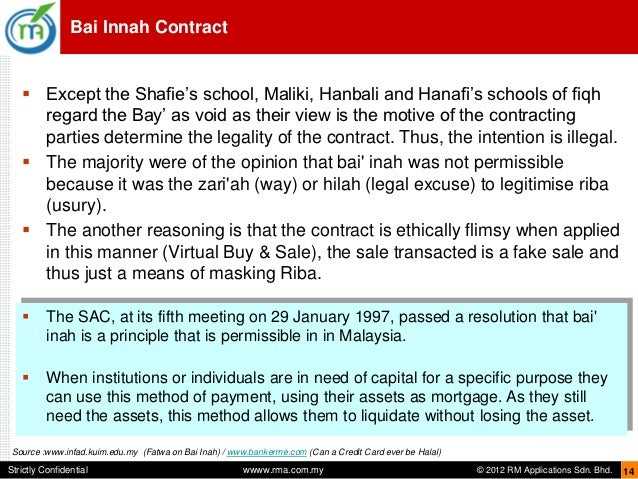

Islamic credit cards, also known as Sharia-compliant credit cards, are a type of credit card that adhere to the principles of Islamic finance. These principles are based on the teachings of the Quran and the Hadith (prophetic traditions). Islamic credit cards offer an alternative to conventional credit cards for Muslims who want to avoid interest (riba) and engage in ethical financial practices.

One of the key differences between Islamic credit cards and conventional credit cards is the way they handle interest. In Islamic finance, charging or earning interest is prohibited. Instead, Islamic credit cards operate on the basis of profit sharing, whereby the cardholder and the card issuer share the profits and risks associated with transactions.

Another important feature of Islamic credit cards is the absence of fees or penalties for late payments. Instead of charging penalties, Islamic credit cards may impose a charitable donation as a form of compensation for late payments. This aligns with the principle of fairness and encourages responsible financial behavior.

Islamic credit cards also offer various features and benefits similar to conventional credit cards. These include cashback rewards, discounts, and travel benefits. The difference lies in the way these benefits are structured and provided, following the principles of Islamic finance.

It is important to note that Islamic credit cards are offered by both Islamic financial institutions and conventional banks. However, they undergo a rigorous Sharia-compliance screening to ensure they adhere to Islamic principles. This screening involves the involvement of Sharia scholars who assess the products and services offered by the financial institution.

Overall, Islamic credit cards provide Muslims with a way to engage in financial transactions while adhering to the principles of Islamic finance. They offer an alternative to conventional credit cards and provide various benefits and features without compromising on religious beliefs.

Key Features of Islamic Credit Cards

Islamic credit cards, also known as Sharia-compliant credit cards, offer a range of features that are different from conventional credit cards. These features are designed to comply with Islamic principles and provide a way for Muslims to use credit while adhering to their beliefs.

Here are some key features of Islamic credit cards:

- No interest: Islamic credit cards do not charge interest on outstanding balances. Instead, they operate on the concept of profit and loss sharing. Cardholders pay a fixed monthly fee instead of interest.

- Halal transactions: Islamic credit cards only allow transactions that are considered halal (permissible) according to Islamic principles. This means that the cards cannot be used for activities such as gambling, buying alcohol, or engaging in any form of usury.

- Rewards and benefits: Just like conventional credit cards, Islamic credit cards offer rewards and benefits to cardholders. These may include cashback, airline miles, discounts, and exclusive offers.

- Charity donations: Some Islamic credit cards may allocate a percentage of the cardholder’s spending to charity. This helps cardholders fulfill their religious obligation of giving back to the community.

- Avoidance of debt: Islamic credit cards encourage responsible spending and discourage cardholders from acquiring excessive debt. The cards have spending limits based on the cardholder’s income and require full payment of the outstanding balance each month.

- No penalty fees: Islamic credit cards do not charge penalty fees for late payments. Instead, they may impose a charitable donation or suspend certain privileges if cardholders fail to make timely payments.

