Islamic banking has gained significant attention globally due to its unique principles and benefits. With an estimated 1.8 billion Muslims worldwide, Islamic banking offers a financial system that aligns with the teachings of Islam. Instead of charging interest, Islamic banks operate on the principles of profit-sharing and risk-sharing, which promote economic justice and stability.

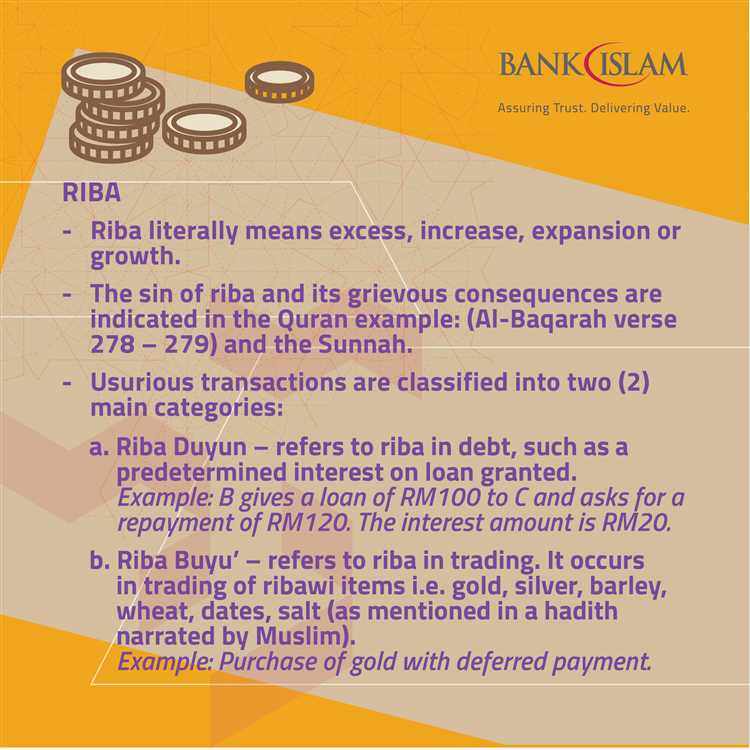

One of the core principles of Islamic banking is the prohibition of riba (interest). According to Islamic teachings, making money through interest is considered usury and is prohibited. Islamic banks offer financial products and services that are compliant with this principle, ensuring that customers can engage in financial transactions without compromising their religious beliefs.

In addition to the prohibition of interest, Islamic banking operates on the principle of risk-sharing. Instead of the lender assuming all the risk, Islamic banks share the risk with the borrower, promoting fairness and accountability. This not only encourages responsible borrowing and lending practices but also fosters a sense of partnership between the bank and its customers.

Islamic banking also places a strong emphasis on ethical and socially responsible investments. Islamic finance screens investments to ensure they comply with Islamic values and do not involve industries such as gambling, alcohol, or pork-related products. This ethical approach to finance resonates with individuals who prioritize socially responsible investing.

Islamic banking provides a financial system that is not only compliant with Islamic principles, but also promotes economic justice, fairness, and ethical investing. By offering profit-sharing and risk-sharing models, Islamic banking encourages responsible borrowing and lending practices. As the global Muslim population continues to grow, Islamic banking has emerged as a viable alternative to conventional banking, offering individuals and businesses the opportunity to engage in financial transactions that align with their religious values.

Why Islamic Banking

Islamic banking is a financial system that operates according to Islamic law, known as Shariah. It is based on the principles of fairness, transparency, and ethical behavior. Islamic banking avoids interest (riba) and prohibits investments in businesses that are considered haram (forbidden). Instead, it focuses on ethical investments that are beneficial to society and the economy as a whole.

There are several reasons why individuals and institutions choose Islamic banking:

- Compliance with Shariah: For Muslims, adhering to Shariah principles is of utmost importance. Islamic banking provides a banking and financial system that is in line with their religious beliefs and values.

- Ethical Investment: Islamic banking encourages ethical investment practices. It prohibits investments in sectors such as alcohol, gambling, and weapons manufacturing. Instead, it promotes investments in sectors that contribute to the well-being of society, such as healthcare, education, and renewable energy.

- Shared Risk and Profit: Islamic banking operates on the concept of shared risk and profit. Islamic financial institutions are partners in their customers’ ventures, sharing both the risks and rewards. This encourages a more equitable distribution of wealth and reduces the chances of exploitation.

- Financial Stability: Islamic banking focuses on asset-backed transactions and avoids speculation and excessive risk-taking. This approach promotes financial stability and reduces the likelihood of financial crises. It encourages responsible lending and discourages excessive debt.

- Social Justice: Islamic banking aims to foster social justice and equality. It provides financial services to underprivileged individuals and encourages the redistribution of wealth. It prioritizes the needs of society over individual profit-making.

Overall, Islamic banking offers a banking and financial system that aligns with Islamic principles, promotes ethical practices, and contributes to the well-being of society. It provides an alternative to conventional banking and has gained popularity worldwide for its fairness and transparency.

Understanding the Principles

Islamic banking operates under the principles of Sharia, which is the Islamic law derived from the Quran and the teachings of Prophet Muhammad. These principles serve as the foundation for the ethical and moral framework of Islamic finance.

1. Prohibition of Interest: One of the key principles of Islamic banking is the prohibition of interest or usury (riba). Instead, profit is generated through the sharing of risks and rewards in business transactions.

2. Prohibition of Gambling: Islamic banking also prohibits any form of speculative or gambling activities. It emphasizes the concept of fair trade and discourages excessive risk-taking.

3. Prohibition of Uncertainty (Gharar): Islamic finance avoids uncertainty and ambiguity in contracts. All parties involved must have a clear understanding of the terms, conditions, and potential outcomes of the business transaction.

4. Ethical Investments: Islamic banking follows strict ethical guidelines when it comes to investments. It avoids investments in industries that are considered haram (forbidden), such as alcohol, gambling, pork, and weapons.

5. Sharing of Profit and Loss: Islamic banks operate on the principle of risk-sharing. In Islamic finance, the bank and the customer share both profits and losses in a business transaction. This promotes a fair and equitable distribution of wealth.

6. Asset-Backed Financing: Islamic banks focus on asset-backed financing, where assets are used as collateral for loans. This promotes more responsible lending practices and reduces the risk of financial crises.

7. Social Responsibility: Islamic banking places a strong emphasis on social welfare and community development. It encourages the concept of philanthropy and promotes financing projects that benefit society as a whole.

Understanding the Benefits

Islamic banking offers several benefits compared to conventional banking systems. These benefits can be categorized into the following areas:

-

Ethical and moral principles:

Islamic banking operates based on ethical and moral principles that promote fairness, justice, and the avoidance of exploitation. This includes prohibiting investments in activities that are considered haram (forbidden) in Islam, such as gambling, alcohol, and interest-based transactions.

-

Shared risk and profit:

In Islamic banking, transactions are based on shared risk and profit between the bank and the customer. This promotes a more equitable and balanced relationship, as both parties have a stake in the outcome of the investment. Unlike conventional banks, Islamic banks do not charge fixed interest rates on loans or deposits.

-

Financial stability:

Islamic banking systems are designed to be more stable compared to conventional banking systems. This is because Islamic banks avoid speculative and risky investments, focusing instead on real economic activities that generate tangible value. The avoidance of excessive leverage and complex financial products also contributes to financial stability.

