Islamic finance refers to a system of banking and financial transactions that adhere to the principles of Islamic law, known as Sharia. With its roots in the Quran and the teachings of Prophet Muhammad, Islamic finance operates on the belief that all economic activities should adhere to ethical and moral standards.

One of the key principles of Islamic finance is the prohibition of usury, or the charging of interest. Instead, Islamic financial institutions operate on the principle of profit sharing, where the lender and the borrower enter into a partnership to share the profits or losses of a business venture. This ensures a more equitable distribution of wealth and prevents exploitation.

Another fundamental principle of Islamic finance is the avoidance of speculation and uncertainty. Islamic financial transactions must be based on tangible assets and real economic activity, rather than on speculative financial instruments. This promotes stability and reduces the risk of financial crises.

“O you who have believed, do not consume usury, doubled and multiplied, but fear Allah that you may be successful.” – Quran (3:130)

Furthermore, Islamic finance also emphasizes the importance of social responsibility and ethical investing. Investments must comply with Sharia guidelines and be directed towards socially beneficial projects that enhance the well-being of society. This ensures that financial transactions align with the broader objective of achieving social justice and reducing inequality.

As Islamic finance continues to gain recognition and popularity worldwide, understanding its key principles and practices becomes essential for individuals and institutions seeking to engage in ethical and sustainable financial transactions. By adhering to the principles of Islamic finance, individuals and institutions can contribute to a more equitable and just financial system that promotes economic growth and social well-being.

Key Concepts in Islamic Finance

Islamic finance operates under a set of key principles that differentiate it from conventional finance. These principles are rooted in the Islamic faith and aim to promote social justice and economic stability.

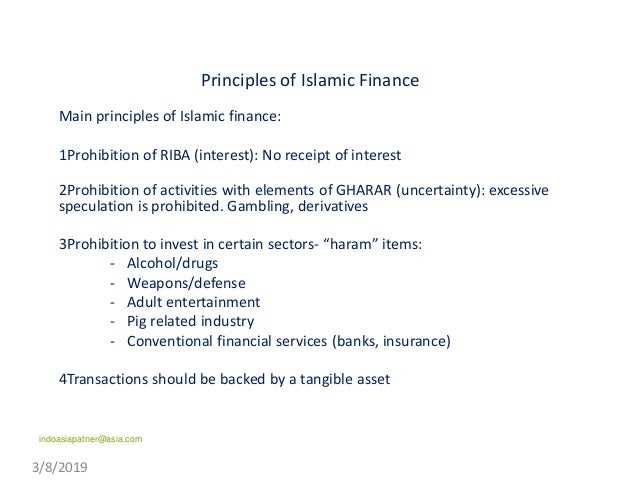

1. Prohibition of Interest (Riba):

- In Islamic finance, earning or charging interest is strictly prohibited. This is based on the belief that money should not generate more money without involvement in productive activities.

2. Profit and Loss Sharing (Mudarabah and Musharakah):

- Islamic finance encourages partnerships and profit-sharing arrangements. Mudarabah is a partnership where one party provides the capital, and the other party manages the investment. Musharakah is a joint venture partnership where all parties share the profits and losses.

3. Asset-Backed Financing:

- Islamic finance promotes asset-backed financing, where investments are linked to tangible assets, such as real estate or commodities. This ensures investments are backed by something of value.

4. Prohibition of Speculation (Gharar):

- Islamic finance discourages excessive uncertainty or speculation in transactions. Gharar refers to contracts with uncertain terms or excessive ambiguity. Contracts must have clear and definite terms and conditions.

5. Ethical Restrictions (Haram and Halal):

- Islamic finance prohibits investments in activities considered haram (forbidden), such as alcohol, gambling, and pork. Investments must comply with Sharia law and be deemed halal (permissible).

6. Social and Environmental Responsibility:

- Islamic finance encourages investments that benefit society and promote sustainable development. Financing projects that have a positive social and environmental impact is highly encouraged.

7. No Excessive Risk-Taking (Maysir):

- Islamic finance discourages excessive risk-taking and gambling-like practices. Investments must be based on real economic activities and avoid speculative transactions.

8. Moral Accountability (Akhirah):

- Islamic finance emphasizes moral accountability and responsible financial behavior. Financial decisions should align with ethical principles and promote the well-being of society.

By adhering to these key concepts, Islamic finance seeks to create a financial system that is fair, sustainable, and aligned with ethical principles. These principles ensure that investments promote economic growth and social welfare while adhering to the teachings of Islam.

Shariah Law

Shariah Law, also known as Islamic Law, is a set of legal and ethical principles derived from the teachings of the Quran, the holy book of Islam, and the Hadith, the teachings and practices of the Prophet Muhammad. It serves as the foundation for Islamic finance and shapes the principles and practices followed in the industry.

Key Principles:

- Prohibition of Riba: Shariah Law prohibits the charging or payment of interest (riba). Instead, Islamic finance operates on the principle of profit and loss sharing, with financial transactions structured as partnerships or joint ventures.

