When it comes to international trade, tariffs and quotas are two commonly used instruments that governments employ to protect domestic industries, regulate imports, and control trade flows. While both measures aim to restrict or limit the entry of foreign goods into a country’s market, they differ in their approach and impacts.

A tariff is a tax imposed on imported goods by a government. It is typically levied as a percentage of the value of the goods and is paid by the importer. The purpose of tariffs is to increase the cost of imported goods, making them less competitive with domestic products. This protectionist measure encourages consumers to choose locally produced goods, thus supporting domestic industries and jobs. Tariffs can also generate revenue for the government.

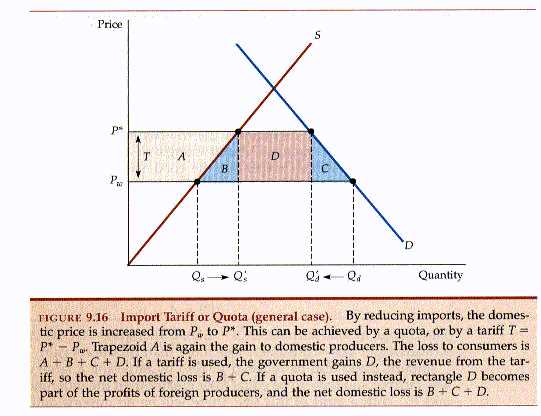

On the other hand, a quota is a physical limit on the quantity or value of goods that can be imported into a country during a specific period. Quotas are usually set by the government and can be applied to individual products or countries. Unlike tariffs, which affect the price of imported goods, quotas restrict the volume of imports. This restriction aims to shield domestic industries from foreign competition, ensuring that domestic producers have a greater share of the market.

While both tariffs and quotas serve protectionist objectives, they have different effects on trade partners and consumers. Tariffs are more transparent and predictable, as they are based on a percentage of the value of the goods. Quotas, on the other hand, can create uncertainty and may lead to market distortions, as they limit the supply of goods. Additionally, quotas can result in higher prices for consumers, as the restriction on imports may reduce competition in the domestic market.

The Importance of Understanding the Distinction between Tariffs and Quotas

Understanding the distinction between tariffs and quotas is essential for comprehending how international trade policies can impact economies and businesses. Tariffs and quotas are both trade barriers imposed by governments, but they have distinct differences and effects on imports and exports.

Tariffs:

A tariff is a tax or duty imposed on imported goods and services. It is usually a percentage of the value of the imported product and is paid by the importer to the government. Tariffs are primarily designed to protect domestic industries by making imported goods more expensive, thus encouraging consumers to buy domestically produced goods. They provide revenue to the government and can also be used as a bargaining tool in trade negotiations.

Quotas:

A quota, on the other hand, is a physical limit on the quantity of goods that can be imported. It restricts the amount of a specific product that can enter a country during a specified period. Quotas are put in place to control the quantity of certain goods entering the market and protect domestic industries from foreign competition. Quotas are often used to stabilize prices, maintain domestic production levels, or address concerns about national security.

The effects on imports and exports:

Both tariffs and quotas can impact imports and exports, but their effects differ.

- Tariffs increase the price of imported goods, making them less competitive in the domestic market. This can lead to a decrease in imports and a boost to domestic industries.

- Quotas limit the quantity of imports, creating scarcity and potentially driving up prices. This can benefit domestic producers who face less competition but may result in higher costs for consumers.

Implications for businesses and economies:

Understanding the distinction between tariffs and quotas is crucial for businesses involved in international trade. Tariffs can directly impact the cost of imported goods and influence the competitiveness of domestic industries. Quotas, on the other hand, can create supply constraints and affect the availability and pricing of specific products.

For economies, the choice between tariffs and quotas can have various consequences. Tariffs can generate revenue for the government but may also lead to retaliation by trading partners. Quotas can protect domestic industries but may result in inefficiencies and reduced consumer choices.

In conclusion, comprehending the differences between tariffs and quotas is important for policymakers, businesses, and society as a whole. By understanding these trade barriers, one can better analyze the effects on imports and exports, as well as the potential implications for economies and industries.

What Are Tariffs?

Tariffs are taxes or duties that governments impose on imported goods. They are a form of trade barrier that is designed to restrict the flow of goods from foreign countries into a domestic market. Tariffs can be imposed on a wide range of imported products, including raw materials, manufactured goods, and consumer products. The purpose of tariffs is to protect domestic industries from foreign competition, promote domestic production, and generate revenue for the government.

Tariffs can be either specific or ad valorem. Specific tariffs are levied based on the quantity of the imported goods, such as a fixed amount per unit. Ad valorem tariffs are levied as a percentage of the value of the imported goods. Tariff rates can vary widely depending on the product and the country of origin.

