Insurance quotes are an essential part of the buying process for any type of insurance – whether it’s for your car, home, or even your life. However, many people are surprised to learn that insurance quotes can change daily. This can be frustrating for consumers who are trying to compare prices and find the best deal.

There are several factors that contribute to these daily fluctuations in insurance quotes. One of the main reasons is the constantly changing risk landscape. Insurance companies rely on a variety of data sources to determine the likelihood of a claim, and this data is constantly being updated. For example, if there has been a recent increase in car accidents in your area, it’s likely that insurance rates will also increase to reflect this higher risk.

Another factor that can cause daily changes in insurance quotes is competition among insurance companies. Insurers are constantly monitoring the market and adjusting their rates to stay competitive. If one company lowers their rates, others may follow suit in order to attract customers. This can lead to daily fluctuations in quotes as insurers try to outbid each other.

Finally, changes in your own personal circumstances can also affect your insurance quotes. For example, if you’ve recently had a traffic violation or made a claim, it’s likely that your rates will increase. On the other hand, if you’ve made improvements to your home security or have a good driving record, you may be eligible for discounts that can lower your rates. These changes in personal circumstances can lead to daily fluctuations in insurance quotes as well.

Reasons behind Daily Insurance Quote Fluctuations

Insurance quotes can change on a daily basis due to various factors that influence the risk calculation and pricing process. These factors include:

- Market Conditions: Insurance is a dynamic industry that is affected by market trends and conditions. Fluctuations in the economy, interest rates, and the stock market can impact insurance companies’ financial stability and ability to offer competitive rates.

- Underwriting Guidelines: Insurance companies have specific underwriting guidelines that determine their risk appetite. These guidelines can change over time based on the company’s risk management strategies and market trends. Adjustments in underwriting guidelines can lead to changes in quoted premiums.

- Claims Experience: Insurance companies analyze their claims experience regularly to evaluate the profitability of their insurance policies. An increase in claims or losses can lead to higher premiums as insurers adjust their rates to maintain profitability.

- Competition: The insurance market is highly competitive, with many insurance companies vying for customers. As a result, insurers may adjust their pricing strategies frequently to attract and retain policyholders. Changes in the competitive landscape can cause fluctuations in insurance quotes.

- Policyholder Information: Insurance quotes are personalized based on individual policyholders’ information, such as age, gender, location, driving history, and claims history. Any changes in this information, such as an updated driving record or a change in address, can lead to variations in quoted premiums.

- Insurance Regulation: Insurance is a regulated industry, and changes in regulations can impact insurance pricing. New laws or regulations may require insurers to adjust their rates, resulting in daily fluctuations in insurance quotes.

- Risk Assessment Models: Insurance companies use sophisticated risk assessment models to determine the likelihood of a claim. These models can change over time as insurance companies refine their risk evaluation processes. As a result, the quoted premiums can vary as the risk assessment models evolve.

- External Factors: Events such as natural disasters, pandemics, or other catastrophic events can impact insurance companies’ risk exposure. Insurers may adjust their quotes to account for the increased potential for claims resulting from these events.

It is important for insurance consumers to understand that daily insurance quote fluctuations are a normal part of the insurance industry. To ensure they are getting the best possible coverage and price, it is advisable for policyholders to regularly review their coverage, shop around for quotes, and stay informed about market trends and changes in insurance regulations.

Market Trends and Economic Factors

Insurance quotes can fluctuate daily due to various market trends and economic factors that affect the insurance industry. These factors include:

- Interest rates: When interest rates change, insurance companies may adjust their premiums to reflect the current economic environment. Higher interest rates can increase the cost of borrowing for insurers, which may result in higher premiums for policyholders.

- Inflation: Inflation can impact the cost of goods and services, including medical expenses and car repairs. As these costs rise, insurance companies may need to increase their premiums to cover potential claims. This could lead to higher insurance quotes for policyholders.

- Loss ratios: Insurance companies analyze their loss ratios, which compare the amount of money paid out in claims to the premiums collected. If the loss ratio is higher than expected, insurers may need to adjust their premiums to maintain profitability. This can result in changes to insurance quotes.