-

Social responsibility:

Islamic banking encourages socially responsible investments that have a positive impact on society. Islamic banks often prioritize funding projects in sectors such as healthcare, education, renewable energy, and affordable housing, which contribute to the well-being and development of communities.

-

Greater financial inclusion:

Islamic banking promotes greater financial inclusion by offering Sharia-compliant financial products and services to a wider range of individuals and businesses. This includes Muslims who prefer banking in accordance with their religious beliefs, as well as non-Muslims who are attracted to the ethical and responsible nature of Islamic banking.

Overall, Islamic banking provides a unique alternative to conventional banking systems, offering a range of benefits that align with the principles of fairness, justice, and responsible finance. As more individuals and institutions become aware of these benefits, the popularity and growth of Islamic banking continue to increase globally.

The Importance of Ethical Finance

Ethical finance, also known as socially responsible investing, plays a crucial role in the global financial system. It is a practice that aligns financial decisions with ethical values and principles, promoting sustainable and responsible economic development.

There are several reasons why ethical finance is important:

- Social Impact: Ethical finance focuses on investing in projects and companies that have a positive social impact. These investments can contribute to areas such as renewable energy, affordable housing, healthcare, and education. By supporting socially responsible initiatives, ethical finance helps address social and environmental issues and promotes a more inclusive society.

- Environmental Sustainability: Ethical finance considers the impact of investments on the environment. It promotes investments in sustainable businesses that take measures to minimize their carbon footprint, conserve natural resources, and support eco-friendly practices. By channeling funds towards environmentally conscious projects, ethical finance contributes to the global efforts of mitigating climate change and preserving the planet.

- Transparency and Accountability: Ethical finance emphasizes transparency and accountability in financial transactions. It promotes responsible lending practices, fair trade principles, and ethical corporate governance. By encouraging transparency and accountability, ethical finance helps prevent fraud, corruption, and unethical behavior, thus contributing to a more trustworthy and reliable financial system.

- Fulfillment of Religious Principles: Ethical finance is important for individuals and communities who seek to align their financial activities with their religious beliefs. Islamic finance, for example, follows the principles of Shariah, which prohibits usury (interest) and promotes risk-sharing and ethical investments. By offering ethical financial products and services, Islamic finance provides a viable alternative for those who want to adhere to their religious principles while participating in the global economy.

- Long-Term Stability: Ethical finance promotes long-term stability in the financial system. By investing in sustainable projects and companies, it helps create a more resilient economy that is less vulnerable to economic, social, and environmental shocks. Ethical investments prioritize the long-term well-being of society and future generations, rather than focusing solely on short-term profits.

In conclusion, ethical finance plays a vital role in promoting social and environmental sustainability, enhancing transparency and accountability, fulfilling religious principles, and ensuring long-term stability. By incorporating ethical values into financial decisions, individuals, businesses, and communities can contribute to a more equitable and sustainable global financial system.

How Islamic Banking Differs from Conventional Banking

Islamic banking differs from conventional banking in several important ways. While both types of banking involve financial transactions and services, Islamic banking operates based on the principles of Shariah or Islamic law.

1. Interest (Riba)

In Islamic banking, the charging or payment of interest (riba) is strictly prohibited. This is because Islam views interest as exploitative and unjust. Instead, Islamic banks focus on profit-sharing and partnership arrangements to generate income.

2. Prohibition of Speculation (Gharar)

Islamic banking also prohibits transactions that involve excessive uncertainty or speculation (gharar). This means that Islamic banks are not allowed to engage in speculative financial activities or investments. Instead, they focus on tangible assets and real economic activities.

3. Prohibited Activities

Islamic banking forbids involvement in activities that are considered unethical or prohibited in Islam, such as gambling, alcohol, pork, and other forbidden practices. This ensures that Islamic banks operate in accordance with Islamic values and principles.

4. Profit and Loss Sharing

In Islamic banking, the concept of profit and loss sharing (PLS) is a fundamental principle. Instead of fixed interest rates, Islamic banks enter into partnerships with customers and share the profits and losses resulting from their investments or financing activities.

5. Social and Ethical Considerations

Islamic banking takes into account social and ethical considerations in its operations. Islamic banks are expected to promote social justice, equity, and fair distribution of wealth. This means that they prioritize financing projects and businesses that have positive social impact and adhere to ethical standards.

6. Transparency and Disclosure

Islamic banking emphasizes transparency and disclosure to ensure that customers are fully informed about the nature of their transactions. This includes providing clear information about the terms and conditions, risks, and returns associated with their investments or financing arrangements.

7. Governance and Supervision

The governance and supervision of Islamic banks are guided by the principles of Shariah and are overseen by Shariah boards or supervisory boards comprising Islamic scholars. This ensures that the operations of Islamic banks are compliant with Islamic principles and that they adhere to ethical standards.

Overall, Islamic banking offers an alternative model of financial services that aligns with the principles and values of Islam. By operating based on profit-sharing, ethical considerations, and transparency, Islamic banking aims to promote economic prosperity while adhering to religious and social principles.

Interest-Free Banking: A Closer Look

Interest-free banking, also known as Islamic banking, is a system of banking that operates in accordance with Islamic law (Shariah). Shariah prohibits the charging or paying of interest, as it is considered usury and exploitative. Instead, Islamic banking operates on the principles of profit-sharing and risk-sharing, promoting ethical and responsible banking practices.

One of the key features of interest-free banking is the absence of traditional loans with interest. Instead, Islamic banks provide financing through partnerships, profit-sharing arrangements, and asset-based transactions. This ensures that both parties share the risks and rewards of the investment, creating a more equitable financial system.

Islamic banks offer a range of financial products and services that comply with Shariah principles. These include Islamic home financing, Islamic car financing, Islamic credit cards, and Islamic investment accounts. Each product is designed to adhere to the principles of fairness, transparency, and social responsibility.

Due to its ethical nature, interest-free banking offers several benefits:

- Equitable Distribution of Wealth: By operating on the principles of profit-sharing and risk-sharing, interest-free banking promotes a more equitable distribution of wealth. This helps to reduce income inequality and create a more just society.

- Stability and Resilience: Interest-free banking encourages responsible financial practices and discourages excessive speculation. This helps to create a more stable and resilient banking system, reducing the likelihood of economic crises caused by reckless lending and borrowing.

- Focus on Real Economic Activities: Islamic banks prioritize investments in real economic activities that contribute to the development of society. This promotes productive economic growth and discourages speculative investments that can lead to financial instability.

- Emphasis on Ethical and Socially Responsible Practices: Shariah-compliant financial transactions encourage ethical and socially responsible practices. Islamic banks are prohibited from investing in industries that are considered unethical, such as gambling, tobacco, and alcohol.

- Financial Inclusion: Interest-free banking aims to provide financial services to all segments of society, including those who may be excluded from the conventional banking system. This helps to promote financial inclusion and economic empowerment.

In conclusion, interest-free banking, or Islamic banking, offers a unique and ethical approach to finance. By operating on the principles of profit-sharing and risk-sharing, it promotes equity, stability, and social responsibility. With its focus on real economic activities and ethical practices, interest-free banking provides a viable alternative to conventional banking systems.

The Role of Shariah Law in Islamic Banking

Shariah law plays a central role in Islamic banking as it provides the framework for the ethical and moral principles that govern the industry. Islamic banking operates according to the principles of Shariah law, which is derived from the Quran and the Hadiths, the teachings and practices of the Prophet Muhammad.