- Compliance with Islamic law: Islamic credit cards are designed to comply with the principles of Islamic law. They undergo thorough scrutiny and approval by Sharia boards, ensuring their adherence to Islamic principles and ethical standards.

In summary, Islamic credit cards provide a way for Muslims to access credit while adhering to their religious beliefs. These cards operate on the concept of profit and loss sharing, offer halal transactions, and provide various rewards and benefits. They also encourage responsible spending and comply with Islamic law.

How do Islamic Credit Cards Differ from Conventional Credit Cards?

Islamic credit cards, also known as Sharia-compliant credit cards, operate on the principles of Islamic finance. They differ from conventional credit cards in various ways:

- No interest: Islamic credit cards are designed to be interest-free. In Islamic finance, the payment or receipt of interest, known as riba, is considered prohibited. Instead of charging interest on outstanding balances, Islamic credit cards may apply other types of fees or generate revenue through profit-sharing agreements.

- Halal transactions: Islamic credit cards restrict the use of funds for certain types of transactions that are considered haram (forbidden) in Islam. This includes transactions related to alcohol, gambling, pork, and other prohibited activities.

- Charitable contributions: Some Islamic credit cards offer the option for cardholders to donate a portion of their spending towards charitable causes. This aligns with the Islamic principle of giving to the needy and promoting social welfare.

- No late payment fees: Instead of charging late payment fees, Islamic credit cards may impose other penalties for late payments, such as suspending the cardholder’s credit limit or blocking the card temporarily.

- Profit and loss sharing: Islamic credit cards operate on the concept of profit and loss sharing. The card issuer may share a portion of its profits with the cardholder, often based on the amount spent on the card. This profit-sharing arrangement provides an alternative to earning interest on savings.

It’s important to note that the specific features and terms of Islamic credit cards may vary among different financial institutions or countries. Therefore, it’s crucial for individuals interested in obtaining an Islamic credit card to research and compare the options available to find the one that best aligns with their financial needs and religious beliefs.

Shariah Compliance in Islamic Credit Cards

Islamic credit cards operate under the principles of Shariah law, which is based on the teachings of the Quran and the Hadith. Shariah compliance is a fundamental aspect of Islamic finance, and it ensures that financial transactions and products are conducted in a manner that is permissible according to Islamic principles.

Prohibition of Riba

One of the key principles that govern Islamic credit cards is the prohibition of riba, which refers to the charging or receiving of interest. In Islam, earning or paying interest is considered to be unjust and exploitative. Therefore, Islamic credit cards do not charge interest on the outstanding balance or late payments.

Avoidance of Gharar

Gharar is the Arabic term for uncertainty or ambiguity. Islamic credit cards are structured to avoid any form of ambiguity or uncertainty in the terms and conditions. The terms of the credit card agreement are clearly defined, and there should be no hidden fees or charges that could lead to uncertainty.

Prohibition of Haram Activities

Islamic credit cards also adhere to the principles of Shariah by avoiding involvement in haram (forbidden) activities. This means that the credit card cannot be used for transactions related to alcohol, gambling, pork products, or any other activities that are considered sinful in Islam.

Profit-Sharing Instead of Interest

Instead of charging interest, Islamic credit cards adopt a profit-sharing mechanism called musharakah. This means that the credit card issuer shares the profits generated from the purchases made using the card. The profit-sharing ratio is agreed upon between the cardholder and the issuer at the time of signing the agreement.

Transparency and Ethical Investment

Islamic credit cards promote transparency by providing detailed information regarding any fees or charges associated with the card. Additionally, the funds deposited by the cardholders are invested in businesses that comply with Shariah principles, ensuring that they are ethical and socially responsible.

Overall, Shariah compliance is a key principle in Islamic credit cards, ensuring that the financial transactions and products align with the values and beliefs of Islamic law. By adhering to these principles, Islamic credit cards provide an alternative banking solution for Muslims who want to manage their finances in a way that is consistent with their religious beliefs.

