Islamic banking is a unique financial system that operates according to the principles of Sharia law, which is derived from the teachings of the Quran and the Hadith. Unlike conventional banks, Islamic banks are guided by ethical principles that prohibit the charging or paying of interest (riba) and the investment in industries that are considered unethical or harmful for society.

One of the key principles of Islamic banking is the concept of risk and profit sharing. In Islamic finance, the bank and the client enter into a partnership, where the bank provides the necessary capital and the client manages the business. Any profit or loss generated from the business is shared between the bank and the client according to a predetermined ratio.

Another important principle of Islamic banking is the prohibition of speculation (gharar) and uncertainty (maysir). This means that all financial transactions must be based on real economic activities and tangible assets. Islamic banks cannot engage in speculative activities such as gambling or derivative trading.

Islamic banking also promotes social and economic justice. Islamic banks are encouraged to provide financing to those who are in need, especially to those who are unable to access conventional banking services. Additionally, Islamic banks are required to ensure that their investments are socially responsible and do not harm the environment or society.

In conclusion, understanding how Islamic banks work requires a comprehensive knowledge of the principles of Sharia law and their application in the financial sector. Islamic banking offers an alternative model that aligns with the values and beliefs of Muslim individuals and societies, while also promoting ethical and responsible financial practices.

The principles behind Islamic banking

Islamic banking is based on principles derived from the Quran and the teachings of Prophet Muhammad. These principles guide the operations and activities of Islamic banks, distinguishing them from conventional banks. Here are the key principles behind Islamic banking:

-

Prohibition of interest (Riba): Islamic banking operates on the principle that earning or charging interest is prohibited. Instead, Islamic banks engage in profit-sharing arrangements and provide financing through methods such as murabaha (cost-plus financing), ijara (leasing), and musharakah (partnership).

-

Prohibition of speculative activities (Gharar): Islamic banking discourages engaging in transactions with excessive uncertainty or ambiguity. Contracts should be based on clear terms and conditions, free from ambiguity and speculation.

-

Prohibition of unethical or forbidden activities (Haram): Islamic banks avoid financing or investing in activities that are considered unethical or forbidden according to Islamic principles. This includes industries such as gambling, alcohol, pork, and interest-based financial institutions.

-

Emphasis on real economic transactions: Islamic banking encourages financing transactions that have underlying real economic activities, such as trade, manufacturing, and investment. Financial innovation should be based on meeting real economic needs rather than speculative activities.

-

Shared risk and profit: Islamic banking promotes sharing risk and profit between the bank and its customers. Contracts are structured in a way that the bank shares in the profits, losses, and risks associated with the financed activities.

-

Equity-based financing: Islamic banking encourages equity-based financing, where the bank becomes a partner in the business venture rather than a lender. This fosters a more equal and fair relationship between the bank and its customers.

These principles provide a framework for ethical banking, promoting fairness, transparency, and social responsibility in the financial system. By adhering to these principles, Islamic banks aim to serve the needs of individuals and businesses while upholding Islamic values.

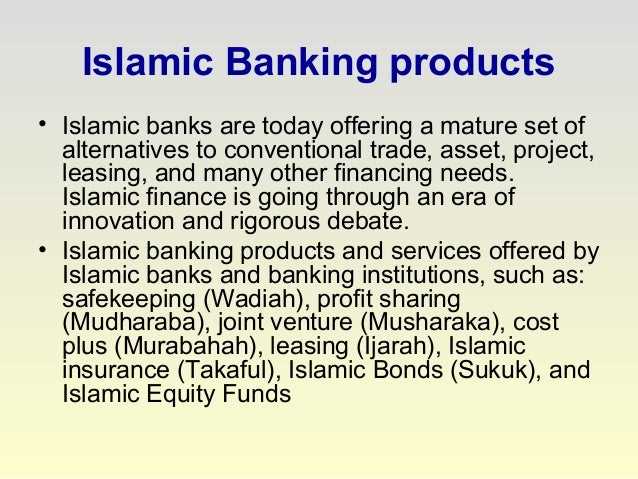

Sharia-compliant financial products and services

Islamic banks offer a wide range of financial products and services that comply with the principles of Sharia law, which governs ethical and moral values in Islam. These products and services are designed to provide customers with alternative options that align with their religious beliefs.

Here are some of the key Sharia-compliant financial products and services offered by Islamic banks:

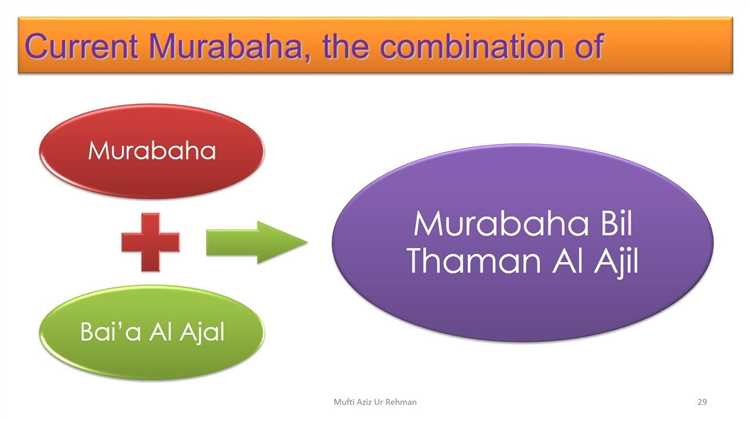

- Murabaha: This is a type of financing where the bank purchases an asset on behalf of the customer and then sells it to them at a higher price. The customer pays in installments instead of paying the full price upfront.

- Ijarah: This is a form of leasing or rental agreement. The bank purchases an asset and leases it to the customer for a specified period. At the end of the lease period, the ownership of the asset may be transferred to the customer.

- Mudarabah: This is a partnership-based financing arrangement where the bank provides the capital and the customer provides the expertise to generate profits. The profits are then shared between the bank and the customer according to an agreed-upon ratio.

- Sukuk: These are Islamic bonds that represent ownership in a tangible asset or a project. Investors earn returns based on the income generated by the underlying asset or project.

In addition to these financing options, Islamic banks also provide various deposit accounts such as:

- Current accounts: These accounts facilitate day-to-day transactions and do not provide any interest or returns on the deposited amount.

- Savings accounts: These accounts offer a profit-sharing mechanism where the bank shares a portion of its profits with the account holders.

- Investment accounts: These accounts are designed for individuals who want to invest their money in Sharia-compliant projects or ventures. Returns are generated from the profits earned by the underlying investments.

Overall, Islamic banks strive to offer a comprehensive range of financial products and services that adhere to Sharia principles. By doing so, they provide Muslims with a viable alternative to conventional banking that aligns with their religious beliefs and values.

The difference between Islamic and conventional banking

Islamic banking and conventional banking are two different systems of providing financial services. While both aim to meet the financial needs of individuals and businesses, their underlying principles and practices differ significantly.

1. Source of funds:

- Islamic banks: Islamic banks rely on the concept of profit sharing (Mudarabah) instead of charging interest. They collect funds from depositors and use them to finance projects and businesses to earn profits, which are then shared between the bank and the depositors.

- Conventional banks: Conventional banks raise funds by accepting deposits and providing loans. They charge interest on loans and pay interest on deposits, earning a profit margin through the difference between the interest rates.