One of the key principles of Shariah law that distinguishes Islamic banking from conventional banking is the prohibition of riba, or interest. In Islamic banking, the charging or payment of interest is considered usury and is strictly forbidden. Instead, Islamic banks operate on the basis of profit-sharing and risk-sharing arrangements. They provide financial services and products that comply with Shariah law and are based on ethical and socially responsible principles.

Another important principle of Shariah law in Islamic banking is the prohibition of uncertainty or gambling. Islamic banks are not allowed to engage in speculative transactions or investments that involve excessive uncertainty or gambling. They are required to provide financing for assets or projects that have clear economic and social benefits, and to avoid investments in sectors or activities that are deemed harmful or non-compliant with Islamic principles.

Furthermore, Shariah law also governs the concept of fairness and justice in Islamic banking. Islamic banks are required to ensure that their transactions and contracts are fair and equitable to all parties involved. They are not allowed to exploit or take unfair advantage of their customers or engage in any fraudulent or deceptive practices. Transparency and accountability are fundamental principles in Islamic banking, and banks are required to disclose all relevant information to their customers.

Overall, the role of Shariah law in Islamic banking is to provide a comprehensive and holistic framework that governs the industry and ensures that banking activities are conducted in accordance with ethical and moral principles. It ensures that Islamic banks operate in a manner that is fair, transparent, and socially responsible, and that they contribute to the development and prosperity of society.

Overview of Islamic Financial Products

Islamic financial products are designed to adhere to the principles and teachings of Shariah, which is the Islamic law. These principles dictate that financial transactions must be fair, ethical, and in accordance with Islamic teachings. Islamic financial products are grounded in the belief that money should not be used to generate wealth on its own, but rather should be utilized to facilitate productive economic activities that benefit society as a whole.

Here are some of the key Islamic financial products:

- Murabaha: This is a type of sale transaction where the seller discloses the cost of goods and adds an agreed-upon profit margin. The buyer then agrees to pay this total amount over a specified period of time.

- Mudarabah: This is a partnership contract where one party provides the capital (rab al-maal) and the other party provides the labor and expertise (mudarib). Profits are shared based on a pre-agreed ratio, while losses are borne by the capital provider.

- Ijara: This is a leasing contract where the lessor owns the asset and leases it to the lessee for a specified period of time and amount of rent. At the end of the contract, ownership of the asset can be transferred to the lessee or extended for another lease term.

- Sukuk: Also known as Islamic bonds, sukuk are financial instruments that represent ownership of an underlying asset or project. The returns to the sukuk holders are derived from the profits generated by the asset or project.

- Takaful: This is an Islamic insurance system based on the principles of mutual cooperation and collective responsibility. Participants contribute premiums to a common fund, which is used to provide coverage and benefits in the event of a loss.

In addition to these products, there are also Islamic financial institutions that offer various banking services, such as current accounts, savings accounts, and investment accounts. These institutions operate in accordance with Shariah principles and provide an alternative to conventional banking for individuals and businesses who wish to adhere to Islamic values.

Overall, Islamic financial products offer a unique and ethical alternative to conventional financial products. They promote fairness, justice, and social responsibility, while also providing financial solutions that cater to the specific needs and values of Muslim individuals and communities.

Investment Opportunities in Islamic Banking

Islamic banking offers a wide range of investment opportunities that align with the principles and values of Islamic finance. These investment opportunities cater to individuals and institutions looking to invest their money in a Halal and ethical manner.

One of the key investment opportunities in Islamic banking is the concept of Mudarabah. Mudarabah is a partnership-based contract in which one party provides the capital (Rabb-ul-maal) and the other party provides the expertise and management (Mudarib). The profits generated from the investment are shared between the two parties according to a pre-agreed ratio. This investment opportunity allows individuals and institutions to invest their money in business ventures without engaging in interest-based transactions.

Another investment opportunity in Islamic banking is the concept of Sukuk. Sukuk is an Islamic financial instrument that represents a proportional beneficial ownership in underlying tangible assets or a pool of assets. It functions like a bond, providing investors with periodic income based on the performance of the underlying assets. Sukuk can be an attractive investment option for those looking for stable and Sharia-compliant returns.

In addition to Mudarabah and Sukuk, Islamic banking also offers investment opportunities in the form of Musharakah and Takaful. Musharakah is a partnership-based contract in which multiple parties pool their financial resources to invest in a particular project. Takaful, on the other hand, is an Islamic insurance concept that allows individuals and businesses to protect themselves against potential risks in a Sharia-compliant manner. Both Musharakah and Takaful provide investors with the opportunity to participate in profit-sharing arrangements while adhering to Islamic principles.

Furthermore, Islamic banks also provide investment opportunities in the areas of real estate, agriculture, and commerce. These investments are structured in a way that ensures compliance with Islamic principles, such as avoiding interest-based transactions and promoting shared profits and risks.

Overall, Islamic banking offers a diverse range of investment opportunities that cater to the needs and values of individuals and institutions looking for ethical and Halal investment options. Whether it’s through Mudarabah, Sukuk, Musharakah, Takaful, or other investment avenues, Islamic finance provides investors with the opportunity to grow their wealth while adhering to Islamic principles.

Islamic Microfinance: Empowering the Underprivileged

Microfinance is an essential tool for economic development, providing financial services to low-income individuals and small businesses who lack access to traditional banking services. Islamic microfinance takes this concept a step further by incorporating the principles of Islamic finance, which are rooted in ethical and moral values.

One of the core principles of Islamic microfinance is the prohibition of interest, known as riba. Instead of charging interest on loans, Islamic microfinance institutions utilize a profit-sharing model, where both the lender and the borrower share the risks and rewards of the investment.

This profit-sharing approach ensures that the borrower is not burdened with excessive debt and promotes a more equitable and sustainable financial system. It also encourages borrowers to use the funds for productive purposes, such as starting a small business or investing in education, rather than being trapped in a cycle of debt.

Another principle of Islamic microfinance is the concept of zakat, which is a mandatory charitable contribution in Islam. Islamic microfinance institutions often allocate a portion of their profits to support charitable initiatives and social welfare programs, benefiting not only the individual borrowers but also the broader community.

Islamic microfinance has proven to be particularly effective in empowering women, who often face significant barriers in accessing traditional financial services. By providing them with access to funding and financial literacy programs, Islamic microfinance institutions enable women to become financially independent, start their own businesses, and support their families.

Furthermore, Islamic microfinance institutions prioritize ethical investments and encourage borrowers to engage in socially responsible practices. For example, funds may be provided for environmentally friendly projects or businesses that adhere to fair trade principles.

In conclusion, Islamic microfinance offers a unique and inclusive approach to financial services, empowering the underprivileged and promoting economic development. By integrating Islamic principles into microfinance practices, it creates a more just and ethical financial system that benefits individuals, communities, and society as a whole.

Islamic Banking and Sustainable Development

Islamic banking, with its core principles based on ethical and responsible practices, has emerged as a potential driver for sustainable development. It offers an alternative financial system that aligns with the principles of social justice, fairness, and environmental sustainability.

One of the key principles of Islamic banking is the prohibition of interest or usury (riba). This principle eliminates the exploitative nature of traditional banking practices, where lenders earn interest on loans regardless of the financial well-being of the borrower. In Islamic banking, financial transactions and investments must be based on tangible assets or activities that generate real value for society.