The Concept of Riba in Islamic Credit Cards

In the context of Islamic credit cards, the concept of Riba plays a crucial role in determining their compliance with Islamic principles. Riba refers to the prohibition of charging or paying interest.

In Islamic finance, the charging of interest is seen as exploitative and unfair. It is believed to create an unequal distribution of wealth and hinder economic justice. Therefore, Islamic credit cards are designed to be interest-free and operate on the principles of profit-sharing or fee-based transactions.

The absence of interest in Islamic credit cards does not mean that they are completely cost-free. Cardholders may be required to pay certain fees, such as annual membership fees or transaction fees. However, these fees are usually fixed and do not increase based on the time taken to repay the borrowed amount. This ensures that the financial burden on the cardholder remains fair and transparent.

Furthermore, instead of charging interest on late payments, Islamic credit cards may impose penalties or late payment fees. These penalties are not considered as interest since they are predetermined and do not increase over time.

In order to comply with Shariah law and avoid Riba, Islamic credit cards also follow specific guidelines for investment and funding. The funds used to provide credit to cardholders are obtained through Shariah-compliant means, such as profit-sharing partnerships or leasing arrangements.

Overall, the concept of Riba guides the operation of Islamic credit cards, ensuring they adhere to Islamic principles and provide financial products that align with the values of fairness and equitable distribution of wealth. By eliminating interest charges, Islamic credit cards offer cardholders an alternative option for managing their financial needs while adhering to their religious beliefs.

Types of Islamic Credit Cards

Islamic credit cards, also known as Sharia-compliant credit cards, come in various types to cater to different needs and preferences of cardholders. Here are some common types of Islamic credit cards:

- Islamic Classic Credit Cards: These are basic credit cards that offer essential features and benefits, such as cashback, rewards, and installment plans. They are suitable for day-to-day transactions and can be used for both local and international purchases.

- Islamic Gold Credit Cards: Islamic gold credit cards come with added benefits and higher credit limits compared to classic credit cards. They provide additional perks like airport lounge access, travel insurance, and concierge services. These cards are targeted towards customers with higher incomes and who travel frequently.

- Islamic Platinum Credit Cards: Platinum credit cards are premium credit cards that offer exclusive benefits and privileges to cardholders. They typically come with higher credit limits, luxury travel perks, complimentary hotel stays, and access to VIP events. These cards are designed for high-income individuals and frequent travelers.

- Islamic Business Credit Cards: Business credit cards cater to the needs of business owners and entrepreneurs. They offer features like expense tracking, higher credit limits for business expenses, and rewards tailored for business purchases. These cards help in managing business expenses and tracking transactions efficiently.

- Islamic Charity Credit Cards: Some Islamic credit cards are specifically designed to support charitable causes. Cardholders can choose to donate a portion of their card spendings to selected charities or organizations. These cards contribute to social causes while allowing individuals to make their regular purchases.

It’s important to note that the specific features and benefits of Islamic credit cards may differ from one bank or financial institution to another. Cardholders should carefully review the terms and conditions of the credit card before applying for one to ensure it aligns with their financial goals and values.

Benefits of Islamic Credit Cards

1. Shariah-compliant: Islamic credit cards operate under the principles of Shariah, which means they adhere to Islamic guidelines and principles. This makes them a more ethical and halal option for Muslims who want to avoid riba (interest) and other forbidden practices.

2. No interest: Unlike conventional credit cards, Islamic credit cards do not charge interest on outstanding balances. Instead, they may charge a monthly fee or profit rate, which is agreed upon upfront.

3. Cashback and rewards: Many Islamic credit cards offer cashback rewards or other benefits for cardholders. These rewards can vary and may include discounts on shopping, dining, travel, and more.

4. Payment flexibility: Islamic credit cards may offer flexible payment options, allowing cardholders to pay their balances in installments or defer payments for a certain period of time without accruing interest.

5. Worldwide acceptance: Islamic credit cards are widely accepted both locally and internationally, making them a convenient payment option for travel and online purchases.

6. Convenience: Islamic credit cards provide the same convenience and functionality as conventional credit cards. Cardholders can use them to make purchases, withdraw cash from ATMs, and access online banking services.