2. Risk and reward sharing:

- Islamic banks: Islamic banking follows the principles of profit and loss sharing (Mudarabah and Musharakah). In Islamic financing, both the bank and the borrower share the risks and rewards associated with the investment. If the investment results in profit, it is shared, but if it incurs a loss, it is also shared.

- Conventional banks: Conventional banking puts the burden of risk entirely on the borrower. The bank charges interest on loans irrespective of whether the borrower makes a profit or a loss.

3. Prohibited transactions:

- Islamic banks: Islamic banks operate according to Shariah law, which prohibits interest-based transactions (riba), gambling (maysir), and investments in businesses that are forbidden in Islam (haram), such as alcohol or pork products.

- Conventional banks: Conventional banks have no restrictions on interest-based transactions or investments in any type of business, as long as they comply with the legal and regulatory requirements of the country in which they operate.

4. Financial products:

- Islamic banks: Islamic banks offer a range of Shariah-compliant financial products, such as Islamic mortgages (Murabahah), Islamic bonds (Sukuk), and Islamic car financing (Ijarah). These products are designed to avoid interest-based transactions and comply with Islamic principles.

- Conventional banks: Conventional banks offer a wide range of financial products, including loans, mortgages, credit cards, and investment products. These products are based on interest and do not have any restrictions based on religious principles.

5. Ethical considerations:

- Islamic banks: Islamic banking is driven by ethical considerations, promoting economic justice, fairness, and social welfare. They aim to create an inclusive financial system that benefits all stakeholders.

- Conventional banks: Conventional banks prioritize profitability and shareholder value. While they adhere to legal and regulatory standards, their primary focus is on maximizing profits.

In conclusion, Islamic banking and conventional banking have fundamental differences in their principles, source of funds, risk-sharing mechanisms, prohibited transactions, financial products, and ethical considerations. Understanding these differences can help individuals and businesses make informed decisions when choosing between Islamic and conventional banking services.

The role of ethics in Islamic banking

One of the distinguishing features of Islamic banking is its strong emphasis on ethics and adherence to Sharia principles. Ethics play a crucial role in shaping the operations and decision-making processes of Islamic banks.

1. Prohibition of interest (Riba): Islamic banking strictly prohibits the charging or payment of interest. This is based on the belief that the charging of interest creates an unfair distribution of wealth and is exploitative in nature. Instead, Islamic banks operate on the principle of profit and loss sharing (PLS), where both the bank and the customer share the profits and losses of the business venture.

2. Prohibition of unethical activities: Islamic banking prohibits involvement in activities that are considered unethical in Islam, such as gambling, alcohol, tobacco, and industries that are harmful to society or the environment. This reflects the emphasis on socially responsible financing and ethical investments.

3. Transparency and disclosure: Islamic banks are required to disclose all relevant information related to their operations, investments, and contracts. This includes providing detailed information about the nature of the investment, the expected returns, and the associated risks. This level of transparency ensures that customers are aware of the risks and benefits of their investments.

4. Ethical investment principles: Islamic banks follow a set of ethical investment principles known as Sharia-compliant investing. This includes avoiding investments in businesses that involve interest-based transactions, speculation, or excessive risk. Instead, funds are invested in ethical and socially responsible ventures, such as real estate, infrastructure, and renewable energy projects.

5. Social welfare and community development: Islamic banking places great emphasis on social welfare and community development. Islamic banks are encouraged to engage in activities that benefit society and promote economic justice. This includes providing financial assistance to low-income individuals, supporting charitable initiatives, and investing in projects that improve the well-being of the community.

6. Ethical behavior and integrity: Islamic banking promotes ethical behavior and integrity among its employees, customers, and stakeholders. It emphasizes the importance of honesty, fairness, and trust in all business dealings. This creates a culture of transparency and accountability within Islamic banks.

7. Governance and supervision: Islamic banks are required to have a strong system of governance and supervision in place to ensure compliance with ethical principles and Sharia regulations. This includes having a dedicated Sharia board composed of Islamic scholars who provide guidance and oversight on the bank’s operations.

In conclusion, ethics play a fundamental role in Islamic banking. The adherence to ethical principles and values sets Islamic banking apart from conventional banking and promotes financial practices that are fair, transparent, and socially responsible.

Transparency in Islamic Financial Transactions

In Islamic finance, transparency is a fundamental principle that promotes trust and confidence in financial transactions. It ensures that all parties involved have access to clear and accurate information about the terms and conditions of the transaction, as well as the risks and rewards involved.

Disclosure Requirements: Islamic financial institutions are required to provide comprehensive disclosure about their products and services. This includes information about the underlying assets, the profit-sharing ratio, the duration of the investment, and any potential risks or conflicts of interest. This allows customers to make informed decisions and ensures that they are fully aware of the nature of their investments.

Accounting Standards: Islamic banks adhere to strict accounting standards to ensure transparency in their financial statements. These standards require the separation and disclosure of Islamic and conventional banking activities, allowing stakeholders to assess the financial position and performance of the Islamic bank accurately.

Audit and Supervision: Islamic financial institutions are subject to regular audits by external auditors to ensure compliance with Islamic principles and transparency in financial reporting. Additionally, regulatory bodies and central banks provide supervision to ensure that Islamic financial institutions operate ethically and transparently.

Shari’ah Compliance: Transparency is also crucial in ensuring Shari’ah compliance in Islamic financial transactions. Islamic banks work closely with Shari’ah scholars who review and approve financial products and transactions to ensure they are in compliance with Islamic principles. This review process adds an extra layer of transparency and ensures that all transactions are conducted in a manner consistent with Islamic values.

Reporting and Disclosures: Islamic financial institutions are required to provide regular and timely reports to stakeholders, including shareholders, regulators, and customers. These reports include information on financial performance, risk management, and compliance with Shari’ah principles. Such disclosures enhance transparency and allow stakeholders to assess the institution’s financial health.

Consumer Protection: Transparency is essential for protecting the rights of consumers in Islamic finance. Clear and transparent disclosure of terms and conditions, fees, and charges ensure that customers understand the risks and costs associated with the financial products they are engaging in. This transparency allows customers to make informed decisions and reduces the likelihood of disputes.

Conclusion: Transparency is an integral part of Islamic finance and plays a vital role in building trust and confidence in the industry. It ensures that all parties have access to accurate and clear information, promotes ethical behavior, and protects consumer rights. Through adherence to strict disclosure requirements, accounting standards, audits, and reporting, Islamic financial institutions demonstrate their commitment to transparency and accountability.

+

Prohibited activities in Islamic banking

Islamic banking operates based on the principles of Shariah law. It follows a strict framework that prohibits certain activities that are deemed unethical or prohibited in Islam. The following are some of the activities that are not allowed in Islamic banking:

- Riba (interest): Charging or paying interest is strictly forbidden in Islamic banking. This means that banks cannot offer or accept any form of interest on loans or deposits.

- Gharar (uncertainty): Islamic banking prohibits any form of transaction that involves excessive uncertainty or ambiguity. This includes speculative transactions or contracts with uncertain outcomes.

- Maysir (gambling): Islamic banking does not allow any form of gambling or speculation. It prohibits participating in games of chance or any financial activity that involves uncertainty or risk.

- Haram activities: Islamic banking does not support or finance any activities that are considered haram (forbidden) in Islam, such as alcohol, pork, gambling, and interest-based financial activities.

- Exploitative transactions: Islamic banking rejects any form of exploitative transactions that involve unfair or unjust practices, such as fraud, deceit, or manipulation.