This fundamental principle of Islamic banking promotes responsible lending and investment practices, which can contribute to sustainable development. Islamic banks conduct thorough due diligence to ensure that the projects they finance are socially responsible, environmentally friendly, and economically viable. This helps prevent investments in industries that harm the environment or exploit vulnerable communities.

Additionally, Islamic banking promotes profit and loss sharing (mudarabah and musharakah), where both the bank and the customer share the risks and rewards of an investment. This encourages a more equitable distribution of wealth and fosters an inclusive financial system that empowers individuals and small businesses.

Furthermore, Islamic banking encourages ethical and socially responsible investments (SRI). Funds deposited in Islamic banks are invested in industries that are in line with Islamic principles, such as halal food production, renewable energy, and affordable housing projects. This enables customers to support sustainable and responsible businesses, while simultaneously earning a return on their deposits.

In conclusion, Islamic banking’s emphasis on ethical and responsible practices makes it well-suited to drive sustainable development. By promoting social justice, fairness, and environmental sustainability, Islamic banking offers a viable alternative to traditional banking that can contribute to a more equitable and sustainable world.

Islamic Banking and Financial Inclusion

Financial inclusion, the ability for individuals and communities to access and use financial services, is a crucial aspect of economic development. In many parts of the world, including Muslim-majority countries, a significant portion of the population remains unbanked or underbanked.

Islamic banking, with its principles rooted in ethical and Sharia-compliant practices, has the potential to contribute to greater financial inclusion. Here are some ways in which Islamic banking promotes financial inclusion:

- No interest-based transactions: Islamic banking operates on the principle of avoiding interest-based transactions, as interest is considered usury in Islam. This eliminates the barriers faced by individuals who are opposed to participating in conventional banking due to religious or ethical reasons.

- Profit-sharing: Instead of charging interest on loans, Islamic banks utilize profit-sharing contracts, such as Mudarabah and Musharakah. This allows individuals to access financing without the burden of interest payments.

- Focus on real economic activities: Islamic banking emphasizes investment in real economic activities, such as trade and entrepreneurship, rather than speculative activities. This approach encourages the development of productive assets and supports economic growth, benefiting individuals and communities.

- Financial products for the unbanked: Islamic banks offer tailored financial products to cater to the needs of underserved populations, particularly those in rural areas or low-income communities. Products such as microfinance and microtakaful provide access to basic financial services, empowering individuals to save, invest, and protect themselves against unexpected events.

Furthermore, Islamic banking institutions often adopt a participatory and community-oriented approach, prioritizing the financing of socially responsible projects and initiatives. This helps in addressing the financial needs of marginalized groups and promoting sustainable development.

In conclusion, Islamic banking promotes financial inclusion by providing accessible and inclusive financial services to individuals and communities. By adhering to ethical principles and Sharia-compliant practices, it offers an alternative and inclusive banking system that caters to the diverse needs of people, regardless of their religious beliefs.

The Growth of Islamic Banking Worldwide

In recent years, Islamic banking has experienced significant growth on a global scale. This growth can be attributed to several factors, including increased demand from the Muslim population, the economic stability of Islamic banking systems, and the ethical principles that underpin Islamic finance.

One of the main drivers behind the growth of Islamic banking is the increasing demand from the Muslim population. Islamic banking adheres to the principles of Shariah law, which prohibits the charging or paying of interest (riba) and prohibits investing in industries that are considered unethical or haram, such as alcohol, gambling, and pork. As a result, Muslims who wish to follow these principles are turning to Islamic banks as a viable alternative to conventional banks.

Another factor contributing to the growth of Islamic banking is the stability of Islamic banking systems. Islamic banks operate based on a profit-sharing model, where the bank and its customers share the profits and losses of a venture. This model encourages transparency and accountability, which in turn helps to mitigate the risks associated with traditional banking practices. As a result, Islamic banks have proven to be more resilient to financial crises and have maintained their stability even during times of economic downturn.

Furthermore, the ethical principles that underpin Islamic finance have also played a significant role in the growth of Islamic banking. Islamic banking promotes ethical business practices and encourages fair wealth distribution. It emphasizes the importance of social responsibility and discourages excessive risk-taking and speculation. These ethical principles have resonated with many individuals and businesses, leading them to choose Islamic banking as a more ethical and socially responsible option.

The growth of Islamic banking is not limited to Muslim-majority countries. In recent years, many conventional banks in non-Muslim majority countries have also started offering Islamic banking services to cater to the increasing demand from Muslim customers. This expansion has allowed Islamic banking to reach a wider audience and has further contributed to its global growth.

In conclusion, the growth of Islamic banking worldwide can be attributed to the increasing demand from the Muslim population, the stability of Islamic banking systems, and the ethical principles that underpin Islamic finance. As more individuals and businesses recognize the benefits of Islamic banking, its growth is expected to continue in the years to come.

The Future of Islamic Banking

The future of Islamic banking looks promising, with continued growth and widespread adoption expected. Several factors contribute to this positive outlook:

- Increasing Demand: The global Muslim population is growing rapidly, with a projected increase to 2.2 billion by 2030. This will lead to a higher demand for Islamic financial services, including banking.

- Ethical and Responsible Banking: Islamic banking principles align with the growing trend of socially responsible investment. With a focus on ethical practices and avoiding interest-based transactions, Islamic banks are attractive to individuals and institutions who seek ethical banking options.

- Financial Stability: Islamic banks have shown resilience during global financial crises. Their avoidance of speculative activities and excessive leverage has helped them maintain stability. This track record makes them a preferred choice for risk-averse investors.

- Innovation: Islamic banks are embracing technology and innovation to enhance their services. Digital banking, mobile apps, and other technological advancements are being integrated into Islamic banking operations to provide convenient and secure financial solutions.

- Global Recognition and Support: Islamic finance has gained recognition and support from international organizations, governments, and regulatory bodies. This recognition has led to the establishment of regulatory frameworks and the inclusion of Islamic finance products in mainstream markets.

- Diversification: Islamic banks are expanding their product offerings beyond traditional banking services. They are venturing into areas such as asset management, insurance, and capital markets, providing a wider range of options to customers.

Overall, the future of Islamic banking looks promising as it continues to meet the financial needs of Muslim individuals and institutions while attracting those seeking ethical and responsible banking options. With the increasing demand, support from various stakeholders, and emphasis on innovation, Islamic banking is set to grow and play an even more significant role in the global financial system.

Islamic Banking and Economic Stability

Islamic banking has gained significant attention in recent years, not only for its adherence to Islamic principles and values, but also for its potential to contribute to economic stability. The principles and practices of Islamic banking promote ethical and responsible lending and investment, which can have a positive impact on the overall stability of a country’s economy.

One of the key principles of Islamic banking is the prohibition of interest, or usury, which is considered unjust and exploitative. Instead, Islamic banks operate on a profit-sharing system, where both the bank and the customer share in the risks and rewards of the investment. This system encourages responsible lending and discourages excessive risk-taking, which can help to prevent financial crises and promote stability in the banking sector.

Furthermore, Islamic banking places a strong emphasis on asset-backed financing and risk-sharing. This means that Islamic banks are required to invest in tangible assets and real economic activities, rather than engaging in speculative practices or financing purely financial transactions. By focusing on real economic activities, Islamic banks contribute to the development of productive sectors of the economy, which can lead to sustainable growth and stability.