- Prohibition of Gharar: Shariah Law also prohibits excessive uncertainty or ambiguity (gharar) in financial transactions. This means that Islamic finance discourages speculative activities and requires transparency and clarity in contracts.

- Prohibition of Haram Activities: Islamic finance prohibits engaging in activities that are considered haram (forbidden) in Islam, such as gambling, alcohol, pork, and weapons.

Practices in Islamic Finance:

- Mudarabah: Mudarabah is a profit-sharing partnership, where one party provides the capital (rab al-maal) and the other party brings expertise and labor (mudarib). Profits are shared according to a pre-agreed ratio, while losses are borne primarily by the capital provider.

- Murabaha: Murabaha is a cost-plus financing arrangement, where the lender purchases an asset and sells it to the borrower at a higher price, allowing the borrower to pay in installments. This method is commonly used for financing in Islamic banking.

- Sukuk: Sukuk are Islamic investment certificates similar to bonds, but they represent ownership in tangible assets or services, rather than debt. The returns to investors come from the profits generated by the assets backing the sukuk.

- Takaful: Takaful is an Islamic form of insurance, based on the principles of mutual co-operation and shared responsibility. Participants contribute to a pool of funds, which is used to provide benefits to those who suffer a loss or damage.

Shariah Boards:

To ensure that Islamic financial institutions and products comply with Shariah Law, they establish Shariah boards composed of Islamic scholars and legal experts. These boards provide guidance and oversight to ensure that operations, contracts, and investments conform to Shariah principles. Their role is crucial in maintaining the integrity and authenticity of Islamic finance.

By adhering to the principles of Shariah Law, Islamic finance aims to provide ethical and inclusive financial solutions that promote economic development and financial stability while adhering to the values and teachings of Islam.

Riba (Interest)

In Islamic finance, riba refers to the prohibition of charging or paying interest on loans. This concept is derived from the principles of Shariah law, which is the religious law governing the Islamic faith.

The word riba translates to “increase” or “excess” and is used to describe any unjustifiable increase in a financial transaction. It is seen as exploitative and unfair, as it allows lenders to profit from simply lending money without taking on any risk.

According to Islamic principles, money is simply a medium of exchange and should not be used to generate more money by itself. Instead, wealth should be generated through productive means, such as investing in businesses or sharing in the profits and losses of a venture.

Islamic finance offers alternative methods of financing that comply with the prohibition of riba. These include profit-sharing partnerships (Mudarabah), joint ventures (Musharakah), cost plus financing (Murabaha), and leasing agreements (Ijarah), among others.

Furthermore, Islamic banks and financial institutions also offer various Islamic banking products that align with the principles of riba-free finance. These products range from Islamic savings accounts and home financing to Islamic bonds (sukuk) and Islamic mutual funds.

To ensure compliance with the prohibition of riba, Islamic finance institutions employ Shariah scholars who evaluate financial products and ensure they are in accordance with Islamic principles. These scholars assess the contracts, mechanisms, and underlying assets involved to determine the permissibility of a financial transaction.

Overall, the prohibition of riba in Islamic finance aims to promote fairness, justice, and ethical practices in financial transactions. By avoiding interest-based lending, Islamic finance seeks to establish a more inclusive and equitable financial system that serves the needs of both individuals and the community as a whole.

Gharar (Uncertainty)

Gharar, meaning uncertainty or ambiguity in Islamic finance, refers to the prohibition of excessive uncertainty or ambiguity in contractual agreements. It is considered one of the key principles in Islamic finance to ensure transparency, fairness, and avoidance of speculative practices. Gharar is rooted in the principles of risk-sharing and avoiding unjust enrichment.

The concept of gharar is derived from the teachings of the Quran and the Hadith, which emphasize the importance of clarity, honesty, and fairness in financial transactions. It is seen as a means to protect the interests of all parties involved and prevent any form of exploitation or deception.

In Islamic finance, gharar applies to contracts that involve excessive uncertainty or ambiguity, such as those that are heavily dependent on chance or luck. This includes contracts that lack necessary details or specifications, making it difficult for parties to fully understand and evaluate the risks and rewards involved.

Some common examples of gharar include:

- Contracts based on speculation or gambling

- Contracts that involve uncertain or ambiguous future outcomes

- Contracts that lack transparency or essential information

To comply with the principle of gharar, Islamic financial institutions and individuals adhere to certain practices. These include:

- Clarity and transparency: Ensuring that all terms and conditions of a contract are clear, well-defined, and easily understood by all parties involved.

- Avoidance of excessive uncertainty: Avoiding contracts that involve excessive levels of uncertainty or risk, where outcomes are heavily dependent on chance or speculation.

- Disclosure of relevant information: Disclosing all relevant information and risks associated with a particular transaction to enable informed decision-making.

- Good faith: Acting in good faith and not exploiting or deceiving other parties in financial transactions.

- Prohibition of speculative practices: Avoiding speculative practices that involve excessive uncertainty, such as gambling, betting, or any form of lottery.

By adhering to the principle of gharar, Islamic finance aims to promote stability, fairness, and ethical conduct in financial transactions, while also ensuring the protection of the rights and interests of all parties involved.