By avoiding these prohibited activities, Islamic banks aim to promote ethical banking and provide financial services that align with Islamic principles. They offer alternative solutions that are based on profit-sharing, equity participation, and asset-backed transactions to create a more socially responsible and sustainable banking system.

Partnership-based financing in Islamic banking

One of the fundamental principles of Islamic banking is the idea of partnership-based financing, which is also known as musharakah. This concept is based on the belief that financial transactions should be conducted in a way that promotes cooperation and shared risk.

In partnership-based financing, a bank and its client enter into a joint venture where they both contribute capital and share in the profits and losses of the venture. This differs from conventional banking where the bank acts as a lender and charges interest on the loan.

Partnership-based financing is commonly used in Islamic banking for various types of transactions, such as project financing, trade financing, and real estate financing. It allows individuals and businesses to access funds without incurring interest, as interest is seen as exploitative in Islamic finance.

- Musharakah: This is a form of partnership where both parties contribute capital and share in the profits and losses of the venture. The profits and losses are distributed based on the agreed ratio, which is determined at the start of the partnership.

- Mudarabah: This is a partnership where one party provides the capital (the investor), while the other party (the entrepreneur) manages the investment. The profits are shared based on a predetermined ratio, while the losses are borne solely by the investor.

Partnership-based financing encourages transparency and accountability in the financial system, as both the bank and the client have a stake in the success of the venture. It also promotes ethical behavior, as it prohibits financing activities that are not permissible in Islam, such as gambling and speculation.

In conclusion, partnership-based financing is a key aspect of Islamic banking that promotes collaboration, shared risk, and ethical financial practices. By adhering to this principle, Islamic banks provide an alternative banking system that aligns with the values and principles of Islam.

Profit and Loss Sharing in Islamic Banking

One of the fundamental principles of Islamic banking is profit and loss sharing, which is an alternative to interest-based lending in conventional banking. This principle is rooted in the Islamic concept of risk sharing and fairness in financial transactions.

In Islamic banking, profit and loss sharing (PLS) refers to a partnership between the bank and the customer, where both parties share the risks and rewards of a business venture. This is in contrast to conventional banks, where the bank bears all the risks while the customer pays a fixed interest rate, regardless of the bank’s profitability.

In a profit and loss sharing arrangement, the bank provides the necessary capital for a business or investment, while the customer manages the day-to-day operations. The profits generated from the venture are shared between the bank and the customer based on a pre-agreed ratio, while any losses incurred are also shared in the same proportion.

There are different types of profit and loss sharing arrangements in Islamic banking:

- Mudarabah: This is a partnership where one party provides the capital (the investor or rabb-ul-mal) and the other party provides the expertise and management (the entrepreneur or mudarib). The profits generated are shared based on a pre-agreed ratio, while the losses are borne solely by the investor.

- Musharakah: This is a partnership where both parties contribute capital to a business venture. The profits and losses are shared based on the agreed-upon ratio, which reflects the respective contributions of the partners.

Profit and loss sharing arrangements in Islamic banking promote risk sharing and encourage the bank and the customer to work together for the success of the business venture. This aligns the interests of both parties and promotes a more equitable and ethical financial system.

| Advantages | Description |

|---|---|

| 1. Risk Sharing | PLS promotes risk sharing between the bank and the customer, reducing the burden on one party and encouraging collaborative decision making. |

| 2. Fair Distribution of Profits | The profits generated from the business venture are distributed based on the agreed-upon ratio, which reflects the contributions and efforts of both parties. |

| 3. Encourages Entrepreneurship | PLS arrangements provide an avenue for entrepreneurs to access financing without burdening them with fixed interest payments. This encourages entrepreneurship and economic growth. |

| 4. Moral and Ethical | Profit and loss sharing aligns with Islamic principles of fairness and ethical business practices, promoting a more just and equitable financial system. |

Overall, profit and loss sharing is a cornerstone of Islamic banking and plays a vital role in promoting risk sharing, fairness, and ethical practices. By aligning the interests of the bank and the customer, it encourages collaboration and fosters a more inclusive and sustainable financial system.

Savings and current accounts in Islamic banking

In Islamic banking, savings and current accounts function in a different way compared to conventional banks. Islamic banks operate under the principles of Shariah, which prohibits the earning or payment of interest (riba) and the involvement in any risk or uncertainty (gharar).

Savings Accounts:

- Savings accounts in Islamic banking are known as Mudarabah accounts. Mudarabah is a profit-sharing contract between the bank and the depositor.

- The depositor, known as the Rab al-Mal, provides the funds, while the bank, known as the Mudarib, manages the funds and invests them in Shariah-compliant activities.

- The profits generated from these investments are shared between the depositor and the bank according to a pre-agreed profit-sharing ratio.

- The depositor bears no responsibility for any loss incurred in the investment, as it is borne solely by the bank.

- The bank may also deduct any management fees or charges from the profits before distributing them to the depositor.

Current Accounts:

- Current accounts in Islamic banking are known as Wadiah accounts. Wadiah means safekeeping or trust.

- In a Wadiah account, the depositor places funds with the bank for safekeeping, and the bank guarantees the return of the funds whenever the depositor requests.

- The bank has the right to utilize the funds in Shariah-compliant activities, but it is not obliged to share any profits with the depositor.

- However, Islamic banks may provide additional incentives or rewards to the holders of current accounts as a goodwill gesture.

- It is important to note that Wadiah accounts do not earn interest, as it is not permissible in Islamic banking.

Differences from conventional banking:

In conventional banking, savings and current accounts earn interest, which is prohibited in Islamic banking. Islamic banking focuses on profit and loss sharing instead of interest-based transactions.

Furthermore, Islamic banking places a greater emphasis on ethical and social responsibility in its investments and operations. The investments made by Islamic banks must adhere to the principles of Shariah, which prohibits investments in certain sectors such as alcohol, gambling, and pork.

Overall, savings and current accounts in Islamic banking offer individuals an opportunity to manage their finances in a manner that aligns with their religious beliefs and principles.

Financing options for individuals in Islamic banking

In Islamic banking, individuals have access to a variety of financing options that comply with Islamic principles. These options are designed to provide individuals with the necessary funds to support their personal needs and aspirations, while adhering to Shariah law.

Here are some common financing options available for individuals in Islamic banking:

- Murabaha: Murabaha is a cost-plus financing arrangement where the bank purchases an item on behalf of the customer and sells it to them at a marked-up price, payable in installments over an agreed-upon period. The customer knows the profit margin added by the bank and the total amount to be paid in advance.

- Ijarah: Ijarah is a leasing arrangement where the bank purchase an asset and leases it to the customer for an agreed-upon period and rental payment. The customer can use the asset during the lease period, but the ownership remains with the bank.

- Mudarabah: Mudarabah is a profit-sharing arrangement between the bank (as a capital provider) and the customer (as a managing partner). The customer provides their expertise and time, and the bank provides the capital. Profits are shared based on a pre-agreed profit-sharing ratio, while losses are solely borne by the bank.

- Salam: Salam is a forward sale arrangement where the buyer pays upfront for goods to be delivered at a later date. This option is commonly used in agricultural financing, where the bank provides funds to farmers in exchange for a specified quantity of future agricultural produce.

- Istisna’a: Istisna’a is a contract for manufacturing or construction projects. The bank agrees to finance the project and the buyer agrees to purchase the finished product once it is completed. Payments are made progressively as the project reaches certain milestones.

It is important to note that the terms and conditions of these financing options may vary between different Islamic banks. Individuals should carefully review and understand the terms of the financing arrangement before entering into any contract.