In addition, Islamic banking promotes social and economic justice through various mechanisms. For example, zakat, or compulsory charitable giving, is an integral part of Islamic banking. This redistribution of wealth helps to reduce income inequalities and ensures that the less fortunate members of society are supported. By promoting social and economic justice, Islamic banking can contribute to a more stable and inclusive economy.

Furthermore, Islamic banking encourages responsible and ethical behavior in banking and finance. The principles of transparency, fairness, and accountability are emphasized in Islamic banking practices, which can help to prevent fraudulent activities and promote a more secure and trustworthy financial system. This can contribute to overall economic stability by reducing the likelihood of financial scandals and crises.

In conclusion, Islamic banking has the potential to contribute to economic stability through its adherence to ethical and responsible practices. By promoting the principles of profit-sharing, asset-backed financing, social and economic justice, and responsible behavior, Islamic banking can help to prevent financial crises, promote sustainable growth, and create a more stable and inclusive economy.

Islamic Banking and Risk Management

In Islamic banking, risk management plays a crucial role in ensuring compliance with Shariah principles and safeguarding the interests of both the bank and its customers. Islamic banks adopt unique risk management strategies that differ from conventional banking practices.

1. Prohibition of interest (riba)

The principle of interest-free banking eliminates the risk of interest rate fluctuations and ensures that the returns generated from investments are based on the performance of the underlying assets. This eliminates the risk of non-performance caused by interest-related factors, reducing the overall risk exposure of Islamic banks.

2. Asset-backed financing (Musharakah and Mudarabah)

Islamic banks rely on asset-backed financing methods such as Musharakah (partnership) and Mudarabah (profit-sharing) to mitigate the risk involved in lending. By sharing profits and losses with the customers, Islamic banks have a direct stake in the performance of the financed project, ensuring proper risk assessment and management.

3. Prohibition of speculative activities (Gharar)

Islamic banking prohibits transactions that involve extreme uncertainty (gharar) or excessive speculation. This principle helps to eliminate the risk associated with highly speculative activities and ensures that banking operations are conducted in a transparent and prudent manner.

4. Strong ethical standards (Adab and Akhlaq)

Islamic banking emphasizes strong ethical standards in its operations, which helps mitigate the risk of unethical practices. The adherence to moral values and ethical guidelines contribute to the overall risk management framework of Islamic banks.

5. Diversification of portfolio

Islamic banks promote the diversification of their investment portfolio to manage risk effectively. By investing across different sectors and asset classes, Islamic banks reduce their exposure to any single investment and enhance their ability to handle potential fluctuations and uncertainties.

6. Risk sharing and equitable distribution of profits and losses

Islamic banks have a unique risk-sharing model where profits and losses are shared between the bank and the customer. This approach encourages a collaborative approach to risk management, as both parties have a vested interest in the success of the venture.

In conclusion, Islamic banking incorporates a unique set of risk management principles and practices that align with Shariah principles. By avoiding interest-based transactions, promoting ethical standards, and emphasizing risk-sharing, Islamic banks aim to create a more stable and sustainable banking system.

Challenges facing Islamic Banking

1. Lack of Awareness: One of the primary challenges facing Islamic banking is the lack of awareness among the general public. Many people are not familiar with the principles and benefits of Islamic banking, and may not even know that it is an option. This hampers the growth of the industry and limits its potential for expansion.

2. Limited Availability: Islamic banking products and services are not as widely available as conventional banking options. This limited availability can be attributed to various factors, including the lack of infrastructure and the limited number of Islamic banks operating globally. This makes it difficult for individuals and businesses to access Islamic banking facilities, especially in non-Muslim majority countries.

3. Lack of Standardization: Another challenge facing Islamic banking is the lack of standardization in terms of products and contracts. There are different interpretations of Islamic principles and practices, which can lead to confusion and disputes among customers, scholars, and financial institutions. This lack of standardization makes it difficult to establish a unified framework for Islamic banking operations.

4. Risk Management: Islamic banking operates on the principle of profit and loss sharing, which inherently involves higher risks compared to conventional banking. Managing these risks effectively is a challenge for Islamic banks, as they need to ensure compliance with Shariah principles while also safeguarding the interests of their customers and shareholders.

5. Regulatory Challenges: Islamic banks operate under different regulatory frameworks compared to conventional banks. The lack of standardized regulations specific to Islamic banking can create challenges for these institutions, especially in regions where there may be limited expertise and experience in regulating Islamic financial institutions.

6. Technological Infrastructure: In the digital age, Islamic banks face the challenge of keeping up with technological advancements to provide efficient and convenient services to their customers. Developing and maintaining a robust technological infrastructure requires significant investments, which can be a barrier for smaller Islamic banks.

7. Perception and Stereotypes: Islamic banking still faces certain negative perceptions and stereotypes, particularly in non-Muslim majority countries. Some people may view Islamic banking as exclusive to Muslims or associate it with terrorism, which can create barriers to its acceptance and growth in the global financial industry.

In conclusion, while Islamic banking has witnessed significant growth in recent years, it still faces several challenges. These challenges range from lack of awareness and limited availability to lack of standardization and regulatory hurdles. Overcoming these challenges will require collaborative efforts from financial institutions, regulators, and the public to promote and develop the Islamic banking industry.

Regulatory Framework for Islamic Banking

In order to ensure the smooth functioning and stability of Islamic banking, various regulatory frameworks have been put in place by regulatory authorities around the world. These frameworks provide guidelines and rules for Islamic banks to follow in their operations and transactions, in line with Islamic principles.

Islamic banking regulatory frameworks typically cover a range of aspects, including:

- Licensing and Supervision: The regulatory authorities are responsible for issuing licenses to Islamic banks and ensuring that they meet the necessary requirements to operate. They also conduct regular inspections and supervision to ensure compliance with Islamic banking principles and standards.

- Shariah Compliance: Islamic banks are required to establish a Shariah board or committee comprised of Islamic scholars who oversee the bank’s operations and ensure compliance with Islamic principles. The regulatory framework outlines the requirements for the composition and functioning of the Shariah board.

- Disclosure and Reporting: Islamic banks are required to provide clear and transparent information to their customers and stakeholders about their operations and financial performance. The regulatory framework sets out guidelines for financial reporting and disclosure of Shariah compliance.

- Capital Adequacy and Risk Management: The regulatory framework outlines the capital adequacy requirements for Islamic banks, similar to conventional banks. It also provides guidelines for risk management to ensure the soundness and stability of Islamic banks.

- Consumer Protection: The regulatory authorities establish rules and guidelines to protect the interests of customers and ensure fair treatment. This includes regulations on transparency in pricing, disclosure of terms and conditions, and handling of customer complaints.

The regulatory frameworks for Islamic banking differ from country to country, as they are influenced by local legal and regulatory systems. However, they generally aim to provide a robust and effective regulatory framework for Islamic banking operations, ensuring compliance with Islamic principles and safeguarding the interests of stakeholders.

It is important for Islamic banks to adhere to these regulatory frameworks to maintain trust and confidence among customers, investors, and regulators. By doing so, Islamic banks can contribute to the growth and development of the Islamic banking industry and its role in promoting ethical and responsible financial practices.

