When shopping for insurance, getting multiple quotes is a smart move. It allows you to compare different offers and find the best coverage at the most affordable price. But what happens if you find a quote that is significantly lower than the others? Can insurance companies match quotes?

The answer to this question is not a simple yes or no. While some insurance companies may be willing to match quotes from their competitors, it is not a guarantee. Each insurance company has its own policies and guidelines when it comes to price matching.

For some insurance companies, matching a quote means offering the same coverage at a lower price. Others may match the price but require you to switch to a similar policy with comparable coverage. Some companies may not offer price matching at all.

If you have found a lower quote from a competitor and want to see if your insurance company will match it, it is best to reach out to them directly. Contact their customer service or speak with your agent to discuss your options. They will be able to provide you with the most accurate information based on their company’s policies.

Understanding the Insurance Quote Matching Process

When shopping for insurance, it’s important to understand the quote matching process. Insurance companies have different policies when it comes to matching quotes, so it’s essential to know how this process works.

What is an insurance quote?

An insurance quote is an estimate of the premium you will pay for an insurance policy. It includes information about the coverage and the cost of the policy. Insurance companies provide quotes based on various factors such as your age, location, driving record, and the type of coverage you need.

How does the quote matching process work?

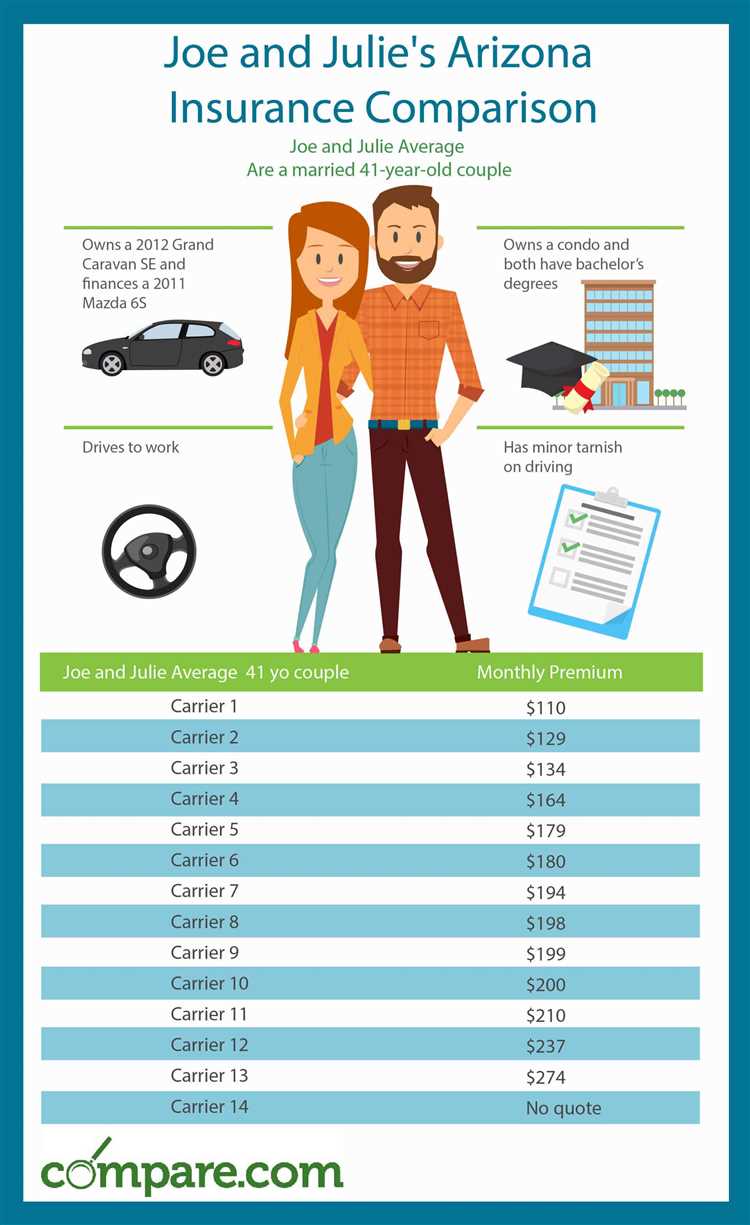

When you request insurance quotes from multiple companies, it’s common to receive different rates. Insurance companies have different risk assessment methods, which can lead to variations in the quotes provided. The quote matching process is the insurance company’s way of determining if they can offer you a better rate than what you initially received.