In addition to these financing options, Islamic banks also offer other services such as personal loans, credit cards, and investment accounts that comply with Islamic principles.

| Financing Option | Description | Ownership | Profit Sharing Ratio |

|---|---|---|---|

| Murabaha | Cost-plus financing arrangement | Customer | Bank:Customer |

| Ijarah | Leasing arrangement | Bank | N/A |

| Mudarabah | Profit-sharing arrangement | Bank | Bank:Customer |

| Salam | Forward sale arrangement | Bank | N/A |

| Istisna’a | Contract for manufacturing or construction projects | Bank | N/A |

Financing options for businesses in Islamic banking

In Islamic banking, there are several financing options available to businesses that comply with Shariah principles. These options are designed to provide businesses with the necessary capital while adhering to the principles of Islamic finance. Here are some of the common financing options for businesses in Islamic banking:

- Murabaha: Murabaha is a common financing option in which the bank purchases the asset the business needs and then sells it to the business at a higher price, which includes a profit margin. The business can pay for the asset in installments.

- Ijara: Ijara is a leasing agreement in which the bank purchases the asset and leases it to the business for a specific period. The business pays regular lease payments and has the option to purchase the asset at the end of the lease term.

- Mudaraba: Mudaraba is a partnership agreement where the bank provides the capital and the business provides the expertise and labor. The profit generated from the business is shared between the bank and the business according to an agreed-upon ratio.

- Musharaka: Musharaka is a partnership agreement where both the bank and the business contribute capital to fund a project. The profit and loss are shared between the bank and the business according to their respective capital contributions.

In addition to these financing options, Islamic banks also offer trade financing facilities such as letters of credit and guarantees, which can help businesses engage in international trade while complying with Shariah principles.

It is important for businesses to consult with Islamic banking experts and scholars to ensure that their financing arrangements comply with Shariah principles. Islamic banks also provide guidance and support to businesses to help them understand and navigate the specific requirements of Islamic financing.

Overall, Islamic banking provides businesses with a range of financing options that align with Islamic principles and can help them meet their capital needs. These financing options promote ethical and responsible business practices while avoiding interest-based transactions prohibited in Islamic finance.

Mortgages in Islamic banking

In Islamic banking, the concept of mortgages is slightly different from conventional banking. Islamic banks use a different approach to enable individuals to purchase a property without falling into interest-based transactions, which are prohibited in Islam. This approach is based on the principle of profit-sharing or partnership.

Islamic banks offer several types of mortgage products, such as Ijarah, Murabaha, and Musharakah. Each of these products operates based on different principles, but they all adhere to the principles of Shariah.

1. Ijarah: This type of mortgage is similar to a lease agreement. The bank purchases the property and leases it to the client for a specific period. The client pays regular rental payments, and at the end of the lease period, the ownership of the property is transferred to the client.

2. Murabaha: This mortgage involves the bank buying the property and selling it to the client at a profit. The client pays the bank in installments, including the original cost of the property plus the profit margin. This arrangement ensures that the transaction does not involve interest.

3. Musharakah: This type of mortgage involves a partnership between the bank and the client. The bank and the client contribute funds towards the purchase of the property. The client then pays rent to the bank, which acts as a partner in the property. Gradually, the client buys out the bank’s share, and eventually, the client becomes the sole owner of the property.

Islamic mortgages also have specific requirements to ensure compliance with Shariah principles. For example, the property must be a permissible asset, and there should be no element of uncertainty or gambling in the transaction. Additionally, the bank may require a down payment from the client to reduce the risk involved.

In summary, Islamic mortgages provide an alternative to conventional interest-based mortgages, enabling individuals to purchase properties in accordance with Islamic principles. The various types of Islamic mortgages, such as Ijarah, Murabaha, and Musharakah, offer different approaches to finance property purchases while adhering to Shariah principles.

Investment accounts in Islamic banking

In Islamic banking, investment accounts play a crucial role in providing a halal alternative to traditional interest-based banking products. These accounts allow individuals and businesses to participate in investment activities in accordance with Islamic principles.

Here are some key points about investment accounts in Islamic banking:

- Sharia-compliant investments: Investment accounts in Islamic banking aim to comply with Sharia, the Islamic law. As such, investments must avoid activities that are prohibited in Islam, such as gambling, alcohol, and interest-based transactions.

- Profit-sharing: Unlike conventional banks where interest is paid on deposits, Islamic investment accounts operate on profit-sharing principles. The bank and account-holder agree to share profits generated from the investments based on pre-defined ratios.

- Loss-sharing: In Islamic banking, loss-sharing is considered an important aspect of investment accounts. In the event of losses, both the bank and the account-holder share the losses based on their agreed ratios.

- Investment diversification: Islamic investment accounts offer a range of investment options for account-holders. These options may include equity investments, real estate investments, sukuk (Islamic bonds), and other Sharia-compliant investment instruments.

- Transparency: Islamic banking emphasizes transparency in investment activities. Account-holders have the right to know where their funds are being invested and how the profits are generated. Islamic banks are required to provide regular reports and updates on investment performance.

- Islamic ethical principles: Investment accounts in Islamic banking adhere to ethical principles that align with Islamic values. Investments should contribute to the betterment of society and avoid harmful industries such as tobacco, alcohol, and gambling.

Overall, investment accounts in Islamic banking offer individuals and businesses the opportunity to invest their funds in a manner that is consistent with their religious and ethical beliefs. These accounts provide a platform for halal investments and encourage responsible financial practices.

Sukuk: Islamic bonds

Sukuk, also known as Islamic bonds, are financial instruments used in Islamic finance that are compliant with Shariah law. Sukuk are structured in a way that allows investors to earn returns without violating Islamic principles, which prohibit charging or paying interest (riba) and investing in prohibited activities.

Structure of Sukuk:

Sukuk are asset-based securities, meaning they are backed by underlying assets. The structure of sukuk involves the following steps:

- Originator: The entity that wishes to raise funds issues the sukuk.

- Absolute Ownership Transfer: The originator transfers the ownership of the underlying assets to a special purpose vehicle (SPV).

- Issuance: The SPV issues sukuk to investors, representing their respective shares in the underlying assets.

- Rent and Profit Distribution: Instead of interest payments, sukuk holders receive regular rental income or share in the profits generated by the underlying assets.

- Selling and Trading: Sukuk can be bought and sold on secondary markets, allowing investors to exit their investments before maturity.

- Maturation: Upon maturity, the SPV sells the underlying assets and distributes the proceeds to the sukuk holders.

Types of Sukuk:

There are several types of sukuk, each with its own structure and characteristics. Some common types include:

- Mudarabah Sukuk: These sukuk represent ownership in a project or investment partnership, where the sukuk holders provide capital and the project is managed by a financial expert. Profits are shared according to a pre-determined ratio.

- Ijara Sukuk: These sukuk are based on the principle of leasing. The sukuk holders effectively purchase the underlying assets and lease them back to the originator, who pays rent to the holders.

- Wakala Sukuk: These sukuk represent ownership in a specific project or investment. The originator appoints an agent who manages the investment on behalf of the sukuk holders, receiving a fee for their services.

- Hybrid Sukuk: These sukuk combine elements of multiple sukuk structures, allowing for greater flexibility in terms of risk and return.

Benefits and Risks of Sukuk:

Benefits of investing in sukuk include diversification, steady income, and potential capital gains. Additionally, sukuk investments provide an avenue for socially responsible investing, as they are based on ethical principles. However, sukuk investments carry risks such as default risk, market risk, and liquidity risk.