Haram and Halal

In Islamic finance, the concepts of haram and halal play a significant role. These terms refer to actions or behaviors that are considered prohibited (haram) or permissible (halal) according to Islamic law, also known as Shariah. Understanding these concepts is crucial for individuals and institutions involved in Islamic finance.

Haram

Haram refers to any action or transaction that is explicitly forbidden in Islam. It encompasses a wide range of activities that are considered morally or ethically unacceptable, and engaging in such activities is considered a sin. Examples of haram activities include:

- Usury (Riba): Charging or paying interest on loans

- Illegal businesses: Engaging in activities that are illegal according to Islamic principles, such as gambling, alcohol, pork, and any forbidden substances or practices

- Gambling: Participating in games of chance or betting

- Speculation: Engaging in speculative investments or transactions that involve excessive uncertainty

- Unfair trade practices: Deceptive or fraudulent practices in business transactions

Halal

Halal, on the other hand, refers to actions or transactions that are permissible and in accordance with Islamic law. Halal finance aims to adhere to the principles of fairness, justice, and ethical conduct. Some examples of halal activities include:

- Investments in permissible industries: Engaging in businesses that are Halal such as real estate, manufacturing, technology, and healthcare.

- Partnership: Engaging in profit-sharing agreements and partnerships between individuals or businesses

- Ethical investing: Supporting socially responsible investment practices, such as investments in renewable energy, healthcare, and education

- Charitable activities: Engaging in philanthropic endeavors and donating to charitable causes

Importance in Islamic Finance

The concepts of haram and halal are integral to Islamic finance as they provide a framework for evaluating the permissibility of financial transactions and investments. Islamic finance seeks to operate within the boundaries of Shariah law, and any financial product or service deemed haram is prohibited. Various Islamic financial instruments and structures have been developed to ensure compliance with these principles while meeting the financial needs of individuals and businesses adhering to Islamic ethics.

| Haram: | Halal: |

|---|---|

| Usury (Riba) | Investments in permissible industries |

| Illegal businesses | Partnership |

| Gambling | Ethical investing |

| Speculation | Charitable activities |

| Unfair trade practices |

Islamic Financial Products

Islamic finance is guided by Sharia principles, which prohibit the charging or earning of interest (riba) and encourage risk-sharing and ethical investment. These principles have resulted in the development of various specialized financial products that comply with Islamic law.

Murabaha: This is a form of cost-plus financing where the bank purchases an asset on behalf of the customer and then sells it to the customer at a marked-up price. The customer can pay the price in installments.

Mudarabah: This is a profit-sharing partnership where one party provides the capital (the investor) and another party provides the expertise and labor (the entrepreneur). Any profits generated are shared between the two parties based on a pre-agreed ratio.

Ijarah: This is a leasing or rental agreement where the bank purchases an asset and leases it to the customer for an agreed period and rental amount. At the end of the lease period, the customer may have the option to purchase the asset at a pre-determined price.

Sukuk: These are Islamic bonds that represent ownership in an underlying asset. Sukuk holders receive a share of the profits generated by the asset. The underlying assets can include real estate, infrastructure projects, or even tangible assets like commodities.

Takaful: This is an Islamic insurance product based on the principles of mutual assistance and cooperation. Participants contribute to a common fund that is used to provide coverage to the insured. Any surplus in the fund is distributed among the participants based on a pre-agreed ratio.

Islamic Mutual Funds: These are investment vehicles that comply with Sharia principles. The funds pool money from multiple investors and invest in Sharia-compliant assets such as equities, real estate, and commodities.

Islamic Microfinance: This is a form of financing that provides small loans and financial services to low-income individuals and micro-entrepreneurs. It follows the principles of Islamic finance by promoting ethical and interest-free lending practices.

These are just a few examples of the diverse range of Islamic financial products available in the market. Each product is designed to meet the specific needs of Muslim consumers while complying with Sharia principles. Islamic finance continues to evolve and innovate to cater to the growing demand for ethical and Sharia-compliant financial solutions.

Mudarabah (Profit and Loss Sharing)

Mudarabah is an Islamic financial contract that involves a partnership between two parties: the Rab al-Maal (capital provider) and the Mudarib (entrepreneur). In this partnership, the Rab al-Maal provides the capital, while the Mudarib manages the business activities. The profits generated from the business are shared between the two parties according to a pre-agreed ratio, while losses are solely borne by the Rab al-Maal.

This concept is based on the principle of profit and loss sharing, where both parties have a stake in the success of the business venture. The Mudarib, as the active partner, is responsible for managing the operations and making investment decisions. Meanwhile, the Rab al-Maal, as the silent partner, provides the capital and relies on the Mudarib’s expertise.

The distribution of profits in Mudarabah is determined based on an agreed ratio that is specified in the contract. This ratio can be fixed or variable, depending on the agreement between the parties. However, it is important to note that the Mudarib cannot guarantee a specific rate of return to the Rab al-Maal, as it is dependent on the profitability of the business.

In the case of losses, the Mudarib does not bear any financial liability. The Rab al-Maal, on the other hand, absorbs the entire loss, as it is part of the risk associated with the investment. This ensures that the Mudarib is motivated to make sound decisions and mitigate risks, as any losses incurred will directly impact the Rab al-Maal.