Factors considered during quote matching

During the quote matching process, insurance companies consider several factors to determine if they can match or beat the quotes from other providers. These factors may include:

- Your driving history

- Your credit score

- The type and amount of coverage you need

- Your age and gender

- Your location

- Any applicable discounts

Benefits of the quote matching process

The quote matching process can be advantageous for insurance shoppers. It allows you to compare rates from different companies and potentially find a better deal. By providing your quotes to multiple insurance providers, you increase your chances of finding the most competitive rate for the coverage you need.

How to get the best outcome from the quote matching process

To ensure you get the best outcome from the quote matching process, consider the following tips:

- Provide accurate information: Make sure to provide accurate and up-to-date information when requesting quotes. Any discrepancies can affect the accuracy of the quotes.

- Shop around: Don’t settle for the first quote you receive. Request quotes from multiple insurance companies to compare rates and coverage options.

- Ask questions: If you receive a matching quote, don’t hesitate to ask questions about the coverage, discounts, and any additional fees or charges.

- Review the policy details: Before accepting a matching quote, carefully review the policy details to ensure it meets your needs.

- Consider other factors: While price is important, also consider factors such as customer service, reputation, and claims handling when choosing an insurance company.

Conclusion

The insurance quote matching process is an important step in finding the best insurance deal. By understanding how the process works and following the tips mentioned above, you can increase your chances of getting a competitive rate and the coverage you need.

Factors That Influence Insurance Quote Matching

When it comes to matching quotes, insurance companies take a variety of factors into consideration. These factors can greatly influence whether or not an insurance company will match a quote provided by another company. Here are some of the main factors that influence insurance quote matching:

- Coverage: Insurance companies will carefully analyze the coverage offered by the competing quote. They will compare the types and limits of coverage to see if they align with their own policies. If the coverage is similar or better, it increases the likelihood of a match.

- Deductibles: The deductible is the amount that the policyholder is responsible for paying before insurance coverage kicks in. Insurance companies will compare the deductible amounts in the quotes to evaluate whether they are reasonable and in line with their own policies.

- Claims History: Insurance companies will review the claims history of the applicant. If there is a history of frequent or costly claims, it may make it less likely for the quote to be matched.

- Driving Record: For auto insurance quotes, the applicant’s driving record will be evaluated. A clean driving record with no or minimal accidents or violations will increase the chances of a quote match.

- Policyholder Information: Insurance companies may also consider factors such as the age, gender, marital status, and location of the policyholder. These factors can influence the risk assessment and pricing of the policy.

- Discounts and Incentives: Insurance companies may offer various discounts and incentives to attract customers. If the competing quote includes any special discounts or incentives, it can impact the decision to match the quote.

It’s important to note that each insurance company has its own underwriting guidelines and criteria for matching quotes. Therefore, even if the above factors align, there is no guarantee that a quote will be matched. It is best to consult with insurance providers directly to understand their specific policies and preferences regarding quote matching.

The Benefits of Insurance Companies Matching Quotes

Insurance companies matching quotes can provide numerous benefits for customers. Here are some of the advantages of this service:

- Cost Savings: By matching quotes from different insurance providers, customers can ensure they are getting the best possible price for their insurance coverage. Insurance companies may be willing to match or even beat a competitor’s quote to secure a customer’s business.

- Convenience: Rather than spending time contacting multiple insurance providers and getting separate quotes, customers can simply provide one quote to an insurance company and have them search for matching offers. This saves time and effort, allowing customers to quickly compare prices and coverage options.

- Transparent Comparison: Matching quotes allows customers to easily compare different insurance providers side by side. This makes it easier to evaluate the benefits and coverage options offered by each company, making the decision-making process more transparent.

- Personalized Service: When insurance companies compete for a customer’s business, they are more likely to provide personalized attention and customer service. They may offer additional discounts, flexible payment options, or tailored coverage options to win the customer’s business.

- Increased Competition: Insurance companies matching quotes creates a competitive market where providers are encouraged to offer more competitive rates and better coverage options. This benefits customers by giving them more options and driving down insurance costs.

- Peace of Mind: Knowing that insurance companies are willing to match quotes provides peace of mind for customers. They can be confident that they are receiving a fair price for their insurance coverage and that they have explored all available options before making a decision.

Overall, insurance companies matching quotes offer numerous benefits to customers, including cost savings, convenience, transparent comparison, personalized service, increased competition, and peace of mind. Taking advantage of this service can help customers make informed decisions and ensure they are getting the best possible insurance coverage at the best possible price.