- Regional factors: Insurance rates can also vary based on regional factors. For example, areas prone to natural disasters or high crime rates may have higher insurance premiums compared to areas with lower risk.

- Competition: The competitive landscape of the insurance industry can also influence insurance quotes. If a new company enters the market or an existing company adjusts their pricing strategy, it can lead to changes in insurance quotes to remain competitive.

It’s important for consumers to understand that market trends and economic factors can impact insurance quotes. By staying informed about these factors, individuals can make more informed decisions when comparing insurance options and understanding why quotes may change on a daily basis.

Changes in Insurer Risk Assessments

Insurance companies assess risk when providing insurance quotes. This risk assessment helps them determine the likelihood of a claim being made and the potential cost of that claim. Insurers use various factors to evaluate risk, such as the customer’s age, driving history, credit score, the type of property being insured, and previous claim history.

Insurer risk assessments are not static and can change over time due to a variety of factors:

- Market conditions: Insurers may adjust their risk assessments based on changes in the overall market conditions. For example, if there is an increase in the number of claims in a particular area or for a specific type of coverage, insurers may adjust their rates accordingly.

- Claim trends: Insurers monitor claim trends to identify any patterns or changes that may affect their risk assessments. For instance, if there is a spike in car accidents in a certain location, insurers may adjust their rates for auto insurance in that area.

- Underwriting updates: Insurers regularly review and update their underwriting guidelines, which are the rules they follow to evaluate risk. Changes in underwriting guidelines can impact risk assessments and result in fluctuations in insurance quotes.

- Customer data changes: Insurance quotes are based on the information provided by customers. If there are changes or discrepancies in the customer’s data, insurers may need to revise their risk assessment accordingly. For example, if a customer’s driving record shows recent traffic violations, their insurance quote may increase.

- Competitive landscape: The insurance market is competitive, and insurers adjust their rates to remain competitive. If a competitor lowers their rates, other insurers may need to adjust their risk assessments and quotes to remain in line with the market.

It’s important to understand that insurance quotes are not set in stone and can change daily based on these factors. Therefore, it’s always a good idea to periodically review your insurance quotes to ensure you’re still getting the best coverage and rate for your needs.

Fluctuations in Underwriting Guidelines

One of the main reasons why insurance quotes change daily is due to fluctuations in underwriting guidelines. Underwriting guidelines are the criteria that insurance companies use to assess risk and determine the pricing for policies. These guidelines can vary from insurer to insurer and can also change over time, leading to fluctuations in quotes.

When underwriting guidelines change, it can affect the risk assessment of certain factors and result in different prices for insurance policies. For example, an insurance company may decide to increase the premium for policies covering certain high-risk areas or industries. This decision could be based on changes in the frequency or severity of claims in those areas or industries.

Similarly, changes in underwriting guidelines can also impact individual policyholders. Factors such as age, driving record, credit score, and claims history are typically considered when determining insurance rates. If an insurer updates their underwriting guidelines to place more emphasis on certain factors, it could result in higher or lower premiums for individuals who fall into those categories.

In addition to changes in risk assessment, underwriting guidelines can also be influenced by external factors such as changes in regulations or market conditions. For example, if new laws or regulations are implemented that affect insurance coverage or pricing, insurance companies may need to adjust their underwriting guidelines accordingly.

Fluctuations in underwriting guidelines can make it challenging for insurance shoppers to predict or compare quotes. The same individual or property could receive different quotes from different insurers or even from the same insurer on different days based on the insurers’ underwriting guidelines at that time.

It’s important for insurance shoppers to regularly review their quotes and understand the factors that can cause fluctuations. By staying informed about changes in underwriting guidelines and comparing quotes from multiple insurers, individuals can better navigate the dynamic insurance market and find the coverage that best suits their needs and budget.

Insurance Claim Trends and Costs

Insurance claim trends and costs play a crucial role in determining insurance quotes and their daily fluctuations. Understanding these trends can help insurance companies assess the risks associated with specific coverage types and set appropriate premiums.