Conclusion:

Sukuk, or Islamic bonds, offer a way for investors to participate in the global financial markets while adhering to Shariah principles. The asset-based structure of sukuk ensures that they are compliant with Islamic finance principles. By understanding the structure, types, and risks associated with sukuk, investors can make informed decisions when considering sukuk investments.

Islamic insurance: Takaful

Takaful is a unique form of insurance that is compliant with Islamic principles. Unlike conventional insurance, which operates on the concept of risk transfer, Takaful is based on the principles of mutual cooperation and shared responsibility.

At its core, Takaful is a system where participants contribute money into a pool that is used to provide coverage for the risks faced by the participants. This pool of funds is managed by a Takaful operator, who is responsible for ensuring the efficient and fair distribution of funds.

One of the key principles of Takaful is the absence of uncertainty (gharar) and gambling (maysir). This means that Takaful contracts are structured in a way that eliminates these elements, ensuring that all parties involved are aware of the risks and benefits. Additionally, Takaful contracts are based on the concept of tabarru, which refers to the voluntary contribution made by participants to help those in need.

Takaful operates through different models, such as Mudarabah and Wakalah. In the Mudarabah model, participants contribute capital and the Takaful operator acts as the manager. Profits from the investments are shared between the participants and the Takaful operator based on a predetermined ratio. In the Wakalah model, the Takaful operator charges a fee for managing the funds, and any surplus is returned to the participants.

Islamic insurance covers a wide range of risks, including life, health, property, and liability. It is increasingly gaining popularity in Muslim-majority countries and has also attracted interest from non-Muslims who appreciate its ethical and cooperative principles.

Overall, Takaful provides individuals and businesses with a Shari’ah-compliant alternative to conventional insurance, ensuring that their financial risks are covered while maintaining adherence to Islamic principles of fairness and cooperation.

Islamic Microfinance: Empowering the Underprivileged

Islamic microfinance refers to the provision of financial services to individuals and small businesses who do not have access to conventional banking systems. It is a system that is based on the principles of Islamic finance, which prohibits the charging or paying of interest.

Islamic microfinance operates on the principles of risk-sharing and profit-sharing. Instead of charging interest on loans, Islamic microfinance institutions provide loans through partnerships or joint ventures, where both the lender and the borrower share the risk and the profit generated from the investment.

One of the key objectives of Islamic microfinance is to empower the underprivileged by providing them with financial resources to start or expand their businesses. By doing so, Islamic microfinance helps to alleviate poverty and promote economic development in communities where conventional banking services are not easily accessible.

Islamic microfinance institutions offer a range of financial services, including microcredit, microsavings, and microinsurance. These services are tailored to meet the specific needs of individuals and small business owners, who often lack collateral or formal credit history, making it difficult for them to access mainstream financial services.

The operations of Islamic microfinance institutions are guided by Islamic principles such as justice, fairness, and ethics. These institutions prioritize the well-being of their clients and aim to create a positive social impact by promoting financial inclusion and sustainable development.

In addition to providing financial services, Islamic microfinance institutions also offer non-financial support to their clients, such as training and capacity building programs. These initiatives not only help individuals and small business owners to develop their entrepreneurial skills but also contribute to the overall growth of the local economy.

Islamic microfinance has gained recognition as an effective tool for poverty alleviation and social empowerment. It has shown promising results in various countries, particularly in the areas of women’s economic empowerment and rural development.

In conclusion, Islamic microfinance plays a vital role in empowering the underprivileged by providing them with access to financial services based on ethical principles. By promoting financial inclusion and sustainable development, Islamic microfinance contributes to creating a more equitable and just society.

Islamic Asset Management

Islamic asset management refers to the management of investments in compliance with the principles and guidelines of Islamic finance. Islamic finance follows Shariah, the Islamic law, which prohibits investments in certain industries such as alcohol, gambling, and pork products, and also prohibits earning interest.

Islamic asset management offers a range of investment options for individuals and institutional investors who wish to abide by the principles of Shariah. These investment options include Shariah-compliant equities, sukuk (Islamic bonds), real estate investments, and Islamic mutual funds.

One key principle of Islamic asset management is that investments should be based on ethical and socially responsible principles. This means that investments should be made in industries that are deemed halal (permissible) according to Shariah, such as healthcare, education, renewable energy, and ethical consumer products.

In order to ensure that investments are Shariah-compliant and ethical, Islamic asset management firms typically employ a team of Shariah scholars who provide guidance and supervision. These scholars review and approve investment strategies, conduct regular audits, and ensure that the investments align with the principles of Islamic finance.

Islamic asset management also differs from conventional asset management in terms of the fee structure. Instead of charging a fixed fee or a percentage of the assets under management, Islamic asset management firms typically charge a profit-sharing fee. This fee is based on the performance of the investments, and the firm shares in the profits generated.

| Feature | Description |

|---|---|

| Shariah Compliance | Investments are made in accordance with the principles of Shariah, avoiding prohibited activities and earning interest. |

| Ethical Investment | Investments are made in industries that are deemed halal and socially responsible according to Shariah. |

| Shariah Supervision | A team of Shariah scholars reviews and approves investment strategies to ensure compliance with Islamic finance principles. |

| Profit-Sharing Fee | Islamic asset management firms charge a fee based on the performance of the investments, sharing in the profits generated. |

Overall, Islamic asset management provides individuals and institutions with the opportunity to invest in a manner that aligns with their religious and ethical beliefs. It offers a range of investment options that are compliant with the principles of Islamic finance, while also supporting ethical and socially responsible investments.

Islamic Corporate Governance

Islamic corporate governance refers to the principles and guidelines that govern the operations and management of Islamic banks and financial institutions. It is rooted in the principles of Islamic law or Shariah, which emphasize fairness, transparency, accountability, and ethical behavior in business transactions.

Key features of Islamic corporate governance:

- Shariah Supervisory Board: Islamic banks have a Shariah Supervisory Board consisting of religious scholars who ensure that the bank’s operations comply with Shariah principles. They provide guidance and oversee the bank’s activities to ensure they are in line with Islamic principles.

- Transparency: Islamic banks are required to disclose relevant information to their stakeholders, including shareholders, depositors, and regulators. This transparency helps build trust and ensures accountability.

- Risk Management: Islamic banks are required to have robust frameworks for identifying, assessing, and mitigating risks. This includes risk management policies and procedures that comply with Shariah principles.

- Board of Directors: The board of directors of an Islamic bank is responsible for the overall management and decision-making. The board should have a mix of skills and expertise to effectively govern the bank.

- Audit and Internal Controls: Islamic banks are required to have independent audits and strong internal control systems in place to ensure that financial transactions and operations comply with Shariah principles.

Benefits of Islamic Corporate Governance:

- Ethical behavior: Islamic corporate governance promotes ethical behavior and discourages activities that are prohibited in Islam, such as charging interest or engaging in speculative transactions.

- Trust and confidence: Transparent and accountable operations build trust and confidence among stakeholders, including depositors, investors, and regulators.

- Stability and resilience: Strong risk management practices and internal controls enhance the stability and resilience of Islamic banks, making them better equipped to withstand financial shocks.

- Social responsibility: Islamic corporate governance encourages banks to consider the social and environmental impacts of their operations, promoting sustainable and responsible banking practices.