Mudarabah is widely used in Islamic banking and finance, particularly in investment accounts and fund management. It provides an alternative to conventional financial systems, where interest-based transactions are prohibited in Islamic finance.

Overall, Mudarabah exemplifies the principles of fairness, risk-sharing, and partnership in Islamic finance. It encourages entrepreneurship and investment while promoting ethical and socially responsible business practices.

Musharakah (Partnership)

In Islamic finance, musharakah is a form of partnership where two or more parties come together to finance a project or venture. It is based on the principles of profit sharing and risk sharing. Musharakah can be used in various Islamic finance transactions, including joint ventures, project financing, and equity financing.

Here are some key features and principles of musharakah:

- Shared ownership: In musharakah, all partners have joint ownership of the venture or project. Each partner contributes capital or assets to the partnership.

- Profit sharing: The profits generated from the venture are divided among the partners based on the agreed-upon ratio. The ratio can be pre-determined or based on the individual contributions of each partner.

- Loss sharing: Similarly, losses are shared among the partners based on their respective shares in the partnership. This reflects the principle of shared risk.

- Active and silent partners: In musharakah, partners can have different roles and responsibilities. An active partner actively participates in the management and operations of the venture, while a silent partner only contributes capital without active involvement.

Musharakah is often used in financing large-scale projects where the capital requirements are significant. It allows for risk sharing among the partners, which can help mitigate the financial burden on a single party. This form of partnership promotes cooperation, fairness, and shared responsibility.

In Islamic banking, musharakah can also be utilized for home financing or business financing. Instead of offering conventional loans with interest, Islamic banks can enter into a musharakah partnership with the customer. The bank and the customer become joint owners of the property or business, and the customer gradually buys out the bank’s share over time.

Overall, musharakah is an important concept in Islamic finance as it promotes ethical and equitable financial practices. It encourages cooperation, risk sharing, and the fair distribution of profits and losses among partners.

Murabaha (Cost Plus Financing)

Murabaha is a commonly used form of Islamic finance that involves cost plus financing. In a Murabaha transaction, the customer identifies a specific asset or product that they wish to purchase, and the financial institution buys the asset on behalf of the customer. The financial institution then sells the asset to the customer at a higher price, which includes an agreed-upon profit margin.

The key principle behind Murabaha is that the financial institution must disclose the cost price and profit margin to the customer. This transparency ensures that both parties are fully aware of the terms of the transaction and the profit being earned by the financial institution.

One of the primary reasons for the popularity of Murabaha is its compliance with Islamic principles such as the prohibition of interest (riba) and uncertainty (gharar). Since the transaction is based on a cost plus financing structure, it avoids the payment or receipt of interest by either party and eliminates uncertainty regarding the price and terms of the transaction.

Murabaha transactions can be used for various purposes, including financing the purchase of assets such as real estate, vehicles, and equipment, as well as fulfilling working capital needs. It is commonly employed in Islamic banks and financial institutions as a means of providing Sharia-compliant financing options to customers.

When implementing Murabaha, a financial institution typically follows a structured process:

- The customer identifies an asset or product they wish to purchase.

- The financial institution conducts due diligence on the asset and verifies its market value.

- The financial institution purchases the asset on behalf of the customer.

- The financial institution sells the asset to the customer at a higher price, which includes the cost price and an agreed-upon profit margin.

- The customer makes installment payments to the financial institution over an agreed-upon period of time.

Overall, Murabaha provides a transparent and Sharia-compliant financing option for individuals and businesses who want to avoid conventional interest-based loans. By adhering to the principles of fairness and transparency, Murabaha plays a significant role in the Islamic finance industry.

Sukuk (Islamic Bonds)

Sukuk, also known as Islamic bonds, are financial instruments used in Islamic finance. They are created in accordance with Islamic principles and provide an alternative way for individuals and organizations to raise capital.

Key Features of Sukuk:

- Sukuk represent ownership or partial ownership in an underlying asset or project.

- Unlike conventional bonds, sukuk holders share in the risk and profits of the underlying asset or project.

- Sukuk are structured as trust certificates, following the principles of Shariah (Islamic law).

- Sukuk are issued by a special purpose entity (SPE) to fund specific projects or activities.

Types of Sukuk:

- Mudaraba sukuk: These sukuk represent investment in a project or business venture, where the investors provide capital while the managing partner handles the operations.

- Musharaka sukuk: These sukuk represent partnerships in an investment or business venture, where the profits and losses are shared among the partners based on their respective contributions.

- Ijara sukuk: These sukuk represent ownership in leased assets, where the investors receive periodic rental income.

- Murabaha sukuk: These sukuk represent the sale of commodities at a marked-up price, where the investors receive a fixed return.

Investing in Sukuk:

Investors who wish to participate in sukuk can do so through various means, such as purchasing sukuk directly from the issuer or through secondary markets. Investors may also choose to invest in sukuk funds, which pool together funds from multiple investors and invest in a diversified portfolio of sukuk.