1. Increasing Claim Costs:

The cost of insurance claims has been on the rise due to various factors. One significant factor is the increasing costs of medical care and treatment. As medical technology advances, healthcare expenses have skyrocketed, impacting the cost of insurance claims for medical treatments and surgeries.

Additionally, the rising cost of automobile repairs and parts has also contributed to increasing claim costs. With the increasing complexity of vehicles and the incorporation of advanced technologies, repairing damaged cars has become more expensive.

2. Frequency of Claims:

The frequency of insurance claims also affects insurance quotes. Areas with higher accident rates or higher probabilities of occurrence (e.g., flood-prone regions) will generally have higher insurance premiums. This is because the insurer needs to compensate for the higher likelihood of claims and the potential costs associated with them.

3. Natural Disasters:

Natural disasters such as hurricanes, earthquakes, and wildfires can have a significant impact on insurance claim costs. When such events occur, insurance companies may experience a surge in claims, resulting in increased costs. This can lead to higher insurance quotes in regions prone to natural disasters.

4. Fraudulent Claims:

Fraudulent insurance claims pose a substantial problem for insurance companies. Fraudulent claims contribute to increasing insurance costs as companies need to investigate and combat fraudulent activities. To cover these additional expenses, insurance quotes may be adjusted accordingly.

5. Litigation and Legal Costs:

Litigation and legal costs associated with insurance claims can significantly impact insurance quotes. Expenses related to defending a claim or settling disputes can be substantial. Insurance companies consider these costs when setting their prices, which can lead to daily fluctuations in insurance quotes.

Understanding insurance claim trends and costs is essential for both insurance companies and policyholders. For insurance companies, it helps assess risks and set appropriate premiums, while for policyholders, it provides insights into the factors influencing insurance costs and fluctuations in quotes.

Shifts in Risk Exposure

One of the main reasons why insurance quotes change daily is due to shifts in risk exposure. Risk exposure refers to the level of risk that an insurance company faces when providing coverage to a particular individual or entity. This risk can change over time based on various factors, leading to fluctuations in insurance quotes.

Several factors can contribute to shifts in risk exposure. Some of the most common ones include:

- Claims history: If an individual or entity has a history of making frequent insurance claims, it increases their risk exposure. This is because insurance companies consider them more likely to make future claims, which can lead to higher insurance quotes.

- Changes in personal circumstances: Life events such as getting married, having children, or moving to a new location can impact risk exposure. For example, if someone moves to an area with higher crime rates, their risk of theft or property damage increases, potentially raising their insurance quotes.

- Market conditions: Insurance quotes can also be influenced by market conditions. This includes factors such as changes in the overall economy, increases in medical costs, or shifts in industry-specific risks. These external factors can lead to fluctuations in insurance quotes for both individuals and businesses.

- Insurance company underwriting guidelines: Insurance companies have specific underwriting guidelines that determine the level of risk they are willing to take on. If an insurer revises their underwriting guidelines, it can affect the quotes they offer. For example, if an insurance company decides to reduce coverage for a particular type of risk, it may result in higher quotes for individuals or businesses in that category.

It’s important to note that insurance quotes are not set in stone and can change based on shifts in risk exposure. This is why it’s crucial to regularly review and compare insurance quotes to ensure you are getting the best coverage at an affordable price.

Modifications in Legal and Regulatory Environment

The insurance industry operates within a legal and regulatory framework that is designed to protect policyholders and ensure fair practices. Changes in this environment can have a significant impact on insurance quotes and premiums. The following are some of the key factors in the legal and regulatory environment that can lead to fluctuations in insurance quotes:

- Insurance Legislation and Laws: Changes in insurance legislation and laws can directly affect the cost of insurance. For example, if new regulations require insurers to provide additional coverage or increase the minimum coverage limits, it can result in higher premiums. Similarly, changes in laws related to accident liability or compensation can also impact insurance rates.

- Regulatory Actions and Oversight: Regulatory actions, such as rate reviews and approvals, can influence insurance quotes. Regulatory bodies monitor insurance rates to ensure that they are fair and reasonable. If regulators require insurers to adjust their rates or provide more transparency in pricing, it can lead to changes in insurance quotes.