How Insurance Quote Matching Works

Insurance quote matching is a process used by insurance companies to compare and match quotes provided by different providers in order to determine the best possible insurance coverage and premium for a customer. This process helps customers find the most affordable and suitable insurance options available in the market.

Here is a step-by-step breakdown of how insurance quote matching works:

- Customer fills out a quote form: The first step in the insurance quote matching process is for the customer to fill out a quote form. This form usually requires the customer to provide information about their personal details, driving history, insurance needs, and any additional relevant information.

- Insurance companies receive the quote form: Once the customer submits the quote form, insurance companies receive the information and use it to generate a personalized insurance quote based on the provided details.

- Insurance companies compare quotes: After receiving the quotes from different insurance companies, the insurance quote matching system compares and analyzes the offers. It takes into account various factors such as coverage limits, deductibles, premiums, and additional benefits to determine the best possible match for the customer.

- Matching the customer with the best quote: Based on the comparison results, the insurance quote matching system identifies the insurance provider with the best quote that suits the customer’s needs and budget. This may involve considering not only the lowest premium, but also the coverage and benefits provided.

- Presenting the best quote to the customer: Once the best quote is identified, the insurance quote matching system presents it to the customer. This allows the customer to review the details of the insurance policy, including coverage, exclusions, and conditions.

- Decision-making by the customer: After reviewing the presented quote, the customer has the option to accept the offer or explore other options. If the customer decides to proceed with the insurance policy, they can finalize the purchase through the insurance company.

- Continued monitoring and adjustments: Insurance quote matching is an ongoing process, and insurance providers may periodically review the customer’s policy to ensure that the coverage and premium remain competitive and suitable for their needs. Customers may also request re-evaluations when necessary.

In conclusion, insurance quote matching is a valuable tool that allows customers to compare and evaluate different insurance quotes to find the best coverage and premium options available. It simplifies the shopping process by providing customers with personalized recommendations, helping them make informed decisions about their insurance needs.

Common Misconceptions About Insurance Quote Matching

Matching insurance quotes is a common practice in the industry, but there are some common misconceptions that people have about this process. Understanding these misconceptions can help you make more informed decisions when it comes to selecting an insurance policy.

1. Insurance companies always match quotes

Contrary to popular belief, insurance companies do not always match quotes. While they may offer similar coverage options, the prices can vary depending on various factors such as your location, driving history, and the type of coverage you require. It’s important to compare multiple quotes and review the details carefully to ensure you’re getting the best deal.

2. All insurance companies offer the same coverage

Insurance policies can vary significantly between companies. While one company may offer a lower premium, they may also provide less coverage or have higher deductibles. It’s crucial to review the terms and conditions of each policy to determine if it meets your specific needs and provides adequate coverage.

3. Matching quotes guarantees the best policy

Matching quotes doesn’t necessarily guarantee that you’re getting the best policy. While price is an important factor, there are other considerations to keep in mind, such as the company’s reputation, customer service, and claims handling process. It’s essential to take a comprehensive approach when comparing quotes to ensure you’re selecting the right insurance company.

4. Quote matching is a quick and easy process

While technology has made it easier to obtain insurance quotes online, the process of matching quotes requires time and effort. Each insurance company has its own underwriting guidelines and pricing algorithms, which can lead to variations in quotes. Taking the time to carefully review and compare quotes can help you make a well-informed decision.

5. Once matched, the quote is final

Once you’ve matched a quote, it’s essential to review the final policy documents. Sometimes, there may be exclusions or limitations that weren’t apparent in the initial quote. It’s crucial to read through the policy documents and clarify any questions or concerns with the insurance company before finalizing the policy.

By understanding these common misconceptions about insurance quote matching, you can make more informed decisions when it comes to selecting an insurance policy. Remember to compare multiple quotes, review the coverage details, and consider other factors beyond just price. Doing so will help you find the best insurance policy for your specific needs and budget.

Tips for Getting Your Insurance Quote Matched

If you’re looking to get the best deal on your insurance policy, it’s important to compare quotes from multiple insurance companies. However, sometimes the quotes you receive may not be exactly what you were hoping for. Luckily, there are some steps you can take to increase your chances of getting your insurance quote matched:

- Provide accurate information: When requesting insurance quotes, make sure you provide accurate and detailed information about your insurance needs. The more accurate the information you provide, the more likely it is that insurance companies will be able to provide you with an accurate quote.

- Ask for discounts: Don’t be afraid to ask insurance companies about any discounts they offer. Many insurance companies offer discounts for things like good driving records, multiple policies, or bundling different types of insurance. Asking about discounts can help lower your quote and increase your chances of getting it matched.