7. Access to exclusive benefits: Some Islamic credit cards offer access to exclusive benefits and privileges, such as airport lounge access, concierge services, travel insurance, and more.

In conclusion, Islamic credit cards offer a range of benefits for Muslim individuals who prefer a Shariah-compliant and ethical financial solution. These cards provide a convenient and flexible way to manage payments and expenses while adhering to Islamic principles.

Drawbacks of Islamic Credit Cards

While Islamic credit cards offer many benefits, there are also several drawbacks to consider before deciding to use one:

- Limited availability: Islamic credit cards are not as widely available as conventional credit cards. They are primarily offered by Islamic banks and financial institutions, which may limit your options.

- Higher fees and charges: Islamic credit cards often come with higher fees compared to conventional credit cards. This may include annual fees, late payment fees, and transaction charges.

- Restrictions on rewards: Some Islamic credit cards have restrictions on the types of rewards they offer. For example, they may not offer cashback rewards or discounts on alcohol, tobacco, or gambling-related purchases.

- Lower credit limits: Islamic credit cards may have lower credit limits compared to conventional credit cards. This can limit your purchasing power and may not be suitable for larger expenses.

- Complex terms and conditions: Islamic credit cards often come with complex terms and conditions that can be difficult to understand. It’s important to carefully review and understand the terms before signing up.

- Limited global acceptance: Islamic credit cards may have limited acceptance in certain countries or regions. It’s important to check whether the card is accepted at your desired locations before using it.

- Limited reward redemption options: Some Islamic credit cards may have limited options for redeeming rewards. This can restrict your ability to use accumulated rewards for travel, shopping, or other desired benefits.

Despite these drawbacks, Islamic credit cards can still be a viable option for individuals who prefer to adhere to Islamic principles and values in their financial transactions.

Eligibility Criteria for Islamic Credit Cards

Islamic credit cards provide a convenient way for individuals to manage their finances while still adhering to the principles of Islamic banking. While the specific eligibility criteria may vary depending on the financial institution, there are some common requirements that applicants must meet to be eligible for an Islamic credit card.

1. Age Requirement: Applicants must typically be at least 21 years old to apply for an Islamic credit card. Some institutions may have a higher minimum age requirement, such as 25 or 18, depending on the specific terms and conditions.

2. Income Requirement: To qualify for an Islamic credit card, applicants usually need to have a minimum income level. This ensures that they have the financial capacity to make repayments on the credit card. The income requirement can vary among institutions and may depend on factors such as employment status and the type of credit card being applied for.

3. Employment Status: Financial institutions typically require applicants to have a stable employment status. This means having a regular income from a permanent job or, in some cases, being self-employed with a consistent source of income. Some institutions may also consider applicants with other sources of income, such as investments or rental properties.

4. Credit History: A good credit history is often a crucial factor in determining eligibility for an Islamic credit card. Financial institutions generally review an applicant’s credit report to assess their creditworthiness. Individuals with a history of timely bill payments, low credit utilization, and no major defaults or bankruptcies are more likely to be eligible for an Islamic credit card.

5. Residency: Applicants are typically required to be residents of the country in which they are applying for the Islamic credit card. Financial institutions may ask for proof of residency, such as a valid ID or utility bills, to confirm the applicant’s address.

6. Documentation: To apply for an Islamic credit card, applicants are usually required to provide certain documents, such as valid identification (passport, driver’s license), proof of income (pay stubs, bank statements), and proof of address (utility bills, rental agreement). The specific documentation requirements may vary among financial institutions.

7. Other Requirements: Some financial institutions may have additional eligibility criteria, such as a minimum credit score, a maximum debt-to-income ratio, or a specific employment tenure requirement. It is important for applicants to carefully review the terms and conditions of the Islamic credit card they are interested in to determine if there are any specific criteria they need to meet.