- Industry Competition: Competition among insurance companies is another factor influenced by the legal environment. Laws and regulations can affect the competitive landscape by promoting or restricting competition. For example, if regulations make it easier for new insurers to enter the market, it can increase competition and potentially result in lower insurance quotes.

- Litigation and Court Decisions: Court decisions can set legal precedents that impact insurance claims and liability. Changes in court interpretations of insurance contracts or accident-related laws can influence how insurance companies assess risks and price their policies. This can lead to fluctuations in insurance quotes.

- Fraud and Claims Abuse: The legal environment also plays a role in addressing insurance fraud and claims abuse. Changes in laws or regulations aimed at combating fraud can impact insurance quotes. For instance, if lawmakers introduce stricter penalties for insurance fraud, it can deter fraudulent activities and potentially result in lower premiums.

- Consumer Protection: Laws and regulations focused on consumer protection can also impact insurance quotes. Measures that enhance consumer rights or require insurers to provide more comprehensive disclosures can influence pricing. For example, if regulations mandate insurers to disclose all fees and charges upfront, it can lead to more transparent pricing and potentially affect insurance quotes.

It is essential for insurance companies to stay informed about modifications in the legal and regulatory environment to ensure compliance and respond to changes effectively. Understanding these factors can help individuals make sense of fluctuations in insurance quotes and better navigate the insurance marketplace.

Competition among Insurance Companies

Competition among insurance companies is one of the key factors that can cause insurance quotes to change daily. The insurance market is highly competitive, with numerous companies vying for customers’ business. This competition can lead to fluctuations in insurance quotes as companies adjust their pricing in response to market conditions and their competitors’ offerings.

Insurance companies constantly analyze market trends, monitor their competitors’ pricing strategies, and adjust their rates accordingly. If one company lowers its prices to attract customers, other companies may feel compelled to do the same in order to remain competitive. This dynamic can result in daily changes in insurance quotes as companies strive to gain a competitive edge.

In addition to price competition, insurance companies also compete based on the coverage and services they offer. They may introduce new features or discounts to attract customers and differentiate themselves from their competitors. For example, one company may introduce a new coverage option for a specific type of property, prompting other companies to consider similar offerings.

Insurance companies also compete for customers by investing in technology and improving their online platforms. They aim to provide a smooth and user-friendly experience for customers seeking insurance quotes or managing their policies. The introduction of new technology or enhanced online capabilities can result in changes to insurance quotes as companies factor in the cost of these investments.

Another factor that contributes to competition among insurance companies is changes in the overall economic landscape. Economic fluctuations, such as changes in interest rates or the cost of materials, can impact insurance companies’ operating costs. In order to remain profitable, companies may adjust their pricing accordingly, leading to fluctuations in insurance quotes.

Overall, the competition among insurance companies is a major driver of daily fluctuations in insurance quotes. Companies constantly monitor market conditions and their competitors’ offerings, adjusting their rates and coverage options to attract customers. This competitive environment can benefit consumers by providing them with a range of options and the opportunity to secure the best insurance quote for their needs.

Adjustments in Customer Demographics

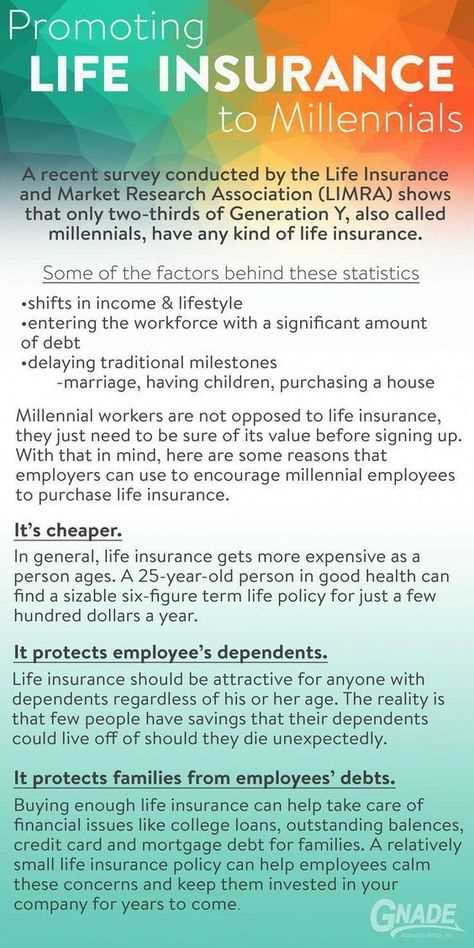

Insurance quotes can fluctuate daily due to adjustments in customer demographics. Insurance companies take into account various demographic factors when determining the cost of a policy, and changes in these factors can lead to changes in the quotes provided.