Conclusion:

Islamic corporate governance plays a crucial role in ensuring the integrity and stability of Islamic banks. By adhering to Shariah principles and promoting ethical behavior, Islamic banks can build trust, stability, and resilience in their operations, ultimately contributing to the development of a more sustainable and responsible banking industry.

Regulation of Islamic banks

Islamic banks are regulated by both national and international bodies to ensure compliance with Shariah principles and financial stability. The regulation of Islamic banks varies across different countries, depending on their legal and regulatory framework.

Supervisory bodies:

- The Central Bank: In most countries, the central bank is responsible for the overall regulation and supervision of Islamic banks. It sets the regulatory framework and guidelines for Islamic banks to operate within.

- Islamic Financial Services Board (IFSB): The IFSB is an international standard-setting organization that promotes the soundness and stability of the Islamic financial services industry. It issues guidelines and standards for the regulation and supervision of Islamic banks.

Shariah boards:

- Each Islamic bank has a Shariah board composed of religious scholars who ensure that the bank’s activities comply with the principles of Shariah. The board reviews and approves the bank’s products, services, and operations.

- The Shariah board’s role is to ensure that all transactions and investments are in line with Islamic principles, such as the prohibition of interest (riba) and the avoidance of uncertainty (gharar).

Regulatory requirements:

Islamic banks are subject to specific regulatory requirements, including but not limited to:

- Capital adequacy: Islamic banks must maintain an adequate level of capital to absorb potential losses and ensure financial stability.

- Liquidity management: Islamic banks are required to manage their liquidity effectively to meet their obligations and maintain stability.

- Disclosure and transparency: Islamic banks must provide clear and accurate information about their financial position and operations to stakeholders and regulators.

- Corporate governance: Islamic banks are expected to have strong corporate governance practices, including having a well-defined board of directors and internal controls.

Monitoring and supervision:

Regulators continuously monitor and supervise Islamic banks to ensure their compliance with regulatory requirements. This includes on-site inspections, off-site monitoring, and regular reporting by the banks.

International cooperation:

Given the growing global nature of Islamic banking, regulators are increasingly engaging in international cooperation to promote consistency and enhance regulatory frameworks. This includes sharing best practices, harmonizing standards, and conducting joint inspections.

Conclusion:

The regulation of Islamic banks is essential for ensuring financial stability, consumer protection, and compliance with Shariah principles. Regulators, Shariah boards, and supervisory bodies play a crucial role in maintaining the integrity and trust of the Islamic banking industry.

Islamic banking in different countries

In recent years, Islamic banking has gained popularity in various countries around the world. Here are some of the countries where Islamic banking is practiced:

- United Arab Emirates (UAE): The UAE is one of the leading countries in Islamic banking. Dubai and Abu Dhabi are home to numerous Islamic banks, offering a wide range of Sharia-compliant financial products and services.

- Malaysia: Malaysia is another country that has embraced Islamic banking. It has a well-established Islamic banking sector and is known for its innovative Sharia-compliant financial products.

- Saudi Arabia: As the birthplace of Islam, Saudi Arabia has a strong presence in the Islamic banking industry. The Saudi Arabian Monetary Authority (SAMA) regulates and supervises the Islamic banking sector in the country.

- Qatar: Qatar has been actively promoting Islamic finance and has a rapidly growing Islamic banking sector. The Qatar Central Bank oversees and regulates Islamic banks operating in the country.

- Indonesia: With the largest Muslim population in the world, Indonesia has a significant Islamic banking industry. The country has witnessed a steady growth in Islamic banking assets and investments.

Other countries that have embraced Islamic banking include Bahrain, Kuwait, Pakistan, Turkey, and Egypt.

Each country has its own regulatory framework and guidelines for Islamic banking, ensuring compliance with Sharia principles. Islamic banks in different countries offer a variety of products and services tailored to meet the financial needs of their Muslim customers.

Islamic banking continues to expand its footprint globally, with an increasing number of countries recognizing the importance of offering Sharia-compliant financial solutions to their citizens and attracting investments from the Muslim population.

It is important to note that while Islamic banking is more commonly practiced in Muslim-majority countries, it is also available in some non-Muslim majority countries as a viable alternative to conventional banking.

Challenges and Opportunities in Islamic Banking

Introduction:

Islamic banking, as a financial system based on Shariah principles, offers a unique set of challenges and opportunities. While it has been growing steadily over the years, there are still certain challenges that need to be addressed in order to further strengthen the industry. At the same time, there are numerous opportunities that Islamic banks can capitalize on to expand their market reach and improve their services.

Challenges:

- Regulatory Compliance: One of the main challenges faced by Islamic banks is ensuring compliance with strict Shariah principles and regulations. These banks need to continuously review and adapt their products and services to ensure conformity, which requires a robust governance framework and a well-trained workforce.

- Limited Product Variation: Another challenge is the limited product variation in Islamic banking. Compared to conventional banks, Islamic banks have a smaller range of products and services to offer, which can be a barrier to attracting a wider customer base. There is a need for innovative product development to cater to the diverse needs of customers.

- Lack of Awareness: Many individuals and businesses still have limited knowledge and understanding of Islamic banking and its benefits. This lack of awareness hinders the growth of the industry and poses a challenge in expanding the customer base. Educational initiatives and awareness campaigns are needed to overcome this challenge.

- Access to Liquidity: Islamic banks face challenges in managing liquidity due to their unique financing and investment mechanisms. Unlike conventional banks, they cannot rely on interest-based transactions to manage their liquidity needs. This necessitates the development of effective liquidity management tools and frameworks.

- Social and Ethical Considerations: Islamic banking, being guided by Islamic principles, places emphasis on social and ethical considerations in its operations. This includes avoiding investments in sectors deemed unethical or harmful, such as alcohol, gambling, and conventional financial institutions. While this commitment is applauded by many, it also presents challenges in finding viable investment opportunities consistent with these principles.

Opportunities:

- Market Growth: Islamic banking has witnessed significant growth over the past decade. This presents an opportunity for Islamic banks to further expand their market reach and capitalize on this growing demand. There is a vast untapped market, both in Muslim-majority countries and non-Muslim-majority countries, where Islamic banking can establish a strong presence.

- Innovation and Product Development: There is immense scope for innovation and product development in Islamic banking. Islamic banks can leverage technology to develop new and improved products and services tailored to the specific needs of their customers. Innovative solutions, such as digital banking platforms and Shariah-compliant fintech, can help attract and retain customers.

- Socially Responsible Investing: Islamic banking’s focus on ethical and socially responsible practices aligns with the growing demand for sustainable finance. Islamic banks can position themselves as leaders in socially responsible investing by offering products and services that promote environmental sustainability, social inclusion, and corporate governance.

- Partnerships and Collaborations: Islamic banks can explore partnerships and collaborations with conventional banks, fintech companies, and other financial institutions to leverage their expertise, resources, and distribution networks. Collaborations can help Islamic banks overcome the challenges they face and create mutually beneficial opportunities for growth.

Conclusion:

Despite the challenges faced, Islamic banking presents significant opportunities for growth and innovation. By addressing the challenges effectively and leveraging the opportunities, Islamic banks can contribute to the development of a more inclusive and sustainable financial system that caters to the needs of diverse individuals and businesses.

The growth of Islamic banking worldwide

Islamic banking, also known as Sharia-compliant banking, has seen a significant growth worldwide in the past few decades. This growth can be attributed to several factors:

- Increasing demand: The demand for Islamic banking services has been steadily increasing among Muslim individuals and businesses who wish to adhere to Islamic principles and avoid interest-based transactions.