Meeting these eligibility criteria is typically a key requirement for individuals who wish to obtain an Islamic credit card. By meeting these criteria, individuals can ensure that they are eligible to apply for and receive the benefits of an Islamic credit card while maintaining their adherence to Islamic principles of finance.

How to Apply for an Islamic Credit Card

If you are interested in applying for an Islamic credit card, you will need to follow a few simple steps to complete the application process. Here is a step-by-step guide on how to apply for an Islamic credit card:

- Research Different Islamic Credit Card Options: Before applying for an Islamic credit card, it is important to research and compare different options available in the market. Look for cards that offer features that align with your financial needs and lifestyle.

- Check Eligibility Criteria: Once you have identified a few suitable options, check the eligibility criteria set by the issuing bank. The criteria may include factors such as minimum age, minimum income requirement, and residency status. Make sure you meet these requirements before proceeding.

- Gather Required Documents: Prepare the necessary documents required for the application process. This may include your identification proof, proof of income, and address proof. Contact the bank or check their website to find out the specific documents needed.

- Fill out the Application Form: Obtain the application form either online or from the bank branch. Fill out the form accurately and provide all the required information. Make sure to read and understand the terms and conditions before signing the application form.

- Submit the Application: Once you have completed the application form, gather all the required documents and submit them to the bank. You can either visit the bank in person or submit the application and documents online, depending on the bank’s policies.

- Wait for Approval: After submitting your application, you will need to wait for the bank to review your application. The bank will assess your creditworthiness and make a decision based on their internal policies. This may take a few days or weeks.

- Activate Your Card: If your application is approved, you will receive your Islamic credit card. Activate the card as per the instructions provided by the bank. This usually involves calling a helpline or visiting the bank branch.

By following these steps, you can apply for an Islamic credit card and enjoy the benefits it offers. Remember to use your card responsibly and make timely payments to maintain a good credit score.

Fees and Charges of Islamic Credit Cards

Just like conventional credit cards, Islamic credit cards also have certain fees and charges associated with them. These charges vary depending on the specific card issuer and the terms and conditions of the card contract. It is important for cardholders to understand these fees and charges to make informed decisions about using their credit cards.

Annual Fee: Some Islamic credit cards charge an annual fee. This fee is typically charged on a yearly basis and is usually non-refundable. The annual fee can vary depending on the type of card and the benefits it offers.

Finance Charges: Islamic credit cards do not charge interest in accordance with Islamic principles. However, they may charge finance charges, which are similar to interest charges. These finance charges are applied when cardholders do not pay their outstanding balance in full by the due date.

Cash Advance Fee: If you use your Islamic credit card to withdraw cash from an ATM, a cash advance fee may be charged. This fee is usually a percentage of the amount withdrawn and is in addition to any finance charges that may be applied.

Late Payment Fee: If you fail to make your minimum payment on time, a late payment fee may be charged. This fee is typically a fixed amount and is in addition to any finance charges that may be applied.

Foreign Transaction Fee: If you use your Islamic credit card for transactions in a foreign currency or outside of your home country, a foreign transaction fee may be charged. This fee is usually a percentage of the transaction amount and is applied to cover the costs of currency conversion.

Overlimit Fee: If you exceed your credit limit on your Islamic credit card, an overlimit fee may be charged. This fee is typically a fixed amount and is in addition to any finance charges that may be applied.

Balance Transfer Fee: If you transfer a balance from another credit card to your Islamic credit card, a balance transfer fee may be charged. This fee is usually a percentage of the amount transferred and is applied to cover administrative costs.

Other Fees: Some Islamic credit cards may have additional fees, such as card replacement fees, statement copy fees, or fees for requesting additional card benefits. These fees can vary depending on the card issuer and the specific card product.

It is important to carefully review the terms and conditions of an Islamic credit card before applying for one. Understanding the fees and charges associated with the card can help cardholders avoid unnecessary costs and make the most of their credit card benefits.

Credit Limit on Islamic Credit Cards

An Islamic credit card, also known as a Shariah-compliant credit card, operates on the principles of Islamic finance. One key aspect of Islamic credit cards is the credit limit, which determines how much credit cardholders can borrow. In general, Islamic credit cards have a credit limit that is based on the customer’s income and creditworthiness, similar to conventional credit cards.