When a tariff is imposed on imported goods, it increases the price of those goods in the domestic market. This makes domestically produced goods relatively more competitive, as they do not have to bear the burden of the tariff. The higher prices of imported goods also discourage consumers from purchasing them, further protecting domestic industries.

Tariffs can have both positive and negative effects. On one hand, they can protect domestic industries from unfair competition and help maintain jobs. They can also generate revenue for the government. On the other hand, tariffs can lead to higher prices for consumers, reduce choices for consumers, and potentially provoke trade conflicts with other countries.

Tariffs can be used as a tool of trade policy to achieve various economic and political objectives. They can be implemented unilaterally by a country, or they can be part of trade agreements or trade negotiations between countries. The impact of tariffs on a country’s economy depends on various factors, including the size of the domestic market, the competitiveness of domestic industries, and the global trade environment.

It is important to distinguish tariffs from quotas, another form of trade barrier. While tariffs are taxes on imports, quotas are restrictions on the quantity of imported goods that can enter a domestic market.

What Are Quotas?

A quota is a government-imposed trade restriction that limits the quantity or value of goods and services that can be imported or exported during a specified period. Quotas are typically used to protect domestic industries by artificially limiting the amount of foreign competition they face.

Quotas are often implemented as a specific number of units or a percentage of a total market share that can be imported or exported. For example, a country may impose a quota on the number of cars that can be imported from a specific country or limit the amount of a certain agricultural product that can be exported.

Quotas can be implemented unilaterally by a single country or agreed upon as part of a bilateral or multilateral trade agreement. When countries agree to quotas as part of a trade agreement, they are usually negotiated and set based on the interests and industries of each country involved.

Quotas can have both positive and negative effects. On one hand, quotas can protect domestic industries and preserve jobs by limiting foreign competition. This can be especially important for industries that are struggling to compete with lower-cost imports. On the other hand, quotas can also lead to higher prices and reduced choices for consumers, as well as potential retaliation from other countries.

Quotas are often criticized for their potential to distort international trade and create inefficiencies. They can lead to a decrease in overall trade volumes and can result in trade diversion, where imports are shifted from more efficient suppliers to less efficient ones, due to the limited supply imposed by the quota.

- Quotas can be used to protect domestic industries.

- They can limit the quantity or value of goods and services that can be imported or exported.

- Quotas can be implemented unilaterally or as part of a trade agreement.

- They can have both positive and negative effects.

- Quotas can distort international trade and create inefficiencies.

Overall, quotas are a tool used by governments to regulate international trade and protect domestic industries. While they can provide benefits to certain industries, they also have the potential to create trade imbalances and limit consumer choices.

Key Differences between Tariffs and Quotas

Tariffs and quotas are both trade barriers used by governments to restrict imports and protect domestic industries. While they both achieve this goal, there are several key differences between tariffs and quotas:

- Nature: Tariffs are taxes imposed on imported goods, while quotas are physical restrictions on the quantity or value of imports.

- Purpose: Tariffs are primarily used to generate revenue for the government and protect domestic industries by making imported goods more expensive. Quotas, on the other hand, are implemented to directly limit imports and protect domestic industries by restricting competition.

- Flexibility: Tariffs can be adjusted by the government based on economic conditions, allowing them to increase or decrease the tax rates as needed. Quotas, on the other hand, are fixed restrictions that cannot be easily adjusted and can lead to supply shortages or surpluses.

- Impact on prices: Tariffs typically increase the price of imported goods, making them less competitive in the domestic market. Quotas, on the other hand, can create scarcity and drive up the prices of imported goods due to limited supply.

- Trade volume: Tariffs do not directly limit the volume of imports as they only increase the cost of imported goods. However, they can indirectly affect trade volume by making imports less attractive. Quotas directly limit the volume of imports by setting a physical restriction on the quantity or value allowed.

- Transparency: Tariffs are more transparent as the tax rates are clearly defined and publicly known. Quotas, on the other hand, may lack transparency as the exact quantity or value restrictions may not be publicly disclosed, making it difficult to predict the impact on trade.

In conclusion, tariffs and quotas are two different mechanisms used by governments to restrict imports and protect domestic industries. Tariffs are taxes imposed on imported goods, while quotas are physical restrictions on the quantity or value of imports. While tariffs primarily generate revenue and make imports more expensive, quotas directly limit imports and can create scarcity. Additionally, tariffs are more flexible and transparent compared to quotas.

Impacts of Tariffs on Economies

Tariffs are import taxes that are imposed by governments on foreign goods. They can have significant impacts on economies, affecting both domestic industries and consumers.