- Expanding Muslim population: The global Muslim population is growing at a fast pace, leading to a larger customer base for Islamic banks. This has prompted both Islamic and conventional banks to offer Sharia-compliant products.

- Government support and regulations: Many governments, especially in Muslim-majority countries, have implemented supportive regulations to encourage the growth of Islamic banking. They have introduced frameworks and guidelines to ensure the compliance of Islamic banks with Sharia principles.

- Innovation in product offerings: Islamic banks have been continually innovating their product offerings to meet the diverse financial needs of their customers. They have introduced products such as Islamic mortgages, Islamic credit cards, and Islamic investment funds, making their services more accessible and attractive.

- Globalization and international recognition: Islamic banking has gained global recognition and acceptance. International organizations such as the International Monetary Fund (IMF) and the World Bank have acknowledged its importance and started collaborating with Islamic financial institutions. This has helped create awareness and fostered the global growth of Islamic banking.

Overall, the growth of Islamic banking worldwide can be attributed to increasing demand, an expanding Muslim population, government support, product innovation, and international recognition. As more individuals and businesses seek ethical and Sharia-compliant financial solutions, the Islamic banking industry is expected to continue its rapid expansion in the coming years.

Islamic Financial Inclusion

In recent years, there has been a growing interest in Islamic banking and finance as a means to promote financial inclusion. Islamic finance is a system that is based on the principles of Shariah law, which prohibits the charging of interest and promotes ethical and socially responsible investing.

Financial inclusion refers to the idea of providing access to financial services to individuals and businesses who are traditionally excluded from the formal banking sector. This includes individuals who may not have access to a bank account, credit, insurance, or other financial tools.

Islamic finance offers an alternative to traditional banking and can play a significant role in promoting financial inclusion for several reasons:

- Prohibition of interest: Islamic finance operates on the principle that charging or receiving interest is prohibited. This means that individuals who may be hesitant to engage with conventional banks due to religious or ethical concerns can turn to Islamic banks for their financial needs.

- Profit-sharing: In Islamic finance, instead of charging interest, banks and customers enter into profit-sharing agreements. This promotes a more equitable distribution of wealth and allows individuals to participate in the financial system while adhering to their religious beliefs.

- Focus on ethical investing: Islamic banks are required to invest in ventures that are compliant with Shariah law, which prohibits investing in industries such as alcohol, tobacco, gambling, and weapons. This ensures that individuals who prefer to avoid these industries can still benefit from financial services without compromising their values.

Islamic banks also offer a range of financial products that cater to the needs of underserved populations. This includes microfinance offerings, which provide small loans to entrepreneurs and individuals in need of capital for their businesses or personal expenses.

Furthermore, Islamic finance fosters financial literacy and education. The principles of Islamic banking require transparency and clarity in financial transactions, promoting a greater understanding of financial products and services among customers.

In conclusion, Islamic finance has the potential to promote financial inclusion by providing individuals and businesses with access to ethical and socially responsible financial services. Through the prohibition of interest, profit-sharing agreements, and a focus on ethical investing, Islamic banks can cater to the needs of underserved populations and help them participate in the formal financial system.

Islamic banking and sustainable development

Sustainable development is a concept that encompasses economic, social, and environmental well-being, with the aim of meeting the needs of present and future generations. Islamic banking, with its principles rooted in fairness, justice, and ethical considerations, aligns well with the goals of sustainable development.

One of the key principles of Islamic banking is the prohibition of usury or interest-based transactions. Instead, Islamic banks operate on the basis of profit-sharing and risk-sharing, where profits and losses are shared between the bank and its customers. This promotes a more equitable distribution of wealth and fosters economic stability, which are essential for sustainable development.

In addition, Islamic banks follow strict ethical guidelines in their investment decisions. They avoid investing in industries that are harmful to society or the environment, such as alcohol, gambling, tobacco, and weapons. This ensures that the financial resources are directed towards socially responsible industries, which contribute to the overall well-being of society and endorse sustainable development practices.

Islamic banking also encourages responsible lending practices. The concept of “Qard al-Hasan,” or benevolent lending, promotes providing interest-free loans to individuals in need. This reduces the burden of debt and promotes financial inclusion, enabling individuals to improve their lives and contribute to their community’s development.

Furthermore, Zakat, which is a form of obligatory charity in Islam, plays a significant role in Islamic banking. Islamic banks collect and distribute Zakat funds to support various social and economic development projects, such as education, healthcare, poverty alleviation, and infrastructure development. This ensures that wealth is distributed more equitably and helps address societal challenges, which are crucial for long-term sustainable development.

In conclusion, Islamic banking promotes the principles of fairness, justice, and ethical considerations, which align with the goals of sustainable development. By fostering economic stability, responsible investment, ethical lending practices, and the distribution of wealth through Zakat, Islamic banking contributes to the overall well-being of society and supports long-term sustainable development.

Islamic banking and fintech

The advent of fintech has brought significant changes to the banking industry, and Islamic banking is no exception. Fintech refers to the use of technology to provide financial services, and it has enabled Islamic banks to offer innovative solutions and reach a wider audience.

One of the key areas where fintech has impacted Islamic banking is in the area of digital banking. Islamic banks have embraced digital technologies to offer online banking services that are compliant with Shariah principles. This has made it easier for customers to access banking services and perform transactions conveniently.

Additionally, fintech has revolutionized the way Islamic banks provide financing and investment solutions. Through the use of online platforms and mobile apps, customers can now access a wide range of Shariah-compliant products such as Islamic insurance (Takaful), Islamic crowdfunding, and Islamic robo-advisory services.

Fintech has also facilitated greater financial inclusion in Islamic banking. Traditional banking practices often excluded individuals and small businesses that did not meet certain eligibility criteria. However, fintech has made it possible for Islamic banks to serve a broader segment of the population by offering digital financial services that are accessible to all.

Moreover, the use of fintech has enhanced the efficiency and transparency of Islamic banking operations. With the help of advanced analytics and AI technologies, Islamic banks can now automate processes, reduce human error, and improve compliance with Shariah principles. This has made Islamic banking more reliable and trustworthy for customers.

Overall, the integration of fintech in Islamic banking has opened up new opportunities for innovation and growth. By leveraging technology, Islamic banks can meet the evolving needs of their customers and tap into a global marketplace, while still adhering to the principles of Islamic finance.

The Future of Islamic Banking

The future of Islamic banking is expected to be bright, with the industry experiencing significant growth and expansion in recent years. As more people become aware of the benefits and principles of Islamic banking, the demand for Sharia-compliant financial products and services is expected to increase.

One of the key factors driving the future growth of Islamic banking is the increasing Muslim population around the world. With over 1.8 billion Muslims globally, there is a large potential market for Islamic financial institutions to tap into. As the Muslim population continues to grow, the demand for Islamic banking products, such as Islamic mortgages, Islamic savings accounts, and Islamic investment funds, is likely to rise.

In addition to the growing Muslim population, non-Muslims are also showing interest in Islamic banking. The principles of Islamic finance, such as fairness and transparency, resonate with individuals from various religious backgrounds who are seeking ethical financial solutions. This trend is expected to further contribute to the growth and development of Islamic banking in the future.

Technology and innovation are also expected to play a significant role in shaping the future of Islamic banking. Fintech companies are already exploring ways to provide digital Islamic banking solutions, making it easier for customers to access Sharia-compliant financial services from anywhere in the world. This technological advancement is likely to open up new opportunities for Islamic banks to expand their reach and cater to a broader customer base.