- Consider raising your deductibles: One way to lower your insurance premium is to increase your deductibles. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By raising your deductibles, you can lower your premium, but be sure to choose a deductible amount that you can afford to pay if you need to make a claim.

- Review and compare coverage: When comparing quotes, make sure you’re comparing the same type and level of coverage. In some cases, a lower-priced quote may offer less coverage. Make sure you understand what’s included in each quote and consider the trade-offs between price and coverage before making a decision.

- Work with an independent insurance agent: Independent insurance agents work with multiple insurance companies and can help you navigate the quoting process. They have access to a wide range of insurance options and can help you find the best match for your needs and budget.

Remember, getting your insurance quote matched isn’t always guaranteed, but by following these tips, you can increase your chances of finding a policy that meets your needs and fits your budget.

What to Do if Your Insurance Quote is Not Matched

Getting an insurance quote that doesn’t match your expectations can be frustrating, but there are steps you can take to address the issue. Here’s what you can do if your insurance quote is not matched:

- Contact the Insurance Company: Reach out to the insurance company and ask for clarification on why your quote did not match. There may be factors you overlooked or misunderstood. Getting a clear explanation can help you understand the differences and potentially negotiate a better offer.

- Review the Details: Carefully review the details of your quote and the information you provided. Check for any mistakes or discrepancies that may have resulted in an inaccurate quote. Make sure all the information is correct, including your personal details, coverage limits, and deductibles.

- Request a Requote: If you discover any errors or receive an unsatisfactory explanation, ask the insurance company to reevaluate your quote based on the correct information. Be prepared to provide any necessary documentation or clarification to support your request.

- Shop Around: Don’t be discouraged if your current insurance company cannot match your quote. Take the opportunity to shop around and compare quotes from other insurance providers. Different companies have different criteria and pricing structures, so you may find a better option elsewhere.

- Negotiate or Modify: If you receive a quote from another insurance company that better aligns with your expectations, you can use it as a bargaining tool. Contact your current insurance company and see if they are willing to match or beat the competitor’s offer. Additionally, you can modify your coverage or deductibles to potentially lower the cost, keeping in mind the level of coverage you need.

- Seek Professional Advice: If you’re still having difficulty finding a suitable insurance quote, consider consulting with an insurance agent or broker. They can provide expert guidance and help you navigate the complexities of insurance policies and quotes.

Remember, insurance quotes can vary based on multiple factors, such as your location, driving record, age, and the coverage options you choose. It’s essential to thoroughly understand your insurance needs and compare quotes to ensure you’re getting the best coverage for your situation.

Question and answer:

How do insurance companies determine the rates for quotes?

Insurance companies determine the rates for quotes based on several factors, including the person’s age, driving record, location, type of vehicle, and coverage options. They use statistical data and risk analysis to assess the likelihood of a claim and calculate the rate accordingly.

Do insurance companies offer discounts on quotes?

Yes, insurance companies often offer various discounts on quotes. These discounts can be based on factors such as bundling multiple policies, having a good driving record, being a student with good grades, or installing safety devices in your vehicle. It’s important to ask the insurance company about the available discounts when getting a quote.

What happens if I get a quote from one insurance company and then find a lower quote from another company?

If you find a lower quote from another insurance company, you have a couple of options. You can contact your current insurance company and provide them with the lower quote to see if they can match it. Sometimes, insurance companies are willing to adjust their rates to keep your business. Alternatively, you can choose to switch to the insurance company with the lower quote.

Is it common for insurance companies to match quotes?

While it’s not guaranteed, some insurance companies may be willing to match quotes if you provide them with a lower quote from another company. It ultimately depends on the specific insurance company and their policies. It’s worth reaching out to your current insurance company to inquire about their willingness to match quotes.

What should I do if an insurance company refuses to match a lower quote?

If an insurance company refuses to match a lower quote, you can choose to switch to the company offering the lower rate. It’s important to review the coverage options and policy details to ensure you are getting comparable coverage. Additionally, you can consider discussing the situation with a broker who can help you find the best insurance option for your needs.

Are there any disadvantages to switching insurance companies for a lower quote?

Switching insurance companies for a lower quote may have some disadvantages. It’s essential to carefully review the coverage and policy details offered by the new company to ensure it meets your needs. Additionally, there may be some administrative tasks involved in canceling your current policy and setting up a new one. It’s important to weigh the potential savings against any potential disadvantages before making a decision.