However, there are some key differences in how the credit limit is determined for Islamic credit cards compared to conventional credit cards. Islamic credit cards are designed to comply with Shariah law, which prohibits charging or earning interest (riba). As a result, Islamic credit card issuers use different methods to calculate credit limits and ensure compliance with Islamic principles.

The credit limit on an Islamic credit card can be determined through various factors, including the cardholder’s income, employment stability, and credit history. In general, the credit limit is set at a percentage of the cardholder’s monthly income to ensure that the individual can afford to repay the borrowed amount without financial strain.

Islamic credit card issuers may also consider the cardholder’s creditworthiness, which is evaluated based on factors such as previous payment history, outstanding debts, and overall financial stability. By assessing these factors, Islamic credit card issuers can determine an appropriate credit limit that aligns with the individual’s financial capabilities.

It is important to note that Islamic credit cards are not designed to encourage excessive borrowing or debt. Instead, they aim to provide a convenient payment tool while adhering to the principles of Islamic finance. The credit limit on an Islamic credit card serves as a safeguard to ensure responsible borrowing and prevent individuals from accumulating excessive debt.

In conclusion, the credit limit on Islamic credit cards is determined based on factors such as the cardholder’s income, employment stability, credit history, and adherence to Islamic finance principles. By setting an appropriate credit limit, Islamic credit cards promote responsible borrowing and discourage excessive debt accumulation.

Rewards and Incentives with Islamic Credit Cards

Islamic credit cards may not offer traditional rewards programs, such as cash back or airline miles, due to the prohibition of riba (interest). However, Islamic credit cards do provide alternative forms of rewards and incentives that are compliant with Shariah principles.

Here are some common rewards and incentives associated with Islamic credit cards:

- Charitable Contributions: Some Islamic credit cards offer a percentage of your monthly transactions to be donated to charitable organizations. This allows cardholders to give back to the community while performing regular transactions.

- Gifts and Discounts: Islamic credit cards may provide exclusive discounts or gifts at partner merchants. These benefits can range from discounts on dining, shopping, or travel expenses. Cardholders can enjoy special privileges while adhering to Shariah principles.

- Takaful Coverage: Takaful is an Islamic form of insurance based on the principles of mutual cooperation and shared responsibility. Some Islamic credit cards offer complimentary takaful coverage for travel, medical emergencies, or other unforeseen events.

- Islamic Finance Education: Some Islamic credit card issuers may offer education programs or resources to help cardholders understand Islamic finance principles and make informed financial decisions.

- Complimentary Airport Lounge Access: Certain Islamic credit cards provide access to premium airport lounges, allowing cardholders to relax and enjoy exclusive amenities while traveling.

It is important for cardholders to review the terms and conditions of their Islamic credit cards to understand the specific rewards and incentives offered. By choosing an Islamic credit card, individuals can enjoy the benefits of modern financial tools while adhering to their religious beliefs.

Overall, Islamic credit cards aim to provide benefits and rewards to cardholders in a manner that is compliant with Shariah principles. These alternatives to traditional rewards programs allow Muslims to enjoy the benefits of credit cards while maintaining their faith-based restrictions on interest-bearing transactions.

Payment Options and Grace Period

When using an Islamic credit card, you have several payment options available to you. These options may vary depending on the specific terms and conditions set by your card issuer. Here are some common payment options:

- Full payment: You can choose to pay the full outstanding balance on your credit card statement by the due date. This option allows you to avoid paying any interest charges as long as you pay the entire amount.

- Minimum payment: In case you are unable to pay the full outstanding balance, you can make a minimum payment. The minimum payment is usually a small percentage of the outstanding balance, but it is important to note that paying only the minimum amount will result in interest charges on the remaining balance.

- Partial payment: If you cannot make the full payment but want to pay more than the minimum amount, you can choose to make a partial payment. This option allows you to reduce the outstanding balance and minimize the interest charges, but you will still have to pay interest on the remaining balance.