Benefits of Sukuk:

- Sukuk provide an avenue for Islamic investors to participate in financial markets while adhering to Shariah principles.

- Sukuk offer an alternative investment option that is backed by real assets or projects.

- Sukuk can help fund infrastructure projects and promote economic development.

- Sukuk can provide diversification opportunities for investors.

Conclusion:

Sukuk are an important component of Islamic finance, providing a viable alternative to conventional bonds. With their unique structures and adherence to Shariah principles, sukuk offer Islamic investors the opportunity to invest in a way that aligns with their beliefs and values.

Takaful (Islamic Insurance)

Takaful is a type of insurance that operates in accordance with the principles of Islamic finance. Unlike conventional insurance, which is based on the concept of risk transfer, takaful functions on the principle of mutual assistance and cooperation.

The word “takaful” comes from the Arabic root word “kafala,” which means guaranteeing or taking responsibility for one another. Takaful is based on the principles of mutual protection and shared responsibility, aiming to provide individuals and businesses with financial protection against potential risks.

One of the key principles of takaful is the concept of “tabarru'”, which refers to voluntary contributions made by participants to a common pool. These contributions, also known as donations or contributions to the takaful fund, are used to cover the losses and claims of participants. The funds are managed by a takaful operator (also known as a takaful company) in accordance with Islamic principles.

Takaful operates on the basis of the principle of “mudarabah,” which is a profit-sharing contract between the participants and the takaful operator. The participants provide the capital, while the takaful operator manages the funds and invests them in Shariah-compliant ventures. Any profits generated from these investments are shared between the participants and the takaful operator in pre-determined ratios.

In a takaful arrangement, the participants are also known as policyholders or certificate holders. They enter into a contract (known as a takaful certificate) with the takaful operator, which outlines the terms and conditions of the takaful coverage. The takaful certificate specifies the contribution amount, the coverage period, the scope of coverage, and the rights and obligations of the participants and the takaful operator.

Takaful offers a range of coverage types, including life takaful, general takaful, and family takaful. Life takaful provides coverage for events such as death and disability, while general takaful covers risks related to property, liability, and marine insurance. Family takaful offers protection against specific risks, such as education, marriage, and healthcare expenses.

Overall, takaful provides a Shariah-compliant alternative to conventional insurance, allowing individuals and businesses to protect themselves against financial risks while adhering to the principles of Islamic finance.

Waqf (Islamic Endowment)

Definition:

Waqf, also known as Islamic endowment, is a unique feature of Islamic finance. It refers to the permanent dedication of a specific property or asset for religious, charitable, or social purposes. The property or asset is typically donated by an individual or institution, and its income or benefits are used for the beneficiaries, such as the poor, or for the maintenance of a mosque, school, hospital, or other social institutions.

Key principles:

- Permanence: Once a property or asset is dedicated as waqf, it becomes inalienable and cannot be sold, mortgaged, or transferred to another owner. This ensures the continuity of the waqf and its intended purpose.

- Irrevocability: Once a waqf is established, it cannot be revoked by the donor or any other party. The assets remain dedicated for the benefit of the designated beneficiaries.

- Intention: The establishment of a waqf requires a clear intention from the donor to dedicate the property or asset for charitable or religious purposes. The intention must be sincere and not for personal gain.

- Permissible purposes: The proceeds from a waqf must be used for permissible purposes according to Islamic principles. These purposes may include providing education, healthcare, food, or shelter to the needy, as well as supporting religious activities.

Types of waqf:

There are different types of waqf, each serving different purposes:

- Waqf khairi: This type of waqf is established for general charitable purposes, such as helping the poor, funding education, or supporting healthcare services.

- Waqf ahli: This type of waqf is established for the benefit of the donor’s family, serving their specific needs and interests.

- Waqf jibran: This type of waqf is established to support a specific individual, such as a scholar or a religious leader.

- Waqf khidmat al-khalq: This type of waqf is dedicated to serving the community, providing social services, and improving the overall welfare of society.

Management of waqf:

The management of waqf is typically done by a board of trustees or a waqf council appointed to oversee the affairs of the waqf. The trustees are responsible for ensuring that the income or benefits generated from the waqf are used according to the donor’s wishes and the principles of Islam. They also take care of the maintenance and preservation of the waqf property or asset.

Benefits and impact:

Waqf plays a crucial role in Islamic societies by providing sustainable resources for charitable and social purposes. It promotes the values of generosity, compassion, and social responsibility. Waqf assets can generate income that is used to support education, healthcare, and other social services, benefiting both Muslims and non-Muslims alike.

| Benefits of waqf | Impact of waqf |

|---|---|

| 1. Poverty alleviation | 1. Improved access to education |

| 2. Social welfare | 2. Enhanced healthcare services |

| 3. Sustainable funding for religious institutions | 3. Preservation of cultural heritage |

Islamic Banking and Finance Institutions

In the world of Islamic finance, there are several types of institutions that play a crucial role in facilitating Islamic banking and finance transactions. These institutions adhere to the principles of Islamic law, also known as Shariah, which prohibits the charging or payment of interest (riba). Here are some of the key Islamic banking and finance institutions:

- Islamic Banks: These are financial institutions that operate in accordance with Shariah principles. Islamic banks provide services such as accepting deposits, providing financing, and offering investment products that comply with Shariah guidelines. Instead of charging interest, Islamic banks enter into partnerships with their customers, sharing the risks and rewards of the business ventures.