Case Studies: Successful Implementation of Islamic Banking

Islamic banking has been successfully implemented in several countries around the world, providing a viable alternative to conventional banking. Here are some case studies showcasing the successful implementation of Islamic banking principles:

1. Malaysia:

Malaysia is one of the leading countries in the world when it comes to Islamic banking. It has a well-established Islamic financial system that consists of Islamic banking institutions, Islamic capital markets, and diversified Islamic financial products. The successful implementation of Islamic banking in Malaysia has contributed to the country’s economic growth and attracted investments from both domestic and international markets.

2. United Arab Emirates (UAE):

The UAE is another country that has embraced Islamic banking principles and experienced significant success in its implementation. The Dubai Islamic Bank, one of the largest Islamic banks in the world, was established in 1975 and has played a crucial role in promoting Islamic banking in the UAE. The successful implementation of Islamic banking in the UAE has attracted global investors and positioned the country as a leading Islamic finance hub in the Middle East.

3. Saudi Arabia:

Saudi Arabia, being the birthplace of Islam, holds a significant position in Islamic banking. The country has a well-established Islamic financial system that includes Islamic banks, insurance companies, and financial institutions. The Al Rajhi Bank, one of the largest Islamic banks in the world, operates in Saudi Arabia and has been instrumental in the successful implementation of Islamic banking principles in the country.

4. United Kingdom:

The United Kingdom has also witnessed the successful implementation of Islamic banking principles, catering to the needs of its Muslim population and attracting non-Muslim customers as well. The Islamic Bank of Britain, established in 2004, has played a crucial role in promoting Islamic banking in the country. The UK government has been supportive of Islamic finance, implementing regulatory frameworks to facilitate the growth of Islamic banking institutions and products.

5. Turkey:

Turkey has emerged as a thriving market for Islamic banking, with the government actively promoting and supporting its growth. The country has introduced regulatory reforms and established Islamic banking regulations to facilitate the implementation of Islamic banking principles. Turkish participation banks, such as Turkiye Finans and Albaraka Turk, have been successful in offering Sharia-compliant banking services and products.

These case studies demonstrate the successful implementation of Islamic banking principles in various countries, highlighting the growth and potential of Islamic finance on a global scale.

Islamic Banking: A Solution for Ethical Investments

Islamic banking is a financial system that operates on the principle of Shariah law, which is based on the teachings of the Quran and the Sunnah. It offers a unique solution for individuals and institutions seeking ethical investments that align with their religious beliefs.

One of the key principles of Islamic banking is the prohibition of usury, or charging interest on loans. This is based on the belief that money should not generate money in and of itself, but should only be used as a medium of exchange. Instead, Islamic banks operate on a profit-sharing model, where the lender and the borrower share the profit or loss generated from the investment.

This profit-sharing model promotes fairness and encourages a more equitable distribution of wealth. It prevents the exploitation of individuals and ensures that investments benefit all parties involved. Islamic banks also focus on investing in ethical and socially responsible activities, such as renewable energy, healthcare, and education, while avoiding industries that are prohibited in Islam, such as alcohol, gambling, and pork.

Another principle of Islamic banking is the prohibition of uncertainty, or gharar. This means that investments should be based on tangible assets and real economic activity, rather than speculative or uncertain ventures. Islamic banks carefully assess the feasibility and risk of investment opportunities to ensure that they are in line with this principle.

In addition to these principles, Islamic banking also emphasizes the importance of transparency, accountability, and avoiding interest-based transactions. This promotes a strong sense of trust between the bank and its customers, and encourages responsible financial practices.

Overall, Islamic banking offers a solution for individuals and institutions seeking ethical investments that are in line with their religious beliefs. It promotes fairness, social responsibility, and avoids interest-based transactions. Islamic banking is not only a viable alternative to conventional banking, but also an opportunity for individuals to align their financial choices with their values.

Exploring the Link between Islamic Banking and Islamic Finance

Islamic banking is an integral part of the broader concept of Islamic finance. While Islamic banking refers specifically to the banking activities that adhere to Islamic principles, Islamic finance encompasses a wider range of financial activities that comply with the Islamic law, known as Shariah.

The link between Islamic banking and Islamic finance lies in the shared principles and objectives that guide their practices. Both are based on the belief that financial transactions should be conducted in a manner that is ethical, fair, and just. The principles of Islamic finance emphasize the importance of social welfare, equity, and justice in financial dealings.

In Islamic finance, lending and borrowing money with interest, known as riba, is strictly prohibited. Instead, Islamic banks offer financial products and services that comply with the principles of Shariah. They utilize various financing techniques, such as profit-sharing partnerships (mudarabah), cost-plus financing (murabahah), and leasing (ijara), to provide funds to individuals and businesses.

One of the key aspects of Islamic finance is the concept of risk-sharing. Islamic banks and financial institutions are encouraged to enter into partnerships with their customers, where both parties share the risks and rewards of the investment. This promotes a more equitable distribution of wealth and fosters a sense of shared responsibility.

Islamic banking and finance also emphasize the avoidance of speculative activities and excessive risk-taking. Investments in sectors deemed unethical or harmful, such as alcohol, gambling, and tobacco, are strictly prohibited. This promotes ethical and socially responsible investing, aligning financial activities with the values and principles of Islam.

Moreover, Islamic finance aims to promote economic stability and sustainability. The focus on real economic activities, such as trade and production, encourages productive investments and discourages speculative behavior. This contributes to a more stable and balanced economy, less prone to financial crises and bubbles.

Overall, Islamic banking and Islamic finance are closely intertwined, sharing the same principles and objectives. By adhering to the principles of Shariah, Islamic banks and financial institutions strive to create a more ethical, fair, and just financial system that benefits society as a whole. The link between Islamic banking and finance lies in their shared commitment to promoting social welfare, equity, and responsible financial practices.

Islamic Banking and Social Responsibility

One of the key principles of Islamic banking is social responsibility. Islamic banks are not only focused on making profits, but also on promoting social justice and equity in the society. This sets Islamic banking apart from conventional banking systems.

Profit-sharing

In Islamic banking, profits are shared between the bank and its customers, rather than being entirely kept by the bank. This profit-sharing system ensures that the interests of both parties are aligned, and encourages the bank to invest in ethical and socially responsible projects. By supporting initiatives that contribute to the well-being of society, Islamic banks actively work towards building a more just and equitable financial system.

Ethical investing

Islamic banking follows strict ethical guidelines when it comes to investments. Investments in sectors such as alcohol, gambling, and tobacco are prohibited. Additionally, Islamic banks are encouraged to invest in sectors that promote social welfare, such as education, healthcare, and renewable energy. By investing in socially responsible projects, Islamic banks help foster sustainable development and contribute to the betterment of society.

Charitable activities

Islamic banking also places a strong emphasis on charitable activities. Islamic banks are obliged to allocate a percentage of their profits to charity, known as Zakat. This money is used to support those in need, including the poor, orphans, and the elderly. By actively participating in charitable activities, Islamic banks play a vital role in addressing social inequalities and uplifting disadvantaged communities.

Microfinance

In addition to charitable activities, Islamic banks also provide microfinance services. Microfinance aims to provide financial services to individuals who do not have access to traditional banking systems. By offering microfinance, Islamic banks empower individuals to start their own businesses, improve their livelihoods, and escape poverty. This initiative promotes economic growth and social development at the grassroots level.