1. Protection of domestic industries: One of the primary reasons for imposing tariffs is to protect domestic industries from competition. By increasing the cost of imported goods, tariffs make domestically produced goods more competitive. This can lead to the growth and development of domestic industries, as they are shielded from foreign competition.

2. Job creation: When domestic industries are protected by tariffs, they are more likely to expand and create jobs. As the demand for domestically produced goods increases, companies may need to hire additional workers to meet the demand. This can have a positive impact on employment rates and the overall economy.

3. Revenue generation: Tariffs can also serve as a source of revenue for governments. The funds generated from import duties can be used to finance public services and infrastructure projects. However, it is important to note that excessive tariffs can lead to decreased trade and ultimately reduce the revenue generated.

4. Consumer prices and choices: Tariffs can have negative effects on consumers. By increasing the cost of imported goods, tariffs can lead to higher prices for consumers. This can reduce purchasing power and limit choices for consumers. Additionally, if domestic industries are unable to meet the demand for certain goods, the availability and variety of products in the market may decrease.

5. Trade wars and retaliation: Tariffs can also trigger trade wars. When one country imposes tariffs on another country’s goods, the affected country may respond with retaliatory tariffs. This can lead to a cycle of escalating tariffs and trade restrictions, which can harm both economies involved.

Overall, the impacts of tariffs on economies can vary depending on the specific circumstances and the policies implemented. While tariffs can protect domestic industries and generate revenue, they can also increase consumer prices and escalate trade tensions. It is crucial for policymakers to carefully consider the potential consequences before implementing tariffs.

Impacts of Quotas on Economies

1. Restrict supply and increase domestic prices: Quotas limit the quantity of a certain good that can be imported into a country. This restriction on supply creates a scarcity in the domestic market, leading to higher prices for consumers. As a result, domestic producers can charge higher prices, increasing their profits.

2. Reduce consumer choices: Quotas limit the variety of goods available to consumers. With restricted imports, consumers have fewer options to choose from, as the variety of imported goods is reduced. This can lead to a decrease in consumer welfare, as they may not be able to access certain goods they desire or have to settle for lower-quality alternatives.

3. Encourage domestic production and employment: Quotas can provide protection to domestic industries by limiting competition from foreign producers. This protection can incentivize domestic production and employment, as domestic industries have a reduced level of competition to contend with. This can be beneficial for the domestic economy, as it helps to support and grow domestic industries.

4. Increase government control and revenue: Quotas require government involvement to administer and enforce. This gives the government more control over the import market and allows them to generate revenue through the issuance of quotas or licensing fees. However, this increased government control can also lead to potential corruption and favoritism in the allocation of quotas.

5. Invite retaliation and trade disputes: Quotas can provoke retaliatory actions from other countries. If one country imposes quotas on imports from another country, the affected country may respond with similar restrictions on imports from the first country. This can lead to a trade dispute or even a trade war, which can have negative impacts on the economies of both countries involved.

6. Distort market signals and hinder economic efficiency: Quotas can distort market signals by artificially limiting the quantity of imported goods. This can hinder economic efficiency by preventing the market from reaching its optimal equilibrium. The restriction on imports may prevent consumers from accessing goods at the most competitive prices and hinder the growth of industries that heavily rely on imported inputs.

7. Increase smuggling and black market activities: Quotas create incentives for smuggling and black market activities. When the legal supply of imported goods is restricted, individuals may turn to illegal methods to obtain these goods. This can lead to an increase in smuggling, black market activities, and organized crime, which can have negative social and economic consequences.

In conclusion, quotas have various economic impacts, including higher domestic prices, reduced consumer choices, increased domestic production, increased government control and revenue, potential trade disputes, market distortions, and increased smuggling. It is essential for policymakers to carefully consider the potential consequences of implementing quotas and assess their overall impact on the economy.

Advantages and Disadvantages of Tariffs

Tariffs are import taxes that are imposed by governments on imported goods. They are often used as a means of protecting domestic industries and promoting economic growth. However, they also have their drawbacks. Here are some of the advantages and disadvantages of tariffs:

Advantages:

- Protection of domestic industries: Tariffs can protect domestic industries from competition with foreign companies by making imported goods more expensive. This can give domestic producers a competitive advantage and help preserve jobs within the country.

- Revenue generation: Tariffs can generate revenue for the government. The revenue collected from tariffs can be used to fund public projects, welfare programs, and infrastructure development.

- Correction of trade imbalances: Tariffs can be used to address trade imbalances between countries. By imposing tariffs on countries with which the country has a trade deficit, the government can reduce imports and promote domestic production.

- Support for emerging industries: Tariffs can provide support for emerging industries by making imported goods more expensive. This can give domestic industries the opportunity to grow and develop before facing international competition.