1. Age:

Age is an important demographic factor that affects insurance quotes. Younger drivers, for example, may be considered higher risk due to their relative lack of driving experience. As a result, insurance quotes for young drivers can be higher compared to older and more experienced drivers.

2. Gender:

Gender may also play a role in determining insurance quotes. Historically, males have been considered higher risk when it comes to driving and may be quoted higher premiums compared to females. However, this varies by location and insurance company, as some jurisdictions have implemented regulations prohibiting gender-based pricing.

3. Location:

The location where a customer resides can impact insurance quotes. Urban areas may have higher rates due to increased traffic congestion and higher chances of accidents. Additionally, areas prone to severe weather events or higher crime rates may also result in higher insurance quotes.

4. Driving Record:

A customer’s driving record is a significant factor considered by insurance companies. Those with a history of accidents or traffic violations may face higher insurance quotes due to being considered higher-risk drivers. On the other hand, individuals with a clean driving record may be eligible for lower quotes.

5. Vehicle Type:

The type of vehicle being insured can impact insurance quotes. High-performance sports cars or luxury vehicles may have higher insurance costs compared to sedans or minivans. The cost of repairs, likelihood of theft, and safety ratings are among the factors taken into consideration.

6. Coverage Options:

The level of coverage and additional options chosen by a customer can also affect insurance quotes. Customers looking for comprehensive coverage with additional benefits may have higher quotes compared to those opting for minimum coverage. The deductible amount and other policy features can also influence the overall cost.

Conclusion:

Insurance quotes are not static and can change daily due to adjustments in customer demographics. Age, gender, location, driving record, vehicle type, and coverage options are some of the demographic factors that contribute to these fluctuations. It’s essential for customers to regularly review their insurance quotes to ensure they are getting the best possible coverage at a fair price.

Question and answer:

Why do insurance quotes change daily?

Insurance quotes can change daily due to various factors, such as changes in the insurance market, updated risk assessments, and adjustments in the insurance company’s underwriting guidelines. Additionally, external factors like economic conditions, weather events, and new regulations can also impact insurance quotes.

What are some factors that can cause fluctuations in insurance quotes?

There are several factors that can cause fluctuations in insurance quotes. These include changes in the insurance company’s claims experience, modifications in the policyholder’s personal circumstances (such as age, marital status, or credit score), advancements in technology and data analysis leading to more accurate risk assessments, and shifts in the overall demand and supply of insurance in the market.

Is it normal for insurance quotes to change frequently?

Yes, it is normal for insurance quotes to change frequently. Insurance companies constantly evaluate and reassess their risks and pricing models. Market conditions, such as the availability and cost of reinsurance, also play a role in determining insurance quotes. Therefore, it is not uncommon for insurance quotes to change on a daily basis.

Can I lock in an insurance quote to avoid daily fluctuations?

In some cases, insurance companies offer the option to lock in a quote for a specific period of time, known as rate locking. This can help policyholders avoid daily fluctuations in insurance quotes. However, rate locking may come with certain conditions and may not be available for all types of insurance policies. It is best to check with the insurance company directly to see if rate locking is an option.

What can I do if the insurance quote increases significantly?

If your insurance quote increases significantly, there are a few things you can do. First, you can shop around and compare quotes from different insurance companies to see if you can find a better rate. Additionally, you can review your coverage options and consider adjusting your policy to align with your budget and needs. It may also be helpful to reach out to your insurance agent or broker to discuss the reasons for the increase and explore any potential discounts or savings opportunities.