Regulatory support and government initiatives are crucial for the continued growth of Islamic banking. Many countries with significant Muslim populations, such as Malaysia, Indonesia, and the United Arab Emirates, have already established regulatory frameworks to promote the development of Islamic finance. As more countries recognize the potential of Islamic banking and implement supportive policies, the industry is expected to thrive.

Furthermore, the integration of Islamic banking into the global financial system is an important aspect of its future. Efforts are being made to enhance coordination and collaboration between conventional and Islamic banks, allowing for greater interoperability and financial inclusion. This integration will not only benefit Islamic banks but also contribute to the stability and resilience of the global financial system.

In conclusion, the future of Islamic banking looks promising, with growing Muslim populations, increasing interest from non-Muslims, technological advancements, regulatory support, and global integration all contributing to its success. As the industry continues to evolve and innovate, Islamic banks are well-positioned to meet the diverse financial needs of individuals and businesses while adhering to Sharia principles.

Choosing an Islamic bank: Considerations

When it comes to choosing an Islamic bank, there are several considerations that one should take into account. Here are some key factors to keep in mind:

- Islamic principles: The foremost consideration should be whether the bank operates in accordance with Islamic principles. It is important to ensure that the bank follows ethical and Sharia-compliant practices, such as avoiding interest-based transactions.

- Product offerings: Evaluate the range of products and services offered by the Islamic bank. Look for a bank that offers a variety of Sharia-compliant products, including savings accounts, home financing, and investment options.

- Reputation: Conduct thorough research to assess the reputation of the Islamic bank. Look for customer reviews, ratings, and testimonials to gauge the bank’s reliability, customer service, and overall satisfaction among its clients.

- Accessibility: Consider the convenience and accessibility of the Islamic bank. Look for branches or ATMs located near your residence or workplace, and assess the availability of online and mobile banking services.

- Fees and charges: Compare the fee structure and charges of different Islamic banks. Pay attention to account maintenance fees, transaction charges, and penalties for early withdrawals or late payments.

- Financial stability: Evaluate the financial stability and strength of the Islamic bank. Review the bank’s financial statements, annual reports, and credit ratings to determine its financial health and ability to fulfill its commitments.

- Customer support: Assess the customer support provided by the Islamic bank. Look for efficient and responsive customer service channels, such as phone support, email, or live chat, to ensure that your queries and concerns can be addressed promptly.

- Additional benefits: Consider any additional benefits or value-added services offered by the Islamic bank. This could include rewards programs, special offers or discounts, or educational resources related to Islamic finance.

By taking these considerations into account, you can make a well-informed decision when choosing an Islamic bank that aligns with your financial goals and values.

Understanding Islamic Banking Terminology

In order to fully understand how Islamic banks work, it is important to familiarize yourself with some key terms and concepts used in Islamic banking. Here are some commonly used terms:

- Riba: This term refers to interest or usury, which is prohibited in Islamic banking. Islamic banks operate on the principle that money should be used as a medium of exchange rather than a commodity to be traded for profit.

- Mudarabah: A Mudarabah is a partnership between the bank (as the investor) and the customer (as the entrepreneur). The bank provides the funds and the customer conducts the business. In case of profit, both parties share the profit based on pre-agreed ratios.

- Musharakah: Musharakah is a profit and loss-sharing partnership. Both the bank and the customer contribute capital to a business project, and both parties share the profits and losses in proportion to their respective capital contributions.

- Wakalah: In Wakalah, the bank acts as an agent and manages the funds on behalf of the customer based on pre-agreed terms. The bank is entitled to a fee for its services.

- Ijara: Ijara refers to leasing or renting. In Islamic banking, it is used as a financing tool where the bank purchases an asset and then leases it to the customer for an agreed-upon term and rental amount.

- Sukuk: Sukuk are Islamic financial certificates or bonds. They represent ownership in an underlying asset or project and generate income based on the performance of that asset or project.

These are just a few examples of the many terms used in Islamic banking. It is important to understand these concepts in order to fully grasp the principles and practices of Islamic banking.

| Term | Definition |

|---|---|

| Riba | Interest or usury, prohibited in Islamic banking |

| Mudarabah | Partnership between the bank and the customer for profit-sharing |

| Musharakah | Profit and loss-sharing partnership between the bank and the customer |

| Wakalah | Bank acts as an agent to manage funds on behalf of the customer |

| Ijara | Financing tool where the bank purchases an asset and leases it to the customer |

| Sukuk | Islamic financial certificates representing ownership in an asset or project |

By familiarizing yourself with these terms and concepts, you will be better equipped to understand how Islamic banks operate and make informed decisions regarding Islamic banking products and services.

Resources for further learning

-

Books: There are several books available that provide in-depth understanding of Islamic banking. Some highly recommended titles include:

- “Introduction to Islamic Banking and Finance” by Brian Kettell

- “Understanding Islamic Banking” by Muhammad Ayub

- “Islamic Banking and Finance: Principles, Instruments and Operations” by Muhammad Kabir Hassan and Mervyn K. Lewis

- “Islamic Finance For Dummies” by Faleel Jamaldeen

-

Academic Journals and Research Papers: Exploring academic journals and research papers on Islamic banking can provide valuable insights. Some prominent journals in this field include:

- Journal of Islamic Economics, Banking and Finance

- Journal of Economic Cooperation and Development

- International Journal of Islamic and Middle Eastern Finance and Management

- International Journal of Islamic Financial Services

-

Online Courses: Enrolling in online courses can help you gain a comprehensive understanding of Islamic banking from experts in the field. Some reputable platforms offering courses on this subject are:

- Khan Academy

- edX

- Coursera

- Islamic Online University

-

Professional Organizations: Joining professional organizations focused on Islamic banking can provide access to networking opportunities and resources for further learning. Some notable organizations include:

- Islamic Financial Services Board (IFSB)

- The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI)

- World Islamic Banking Conference (WIBC)

- Islamic Banking and Finance Institute Malaysia (IBFIM)

Exploring these resources will help you develop a solid understanding of Islamic banking and its principles. Remember to always seek information from reliable sources and consult experts in the field for a comprehensive understanding.

FAQ

What is an Islamic bank?

An Islamic bank is a financial institution that operates in accordance with Sharia principles, which prohibit the charging or paying of interest. Instead, Islamic banks use profit-sharing arrangements and asset-based financing to provide their services.

How do Islamic banks generate profit?

Islamic banks generate profit by entering into profit-sharing arrangements with their customers. This means that the bank and the customer share the profits and risks of a business venture. Islamic banks also generate profit through fees and charges for services provided.

What are some of the key principles of Islamic banking?

Some of the key principles of Islamic banking include the prohibition of interest (riba), the promotion of risk-sharing, the prohibition of investing in activities that are considered haram (forbidden), and the requirement for transactions to be based on tangible assets.

Can non-Muslims use Islamic banks?

Yes, non-Muslims can use Islamic banks. Islamic banks offer a wide range of financial services that are suitable for individuals and businesses of all faiths. However, it’s important to note that Islamic banks operate in accordance with Sharia principles, which may differ from conventional banking practices.

Are Islamic banks regulated?

Yes, Islamic banks are regulated by the regulatory authorities in the countries where they operate. These regulatory authorities ensure that Islamic banks comply with Sharia principles and the regulations governing the banking industry. They also monitor the financial stability and integrity of Islamic banks.