Conclusion

Islamic banking’s commitment to social responsibility sets it apart from conventional banking. By incorporating profit-sharing, ethical investing, charitable activities, and microfinance, Islamic banks strive to create a more equitable and sustainable financial system. This socially responsible approach not only benefits individuals and communities but also contributes to the overall development and well-being of society as a whole.

Islamic Banking and Wealth Distribution

One of the fundamental principles of Islamic banking is the concept of wealth distribution. In Islamic finance, the accumulation of wealth is not seen as an end in itself but rather as a means to serve the greater good and promote social justice.

In traditional banking systems, wealth tends to concentrate in the hands of a few individuals or institutions, leading to income inequality and societal imbalances. Islamic banking seeks to address this issue by promoting a more equitable distribution of wealth.

Islamic banking practices encourage the sharing of profits and losses between the bank and its clients, which ensures a more fair distribution of financial gains. This is achieved through various mechanisms, such as profit-sharing, profit-loss sharing partnerships, and Islamic bonds (sukuk).

Profit-sharing is a key feature of Islamic banking, where the bank and the customer share the profits generated by the investment or financing activities. This encourages productive investment and ensures that the benefits of economic growth are shared among all stakeholders.

Another mechanism used by Islamic banks is profit-loss sharing partnerships, where the bank enters into a partnership with the customer to finance a project or investment. The profits and losses are shared in proportion to each party’s investment, promoting a fair distribution of wealth.

Islamic bonds, or sukuk, are another important tool for wealth distribution. These bonds are structured in a way that allows investors to earn a return on their investment without violating Islamic principles. The proceeds from sukuk issuances can be used for socially beneficial projects, such as infrastructure development or education, further contributing to wealth distribution.

In addition to these mechanisms, Islamic banking discourages exploitative practices, such as charging excessive interest (riba). Instead, Islamic banks provide financing based on profit-sharing models or asset-based transactions, which ensures a more equitable distribution of wealth.

By promoting wealth distribution, Islamic banking aims to create a more just and inclusive financial system. It provides individuals and communities with opportunities to participate in economic activities, reduces income inequality, and contributes to overall societal well-being.

Myths and Misconceptions about Islamic Banking

Islamic banking is a unique financial system that operates according to the principles of Shariah law. However, there are many myths and misconceptions surrounding Islamic banking that often lead to a misunderstanding of its principles and benefits. In this section, we will debunk some of the common myths about Islamic banking.

- Islamic banking is only for Muslims: One of the biggest misconceptions about Islamic banking is that it is only for Muslims. In reality, Islamic banking is open to people of all faiths and backgrounds. The principles of Islamic banking, such as avoiding interest (riba) and promoting ethical investments, can be appealing to individuals from various religious and cultural backgrounds.

- Islamic banking is the same as conventional banking: Another common misconception is that Islamic banking is just like conventional banking but with different terminology. In fact, Islamic banking operates on a completely different framework and has its own set of principles and regulations. Conventional banking relies on interest-based transactions, whereas Islamic banking focuses on profit-sharing and risk-sharing arrangements.

- Islamic banking is not profitable: Some people mistakenly believe that Islamic banking is not as profitable as conventional banking. However, studies have shown that Islamic banks have been able to achieve competitive returns on their investments. Islamic banking principles encourage investments in real assets and productive activities, leading to sustainable growth and profitability.

- Islamic banking limits financial products: There is a misconception that Islamic banking offers a limited range of financial products. On the contrary, Islamic banks provide a wide range of products and services that cater to various financial needs. These include Islamic mortgages, car financing, investment accounts, and business financing, among others. Islamic banks also have innovative products such as Sukuk (Islamic bonds) and Takaful (Islamic insurance).

- Islamic banking is only for individuals: Islamic banking is not limited to individuals only. It also caters to the needs of businesses, corporations, and institutions. Islamic banking offers financing solutions for small and medium-sized enterprises (SMEs), trade finance facilities for businesses, and corporate banking services.

- Islamic banking is not regulated: Some people believe that Islamic banking operates without any regulatory oversight. However, Islamic banks are subject to the same regulatory framework as conventional banks. Regulatory authorities ensure that Islamic banks comply with Shariah principles and ethical standards, providing a secure and transparent banking environment.

By debunking these myths and misconceptions, it becomes evident that Islamic banking is a viable and inclusive financial system that offers numerous benefits to individuals, businesses, and society as a whole.

Islamic Banking and Financial Stability

Islamic banking can play a crucial role in ensuring financial stability in the global economy. Unlike conventional banking, Islamic banking operates on the principles of Shariah law, which prohibit the use of interest and speculative activities. This unique approach to banking helps to prevent excessive risk-taking and promotes stability in the financial system.

One of the main reasons why Islamic banking promotes financial stability is its emphasis on asset-backed financing. In Islamic finance, financial transactions must be supported by real assets, such as property or commodities. This requirement reduces the reliance on debt and helps to avoid the creation of speculative bubbles. By having tangible assets as a basis for lending, the risk of default is minimized, making Islamic banks more resilient during economic downturns.

Another key feature that contributes to financial stability is the concept of profit and loss sharing (PLS). In Islamic banking, both the bank and the customer share the risk and reward of investments. This encourages a more cautious and responsible approach to lending, as both parties have a stake in the outcome. The PLS model helps to align the interests of the bank and its customers, reducing the likelihood of moral hazard and promoting long-term stability.

Additionally, Islamic banking promotes ethical and socially responsible investments, which can help prevent financial crises caused by unethical business practices. Islamic banks are required to ensure that their investments comply with Shariah principles, which prohibit investments in industries such as alcohol, gambling, and pork products. This focus on socially responsible investments reduces the risk of negative externalities and contributes to the overall stability of the financial system.

Moreover, Islamic banking promotes risk-sharing and risk diversification through various Islamic financial instruments. For example, Islamic banks use mudarabah (profit-sharing) and musharakah (partnership) contracts to finance projects. These contracts distribute the risk among multiple parties, reducing the concentration of risk and enhancing financial stability.

In conclusion, Islamic banking’s principles and practices have the potential to enhance financial stability. By promoting asset-backed financing, profit and loss sharing, ethical investments, and risk diversification, Islamic banks can contribute to a more stable and resilient financial system. As the global economy faces increasing uncertainties, the adoption of Islamic banking principles could be a valuable tool in maintaining financial stability.

The Role of Islamic Banking in a Globalized Economy

Islamic banking plays a crucial role in a globalized economy by offering an alternative financial system that adheres to the principles of Islamic law, or Shariah. With the growth of international trade and investment, Islamic banking provides a viable option for individuals and businesses looking to participate in the global economy while preserving their religious and ethical values.

Principles of Islamic Banking:

- Prohibition of interest (riba): Islamic banking operates on a profit-sharing model and prohibits the charging or payment of interest. This promotes fairness and eliminates exploitative lending practices.

- Prohibition of uncertainty or speculation (gharar): Islamic banking encourages transparency and discourages speculative transactions that involve excessive uncertainty or ambiguity.

- Prohibition of investing in unethical activities: Islamic banking prohibits investments in sectors such as gambling, alcohol, and pork, promoting ethical and socially responsible financing.

- Emphasis on partnership and risk-sharing: Islamic banking promotes a partnership-based approach where the bank and the customer share the risks and rewards of the business venture.