In addition to these payment options, Islamic credit cards typically offer a grace period. The grace period is the period of time between the statement date and the payment due date during which no interest is charged on new purchases. This period typically ranges from 20 to 50 days, depending on the card issuer and the specific terms of your card.

It is important to understand that while the grace period may apply to new purchases, it usually does not apply to cash advances or balance transfers. Interest on these transactions is usually charged from the date of the transaction.

Before deciding on a payment option, it is crucial to carefully review the terms and conditions of your Islamic credit card. This will help you understand the applicable payment options, the grace period, and any other fees or charges that may apply. By staying informed, you can effectively manage your credit card payments and avoid unnecessary interest charges.

Managing Credit Card Debt with Islamic Credit Cards

Managing credit card debt can be a challenge for many people. Islamic credit cards offer a unique solution for individuals who want to avoid conventional interest-based credit card debt. These cards operate on the principles of Islamic finance, which prohibits the charging or paying of interest.

Here are some strategies for managing credit card debt with Islamic credit cards:

- Pay off the balance in full each month: One of the best ways to avoid accumulating debt with an Islamic credit card is to pay off the entire balance before the due date. By doing so, you can avoid any interest charges and ensure that you are only spending money that you actually have.

- Set a budget and stick to it: Creating a budget can help you manage your expenses and avoid overspending. By tracking your income and expenses, you can allocate funds for essential items and avoid unnecessary purchases that can contribute to credit card debt. It is important to avoid spending beyond your means, even with an Islamic credit card.

- Utilize balance transfer options: If you have existing credit card debt from conventional cards, you may be able to transfer the balance to an Islamic credit card. This can help you consolidate your debt and potentially save on interest charges. However, it is important to read the terms and conditions of the balance transfer offer and ensure that it aligns with Islamic finance principles.

- Communicate with your card issuer: If you are facing financial difficulties and are unable to make your credit card payments, it is important to communicate with your Islamic credit card issuer. Many card issuers offer hardship programs or payment plans that can help you manage your debt and avoid additional charges or penalties.

- Seek financial advice: If you are struggling with credit card debt or your overall financial situation, it may be beneficial to seek advice from a financial professional who is knowledgeable about Islamic finance. They can provide guidance on managing your debt and creating a sustainable financial plan.

Overall, managing credit card debt with Islamic credit cards requires discipline, responsible spending, and adherence to Islamic finance principles. By following these strategies and seeking assistance when needed, you can effectively manage your credit card debt and maintain financial stability.

Safety and Security of Islamic Credit Cards

When it comes to using Islamic credit cards, safety and security are of the utmost importance. Islamic credit cards offer various features that help ensure the protection of cardholders’ personal and financial information.

- Fraud Protection: Islamic credit cards come with advanced fraud protection measures to safeguard against unauthorized transactions. These cards use advanced security technologies such as encryption and tokenization to protect cardholders’ data.

- Chip and PIN: Most Islamic credit cards come equipped with an embedded microchip that stores encrypted information. The use of a PIN (Personal Identification Number) adds an extra layer of security during transactions by requiring the cardholder to enter a unique PIN.

- Secure Online Transactions: Islamic credit cards provide secure online transaction capabilities. They use secure payment gateways and additional verification methods, such as two-factor authentication, to ensure the safety of online purchases.

Additionally, Islamic credit cards adhere to Islamic principles, which promote ethical banking practices. These principles prohibit cardholders from engaging in transactions that involve interest (riba) or unethical activities.

Moreover, Islamic credit cards prioritize the privacy and confidentiality of cardholders’ information. They have strict data protection policies and safeguards in place to prevent any unauthorized access or disclosure of personal information.

Overall, Islamic credit cards prioritize safety and security, ensuring peace of mind for cardholders while conducting their financial transactions.

How to Cancel an Islamic Credit Card

Canceling an Islamic credit card involves several steps. Here’s a guide to help you through the process:

- Contact the customer service: Reach out to the customer service department of the Islamic bank or financial institution that issued your credit card. You can find the contact information on the credit card statement or the bank’s website.