Disadvantages:

- Higher prices for consumers: Tariffs can lead to higher prices for imported goods, which can impact consumers. This can reduce consumer purchasing power and result in a decrease in the standard of living.

- Retaliation from other countries: Imposing tariffs can lead to retaliation from other countries. If a country imposes tariffs on imports, other countries may respond by imposing tariffs on the country’s exports, leading to a trade war.

- Reduced options and competition: Tariffs can limit the options available to consumers by reducing the variety of imported goods. This can lead to reduced competition, which could result in lower quality and higher prices for domestic products.

- Inefficient allocation of resources: Tariffs can distort the allocation of resources within the economy. By protecting domestic industries, tariffs can prevent the efficient allocation of resources and hinder the growth of more competitive industries.

Overall, tariffs can provide advantages such as protection for domestic industries and revenue generation. However, they also have disadvantages, including higher prices for consumers and the potential for retaliation from other countries. It is important for governments to carefully consider the implications of tariffs before implementing them.

Advantages and Disadvantages of Quotas

Advantages:

- Protecting domestic industries: Quotas can be used to limit imports and protect domestic industries from foreign competition. By restricting the quantity of imports, quotas can help maintain market share for domestic producers.

- Stabilizing prices: Quotas can help stabilize prices by limiting the supply of imported goods. This can prevent sudden fluctuations in prices and provide stability for domestic producers.

- Job creation: By restricting imports, quotas can create job opportunities in domestic industries. This can help support local economies and reduce unemployment rates.

- Industrial development: Quotas can be used to promote industrial development by encouraging domestic industries to expand their production capabilities. This can lead to increased economic growth and competitiveness.

Disadvantages:

- Higher prices for consumers: Quotas often lead to higher prices for consumers, as the restricted supply of imported goods can result in increased prices in the domestic market. This can negatively impact consumers’ purchasing power.

- Reduced competition: Quotas limit the competition faced by domestic industries, which can lead to decreased efficiency and innovation. Without the pressure of competition, domestic industries may become complacent and less motivated to improve their products and processes.

- Potential for corruption: Quotas can create opportunities for corruption, as the limited supply of imported goods can lead to the emergence of black markets and smuggling. This can undermine the effectiveness of the quota system and distort market dynamics.

- Trade disputes: Quotas can contribute to trade disputes between countries. If a country feels that its exports are being unfairly restricted by quotas imposed by another country, it may retaliate with its own trade barriers, leading to a trade war.

In conclusion, quotas can have both advantages and disadvantages. While they can protect domestic industries and support job creation, they can also lead to higher prices for consumers and reduced competition. It is important for policymakers to carefully consider the impact of quotas and weigh the benefits against the potential drawbacks.

Question and answer:

What is the difference between tariffs and quotas?

Tariffs and quotas are both measures used by governments to restrict imports and protect domestic industries, but they work in different ways. Tariffs are taxes imposed on imported goods, making them more expensive and less competitive in the domestic market. Quotas, on the other hand, limit the quantity of imported goods allowed into a country.

Why do governments use tariffs and quotas?

Governments use tariffs and quotas to protect domestic industries from foreign competition. By imposing tariffs, governments can make imported goods more expensive, which can give an advantage to domestic producers. Quotas, on the other hand, limit the quantity of imported goods, which can help to prevent domestic industries from being overwhelmed by foreign imports.

Which is more effective: tariffs or quotas?

The effectiveness of tariffs and quotas can vary depending on the specific circumstances. Tariffs can generate revenue for the government and provide a source of protection for domestic industries. Quotas, on the other hand, can provide a more precise and direct control over the quantity of imported goods. Ultimately, the choice between tariffs and quotas depends on the objectives of the government and the specific industry being protected.

Do tariffs and quotas always lead to higher prices for consumers?

Yes, tariffs and quotas generally lead to higher prices for consumers. Tariffs directly increase the cost of imported goods, making them more expensive for consumers. Quotas limit the supply of imported goods, which can also lead to higher prices. In both cases, the reduced competition from imports can result in less choice and higher prices for consumers.

Are there any benefits to using tariffs or quotas?

Yes, there can be benefits to using tariffs and quotas. From an economic perspective, tariffs can protect domestic industries and promote the development of domestic production capabilities. Quotas can help to prevent domestic industries from being overwhelmed by foreign imports and can provide a level of control over the quantity of goods entering the country. However, it is important to weigh these benefits against the potential costs, such as higher prices for consumers.

Can tariffs and quotas be used together?

Yes, tariffs and quotas can be used together. In fact, they are often used in combination to provide a greater level of protection for domestic industries. For example, a government may impose a tariff on imported goods to make them more expensive, and also set a quota to limit the quantity of imports allowed. This combination of measures can provide a strong barrier to foreign competition.