Role in a Globalized Economy:

Islamic banking has gained traction in the global economy and has witnessed significant growth over the past few decades. Its role in a globalized economy can be summarized as follows:

- Financial Inclusion: Islamic banking provides access to financial services for individuals and businesses who may have been excluded from conventional banking due to religious beliefs or ethical concerns. It promotes financial inclusivity and supports economic development.

- Diversification of Financial Markets: Islamic banking offers a diversified financial system, providing an alternative to conventional banking that appeals to a large population of Muslims and non-Muslims alike. This diversification contributes to the stability of the global financial markets.

- Attraction of Foreign Investment: Islamic banking attracts foreign investment from countries with a predominantly Muslim population, as well as non-Muslim investors looking for ethical and Shariah-compliant investment opportunities. This influx of investment contributes to the growth and development of the global economy.

- Stimulation of Ethical Finance: Islamic banking promotes ethical and responsible financing by prohibiting investments in unethical activities. This emphasis on ethical finance encourages businesses to adopt sustainable and socially responsible practices, benefiting both society and the environment.

Conclusion:

In a globalized economy, Islamic banking serves as an important alternative to conventional banking by offering a financial system that aligns with the principles of Islamic law. Its adherence to ethical and transparent practices attracts individuals and businesses who seek financial services that align with their religious and ethical values. As Islamic banking continues to grow and evolve, it will play an even more significant role in a globalized economy, promoting financial inclusion, diversifying financial markets, attracting foreign investment, and stimulating ethical finance.

Consumer Protection in Islamic Banking

Consumer protection is a fundamental principle in Islamic banking. Islamic banking aims to provide financial services that are fair, transparent, and socially responsible. This includes ensuring the rights and interests of consumers are protected in all aspects of their banking experience.

One of the key principles of consumer protection in Islamic banking is the prohibition of usury, or charging interest. Islamic banks operate on the principle of profit sharing (Mudarabah) or cost-plus (Murabaha) financing, where the bank and the customer share the profits or costs of a transaction. This eliminates the burden of interest payments and promotes a more equitable relationship between the bank and the customer.

Another aspect of consumer protection in Islamic banking is the requirement for full disclosure and transparency. Islamic banks are required to provide clear information about the terms and conditions of their products and services, including any fees or charges. This allows customers to make informed decisions and ensures they are not taken advantage of by hidden costs or unfair practices.

Islamic banks also have a responsibility to ensure that the products and services they offer are ethical and compliant with Islamic principles. This includes screening investments to ensure they are free from activities that are forbidden in Islam, such as gambling, usury, or the production of alcohol. By offering ethical products and services, Islamic banks provide consumers with the assurance that their money is being handled in a socially responsible manner.

In addition to these principles, Islamic banking also promotes financial education and literacy. Banks are encouraged to provide educational resources and guidance to help customers make informed financial decisions. This can include workshops, seminars, or online resources that help customers understand the principles and benefits of Islamic banking and how to manage their finances in a responsible manner.

In conclusion, consumer protection is a core principle in Islamic banking. Through the prohibition of interest, full disclosure, ethical practices, and financial education, Islamic banks strive to protect the rights and interests of their customers. By choosing Islamic banking, consumers can have confidence that their banking experience is fair, transparent, and socially responsible.

Islamic Banking and the Principles of Riba

In Islamic banking, the principles of riba play a crucial role in the decision-making process. Riba is an Arabic term that translates to “usury” or “excessive interest.” It is strictly forbidden in Islamic financial transactions as it promotes unfairness and exploitation.

According to Islamic teachings, riba goes against the principles of justice and social welfare. It encourages wealth accumulation without any real economic activities, leading to an unequal distribution of resources. Islamic banking strives for a more equitable financial system that promotes economic stability and social justice.

In contrast to conventional banks, Islamic financial institutions operate on the basis of profit and loss sharing. To comply with the principles of riba, Islamic banks offer alternative structures such as Mudarabah, Musharakah, and Wakalah.

Mudarabah is a partnership-based contract where one party provides the capital (Rab ul Mal) while the other party manages the investment (Mudarib). Profits are shared as per a pre-determined ratio, while losses are solely borne by the capital provider.

Musharakah refers to a joint venture between two or more parties where they contribute capital and share profits and losses based on their respective investments. It encourages cooperation, risk-sharing, and active participation in economic activities.

Wakalah is a contract in which one party acts as an agent to manage funds on behalf of another party. The agent is entitled to a fixed fee or a percentage of the profits generated from the investment. This arrangement ensures transparency and limits the potential for exploitation.

To ensure compliance with riba principles, Islamic banks also refrain from dealing with interest-bearing instruments, such as conventional bonds or loans. Instead, they focus on Sharia-compliant investment assets, such as real estate, commodities, and ethical businesses.

Furthermore, Islamic banking promotes ethical and socially responsible practices. It prohibits investments in industries that are considered harmful or incompatible with Islamic values, such as gambling, alcohol, and pornography.

In summary, Islamic banking rejects the principles of riba and aims to establish an equitable financial system based on profit and loss sharing. It provides alternative banking solutions that promote economic stability, social justice, and ethical practices.

FAQ

What is Islamic banking?

Islamic banking is a banking system that operates in accordance with the principles of Islamic law, also known as Shariah law. It prohibits usury (interest), speculation, and investments in products or services that are considered haram (forbidden) in Islam. Instead, Islamic banks provide financial services that are based on profit-sharing and risk-sharing principles, and they avoid investments in sectors such as alcohol, gambling, and pork.

What are the key principles of Islamic banking?

The key principles of Islamic banking include prohibition of interest (riba), sharing of profit and loss, ethical investment, and avoiding investments in haram businesses. Islamic banks operate on the principles of fairness, justice, and transparency. They also promote social and economic development, as well as risk sharing between the bank and its customers.

How does Islamic banking ensure fairness?

Islamic banking ensures fairness by prohibiting the charging and receiving of interest. Instead, banks enter into profit-sharing agreements with their customers, where both parties share the profits or losses arising from an investment. This ensures a more equitable distribution of wealth and promotes economic justice.

What are the benefits of Islamic banking?

There are several benefits of Islamic banking. Firstly, it promotes financial stability by discouraging excessive speculation and risky investments. Secondly, it encourages responsible banking practices by focusing on ethical investments and avoiding money from businesses that are considered haram. Thirdly, it promotes economic justice and social development by sharing profits and risks with customers. Lastly, Islamic banking incorporates Islamic values and principles, which resonates with a large segment of the Muslim population.

Is Islamic banking only for Muslims?

No, Islamic banking is not only for Muslims. While Islamic banking operates in accordance with Islamic principles, anyone can avail its services, regardless of their religion. In fact, Islamic banking has gained popularity among non-Muslims as well, who appreciate its ethical and fair banking practices.

How does Islamic banking avoid interest?

Islamic banking avoids interest by utilizing profit-sharing and risk-sharing mechanisms. Instead of charging interest on loans, Islamic banks enter into partnerships with customers where profits and losses are shared. This ensures that the banks and customers have a mutual interest in the success of the investment and discourages the exploitation that can occur through the charging of interest.

Are there any challenges to Islamic banking?

Yes, there are challenges to Islamic banking. One of the main challenges is the lack of harmonization and standardization among Islamic banking regulations and practices across different countries. This can create difficulties for international transactions and limit the growth of Islamic banking globally. Additionally, some experts argue that Islamic banking products can be more expensive than conventional banking products, which can deter some customers. However, despite these challenges, Islamic banking continues to expand and gain recognition worldwide.