- Takaful Companies: Takaful is a form of Islamic insurance based on the principles of mutual cooperation and solidarity. Takaful companies operate as cooperative societies, where members pool their resources to provide protection against risks. The premiums paid by the participants are used to build a fund that is utilized to compensate for any loss suffered by the covered individuals.

- Islamic Investment Banks: Islamic investment banks provide Shariah-compliant investment services, including advisory, underwriting, and asset management. These institutions offer investment products that are structured to comply with Islamic principles, ensuring that investments are made in permissible activities and avoiding prohibited sectors such as alcohol, gambling, and pork.

- Islamic Development Banks: Islamic development banks are financial institutions that focus on providing financial support for development projects in Muslim countries. These banks provide loans on non-interest terms and offer technical assistance to promote economic development in line with Shariah principles.

Furthermore, regulatory bodies such as central banks and financial regulators in Muslim-majority countries also play a crucial role in overseeing and regulating Islamic banking and finance institutions. These bodies ensure compliance with Shariah principles, monitor risk management practices, and promote the growth and stability of the Islamic finance industry.

Overall, Islamic banking and finance institutions provide an alternative financial system based on ethical principles and adherence to Shariah guidelines. These institutions have gained global recognition and continue to grow as a viable option for individuals and businesses seeking financial services that align with their religious beliefs.

Islamic Banks

Islamic banks are financial institutions that operate in accordance with the principles of Islamic finance. These banks perform their activities in a way that is consistent with Islamic law, known as Shariah. The main difference between conventional banks and Islamic banks is that the latter avoid engaging in interest-based transactions, as interest (riba) is prohibited in Islam.

Islamic banks offer a range of products and services that meet the needs of individuals and businesses while adhering to Islamic principles. One key principle is that Islamic banks share both the profits and losses of their customers instead of charging interest. This concept is known as profit and loss sharing (PLS) or risk-sharing. This means that if a customer takes a loan from an Islamic bank, the bank will also share in the risk, making it more aligned with the customer’s interests.

In addition to avoiding interest-based transactions, Islamic banks also ensure that they only invest in businesses and industries that are permissible under Islamic law. This means that investments in sectors such as alcohol, gambling, and tobacco are strictly prohibited. Instead, Islamic banks focus on sectors such as real estate, infrastructure, and ethical investments that benefit society as a whole.

Islamic banks also offer a variety of Shariah-compliant financial products, including Islamic mortgages (known as Murabaha), Islamic car financing (known as Ijarah), and Islamic credit cards. These products are structured in a way that follows Islamic principles and avoids interest-based transactions.

Furthermore, Islamic banks play an important role in the development of Islamic finance globally. They promote financial inclusion by providing services to individuals and businesses who may prefer to operate in accordance with Islamic principles. Islamic banks also contribute to the growth of the Islamic finance industry by participating in sukuk (Islamic bond) issuances, providing Islamic investment products, and actively supporting the development of Islamic financial markets.

In summary, Islamic banks operate in accordance with Islamic principles, avoiding interest-based transactions and investing in permissible industries. They offer a range of Shariah-compliant financial products and contribute to the growth of the Islamic finance industry. Islamic banks play a key role in providing financial services to individuals and businesses who wish to operate in compliance with their religious beliefs.

Islamic Investment Banks

In Islamic finance, investment banks play a crucial role in facilitating financial transactions that comply with Sharia law. These banks provide a range of services such as asset management, investment advisory, capital raising, and financial structuring in accordance with Islamic principles.

Islamic investment banks operate on the basis of a partnership model, where investors’ funds are pooled together to invest in Sharia-compliant assets. These banks engage in various investment activities, including equity investments, real estate investments, and sukuk issuance.

Equity investments are a common practice in Islamic investment banking. Instead of buying shares of a company, Islamic investment banks enter into partnerships with businesses, sharing both profits and losses. This form of investment aligns with the Islamic principle of risk-sharing and prohibits investing in companies involved in activities forbidden in Islam, such as alcohol, gambling, or pork-related businesses.

Real estate investments are another key area of focus for Islamic investment banks. These banks provide financing for real estate projects that comply with Sharia principles, such as avoiding interest-based loans. They often use structures like musharakah (partnership) and ijara (leasing) to finance the acquisition and development of properties.

Sukuk issuance is a unique feature of Islamic investment banking. Sukuk are Islamic bonds that represent ownership in an underlying asset or project. They are structured based on Sharia principles and provide investors with a return on their investment derived from the profits generated by the underlying asset. Islamic investment banks play a vital role in structuring and arranging sukuk issuances for both corporate and government entities.

Islamic investment banks also provide investment advisory services to their clients, helping them select suitable investment opportunities that align with their financial goals and Islamic values. These banks conduct thorough due diligence on potential investments to ensure they comply with Sharia rules and regulations.