- Provide necessary information: When you contact customer service, make sure to have your credit card details ready. This can include the card number, your name, and any other identifying information they may need.

- Inform them of your intention: Clearly state that you want to cancel the Islamic credit card. The customer service representative will guide you through the cancellation process.

- Settle outstanding balance: Before canceling the card, make sure to pay off any outstanding balance on your credit card. This will ensure that you are not left with any pending payments or fees.

- Follow the bank’s procedure: The Islamic bank or financial institution will have specific procedures to cancel a credit card. Follow their instructions carefully and provide any necessary documentation or signatures as required.

- Destroy the card: Once you have canceled the Islamic credit card, destroy it by cutting it into several pieces. This step is important to prevent any misuse of the card information.

- Confirm cancellation: After completing the cancellation process, ask the customer service representative for confirmation that your Islamic credit card has been successfully canceled. This will provide you with peace of mind and ensure that there are no future complications.

It’s always a good practice to review the terms and conditions of your Islamic credit card before canceling it. This will help you understand any potential fees or consequences associated with canceling the card.

Remember, canceling a credit card should be done responsibly to avoid any negative impact on your credit score or financial standing.

Comparison of Islamic Credit Cards

When it comes to Islamic credit cards, there are a few key factors to consider before choosing one. Here’s a comparison of some important features:

| Feature | Traditional Credit Cards | Islamic Credit Cards |

|---|---|---|

| Interest Charges | Charge interest on outstanding balances | No interest charges, based on the concept of profit sharing |

| Shariah Compliance | Might not be compliant with Shariah principles | Compliant with Shariah principles, certified by Shariah advisors |

| Rewards and Benefits | Offer various rewards programs and benefits | Offer rewards and benefits in compliance with Shariah principles |

| Annual Fees | May charge annual fees | May charge annual fees, but some Islamic credit cards offer no annual fees |

| Charity Initiatives | May not have specific charity initiatives | Some Islamic credit cards allocate a portion of profits for charity initiatives |

| Additional Features | May offer additional features like balance transfer and cash advances | May offer additional features like balance transfer and cash advances, in compliance with Shariah principles |

It’s important to carefully review the terms and conditions of each Islamic credit card to ensure it aligns with your values and financial needs. Consider factors such as interest charges, Shariah compliance, rewards and benefits, annual fees, charity initiatives, and any additional features offered.

By comparing these factors, you can make an informed decision and choose the Islamic credit card that best suits your requirements.

FAQ

What is an Islamic credit card?

An Islamic credit card is a financial product that is compliant with Islamic principles and is designed for Muslims who want to avoid paying or receiving interest on financial transactions.

How does an Islamic credit card work?

An Islamic credit card works by offering a line of credit to the cardholder, similar to a conventional credit card. However, instead of charging interest on the outstanding amount, the cardholder has the option to pay a fixed fee or make a donation to a charitable cause.

Are there any restrictions on the usage of an Islamic credit card?

Yes, there are certain restrictions on the usage of an Islamic credit card. For example, it cannot be used for transactions that involve the purchase or consumption of alcohol, pork, gambling, or any other prohibited activities according to Islamic principles.

What are the benefits of using an Islamic credit card?

The benefits of using an Islamic credit card include avoiding interest charges, earning rewards or cashback on eligible purchases, and contributing to charitable causes through the fixed fees or donations. Additionally, many Islamic credit cards offer special discounts and privileges at selected merchants.

Can non-Muslims use an Islamic credit card?

Yes, non-Muslims can use an Islamic credit card. These cards are not limited to Muslim customers and can be used by anyone who wants to avoid paying or receiving interest on their credit card transactions.

Are Islamic credit cards widely available?

Islamic credit cards are becoming increasingly available in many countries. However, their availability may vary depending on the location and the financial institutions that offer these products. It is always recommended to check with local banks or financial institutions to inquire about the availability of Islamic credit cards.