In summary, Islamic investment banks are essential entities within the Islamic finance industry. They provide a wide range of services, including asset management, investment advisory, capital raising, and financial structuring, while adhering to the principles of Sharia law. Their participation in equity investments, real estate financing, and sukuk issuance helps to meet the growing demand for Sharia-compliant investment options.

Islamic Funds

Islamic funds, also known as Shariah-compliant funds, are investment funds that follow the principles and guidelines of Islamic finance. These funds abide by the rules and regulations specified in Shariah law, which prohibits certain activities such as charging interest (riba) and investing in businesses related to alcohol, gambling, or pork.

Islamic funds are managed by fund managers who ensure that the investments made on behalf of the investors comply with Shariah law. These fund managers work closely with Shariah scholars who advise on the permissibility of investment opportunities and the compliance of the fund’s activities.

In order to meet the requirements of Islamic finance, Islamic funds may invest in a variety of permissible asset classes such as equities, real estate, sukuks (Islamic bonds), and commodities. However, they must avoid prohibited activities and investments. This means that Islamic funds may not invest in conventional financial institutions, such as those that deal with interest-based transactions.

Islamic funds have become increasingly popular among Muslim investors and also attract non-Muslim investors who are interested in ethical and socially responsible investments. These funds often incorporate environmental, social, and governance (ESG) criteria in their investment decisions in addition to the adherence to Shariah principles.

Investors in Islamic funds benefit from the potential returns generated by the investments, while also adhering to their religious beliefs. These funds offer a way for individuals to grow their wealth in a manner that is socially responsible and in line with their religious values.

Overall, Islamic funds play a significant role in the development of the Islamic finance industry by providing a platform for individuals to invest in a manner that aligns with their religious and ethical beliefs.

Islamic Microfinance Institutions

Islamic microfinance institutions (IMFIs) are organizations that provide financial services in accordance with Islamic principles to support microentrepreneurs and low-income individuals. These institutions aim to address the needs of the financially excluded population who are unable to access conventional financial services due to barriers such as interest-based transactions.

IMFIs operate based on the principles of Islamic finance, which prohibit the charging or payment of interest (riba) and the involvement in activities that are considered haram (prohibited) in Islam, such as gambling or dealing with alcohol. Instead, they offer products and services that align with Islamic principles while promoting financial inclusion and social welfare.

The key features of Islamic microfinance include:

-

Musharakah: This is a type of partnership where the IMFIs provide capital and share the risks and profits of the business with the microentrepreneur.

-

Mudarabah: In this form of partnership, the IMFIs provide the capital, while the microentrepreneur provides the skills and labor. The profits are shared based on pre-agreed ratios, but the losses are solely borne by the IMFIs.

-

Murabahah: This refers to a cost-plus financing arrangement, where the IMFIs purchase an asset on behalf of the microentrepreneur and then sell it to them at an agreed-upon price, which includes a profit margin.

IMFIs also commonly offer other financial products such as Qard al-Hasan (benevolent loans), which are interest-free loans provided to low-income individuals, and Takaful (Islamic insurance), which is a cooperative insurance concept based on mutual assistance and shared responsibility.

Besides providing financial services, IMFIs also emphasize financial education and capacity building to empower their clients and foster sustainable livelihoods. They often offer trainings and workshops on business development, financial management, and Islamic principles in finance.

In conclusion, Islamic microfinance institutions play a vital role in promoting financial inclusion while adhering to Islamic principles. By offering Sharia-compliant financial products and services and focusing on social welfare, these institutions contribute to poverty alleviation and sustainable economic development.

Islamic Financial Regulation and Supervision

In Islamic finance, regulation and supervision play a crucial role in ensuring that financial institutions and transactions adhere to the principles of Shariah law. This helps maintain transparency, fairness, and stability within the Islamic financial system. Here are some key aspects of Islamic financial regulation and supervision:

- Shariah Boards: Islamic financial institutions are required to have a Shariah board composed of Islamic scholars who are experts in Islamic law and finance. These boards are responsible for providing guidance and oversight on the Islamic compatibility of financial products and transactions.

- Legal Framework: Countries with Islamic financial systems have specific legislation in place to regulate Islamic finance. This includes laws related to Islamic banking, takaful (Islamic insurance), sukuk (Islamic bonds), and other Islamic financial instruments. The legal framework ensures that Islamic financial activities are conducted in accordance with Shariah principles.

- Central Bank Regulation: Central banks or monetary authorities play a significant role in regulating and supervising Islamic financial institutions. They are responsible for issuing licenses, setting prudential regulations, and conducting regular inspections to ensure compliance with Shariah principles and financial stability.

- Capital Adequacy: Islamic financial institutions are required to maintain appropriate capital adequacy ratios to support their financial stability and resilience. The ratios are determined based on the specific risk profiles of Islamic banks and are in line with international standards such as the Basel Accords.

- Audit and Reporting: Islamic financial institutions are required to undergo regular audits by independent and qualified auditors to ensure compliance with Shariah principles and financial regulations. They are also required to provide transparent and timely financial reporting to regulators and stakeholders.

- Consumer Protection: Regulatory bodies have a responsibility to protect the interests of customers and investors in Islamic finance. They enforce regulations related to transparency, disclosure, and fair treatment of customers. Dispute resolution mechanisms are also in place to address any conflicts or grievances that may arise.

Overall, Islamic financial regulation and supervision aim to establish a robust and ethical financial system that aligns with Islamic principles. It ensures that Islamic financial institutions operate with integrity, transparency, and accountability, while safeguarding the interests of customers and the stability of the system as a whole.

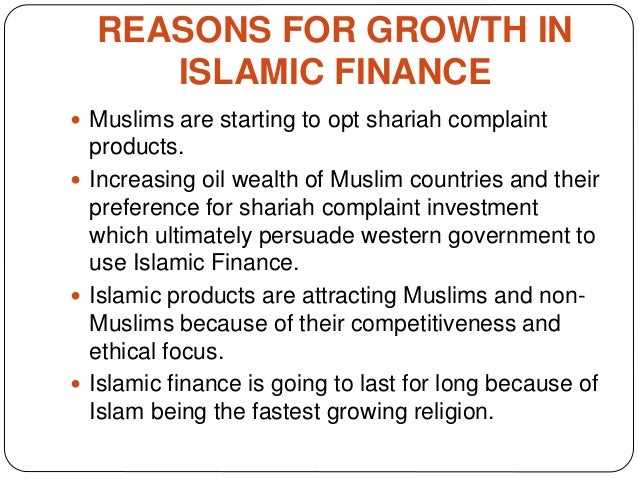

Current Trends in Islamic Finance

Islamic finance has experienced significant growth and evolution in recent years, with several key trends shaping the industry. These trends reflect the changing needs and preferences of both businesses and consumers in the global Islamic finance market.

- Expanding product range: One of the notable trends in Islamic finance is the expansion of product offerings. Traditionally, Islamic finance focused on basic banking products such as Islamic savings accounts and home financing. However, there has been a shift towards more sophisticated products, including Islamic bonds (sukuk), Islamic insurance (takaful), and Islamic mutual funds. This broadening product range caters to the diverse financial needs of individuals and businesses.

- Focus on sustainable and ethical investments: Islamic finance has also embraced the concept of socially responsible investing. With an emphasis on ethical and sustainable investments, Islamic finance institutions have started offering products that comply with Islamic principles while aligning with environmental, social, and governance (ESG) standards. This trend reflects the growing demand for investments that consider both financial returns and societal benefits.

- Digitalization and fintech: Like the broader financial industry, Islamic finance is embracing digitalization and fintech solutions. Islamic banking institutions are adopting online and mobile banking platforms, allowing customers to access their accounts and perform transactions conveniently. Additionally, fintech startups focusing on Islamic finance have emerged, offering innovative solutions such as crowdfunding platforms, robo-advisors, and digital wallets compliant with Shariah principles.

- Internationalization of Islamic finance: Muslim-majority countries have traditionally been the primary markets for Islamic finance. However, there has been a growing interest in Islamic finance from non-Muslim countries. Governments and financial institutions worldwide are recognizing the potential of Islamic finance as an alternative to conventional finance, and they are making efforts to establish Islamic finance hubs and regulatory frameworks to attract international investors and tap into the growing demand for Shariah-compliant products.

These trends in Islamic finance highlight the industry’s adaptability and its ability to cater to the evolving needs and preferences of consumers. As the global Islamic finance market continues to grow, it is expected that new trends will emerge, further shaping the industry and its practices.

FAQ

What is Islamic finance?

Islamic finance is a banking system that is based on the principles of Sharia law, which prohibits the charging or receiving of interest. Instead, it focuses on profit-sharing and asset-backed financing.

How does Islamic finance work?

Islamic finance works by adhering to principles such as sharing risk and reward, avoiding the payment and receipt of interest, and only investing in businesses that are halal (permissible).

What are the key principles of Islamic finance?

The key principles of Islamic finance include the prohibition of interest (riba), the sharing of risk and reward (mudarabah), the avoidance of uncertainty (gharar), and the prohibition of investing in certain industries such as gambling or alcohol.

Can non-Muslims use Islamic finance?

Yes, non-Muslims can use Islamic finance as it is not limited to Muslims. Many people, regardless of their religious beliefs, are attracted to the ethical and transparent nature of Islamic finance.

What are some common financing instruments in Islamic finance?

Some common financing instruments in Islamic finance include musharakah (partnership), mudarabah (investment partnership), murabaha (cost-plus financing), and ijara (leasing).

What is the difference between Islamic finance and conventional finance?

The main difference between Islamic finance and conventional finance is the prohibition of interest in Islamic finance. Instead of charging or paying interest, Islamic finance focuses on profit-sharing and asset-backed financing.

Are there any risks associated with Islamic finance?

Like any financial system, Islamic finance also carries certain risks. These risks include the risk of default, the risk of non-compliance with Sharia principles, and the risk of insufficient regulatory framework in some jurisdictions. However, Islamic finance aims to minimize these risks through its principles and practices.